What are the difficulties that arise in the business of a credit broker?

There are a large number of barriers that will prevent a new broker from entering the credit brokerage market.

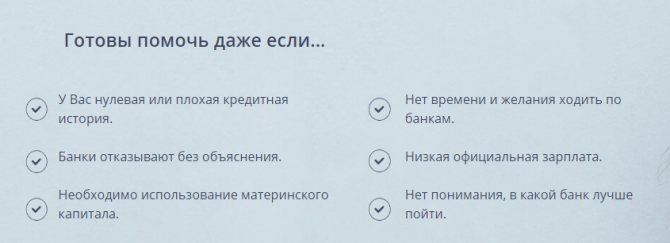

First of all, the question arises, where to get clients? This question should be key, not only in the brokerage business, but in any other business. Many potential clients in Russia are afraid to contact a credit broker because there are a large number of “gray” and “black” brokers on the market. So, if you decide to take a large advance for your services, it is unlikely that anyone will work with you. Secondly, when contacting a credit broker, the client wants to have a guarantee of receiving a loan. So why does he contact a broker rather than go directly to the bank? After all, only a small part of clients are truly busy and do not have time for this. In other cases, the client has a bad credit history or is unable to officially confirm his income.

How to start a business from scratch: mortgage broker

A mortgage broker is a specialist who specializes in mortgage lending and provides services to clients in the relevant industry. The main feature characteristic of specialists in this profile is that they must be qualified in matters of lending, as well as understand the situation on the real estate market.

On video: Mortgage 2020, mortgage broker, situation on the real estate market

There are several reasons why you should choose a mortgage broker profile:

- relative vacancy of this niche: today there is a very small number of specialized agencies providing consulting and other services in mortgage matters. Therefore, the demand for private specialists is increasing;

- minimum starting investment;

- high profitability of such activities.

One of the aspects that makes the idea of opening a business providing mortgage brokerage services very promising is the projected decline in loan rates. In the near future, this may mean an increase in demand for the population to purchase housing in installments. Thus, the services of these specialists will become even more in demand.

On video: Mortgage without down payment

The main responsibilities of a mortgage broker will be the following:

- providing advice to clients regarding the conditions for obtaining a mortgage in modern banks;

- selection of suitable offers taking into account the client’s wishes;

- providing assistance in preparing documents for mortgage lending.

Starting a mortgage brokerage business from scratch can be difficult for several reasons.

Firstly, you need to establish relationships with the largest banks offering mortgage lending, as well as keep your finger on the pulse of the current state of the real estate industry in your city and region. In fact, this knowledge, as well as the ability to quickly use Internet technologies, will help not only open, but also achieve promotion of your activities.

On video: Where to get clients for a mortgage broker, personal experience

The mortgage broker himself must have a certain education - as a rule, he will need knowledge and skills in the field of lending and real estate. This means that the broker must be educated as a banker, economist or accountant, and it would be nice if he had experience working in credit institutions.

Many brokers begin their activities by signing an agreement with credit institutions. This not only guarantees the availability of customers, but also provides several other benefits. In addition, banks often provide their partner brokers with the necessary software free of charge, which greatly facilitates their work and allows them to save on start-up costs.

Become a loan agent to get started

Before you come to the decision, “I will become a loan donor,” become a loan agent. Essentially, this is the same credit broker, but acting exclusively on behalf of a specific bank. This is a kind of sales manager for banking products who receives an agency fee for his work. Many large Russian banks have such programs.

The benefit from such cooperation is obvious - banks want you to bring them clients. To do this, you are provided with all the necessary promotional materials and are introduced to all existing credit products. A credit agent has only two tasks: to find a client who wants to get a loan and to persuade him to fill out an application. On average, an agent receives 150-200 rubles for each approved application.

Cost of services

The intermediary charges a fee for his work, and the retained amount is quite high. Let's consider the main parameters on which the cost of brokerage services depends:

- the region where the client applies for services and obtains a loan (for example, the remuneration for a mortgage loan in Moscow is the highest);

- a list of services that the intermediary provides to the borrower (with an additional search for real estate, the price increases);

- what amount the client claims when applying for a mortgage, as well as the amount of the down payment;

- conditions of the lender that may be offered to the borrower under the loan program upon application.

These parameters add up to the deduction that is charged by the intermediary for helping the client apply for a loan. As a rule, Russian institutions retain a commission of 5 to 15% based on the results of a successful transaction.

Important! A reliable intermediary does not withhold an advance payment from the client, since he charges only for a high-quality result and a issued loan.

How do credit brokers work?

Credit brokers enter into agency agreements with several banks at once: having a variety of credit programs at their disposal, they are ready to offer their clients the opportunity to choose the best.

They have full information about what factors are taken into account by banks when assessing borrowers, and by helping in the collection and execution of documents, they can significantly increase the chances of approval. In addition, a credit broker can point out pitfalls in the agreement and ultimately save you a lot of money.

As for payment for specialist services, this can be either a percentage of the approved loan or a fixed payment. The latter option is more common in Russia.

List of services offered

Extensive knowledge in the field of real estate lending, insurance and some other related areas allows a mortgage broker to take on all the work on:

- choosing a creditor bank and a specific lending program;

- collecting and filling out all necessary documentation;

- selection of real estate;

- obtaining bank approval;

- support of the process of signing a mortgage agreement.

Responsibilities

The main responsibilities of a mortgage broker include quickly selecting the most profitable mortgage program and concluding a loan agreement between the borrower and the bank.

In Russia there is no law regulating the activities of mortgage brokers. Therefore, an important point in working with an intermediary is the conclusion of an agreement, which outlines all his responsibilities. It should be remembered that the broker has the right not to provide services not specified in the contract. And it will be impossible to oblige him to do this.

Brokerage opportunities

To more fully understand who a mortgage broker is, it is necessary to understand what opportunities open up for a borrower using his services:

- The specialist has an understanding of all existing credit programs and is familiar with their conditions. A loan application can be submitted for consideration to several banks simultaneously;

- Established contacts and connections with bank credit departments significantly reduce the time it takes to consider an application. In some cases, the loan can be issued directly on the day the application is submitted;

- The use of professional intermediary services when filling out the application form and collecting documents significantly reduces the risk of refusals;

- Many brokers have agreements with banks to provide their clients with certain privileges. For example, a mortgage at a reduced interest rate or other nice bonuses.

What does working with a mortgage broker look like?

When you first contact, a mortgage selection specialist will ask in detail:

- what kind of housing and under what conditions does the client want to purchase;

- what loan amount does he expect;

- financial condition;

- what mortgage terms is being considered?

Based on an analysis of the data received and the financial condition of the borrower, the specialist selects the most profitable mortgage programs from the banks’ offers. The credit guru will tell you in detail about all the nuances and features of cooperation with each of the applicant banks.

The next stage of work will be the signing of an intermediary agreement, which will outline all the services provided by the specialist and their cost. At this stage, you need to be extremely careful and carefully study all the points of the document proposed for signing.

Collecting and filling out the necessary documents, submitting an application is carried out jointly with the borrower. After receiving bank approval, it’s time to select real estate. A mortgage broker will help check the legal purity of the apartment, assess the financial condition of the developer, and select the most favorable insurance conditions.

All the terms and conditions of the loan will be explained to the client in clear and accessible language before signing the mortgage agreement. The work of the mortgage broker will be completed only after the borrower completes the transaction and receives housing.

What it takes to become a mortgage broker

You can learn how to become a mortgage broker by completing special training. The first mortgage brokerage courses were created in 2005 at the initiative of the banking sector, the Russian Guild of Realtors and the Association of Individual Housing Construction. Many large brokerage agencies develop and implement their own programs based on their experience.

in addition to educational services, they offer future specialists their support and assistance in developing and promoting their business. The League developed special standards for the profession and introduced a voluntary certification system.

The professions of “Credit Broker” and “Credit Consultant” are taught at the Samara State University of Economics. The course program was developed jointly with the Association of Credit Brokers of Russia.

You can find other mortgage broker training centers on the Internet. It is noteworthy that the cost of such training ranges from 10-15 to 60 thousand rubles.

How does it work

White mortgage brokers are good at refusing people who ask for help in obtaining borrowed bank money. If, based on the results of a survey of the applicant (in the office or by phone), the specialist comes to the conclusion that no bank will give this person a housing loan, then he immediately reports this.

Many conscientious companies refuse to apply to persons who do not have a large official salary, confirmed by Form 2-NDFL. Borrowers with a bad credit history should not count on a mortgage loan.

I do not give a list of cases when banks absolutely refuse, but brokerage professionals know them (the cases), and decent intermediaries do not mislead clients with impossible promises.

If it is possible to help a potential mortgagee, the specialist invites him to sign an agreement.

The intermediary can take over filling out the application for a mortgage loan, but the borrower has to collect the remaining documents; the broker only advises on what papers are needed and how they should be completed.

When the entire package of papers is collected, it is transferred to the bank. An intermediary can significantly speed up the process of reviewing documents and making a decision on an application for a large loan.

Having learned that the lender has resolved the client’s issue positively, the broker invites him to call a bank employee, agree on the date and time of his visit to the branch, come and sign the agreement. The satisfied borrower then pays the intermediary a fee upon successful transaction.

Further worries - settlement with the seller of the real estate, registration of ownership of the property, transferring it as collateral to the bank - fall on the mortgager.

Types of services

Mortgage Broker:

- selects a loan program;

- helps the borrower collect and fill out the documentation required to obtain borrowed funds;

- selects a suitable real estate object, against which the bank will agree to issue a loan;

- makes every effort to obtain lender approval of the mortgage application;

- accompanies the process of concluding a mortgage agreement between the bank and the mortgagee.

The intermediary is also able to help the borrower obtain a non-targeted cash loan (consumer loan), which will be used as a down payment on a mortgage.

What knowledge should you have?

A mortgage brokerage specialist knows:

- specifics of servicing borrowers by banks;

- properties of credit banking products;

- legal subtleties of drawing up mortgage agreements;

- characteristics of residential real estate;

- the nature of the mediator's work.

How much does a broker earn?

Well, the costs are clear - time plus money for training, start-up capital for the first operations, gaining experience. How much does a broker earn? Everything here will depend on two factors. Firstly, a fixed monthly rate for the organization in which you will work (if you decide to work as a full-time and not an independent unit). And secondly - interest on each successfully completed operation. The last factor is difficult to predict - everything will depend on the number of people who trust you with their funds, and on knowledge of the market. Experienced brokers with a strong reputation, who instantly catch the slightest fluctuations in the exchange rates of currencies and securities, have consistently high earnings.

Credit broker percentage

It is clear that the services of a credit broker cannot be free. Another thing is that in Western practice, the responsibility for paying for the broker’s work is assumed by banks, to whom the specialist “supplies” clients, while in Russia the borrower pays.

We can talk about different payment schemes:

- interest. Typically, loan brokers charge between 1% and 5% depending on the loan amount. If no loan is approved, no payment is made;

- fixed rate. Different brokerage companies offer different prices for their services - check this question in advance;

- mixed scheme. The client can choose either interest or a fixed amount. The division by payment methods may depend on the range of services offered, for example, for a consultation a broker may ask for a fixed payment, while for intermediary work he will take a percentage of the loan received.

Can a mortgage broker help you avoid rejection or get approved for a loan?

Yes. This is its direct function. But everything is within the law.

For example, if a mortgage broker sees that you, as a potential borrower, are likely to be rejected, he will warn you about this and suggest options for solving the problem.

It is naive to think that if you get rejected by 2-3-4 banks, then you will probably be lucky with the 5th one. The reasons for refusals are usually systemic, and all banking institutions have a similar scoring system, plus or minus. Plus, don’t forget about your credit history—all banks also have access to it.

In order to understand the likelihood of being denied a mortgage loan, you should know the most common reasons for such a decision by the credit committee:

Damaged credit history

Bankers very carefully check how conscientiously a citizen made payments on previously taken, past loans:

- If a person is late with a payment once, and for no more than 5 days, banks will not pay attention to this when applying for a mortgage;

- If the delays were regular and long, the bank can approve the loan, but the client must confirm that it has been corrected, but they can also refuse;

- If a person has never returned funds on past loans, then the bank will not even consider such a questionnaire.

"Gray" wages.

Today, many banks advertise left and right that they are ready to issue loans to everyone, even citizens who receive their salary in an envelope. To do this, they have their own form to confirm the borrower's income. The client only needs to sign it from the director of the organization or chief accountant.

However, surveys show that if a client could not provide a 2-NDFL certificate, even for a small salary, then he will be denied a mortgage.

No official employment

Many people who are not officially employed face the problem of obtaining a mortgage loan. They are ready to provide statements from their deposit accounts, show their property, bring many guarantors, but, as a rule, this does not help - the bank still refuses.

What is the cheapest way to fence a plot? Metal mesh fence

Flooring in the house: laminate, parquet or linoleum. What's better?

Concrete mixer for building a house. Which one is better to choose?

How to choose the right private house for permanent residence?

Who and how are cottage villages managed? Functions of management companies

How to buy municipal land and register its ownership? Auctions and tenders for land plots

Energy-saving methods of building houses and cottages

Study: How the cost of plots changes depending on the distance from the center of Moscow

Cottage projects. Why such a difference in prices?

How to protect plants on the site from frost?

Little work experience

If you have just recently gotten a job and have little experience, it will be difficult to get a mortgage.

Officially, banks say that they can provide a loan to a young specialist if his work experience exceeds 1 year, but in practice this is far from the case. The easiest way to get a mortgage is if you have a solid work history and worked for more than 3 years at your last place of employment.

Age limit

In Russian banks, experts believe that upon retirement, a citizen loses his solvency, and this fact is not subject to discussion. That is, if a person has 5 years left before retirement, then, of course, he can theoretically count on receiving a loan, but the bank will still refuse him.

Debt load

Quite often, banks refuse clients with a large number of outstanding loans. Moreover, this figure is different for all bankers: for some, 2 loans taken out at once seem suspicious, and for others, 5 loans paid by the borrower seem to be the norm. A lot depends on the size of the loans and the bank itself.

It seemed that the person took out loans and was paying them off - this should, on the contrary, serve as confirmation of his solvency. However, credit experts fear that the borrower will not be able to bear the burden of payments, which means that payments will be irregular, and if the client goes bankrupt, then several banks will claim to collect the debts.

How to become a broker in Russia

Before becoming a broker in Russia, you must undergo special training. The Federal Service for Financial Markets, available in every region of the Russian Federation, will send you to the training courses. Please note: courses must be official. That is, they must be carried out by licensed companies. The training will take from 2 to 8 weeks, depending on the specifics of your future work chosen and the desired level of skill. The training will be considered successfully completed if you pass the exam. Having passed this last test, you will receive a license that allows you to officially provide brokerage services in the Russian Federation.

Pricing policy for services for assistance in obtaining a mortgage

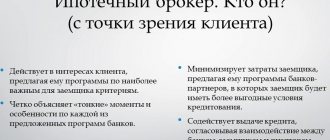

How much assistance in obtaining a mortgage costs depends on whether the mortgage broker is a representative of the interests of a particular bank or developer or an independent expert. Banks interested in clients can pay for the services of a mortgage broker, and the price for the borrower is reduced. However, the client should exercise caution, since loan officers have a direct interest in obtaining a mortgage from a specific financial institution, which may not be profitable.

On average, obtaining a mortgage through a broker costs about 1-3% of the loan amount received. The percentage fluctuates depending on a number of factors:

- liquidity of the purchased real estate, since illiquid housing is more difficult to sell, which imposes restrictions on the number of credit institutions;

- desired loan term due to banking restrictions;

- the size of the down payment, which the higher, the more banks will be interested in the client;

- the borrower's reputation (credit history, presence or absence of official income, debt load).

Typically, the mortgage loan officer will want 100% advance payment before performing duties. The borrower can do this on condition of repayment if the banks refuse the mortgage. Otherwise, in the absence of clarity in the contract, the client will have no reason to demand an advance for a service that is not actually provided.

Who regulates the activities of mortgage brokers in Russia

Today in Russia there is no supervisory body regulating this activity. Even the powers of the financial mega-regulator - the Central Bank of the Russian Federation - do not extend to intermediaries between lenders and borrowers.

There is also no federal law on the concept of credit brokerage, the rights and responsibilities of market participants. A corresponding bill was developed, but subsequently remained unadopted.

Therefore, both white and black brokers work freely in Russia, whose activities do not violate the Civil, Criminal and other codes. Whites respect the laws, blacks skillfully circumvent them, taking advantage of legal illiteracy or simply the naivety of those who believe their promises, give an advance payment, and are left with nothing.

It is better for borrowers to choose a reputable service provider from the list of members of ACBR - the Association of Credit Brokers of Russia. ACBR, to the best of its ability, promotes the development of a civilized market in the country.

Service agreement

An agreement must be concluded between the borrower and the intermediary if the interests of the client are satisfied. The following information is written here:

- Information about the subject of the agreement.

- Information about the lender, borrower and intermediary.

- Nature of the services provided.

- Amount of reward.

- Information regarding the collateral object.

- All necessary information about the loan product.

The rights and obligations of the parties, as well as liability in case of violation of the agreement, are specified separately. All details of the parties to the transaction are indicated separately.

Important! The mediation agreement is drawn up in triplicate and distributed between the borrower, lender and third-party institution.

On the territory of the Russian Federation, various intermediary companies operate and provide assistance in obtaining targeted loans. Their activities greatly facilitate the client’s tasks when obtaining a loan, but we must not forget that a commission is charged for the work, and its size is quite large. In addition, there are a number of unscrupulous intermediaries who seek to deceive the client, extracting additional benefits from this.

How to become a mortgage broker: a step-by-step business plan

A step-by-step business plan for the development of a credit brokerage agency must necessarily include the following points:

- A clear definition of the range of services offered.

This could be consulting, assistance with choosing a bank to obtain a loan, preparation of all necessary documents, or complete transaction.

- It is necessary to choose the right place for your office. The brokerage agency office should be located in a busy urban area.

- Personnel must be properly selected.

Managers are required to understand the specifics of processing loans and clearly determine how solvent each borrower is.

Each employee must have a prepared workplace.

- It is recommended to use outdoor advertising to promote your services. It should be placed in the vicinity of your own office. Internet advertising is effective.

You also need to promote your own services on specialized forums and advertise services on relevant websites.

- The result of all operations performed is the level of return on investment for the project. At the very first stage, you should not count on more than 15-20 clients per month.

If the advertising campaign is carried out correctly, an increase in the number of clients by 20% within a month is ensured.

With this order of things, the costs are recouped in four months.

Business registration

To start a commercial activity, you need to open an LLC or register an individual entrepreneur. If you don’t have enough time or money for this, before becoming a broker, you can work with your first clients without official registration, as an individual. But in order to avoid problems in the future, documents must be completed. At first, you can work as an individual entrepreneur under a simplified taxation system.

No certificates, licenses or other permits are needed for intermediary activities in the field of lending.

Where to start: choosing a direction of activity

The choice of a specific direction for carrying out business activities and providing brokerage services plays an important role in the process of implementing the business project under consideration. An entrepreneur can practice in the direction of one credit service or provide clients with a wide range of brokerage services in the field of lending. For example, in the case of providing brokerage services for mortgage lending, real estate agencies, in addition to other companies, will compete with the broker.

Office location

It is advisable that the office space be located near a bank, business center or car market. If you can choose the right location, the influx of clients to your company will be stable.

You don't need a large office to work. It is enough to rent a room of 10-20 square meters. meters. It should be equipped with workplaces for managers who will provide clients with information about the loan products of different banks, as well as their advantages and disadvantages.

A credit broker can run his own business without an office. In this case, all you need to work is a table, a chair and a computer with Internet access. You can also consult clients by visiting them at home. This service usually costs more, so it brings additional profit.

Equipment and consumables

To organize a business, it will be enough to purchase the necessary office furniture and equip workplaces with computer equipment and landline telephones.

How to set up a broker's workplace

The goal of organizing a well-equipped workplace for each employee is to maximize productivity. To do this, you will need to install a multi-channel telephone line and high-speed Internet.

Accordingly, purchase pieces of furniture (tables, chairs, cabinets, etc.) and office equipment. The estimated costs for all of the above are approximately 50 thousand rubles . To run a business, in addition to broker managers, you will need an accountant and a system administrator.

Typically, a system administrator and a person in charge of accounting are not hired for a permanent job. Accountant and system administrator services are ordered from specialized companies. Payment for these services for 1 month will be 15,000-18,000 rubles .

Staff

To work in a brokerage office you need to hire the following personnel:

- Managers;

- System Administrator;

- Accountant.

Managers must objectively assess the solvency of clients, and also clearly know the procedure for applying for a loan. Therefore, it is advisable to hire former bank employees or graduates with a higher economic education for such a position, with their subsequent practical training.

Such specialists are paid a constant salary of 6–10 rubles and a certain percentage of each transaction. Employees receive 0.5–1% from each loan. When things get better, the salary can be withdrawn, since the interest will generate a quite decent salary. Each employee must have his own workplace, the arrangement of which will cost 40 thousand rubles. You will also have to purchase a dedicated Internet channel and a telephone line.

You can hire employees from an outsourcing company as an accountant and IT specialist. The system administrator will come to the office once a quarter. For each visit he will have to pay approximately 2 thousand rubles. An accountant charges an average of about 20 thousand rubles per month for his services.

As you can see, the business idea of a credit broker does not require large investments, but at the same time allows you to get a good profit.

Learn to assess creditworthiness

A credit assessment helps a broker match a client with the right lender and loan product. For example, a client with no lending experience approaches a mortgage broker. The client needs a mortgage, but the banks refuse. A broker will help you build a credit history so that any bank will approve a mortgage.

Another example: a client approaches a broker with late payments on a loan. I urgently need a loan, but they refuse everywhere. The broker finds a credit cooperative that is willing to provide a loan secured by the apartment. The client closes the overdue payments, his credit history improves, and he can get a loan.

Research lenders in your region of operation

To select a suitable lender for a borrower, you need to know the loan products and the “entry threshold” of different banks, microfinance organizations and credit unions. For example, an individual entrepreneur approaches a broker: he needs money to develop his business. The broker knows that Zoloto Bank does not lend to small businesses at all, Serebre lends against real estate, and Olov allows you to get a loan without collateral. If the individual entrepreneur has collateral, the broker will send it to Serebro; if there is no collateral, he will send it to Olovo.

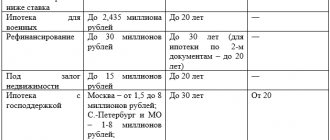

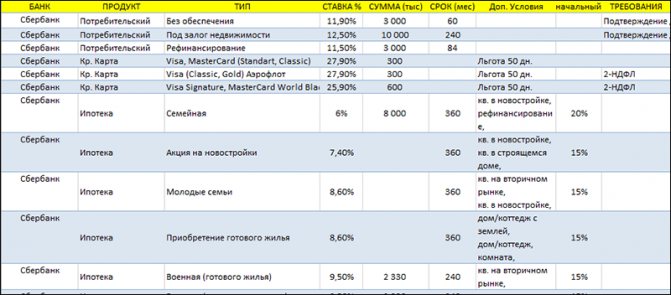

For convenience, brokers create a table with credit institutions in the city. In this table they record credit institutions, loan products, interest rates and requirements for borrowers. We recommend updating this table at least once a quarter, because lending conditions and interest rates change frequently.

Fragment of a table with credit institutions

Organize the flow of clients

Typically, brokers use three tools to attract clients: online, outdoor advertising and word of mouth. The last tool is activated over time - when you have a lot of satisfied clients who recommend the broker to their friends. Practice shows that 3-4 months of active work are enough for clients to start returning on their own, bringing acquaintances, colleagues and friends.

online in two ways: create a platform for gathering visitors and set up advertising traffic, or buy ready-made applications. A classic example of a site and traffic: website + contextual advertising. If you type “help in obtaining a loan” into Yandex, you will see advertisements for credit brokers in advertising spaces.

Contextual advertising of credit brokers

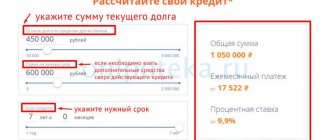

Brokers also buy ready-made online applications. Such requests are also called leads. In the EBK system, working with leads looks like this: the broker makes a deposit of 10,000 rubles to the account and receives applications for the deposited amount. Applications are customized by city, loan size and age. For example, it is convenient for a broker to work with consumer loans for Yekaterinburg residents from 25 to 30 years old. Using a website to segment applications so subtly is almost impossible. And it’s easy to buy ready-made ones.

Outdoor advertising : billboards, announcements at bus stops, leaflets, etc. Compared to online advertising, outdoor advertising is more expensive. You need to develop a layout and print it. For example, a broker from Yekaterinburg Pavel Babushkin spent 25,000 rubles to place advertisements at 230 stops. Outdoor advertising is also riskier: to test its effectiveness, you need to print a whole batch. Online testing is much cheaper. We recommend that novice brokers start with online advertising, and when a stable flow of clients from the Internet appears, connect offline channels.

Word of mouth is a nice bonus for brokers who do their job well. Recommendations lead to loyal clients, and you don’t have to pay to attract them. To encourage referrals, some brokers offer cash bonuses to clients. For example, broker Ibragim Badalov pays a 10% commission to the recommender from whom the client came.

Minimum amount for work

Consultation with a bona fide broker can be obtained free of charge.

The standard prepayment is 50% of the fee for the work (if it is 10 thousand rubles, you need to pay 5 thousand right away).

The minimum percentage of the mortgage loan amount is 1%.

Business registration and broker agreement

Brokers register individual entrepreneurs or LLCs to enter into agreements with clients and banks. The easiest option to start: individual entrepreneur on the simplified tax system. With this form of registration, it is enough to take into account income and pay 6% on it. As the company grows, there will be more arguments in favor of an LLC, including for tax optimization.

To work, you definitely need a contract. The agreement helps out in controversial situations with clients and protects against attempted non-payment of commission. Thus, a broker from Kazan, thanks to a competent agreement, won the case when the client refused to pay for his services.

How to conclude a service agreement

Before signing the contract, it is recommended to check:

- list of services that the contractor undertakes to provide. It should contain everything that the specialist promised to do;

- “Payment for services” item. The costs of executing the contract must be borne by the broker. He does not have the right to charge any money from the customer other than remuneration;

- place of service provision;

- validity period of the document.

I advise you to provide in the agreement the right of the customer to terminate it early.

What documents will the representative request?

The mortgage brokerage specialist should request from the client only the documents required by the bank.

He undertakes to keep the personal data of the customer of services secret, without transferring documents to third parties.

Promoting business and fighting competitors

In order to promote this business, it is advisable to use outdoor advertising and the Internet.

If your company has a corporate website, this will significantly raise its status. On it you can post information about prices and services. Also, promote your business through forums and advertisements in print publications.

Activities of a mortgage broker from A to Z

There are two parties involved in obtaining a mortgage loan: the lending institution and the buyer of the property. An agent can represent both the bank and its client, interacting with other market participants: realtors, appraisers, insurance companies.

Responsibilities

Functional responsibilities can be determined from the job description. Such a specialist must:

- monitor all available programs;

- help in choosing the optimal loan program;

- carry out all instructions specified in the agreement;

- provide advice related to lending;

- explain the risks associated with any transaction;

- resolve conflicts of interest in favor of the client;

- ensure confidentiality;

- provide the client with all the data necessary to execute the order;

- before concluding a transaction, study the client’s financial situation;

- provide assistance in preparing a package of documents;

- accompany the transaction and its servicing;

- interact with other market participants: real estate agencies, appraisal and insurance companies;

- warn the client about responsibility for providing false information.

Attention! Most often, an agency agreement is drawn up with a broker. This means that the intermediary can act on behalf of the client, but at his expense.

Brokerage opportunities

If an agent works for a specialized company, the range of services is quite wide:

- assessment of the borrower’s financial condition, ordering a credit history from several bureaus, and analyzing it;

- assistance in collecting documents, checking and evaluating them;

- providing advice on the lending and loan servicing procedure, risks, ways to improve status;

- calculation of associated costs;

- search for the optimal program;

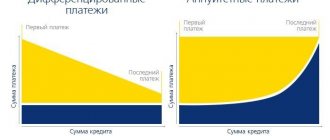

- calculation of overpayments and analysis of debt repayment schemes;

- assistance in real estate valuation;

- preliminary approval with the bank;

- registration and submission of an application;

- support during the execution and signing of the contract (analysis and correction of conditions);

- assistance (if necessary) in refinancing.

Important! It is believed that the most profitable services are provided by mortgage agents who are also realtors.

What does working with a mortgage broker look like?

If the specialist is chosen correctly, he will begin to understand the situation at the first meeting.

First of all, he finds out:

- what amount is required;

- level and type of income (“white” or “gray”);

- credit history status;

- how much money is available for the down payment;

- over what period of time it is planned to repay the debt;

- Are there any additional wishes regarding the program?

Collaboration is facilitated by accurate answers to all questions.

Next, several programs that meet specific conditions are selected and calculations are made. In a non-standard situation, it takes time to select the optimal option.

The borrower collects a package of documents. If necessary, he is provided with consultation. The application is completed by an agent and most often approved, since good mortgage brokers are regular clients of banks.

If the answer is yes, the borrower begins collecting documentation for the property. The assistance of an agent is required if the lending institution does not work with a certain category of real estate. An intermediary is also necessary when assessing and insuring real estate and the life of the borrower. He most often has appraisal and insurance companies with which he constantly cooperates.

All documents are submitted to the bank, the agent studies the agreement and agrees to make changes to the text (if necessary). After signing the agreement, documents for registration of real estate are submitted. If you encounter difficulties with payments, you can contact the same specialist to choose a refinancing program.

What does it take to become a mortgage broker?

Given the market situation, many are interested in how to become a mortgage broker. Since the Russian market differs from the US and European models, foreign training programs cannot be adapted. Banks, AHML and the guild of realtors were the first to understand the need for training. Since 20015, schools and courses began to open in cities where these specialists are most in demand.

At the moment, the largest center can be considered the ANO National League of Certified Mortgage Brokers. This organization divided trainees into several categories and began testing and issuing certificates. Professional standards have been developed. Large brokerage companies train employees on their own.

It is important for banks that intermediaries are able to classify borrowers, collect standard packages of documents and simplify their processing. It is important for a realtor to have a broker help him increase the number of clients.

Based on these requirements, training objectives were developed:

- teach how to attract potential borrowers;

- learn to expand the range of services;

- teach how to assess risks and pre-select clients;

- teach how to work with appraisers and insurers;

- teach document management and the use of modern technologies.

There are 3 categories of students undergoing training:

- future employees of large brokerage companies;

- employees of enterprises for which brokerage is not the main area of activity;

- individuals who want to learn a new profession from scratch or improve their skills.

Training centers are created by banks, real estate agencies, brokerage companies, and universities. To become a mortgage broker, you need to find a training center. If there is no such thing nearby, it is worth searching on the Internet. It is desirable to have a higher education. After full-time or part-time study, you need to pass an exam. If the result is positive, a certificate is issued.

What should it be

A self-employed mortgage broker must be a good white collar worker who performs the duties of an office manager.

A self-employed private broker must have the qualities of a successful entrepreneur.

Qualities as a person

A mortgage brokerage specialist must have:

- punctuality, attention to detail;

- perseverance;

- communication skills, communication skills with clients and business partners;

- business acumen.

Career

The opportunity to grow from an ordinary specialist to a manager of one or another level in the credit broker profession is the same as in any segment of the legal or financial sphere.

It is possible to move to a higher position in a financial or legal company.

What is a Mortgage Broker?

A mortgage broker is a specialist or organization engaged in providing assistance in obtaining home loans. The person selects the optimal loan terms that suit the client on all legal and financial issues, and deals with the preparation and collection of documentation. In fact, this is an intermediary between the bank and a potential borrower. The specialist acts in the interests of the client and makes every effort so that the citizen can conclude a deal on suitable terms.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

For your information

The service is usually provided by former bank employees. They understand how the interest rate is formed, can quickly understand all the features of the offer and present the potential borrower in a favorable light. Initially, the mortgage broker communicates with the client and collects the necessary information to submit an application, and then helps fill out the documentation and submit it to the authorized body. By enlisting the support of a specialist, a citizen increases the likelihood of approval of the application and can reduce the possible overpayment by 0.5-1% per annum. This is a significant saving in case of purchasing expensive real estate.

Scheme of work of a financial intermediary

As a rule, the work scheme of a financial intermediary when obtaining a loan consists of several stages:

- Initial consultation with the client, familiarization with his situation, wishes and credit history;

- Analysis of current lending programs in various banks;

- Joint consideration of the most suitable options and making a final decision;

- Consulting support and assistance in preparing a package of documents;

- Support when signing a loan agreement.

What are the broker's services?

There are various companies operating on the territory of the Russian Federation that provide assistance in obtaining a housing loan. Typically, their main job is to:

- filling out a loan application to financial institutions that provide the opportunity to buy a home with a mortgage;

- searching for a suitable residential property according to the client’s parameters, as well as the possibilities of an approved lending program;

- preparation of documents for registration of a transaction for the purchase of an apartment on credit using borrowed funds;

- support of the transaction until the borrower receives the acquired property at his disposal and transfers the down payment to the bank;

- monitoring the fulfillment of loan obligations by a client who has taken out a mortgage with a broker.

In other words, a third-party company acts as an intermediary between the borrower and the financial institution, and in addition acts as a guarantor of a fair transaction when purchasing property.

Interesting! Brokerage institutions significantly reduce the time spent on the borrower, but for this they retain a substantial commission, which is why their services are not always relevant.

Basic services

Most often, people turn to a professional mediator for help in the following cases:

- failure to obtain a loan;

- with bad credit history;

- insufficient income;

- urgent need for money;

- problems with existing credit;

- if you need specialist advice;

- when you need to take out a loan for the first time.

The main services of a credit broker are intermediation in borrowing funds for consumer purposes, for running a business, purchasing real estate, a car, obtaining a credit card or a large amount of cash.

How does a mortgage broker work?

So, you decided that you need a mortgage broker and turned to a specialist. What happens next? You will be required to answer many questions honestly, and the broker may also ask you to take certain documents with you to the consultation.

At the first visit, the specialist should find out:

- your financial situation and creditworthiness;

- information about your employment (where you work, for how long, whether you are at risk of being fired in the foreseeable future, etc.);

- presence of existing credit obligations;

- the possibility of attracting co-borrowers;

- your wishes, i.e. what kind of housing do you want to get, etc.

In addition, the credit broker will check your credit history and make sure that you can, in principle, be granted a loan. If there are any critical problems, you will know about it and get tips on how to improve the situation.

If the information collected allows you to apply for a mortgage, the broker proceeds to selecting a loan program.

What should the specialist do next:

- Choose a program that best suits your wishes, requirements and capabilities.

- Help you collect and draw up documents in such a way as to maximize your chances of loan approval. This may involve attracting co-borrowers, properly preparing certificates, drawing up an application, etc.

- Collect all documents and prepare a mortgage dossier.

Next, the mortgage broker personally transfers the package of documents and the compiled dossier to the selected bank. All you have to do is wait for a solution, which, with the help of a specialist, is almost always positive.

As soon as a positive decision is made on your issue, the mortgage consultant will contact you and also help you obtain insurance and obtain documents for the purchased home from an appraisal company. The specialist provides you with full legal support until you sign a mortgage agreement with the bank. They become your representative throughout the home buying process, which is why it is important to choose the best mortgage broker you can afford.

Payback

The payback period for the initial investment largely depends on how well the company operates. Of the 60–70 clients who visit the brokerage office every month, 30–40 people receive loans. Some are weeded out by banks, and the specialists themselves refuse to work with the rest. At first you will have about 20 visitors per month. But over time, the client base will begin to grow and income will increase. Success in work is ensured by a successful advertising campaign. Under favorable circumstances, you will return the starting capital in 3-4 months. Now you know how to become a broker in Russia, so everything is in your hands.

Business plan and stages of activity

How to become a mortgage broker

Even working as an independent mortgage broker on a freelance basis, such a specialist will actually be engaged in entrepreneurial activity. Like any business, even a small one, mortgage brokerage must be built on the basis of a specific business plan. It should include both the financial investments necessary to start the activity and the calculation of the payback of future activities.

The calculation of the business plan will have to include the following points:

- collecting information about the selected business sector: assessing competitors and studying demand for the selected type of service;

- registration of activities in the tax service;

- expenses for paying for premises if the broker rents an office;

- information costs: purchase of computer and software, Internet and telephone communications;

- fare;

- projected profit level. As a rule, this indicator is determined taking into account the calculation of the level of payment for brokerage services, while being guided by the prices existing in the industry. Basically, payment can be standard, provided for in the initially developed price list, or represent a certain percentage of the transactions carried out. In most cases, the interest rate will be from 1 to 5 percent of the transaction, depending on the complexity of the work performed. Thus, having calculated all these indicators, we can conclude that in general, to get started and enter the mortgage brokerage market, you will need an investment of 2 thousand dollars. The payback of the business, if carried out correctly, will be from 2 months or more, depending on the nature of the start-up costs and the established prices for the services provided.

On video: Mortgage broker as a business

How to make money on mortgage lending

Organizing mortgage brokerage via the Internet today can be one of the options for saving investments in business development. So, without spending money on renting an office and its furnishings, as well as paying utilities and other expenses, a novice broker can focus his attention on organizing work via the Internet. The main condition for successful activity in this case will be the creation of a high-quality Internet site optimized for major search resources.

If brokerage activities will be carried out as usual and the mortgage broker plans to receive clients in the office, you should select a suitable room. As a rule, an office in a central or busy residential area of the city will be sufficient for this purpose. It is imperative that the place is crowded, and that the office building itself is equipped with convenient access and parking. The office must accommodate a workplace for the specialist himself and for receiving visitors. High-quality software and Internet access are a must.

A mortgage broker can provide its services either independently or by hiring one or two assistants. In the second case, you will need more spacious premises to create several jobs, in addition, additional costs associated with paying salaries, as well as possible training of future employees, will have to be included in the budget. The issue of training in specialized courses may also be relevant for an individual entrepreneur who is personally involved in brokerage activities - even experienced specialists need to improve their own level and keep up with the general development of the industry.

An advertising campaign will primarily determine how successful the business will become and how long it will take for the initial investment to pay off. First you need to study the target audience and determine the profile of the potential client and the most suitable advertising methods.

How to start a mortgage lending and consulting business

As a rule, Internet resources are used to disseminate information about assistance services in selecting appropriate mortgage programs and preparing documents. This includes contextual advertising and posting information on forums dedicated to lending and real estate issues. It will be effective to create your own website.

This service may contain not only information about the services provided and prices for them, but also general information on the topic that may be useful to potential clients. Since a fairly wide audience of clients seeks the help of specialists in obtaining a mortgage loan, the area of advertising distribution should be as wide as possible, including also the media and outdoor advertising. Advertising in local newspapers, posting advertisements and placing information banners near bank branches and in residential areas of the city are also effective.

The nuances of working with legal entities

Of course, this type of brokerage work has its own nuances. The fact is that collecting the documents necessary to obtain a loan and consider the application takes a month or longer. And this despite the fact that there is no guaranteed result, so you can run for a whole month and earn nothing. In order to avoid this, it is necessary to have serious knowledge of economic analysis and accounting. This will allow you to quickly navigate and understand how reliable the client is from the bank’s point of view.

So, to get started, there is no easier option than becoming an experienced loan agent at a large bank. But still, it’s up to you to decide what’s best to choose. The most difficult, as well as the most profitable option is to organize a brokerage business under your own brand. But it should be remembered that in this case you cannot do without a client base and connections in banks.

If the phrase “I will become a professional and experienced credit donor in Moscow or another city in Russia” attracts you more than organizing your own business, then it is better to work as a franchise or become a credit agent of a reputable bank. Only after this can you open your own business and “go free swimming”.

As a last resort, you can become a mortgage broker, but remember that there is the lowest demand for these services in Russia. This is due to the fact that private brokers in this segment have a very strong competitor - real estate agencies. And it’s not worth specializing in a certain type of loans, so as not to narrow your already small client base.

We hope that our article helped you learn how to quickly become an experienced loan specialist and open your own business without unnecessary problems. Having studied all the nuances of brokerage in Russia, this is not as difficult as it seems at first glance.

Pitfalls when working with a mortgage broker

Not all potential borrowers trust mortgage brokers in Moscow or other regions of the Russian Federation. This is due to the presence of the following points:

- among companies there are often scammers or unscrupulous institutions (there have been cases when residential property was selected that did not correspond to the value, so it is necessary to check the proposed property);

- as a result, the bank may require a larger down payment or provide additional paid services (often expensive insurance is provided for the collateral);

- the cost of the broker's services may increase at the end of the transaction (in order not to encounter such injustice, it is required that the contract contains the exact price for the services provided);

- There may be data that does not correspond to reality regarding the interest accrued by the bank per year (it is recommended to request a copy of the agreement not only with the broker, but also with the lender in order to compare).

Additionally, clients can expect hidden fees and other inaccurate information. The broker is interested in making money through mediation, without taking on any obligations. As a rule, most intermediary companies withdraw completely immediately after the transaction, not accompanying the borrower until the loan is completely closed.

Important! Clients should carefully study all documentation when working with a broker, and also request everything necessary from the bank where the mortgage is issued.

How to choose the right mortgage broker

The success of cooperation with a credit broker will depend on his experience and professionalism. When choosing who to contact, try to follow a few rules:

- It is best to communicate with a specialist through an agency that specializes in providing this type of service or a specific developer;

- When choosing, pay attention to the recommendations of people who have already used the services of this professional. Remember that positive reviews on the agency’s website may be custom-made and have nothing to do with reality;

- A mortgage broker who cares about his reputation always represents the interests of his client, and not the bank or real estate agency;

- A specialist with extensive experience in the real estate field is always preferable to someone who has recently appeared on the market. They become professionals only after several years of successful work in their industry;

- The optimal payment amount for a mortgage broker's service is 10,000, in particularly difficult cases - 30-60,000. It is preferable to pay for the work in installments: 50% in advance, 50% after signing the mortgage agreement.

How to choose?

When choosing a broker, you should pay attention to the availability of certificates and diplomas

For a credit search to be successful, it is necessary to choose the right broker-intermediary, and for this, great attention should be paid to the first application.

When familiarizing yourself in detail with the broker's services, clarify all aspects of interest, from the loan amount and type of housing, to the results of cooperation with financial institutions of applicants.

You should pay utmost attention to the step of signing a bilateral agreement, which describes the services of a mortgage specialist and their prices.

Filling out the necessary documents and collecting them is carried out jointly with the borrower, and the mortgage broker not only selects real estate and a financial institution, but also worries about the legal purity of the property and selects favorable insurance conditions.

All points of available services to the client are explained in simple language, and the work of the loan specialist on the transaction ends after the borrower has safely received housing and is satisfied with the result - this indicates that the mortgage broker has done his job to the highest possible quality.

What problems will you have to face?

The first problem for a beginning credit broker will be recruiting personnel. All selected employees must be competent in their field and have a pleasant appearance.

In addition to managers, a beginning credit broker will need a system administrator and an accountant.

True, it is not necessary to officially employ them in the new organization; it is enough to use an outsourcing scheme.

The next major issue will be competition. Of course, at the very beginning of your business you shouldn’t expect a large influx of clients.

To carry out a competent marketing policy you need:

- advertise a brokerage agency. This is a necessary step in starting a company;

- guarantee clients the conscientious fulfillment of their obligations. Communicating your organization's benefits is important.

The client must be confident that his interests are represented by competent and highly qualified specialists;

- consider providing clients with discounts and promotions on your services. This is a very effective marketing ploy.

In conclusion, we can focus on the fact that the project must pay off. To increase profits, it is recommended to expand the range of services offered.

This factor allows you to differentiate yourself from your competitors and stand out from them.

Pros and cons of cooperation

The main disadvantage of an intermediary agreement with a mortgage broker is that the services involve payment, which is not always justified in terms of price-quality ratio.

You will have to pay a certain amount for information and consulting services even if you refuse lending from financial institutions. The possibility of fraud or dishonesty on the part of the specialist cannot be ruled out.

- How and where to get a mortgage with bad credit history

But when providing services to a professional, there are a number of advantages:

- Save time. No matter how much a non-professional studies the real estate market lending system, he cannot compare in the speed of orientation with a specialist who works professionally and has training. In addition, the mortgage broker receives information updated by banks almost every day.

- Financial savings. The specialist will select a profitable program that allows you to save on payments, taking into account the cost of mortgage brokerage services. The minimum price is 50,000 rubles, in relation to the savings of 0.5-1%, the overpayment on the loan averages 200,000 rubles, which is significant for every citizen. It is also possible to receive pleasant bonuses from the bank in the form of privileges regarding the timing or size of the down payment, since in the eyes of bank specialists, a borrower who comes with a real estate specialist looks more reliable than a person who applies on his own.

- Minimum visits to the credit institution. An intermediary will fill out the application and check the correctness and completeness of the collection of documents, and the citizen only needs to visit the bank in order to sign his own autograph.

- Minimizing the risk of refusal. Mortgage brokers are aware of each bank's profile of ideal borrowers. For example, they clearly know a bank that gives a loan without a down payment with a confirmed high level of income and a bank that refuses a loan to a client if there is no six-month period at the last place of work. Financial institutions trust mortgage brokers for their successful selection of clients and long-term cooperation.

- Legal support of real estate acquisition transactions. With the participation of a specialist, documentation regarding the purchased object will be drawn up quickly and legally competently.

- Reduced application processing time. Business contacts with credit institutions contribute to the priority consideration of the application, relieving the bank employee from checking information when trusting the mortgage broker. Loan funds can be issued on the day the documentation is submitted.

Benefits of cooperation

According to the Moody's rating agency, at the end of 2015 the level of overdue debt in Russia reached 11% of the total portfolio. Many people, finding themselves in such a situation, get lost and panic. The advantages of seeking professional support are obvious - this is the possibility of competent and easy debt restructuring, refinancing (on-lending), and conducting a constructive dialogue with the bank (with professional representation of the interests of the debtor). As a result of such cooperation, the borrower will be able to improve his affairs and regain peace of mind with the least financial and moral damage.

Features of the activity

The main feature of the activities of a credit broker is the fact that the intermediary services that he provides must be clearly regulated by current law.

However, in the conditions of the Russian economy, these norms created by law are oriented towards Western models. Such norms cannot adequately reflect the current state of the economy in Russia.

The result is a lack of coordination of legislative acts regulating the professional activities of credit brokers.

How to distinguish scammers from legitimate brokers

No notices on fences, in transport, or other “free” places. A reputable company advertises itself in a different way and pays for advertising. Promises without certificates to urgently issue a loan within minutes are the most blatant lies, this speaks from the dishonesty of the intermediary. Registration over the phone should also be discarded immediately.

The credit broker’s reputation, customer reviews, and participation in white lists will help you choose the right intermediary. Professional intermediaries do not make any promises without prior consultations and document analysis.

Do not give card and bank account numbers to the intermediary; all this information can only be accessed by bank employees.

The main thing is that the “blacks” offer fraudulent schemes for obtaining money, using fictitious documents.

How to choose and apply for a loan through a broker

It is better to use the following criteria:

- determine who is best able to satisfy your needs;

- read reviews from clients who were helped;

- carefully study the business license;

- make a visit to the office and talk with the staff;

- proceed according to the scheme indicated above in the text.

Sources

- https://kreditkavbanke.ru/kak-stat-kreditnym-brokerom.html

- https://www.kredibank.ru/kreditnye-brokery/kak-rabotajut-kreditnye-brokery/

- https://ipotekaved.ru/v-rossii/ipotechnyj-broker.html

- https://www.Sravni.ru/enciklopediya/info/kak-stat-brokerom/

- https://greedisgood.one/ipotechniy-broker

- https://creditzzz.ru/kreditnyj-broker/kak-stat-kreditnym-brokerom.html

- https://kakbiz.ru/kredit/kak-stat-kreditnyim-brokerom.html

- https://xn—-8sbebdgd0blkrk1oe.xn--p1ai/biznes-plan/yslygi/kak-stat-kreditnym-brokerom.html

- https://credits-pl.ru/bankg/kak-stat-kreditnym-brokerom-otkrytie-brokerskoj-kompanii/

- https://exbico.ru/kak-stat-kreditnym-brokerom/

- https://greedisgood.one/kreditnyy-broker

[collapse]