What determines the amount of overpayment on a mortgage?

The overpayment of a mortgage to the bank depends on several factors. In addition to the main ones, commissions, insurance and other expenses are added. The main characteristic that you need to pay attention to is the TLC (total cost of the loan). It is specified in the mortgage agreement.

Life and health insurance of the loaned object are mandatory conditions and will be included in it. This also includes overpaid interest and the amount transferred to repay the principal debt.

The PSC does not include payments that should not occur if the loan is repaid consistently: penalties, state duties, money credited to the account upon early repayment, tax deduction, etc.

Loan term

The time during which the client repays the loan directly affects its cost. Change even for 1 month in a larger direction with a loan amount of 1 million rubles. for 5 years without taking into account commissions leads to the transfer of an extra 4,000 rubles from your budget to the bank. Therefore, you should try to shorten the period as much as possible, paying a larger amount if possible.

Property value

The higher the price of the real estate property, the greater the overpayment. It `s naturally. Conditions: term 10 years, rate 10%, type of payment - annuity, other payments - no, loan amount: 1 million rubles. and 1.2 million rubles The overpayment on a mortgage for 10 years is in the first case 585,809 rubles, in the second – 702,971 rubles.

The difference is obvious. And with the same data, but the loan size is 1.7 million rubles. the overpayment will be almost a million rubles. There's a lot to think about.

Bid

Everything is clear here - the lower the rate, the less the overpayment. If you want to cut costs, look for offers with the lowest possible rates. Banks offer favorable conditions to salary clients and preferential categories of citizens.

Study the programs carefully, see for which actions the % increases and for which they decrease.

Payment type

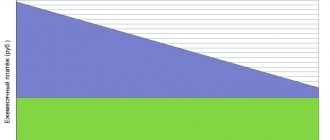

There are 2 types of payments - annuity, when the debt is repaid in equal amounts and at first the loan body is minimal, and differentiated - in which the principal debt remains unchanged throughout the entire time, and interest melts away from month to month.

The final overpayment with the second method of debt repayment is lower, but out of hundreds of organizations, only a few offer the opportunity to choose it: Gazprombank, Rosselkhozbank, SKB-bank. If you want to reduce your debt and have the opportunity to take out a mortgage from these banks, do it. For example:

- Amount borrowed – 2 million rubles;

- Rate – 10% per annum;

- Duration – 15 years.

Calculation of overpayment: annuity – 1 million 868 thousand 578 rubles, “differential” – 1 million 508 thousand 333 rubles. To calculate the amount of interest, use any mortgage calculator or specialized formula.

The disadvantage of the differentiated method is the increased monthly payment at first and the need to receive a higher salary. But after a year or two, the load will begin to gradually decrease and eventually become minimal.

Options for reducing overpayments

It is necessary to reduce the amount of costs included in the final cost of the loan.

There are several such methods:

- Take out a loan for a short period.

For loans with a short repayment period, banks set minimum interest rates, so overpayments will be minimal. Lenders also periodically offer promotions and discounts when a borrower, taking out a mortgage for 5-10 years, will receive a reduced interest rate.

- Pay off your debt early.

In case of partial or full early repayment of debt to the bank, the amount of accrued interest will be transferred in favor of the client. The lower the debt balance, the lower the overpayment.

- Apply for a mortgage at your salary bank.

Banks usually offer favorable lending conditions for participants in salary projects. In addition, the requirements for them are distinguished by a loyal attitude.

- Make a substantial down payment.

If you receive a mortgage loan with a minimum down payment, the client will pay a considerable amount each month, which will result in a huge overpayment. Therefore, it is logical to assume that by paying a large share of the cost of the purchased home at once, the borrower will be able to reduce the final overpayment.

How to calculate overpayment on a mortgage?

You can find out how much you will need to give to the bank for the opportunity to use its money in 5 ways: through online mortgage calculators, using specialized formulas, through the bank, asking an employee to voice the data, look at the contract after its conclusion, use the software.

Look at the same topic: Interest rates and mortgage conditions at Gazprombank today

Choose calculators that provide the possibility of adding fees, fines and early repayment of the mortgage. Among the popular ones are fincalculator, Banki.ru, calculator-ipoteka, ipotek.

To find an overpayment using formulas, you must first calculate the monthly payment amount. This can be done using this formula:

Pl=S∗Annual12∗1001−(1+Pannual12∗100)−T

Where:

- Pl – the amount that the borrower will need to pay every month;

- P year. - % bid;

- S – total loan amount or its balance;

- T – number of remaining periods.

The resulting value must be multiplied by the number of periods for the entire period (for 1 year - 12 times), and from it subtract the principal debt (the amount initially taken to the bank). If you don’t want to use formulas to calculate how much you will overpay on your mortgage, use an online calculator.

Five ways to reduce your mortgage overpayment

YKTIMES.RU – A reduction in loan rates from large banks has forced existing borrowers to think about how to make their mortgage more profitable. Forbes magazine gives its recommendations.

In August 2020, Sberbank reduced interest rates on housing loans by 0.6-2 percentage points. Other banks followed suit.

“By mid-2020, rates on newly issued mortgage loans dropped to historical lows and continue to be reduced by the largest banks,” says Mikhail Doronkin, . “The difference between mortgage rates taken today and in the crisis years of 2014-2015 may exceed 3-5 percentage points.”

Even those borrowers who took out a mortgage at the beginning of this year are now often forced to pay significantly more than new bank borrowers, the analyst adds.

In the first half of 2020, banks issued mortgage loans worth 773 billion rubles, thereby breaking the record set three years ago (770 billion rubles for the first half of 2014), according to data from the Expert RA rating agency.

The reduction in rates spurred interest from potential borrowers, exceeding pre-crisis demand. But a lot of existing borrowers were puzzled - how could they reduce the rate?

The average term of a mortgage loan, according to the Bank of Russia, is 15.5 years. According to banks surveyed by Forbes, citizens actually take out a mortgage loan for an average of 15 years, with the actual repayment period being about 7 years.

“Many borrowers deliberately take out a mortgage for a longer period to reduce monthly payments - this allows them to insure themselves, for example, in the event of temporary job loss or reduction in income,” explains Mikhail Doronkin.

A longer mortgage loan term—20 years and above—increases the final overpayment of interest. Saving on this is the main motivation to pay off your mortgage early.

At the same time, the share of early repaid mortgage loans is decreasing: according to the National Bureau of Credit Histories (NBKI), at the beginning of September 2020 this figure was 12.7% (minus 2.1 percentage points compared to the same period in 2020). For comparison: in January 2014 this figure reached 24.8%. This was influenced by the devaluation of the national currency and a sharp increase in the key rate of the Bank of Russia. “In addition, the reduction in the share of early repayment of mortgage loans is being pressured by the decline in real incomes of the population,” comments an NBKI representative.

Five ways to save

The mechanism for saving on a mortgage is based on three principles: reducing the size of the principal debt, lowering the interest rate, and shortening the loan term. It is important to keep in mind that you will encounter different conditions and restrictions at each bank. Therefore, the starting point in this entire process is to study the current mortgage agreement and consult with banking specialists.

It is important to remember that any savings for the borrower result in lost profits for the bank. Therefore, every refusal of a credit institution is an attempt to maintain projected profits. Every time you overcome a refusal, you get closer to your intended goal.

Re-registration of a mortgage loan agreement with a creditor bank (internal refinancing)

Refinancing a loan from a creditor bank involves concluding a new agreement with a new payment schedule.

“The grounds for refinancing a mortgage are the borrower’s application, the presence of a positive credit history and a refinancing program at the bank,” explains Stepan Sorokin, .

According to experts interviewed by Forbes, the creditor bank is reluctant to refinance existing loans because it loses the profitability of the loan. But if the bank has a refinancing program, and the terms of the loan agreement allow the interest rate to vary, then the credit institution has no right to refuse a reliable borrower.

“Banks are really reluctant to refinance mortgage loans for their clients, since at the time the loan was issued, not only the rates on placed, but also on borrowed funds were at a higher level. Accordingly, the issued loan included a margin determined by the cost of funding at the time of issue,” explains leading analyst at Expert RA Ekaterina Kirillova .

Since the reduction in rates led to a wave of refinancing, in order to retain a solvent client, even those credit institutions may agree to reduce the interest rate where this is not provided for by the terms of the mortgage agreement.

On-lending to a third-party bank (external refinancing)

The refinancing procedure is not limited to one bank - with the help of this tool you can repay your loan from another bank. In this case, the selected bank, after completing the agreement, pays off the debt on the existing mortgage loan from its funds, and the “collateral” property is transferred to it. As well as the right to collect monthly payments.

According to experts interviewed by Forbes, the approval rate for applications to refinance mortgage loans from other banks is high. Thus, according to Andrey Morozov, head of the mass market and credit products department at Raiffeisenbank, refinancing accounts for about 50% of the total volume of new loans in the bank’s mortgage portfolio.

The consent of the bank where the mortgage loan was originally issued is not required for refinancing. By law, the bank can be changed several times.

But the next time you can refinance only a year or more after the start of the agreement, warns General Director of Personal Advisor Natalya Smirnova.

Switching to another bank will require additional costs, so the rate of the new lender should be at least 1.5 percentage points lower than the previous one, notes Andrey Morozov. Otherwise, it is unlikely that you will be able to win on refinancing, say experts interviewed by Forbes.

“The new bank will require a registration and application fee, as well as a fee for servicing the new account. An additional payment will have to be made for the services of a real estate appraiser. Finally, we cannot do without insurance of real estate and the risk of disability of borrowers. To change a bank, you need to collect a lot of documents: sometimes when refinancing, more paperwork is required than to apply for the first loan,” explains QBF expert Irina Gladysheva .

Moreover, the rate announced on the banks’ website is not always final. It may increase if you are not a salary client or refinance more than 50% of the debt; also, the increased rate remains for the period of registration of the collateral obligation to the new creditor bank, Natalya Smirnova lists.

When moving to another bank, the borrower’s application is submitted to the credit committee; the timing of this committee’s decision is unpredictable. And all this time the previous loan rate will remain the same.

“The promised 2-3 weeks of reviewing an application and making a decision in practice can turn into 2-3 months at best. Elizaveta Nekrasova, general director of the luxury real estate bureau Must Have .

It is better to obtain the consent of the creditor bank, otherwise this will also affect the size of the final rate of the bank refinancing the loan, says lawyer, member of the Moscow Regional Bar Association Lyubov Kiseleva .

“Obtaining such consent allows Bank No. 2 to register the encumbrance of the collateral in its favor simultaneously with the execution of a new loan agreement at a lower interest rate. Without obtaining prior approval from the original lending bank, the second loan is unsecured at this stage, so the rate will be high.”

Reducing the loan term

If you are confident in your financial situation, then you can shorten the loan term - as a rule, this involves increasing monthly payments.

Banks are reluctant to accept this option. A clause may be included in the mortgage agreement stating that in case of partial early repayment, the loan term does not change, but the payment amount is recalculated, warns General Director of Legal Bureau No. 1 Yulia Kombarova .

“Recalculating the payment amount is also beneficial, but if you shorten the loan term, you will be able to save more on interest,” adds the expert.

Stepan Sorokin from Rosgosstrakh Bank agrees that banks are more willing to reduce the amount of the monthly payment (as needed), but not the term:

“The lower the client’s monthly payment, the less risk the bank has (in terms of non-repayment) and the more opportunities to provide additional credit resources - credit cards or consumer loans.”

Deputy Director of the Retail Business Development Department of JSCB Svyaz-Bank Andrey Tocheny notes that, in fact, there is no reason to reduce the loan term. But if the client’s financial situation changes, a reduction in the actual period can be ensured by early repayment of the debt in full or by regular early repayments.

The head of the Retail Business block of Promsvyazbank, Vyacheslav Gritsaenko , also notes that the initially selected loan term primarily takes into account the client’s solvency at the moment and the fact that the monthly payment amount will not exceed 50-70% of total income. Accordingly, a reduction in the term of a mortgage loan is possible first of all with partial repayment of the loan.

“During the servicing of the loan, the client may receive additional income, with which he can repay the mortgage ahead of schedule,” emphasizes Vyacheslav.

“The main condition is that the payment on all loans, including refinanced ones, does not exceed 30-40% of the family’s monthly confirmed income. If this rule is followed and the credit history is impeccable, then the bank can agree to these conditions, especially for long-term loans (reducing the term of a 5-year loan to 2 years is not particularly profitable for the bank due to the strong difference in overpayment, but instead of 15 years, make it 13 years is not so critical),” sums up Natalya Smirnova.

Early repayment of payments: large amounts or small overpayments on regular payments

Experts clearly recognize that repaying a mortgage loan by making payments ahead of schedule is the most reliable and risk-free way. At the same time, it is much more profitable to make increased payments regularly than to save a large amount for repayment, for example, at the end of the year.

Interest is charged on the outstanding portion of the debt: by choosing the option of early repayment in large payments, you simultaneously save and lose money.

“Interest is accrued every day, and the sooner you repay it, the less you will ultimately pay the bank,” emphasizes Lyubov Kiseleva.

“For any repayment of the principal debt (planned or early), the bank automatically recalculates interest based on the balance of the debt. Thus, if you repay the loan early in small installments every month, then next month the client will pay less interest, since at least a little, but still, the amount of the principal debt has decreased, and as a result, the total overpayment on the loan will be less,” explains the boss SDM Bank Client Relations Department Ivan Lonkin .

On the other hand, “to make an additional payment on a mortgage loan, as a rule, you need to draw up documents in the office, so it is more convenient to make repayments in large amounts,” says Irina Gladysheva. Associate Professor, Department of Banking, REU named after. G.V. Plekhanov Lazar Badalov notes that with the development of modern technologies, banks are simplifying the procedure for transmitting orders and instead of a written order, some credit institutions use its analogues, for example, a call to a call center.

Natalya Smirnova recommends approaching the issue of early repayment of any loan obligations primarily from an investment point of view.

“If the loan rate exceeds inflation and exceeds the yield on investment instruments with low risks, in which free funds could be accumulated throughout the year for a large one-time repayment, then it is better to repay in small amounts as they appear. Otherwise, it is more profitable to accumulate funds for a larger payment: for example, in 2015, deposit rates were high, so it was profitable for people to save money to repay loans on deposits at a high interest rate, since very often the deposit rate exceeded the loan rate.” “, the expert summarizes.

Involving maternity capital in the early repayment procedure

The 453,026 rubles of maternity capital received from the state can be used to cover a mortgage loan. Maternity capital is used only to repay the main part of the debt, notes Andrey Tocheny. This makes it possible to recalculate the loan term or the amount of monthly payments.

“Reducing the term for early repayment (no matter whether at the expense of maternity capital or not) or changing the annuity payment depends on the terms of the agreement, in which the actions of the parties in such cases are provided for and specified,” explains Ivan Lonkin.

What is important to take into account: the period for consideration of the application by the Pension Fund of Russia - and this is where you will submit the application for the transfer of maternity capital funds to a bank account - one month; The deadline for transferring money to the bank is 10 days instead of one month from March of this year.

If you plan to use maternity capital funds to pay off your mortgage and at the same time want to refinance with another bank, then you should think about the sequence of actions. Representatives of banks interviewed by Forbes assure that maternity capital in itself is not a negative factor when approving refinancing.

“But refinancing a mortgage in another bank, partially repaid with maternal capital, will be quite difficult due to the peculiarities of the legislation,” emphasizes Stepan Sorokin.

In accordance with the law, shares in property acquired with the participation of maternal capital must be allocated to children.

On the one hand, shares in property rights are allocated to children only after the loan is fully repaid. But on the other hand, this is exactly what happens with external refinancing of a mortgage loan.

“The newly selected bank must repay the mortgage debt to another bank where the loan was issued earlier. If the debt is repaid, then within six months after the removal of the encumbrance, shares of the real estate must be allocated to minor children. After this, the bank with which the new agreement was concluded is deprived of the opportunity to repossess the property under the mortgage in case of non-payment of the debt, since the shares of the apartment belong not only to the borrowers themselves, but also to their minor children, and they have no obligations to the bank,” explains Irina Gladysheva .

One of the mandatory documents that the “new” bank will request may be the consent of the guardianship and trusteeship authorities to the alienation of the collateral, which is essentially consent to the seizure of the apartment in favor of the bank in the event of litigation, notes the project manager for the development of retail business in banks ( lending expert at MIA Bank) Larisa Baykina .

“If you receive a refusal, the bank also refuses. If the answer is positive, refinancing is possible and proceeds according to the standard scheme. But we must understand that guardianship authorities rarely give a positive answer, and only in cases of non-infringement of the property and housing rights of minors (or simply, the guardians have other real estate in the territory of which minors can be registered and receive a share there),” explains Larisa Baikina .

Legal adviser Alina Dmitrieva recommends first refinancing the loan, and then using maternity capital to pay off part of the debt.

A few more nuances

– Penalties for early fulfillment of loan obligations without the consent of the creditor bank were abolished in 2011. However, the loan agreement has the last word: if it does stipulate penalties for early repayment of the loan, time limits or its complete exclusion, consultations with specialists of the borrowing bank or a qualified lawyer can save you.

– It is possible to partially repay or close credit obligations in full only 30 days after registration of the mortgage - not earlier than making the first payment.

– The period for informing the bank about full early or partial early repayment of a mortgage loan is usually 30 days. However, in the contract it may be more or less.

– With annuity payments (equal in amount monthly, where the interest is calculated for the entire loan term and not accrued on the amount of the principal debt), early repayment is most effective at the initial terms due to the distribution of the monthly payment - a larger part for interest payments, a smaller part for the principal debt .

“Most mortgage banks set an annuity loan repayment rate. If you refinance the mortgage after most of the interest has already been paid, there will be no savings,” explains Lyubov Kiseleva.

– It is possible to return 13% of the interest actually paid on the mortgage loan in the form of tax deductions. Since January 2014, the amount of the deduction calculation is no more than 3 million rubles, but if your loan was issued earlier, the amount of compensation for interest paid is not limited.

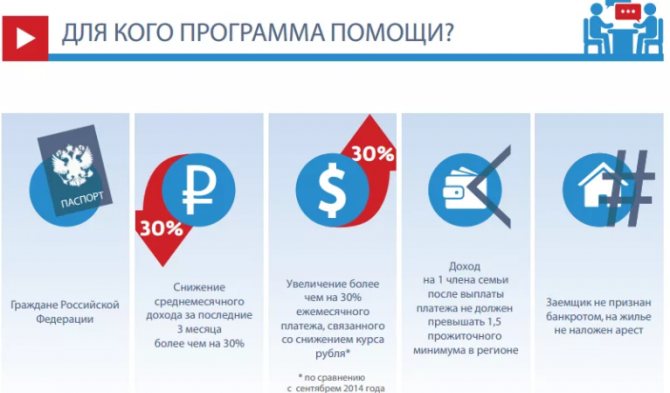

– There is a state program for assistance with mortgage loans to certain categories of borrowers who find themselves in a difficult financial situation.

“An important feature of the state program is that in the event of restructuring (changing the payment schedule within one agreement) of a mortgage housing loan, the borrower’s financial obligations will be reduced by 30% of the loan balance, but not more than 1.5 million rubles,” says the leading lawyer of the European Legal Service Victoria Aptekina.

Marina Soboleva.

Refinancing

Banks are actively offering refinancing services to clients. You can get a new loan to pay off the old one, but on different terms, both from your own organization and from a third party. For external companies, this is an opportunity to lure a borrower and get another source of profit.

Features of refinancing:

- Merging up to 5 credits into 1;

- Reduced interest (often the larger the amount, the lower the rate);

- Reducing the monthly amount paid or the total overpayment.

What you need to do: familiarize yourself with the organizations’ proposals and the terms of the transaction (conveniently through the Banki.ru service), come to the bank and submit an application for loan refinancing, wait for the decision, conclude a new agreement after the new lender transfers money to the accounts of the previous one.

Documents required include a passport and information on the previous loan, which can be obtained in your personal account. If you need an additional amount, prepare a 2-NDFL certificate (not needed for salary clients) and a copy of your employment record.

You need to know: the disadvantages of refinancing are the need for additional costs (find out in advance) and dependence on the registration period: the sooner this is done, the better.

Early repayment

The most effective way to quickly reduce overpayments on a mortgage loan is to make early repayments ahead of the payment schedule. This approach allows you to reduce the financial burden by at least 2%. You can choose one of two options:

vidtok

- Pay off all debt in full. If the debtor has his own savings, he can pay off the balance of the debt with interest in one go and completely repay the bank for the housing loan.

- Do this in parts, but in larger amounts than originally provided for in the loan agreement. After all, the faster the debtor pays the lender for his mortgage obligations, the less the final amount of overpayments will be.

If the debtor pays a larger amount each month than specified in the contract, then the actual balance of the mortgage loan will decrease faster. And, as a result, subsequent payment amounts will be reduced, along with accrued interest on the outstanding balance.

The only problem that a borrower may encounter is the lack of financial ability to contribute more money to repay the mortgage. And this is not to mention paying off the loan to the bank in full, in one sum.

Tax deduction

Every year the borrower has the right to return part of the funds from the loan. This right is enshrined in law.

The higher a person’s official salary, the greater the tax deduction, since it represents a refund of the taxes paid for him in the past year. The maximum refund amount cannot exceed 2 million rubles. (260 rubles), and for a refund of taxes on interest paid - 3 million rubles. (390 rubles).

To register you need:

- Fill out the 3-NDFL declaration and write a statement indicating the details of your current account;

- Obtain a certificate from the accounting department in form 2-NDFL;

- Prepare copies of documents for housing: contract, extract from the Unified State Register of Real Estate or certificate of state registration of rights (before July 15, 2020), “payments”: receipts, checks, orders, receipts, etc.

The maximum period for consideration of an application is 90 days + 30 days for the transfer of funds. Everything can be done through Sberbank’s “Return Taxes” service for 1,499 rubles. You need to go to the website, upload documents, wait for the declaration to be prepared and then submit it through your personal account of the Federal Tax Service or by direct delivery to the tax office.

Formula for calculating overpayment for a mortgage

When the borrower has theoretically figured out how to correctly calculate the overpayment on a mortgage, you can start working with the calculator. There are no particular difficulties in the process. In special windows you need to enter the following parameters:

- cost of the apartment;

- the amount of the initial contribution;

- optimal mortgage lending period;

- bank interest rate.

For a more accurate calculation, it is advisable to take into account additional factors that influence the amount of overpayment. Among them:

- one-time bank commissions for opening an account, processing/issuing a loan, etc.;

- monthly fees for using credit money, servicing a mortgage agreement, etc.;

- payment type;

- payment start date.

In this way, you can find out not only the size of the monthly payment, but also the effective interest rate, the overpayment at interest rates and the total total overpayment, taking into account bank and insurance commissions.

Mortgage Borrower Assistance Program

The assistance program started in April 2020. It lasted until May 31, 2020, but was resumed in August. Persons in difficult financial situations can count on benefits. The borrower must submit an application for restructuring. The new agreement contains other conditions that must comply with legal requirements:

- Changing the mortgage currency (for loans received in dollars, euros or yen);

- Interest – no more than 11.5 for foreign loans and not higher than the rate that is relevant at the time of concluding the contractual relationship;

- Reduction of the amount - in the amount of at least 30% of the balance of the debt, but not more than 1.5 million rubles. According to DOM.RF it can be increased by 2 times;

- Exemption from further payment of penalties.

Look at the same topic: Military mortgage in Promsvyazbank in [y] year - conditions and interest rate

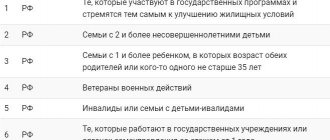

There is no fee for registering a new agreement. The loan term does not change. Only a citizen of the Russian Federation can receive help. Who falls under the conditions:

- Parents of 1 or 2 minor children or guardians/trustees;

- Disabled people/citizens with children with disabilities;

- Combat veterans;

- Persons who have dependents under 24 years of age who are studying full-time;

- Families whose total income for 3 months before submitting the application does not exceed twice the subsistence level for each family member after deducting the scheduled mortgage payment.

Remember: the area of the mortgaged property cannot exceed 45 sq.m. for a one-room apartment, 65 sq.m. – for a two-room apartment, 85 sq. m. - for three or more rooms. You can submit an application one year after the conclusion of the mortgage agreement.

Calculation example

The cost of a home loan depends on the loan term and accrued interest. Let’s say, with an amount of 2.5 million rubles and a rate of 11.5%, the following picture is obtained with the annuity form of repayments:

- 1 year – 158,452 rub.

- 5 years – 798,891.

- 10 years – 1,717,863

- For 15 and 20 years - 2,756,854 and, respectively, 3,898,578 rubles.

- 30 years – 6,412,623 rubles.

In this case, the amount of payment when paying off the debt over 5 years will be 54,982 rubles. If we consider terms of 20-30 years, then the payment will be at the level of 24.7 - 26.6 thousand, almost the same, but the overpayment looks significant.

Experts advise taking out a loan for a period of up to 15 years , where the monthly payment will be 29,205 rubles. In the interval of 15 or more, the highest interest rates for payments are formed.

Advantageous mortgage offers from Sberbank of Russia ⇒

Mortgage at 6% at birth of children

The state has a preferential program, participants of which can count on loan approval at a rate of 6 percent. Condition – birth of the second, third and subsequent children in the period from January 1, 2018 to the last day of December 2022. Families where children were born from July 1, 2022 to December 31 of the same year can apply for help until March 31, 2023 .

Grace period duration:

- 3 years at the birth of the 2nd child;

- 5 years – third child and subsequent ones;

- 8 years – with the simultaneous birth of 2 children (second, third, etc.

The maximum mortgage amount is 12 million rubles. for Moscow, St. Petersburg and regions, 6 million rubles. - for regions.

A preferential mortgage can be covered with maternity capital.

External refinancing

If the home bank where the housing loan was previously issued is for some reason unable or unwilling to renegotiate the terms of the agreement, the borrower can turn to a completely different bank for refinancing. Simply put, he can find another bank where the terms of a mortgage loan are much more favorable, and submit an application there.

If the new bank considers the borrower to be reliable, it will fully repay all debt on the loan to the old lender at the expense of its capital, that is, it will buy out the debt. Well, the borrower, in turn, will now pay the mortgage debt to another bank, but on the most favorable terms for himself.

12

A trustworthy client will be able to count on a new loan repayment schedule, as well as a significant reduction in the rate, which will reduce overpayments by at least 2%.