Is it possible to refinance an internal loan and one taken from another institution?

Important. The refinancing program at Promsvyazbank is aimed primarily at refinancing agreements concluded with other banking institutions. Promsvyazbank did not make any official statements about reducing the interest rate on its own mortgage loans.

However, the client may make a corresponding request. The reasons for its consideration are:

- no late payments for the last 12 months;

- good credit history;

- The payment deadline is up to six months.

For borrowers in difficult life situations, it is necessary to submit a request for mortgage restructuring, attaching all the necessary documents, primarily those that confirm the onset of a period of insolvency and justify it.

Features of the program

In most cases, the final decision of the bank is influenced by whether the borrower has a good credit rating , because no organization is interested in losing significant amounts. Of course, the easiest way to negotiate with a lender would be for a citizen who has already received a mortgage here and has been paying it off for some time. Even those borrowers whose “home” bank does not have such a service can contact Promsvyazbank.

To review the application, you will need to collect a package of documents, a detailed list of which is given on the bank’s official page. Advantages of applying to Promsvyazbank for refinancing:

- This will reduce the monthly payment, making it easier to pay off the loan;

- The mortgage term can be increased or decreased at the request of the borrower, depending on his needs;

- It is convenient to monitor your balance online through your personal account on the website or find out useful news using the mobile phone application.

Requirements and conditions for the borrower and real estate

The terms of refinancing depend on the refinancing program chosen by the client. There are no special requirements for real estate: the procedure is possible for primary and secondary housing.

But the bank puts forward standard requirements for borrowers that a mortgage borrower must meet:

- citizenship of the Russian Federation;

- age from 21 years;

- age up to 65 years before the loan is repaid;

- permanent registration;

- mobile and landline work phone number;

- work experience of 12 months;

- work experience at the last place of work of 4 months;

- the borrower is an individual;

- military ID for men under 27 years old.

Important! In the absence of a document confirming completion or unfitness for military service, the borrowers must be close relatives or the spouse of the applicant.

Also, his income will not be taken into account when calculating monthly payments.

Mortgage loan restructuring program

Promsvyazbank has two refinancing programs: standard and for families. Participation in the family program is possible if, from January 1, 2020, the applicant and his spouse had a second or subsequent child.

Comparative table of conditions for both programs:

| Meaning | Standard refinancing | "Refinancing. Family mortgage" |

| Minimum amount | from 1 million | from 500 thousand |

| Maximum amount | up to 15 million, no more than the balance of the principal debt on the mortgage |

|

| Loan terms | from 3 to 25 years | from 3 to 25 years |

| Interest rate, per year | 8% | 4,5% |

| Interest rate surcharges | 3%* | 5%* |

| Commission | No | No |

| Collateral ratio | 20-80% | 20-80% |

* are charged in the absence of comprehensive insurance.

Important. The stated interest rate comes into effect upon presentation of the original mortgage agreement and registered pledge agreement. Until this point, as well as in the absence of documents after 60 days after refinancing, the percentage increases by several points (for the standard program up to 13%).

Learn more about the documents required by the bank

In order for the borrower to have the opportunity to receive the most favorable conditions, he will have to spend time preparing and collecting documents. So, to get a mortgage refinancing from Promsvyazbank you need to have with you:

- A valid bank agreement (exclusively its original) and plus a debt repayment schedule that the client adheres to. It is permissible to use a copy of the document if it bears the signature of an authorized person of the original creditor;

- A certificate containing the details required for the transfer of funds in honor of the repayment of the monthly payment is also an original;

- If the borrower who applies for refinancing has two or more children in the family, a certificate will be required stating that maternity capital funds were not used for the purpose of the down payment or did not pay off part of the debt on the mortgage that needs to be refinanced. To do this, you need to request an extract from the Pension Fund of the Russian Federation - only its original;

- If the title borrower on the mortgage and the person applying for refinancing are different people, you need an application to transfer the loan obligations to the new borrower. The document is signed by the authorized representative of the initial creditor, affixing his stamp. The original document is required.

You will also need a certificate for the refinanced mortgage. It consists of the following key points: the date of registration, information about the borrower and documents that prove his identity, an indication of the amount of the debt and the date on which this information was received. It also states the balance of the debt, including interest, indicating the number of the loan agreement. An original document is required, which contains the full name, signature of the employee who issued it and the seal of the bank.

Please note that the latest document is only valid for 30 days from the date of receipt.

Therefore, even before filling out the refinancing application, you need to take care of collecting all the information. The bank also reserves the right to require other documents that are not presented in this list, if necessary to make a final decision. On the website in the appropriate section there is a list of all related documents, samples of which, if necessary, can be downloaded for review.

What documents and certificates need to be prepared?

First of all, you need to fill out an application form according to the bank’s form. Main documents:

- passport of a citizen of the Russian Federation;

- SNILS number;

- military ID;

- a copy of the work book certified by the employer;

- certificate of marital status.

Documents confirming the borrower's income (one to choose from):

- 2-NDFL, in the form of a bank or employer, signed by an authorized person;

- salary account statement with the seal of a third-party bank;

- Sberbank salary account statement in pdf with facsimile and round seal.

Documents for the apartment:

- purchase and sale agreement or equity participation agreement;

- an extract from the Unified State Register or a certificate from the State Register;

- technical passport plan;

- an extract from the house register from the Criminal Code or passport office;

- a document confirming the approval of the redevelopment (if necessary);

- apartment appraisal document (can be ordered on the Promsvyazbank website).

To refinance a mortgage on a primary home, it is enough to provide only an extract from the Unified State Register of Real Estate, an equity participation agreement and an assessment report.

Important! Certificates are provided for the past and actual year of refinancing. If desired, the borrower provides other documents confirming income. For the family program, you must bring birth certificates for your children.

How to fill out an application?

You can submit an application for initial approval on the official website of Promsvyazbank. You will need to provide personal and contact information, then wait for feedback from bank employees.

You can submit your application directly to the nearest branch without initial approval. There you will need to fill out a questionnaire according to the bank’s form, which contains:

- purpose of the loan (refinancing);

- type of real estate (apartment, house, apartments);

- form of loan security (pledge, guarantee);

- value of the collateral;

- name of the developer (for the primary market);

- loan amount and term, down payment;

- insurance conditions (yes or no);

- Full name and passport details of the main borrower;

- address of the actual residence;

- form of ownership at the address of residence (rent, property);

- mobile phone, work landline phone, e-mail;

- details of the emergency contact person (spouse or relative);

- information about education and marital status;

- personal data of the spouse, actual residence, marriage contract;

- information about the borrower’s assets (real estate, cars);

- information about the employer: address and name of the organization, official website address, type of employer (individual entrepreneur, LLC), number of staff, field of activity (select from the list), managerial status;

- information about the borrower’s employment: part-time job, main job, position, length of service;

- salary amount (monthly);

- additional information about illnesses, tax arrears, founding a legal entity, disability, divorce, alimony (select from the list).

Important. The completed form is provided to the employee, where he/she leaves his/her details and signs. Before signing, you must read the information block on the last sheet of the document.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

+7 (499) 938-90-71Moscow

How to calculate refinancing

To get a calculation that best suits your requirements, contact your bank branch.

For a quick preliminary assessment of loan terms, use the mortgage calculator located on the bank’s website:

- from the main page, go to the section for individuals using the link in the top menu;

- Scroll down the page that opens to the credits block;

- click on the Mortgage button;

- A calculator is placed before the description of Promsvyazbank's mortgage programs.

The service does not offer to calculate the refinancing product as such. The closest terms and conditions are to purchasing premises on the secondary market; select the appropriate markers in the calculator. Please also include:

- your income;

- the cost of the premises - if you have a recent assessment report on hand, look at it, otherwise indicate the market value, independently evaluating the proposals for advertisements, it is important not to inflate the estimated price;

- the available money in the case of refinancing is the cost of housing minus the requested amount;

- desired period.

Below the calculator there will be an approximate calculation of payment terms. There is also a link here that the minimum rate is an affiliate rate, on a general basis the figure is 11%.

How to refinance: step-by-step application procedure

Borrower's algorithm:

- Get advice by phone or in person at the branch.

- Prepare a package of necessary documents for the apartment and the borrower.

- Leave a request on the website, wait for feedback and agree on a time and date for your visit.

- Provide documents for the borrower and the apartment to the bank for review.

- Order a residential real estate assessment report on the Promsvyazbank website.

- Expect feedback from a bank employee who will inform you about the decision.

- Agree on the time and date of the transaction, select an insurance company for comprehensive insurance (to reduce the interest rate).

- Obtain a letter of consent from the insurance company.

- Receive from the primary creditor a document about the balance of the debt and a certificate about the details of the transfer of funds.

- Send the received documents to the bank, read the loan documentation sent by mail.

- Open an account, sign loan documentation, sign an agreement with the insurance company.

- After the loan is issued, contact the primary lender and apply for early repayment.

- After repayment, receive a certificate of removal of the encumbrance in favor of the primary creditor.

- Register the mortgage with Rosreestr in favor of Promsvyazbank.

- Receive a certificate of repayment of the refinanced loan.

After completing the transaction, the bank will transfer funds to the borrower’s account for early repayment of the mortgage with another bank.

Differences in the procedure for individuals and legal entities

Important! Only employed persons can participate in the refinancing program from Promsvyazbank. However, when calculating the loan amount, income from participation in the organization can be taken into account, provided that it is no more than 1/3 of the total.

If the employee does not work for the relevant hiring organization, then the share in the authorized capital of the organization should be no more than 49%.

Legal entities can carry out on-lending under the “Loan to Loan” program. A guarantee from business owners or legal entities will be required.

Features of mortgage refinancing at Promsvyazbank

It is possible to refinance a mortgage at Promsvyazbank, as well as other loans, provided that the client meets the parameters of the financial institution. If the client is salaried, has a good income and a positive credit history, there is a higher probability of approval of a consumer loan on attractive terms.

Refinancing of individuals

You can refinance at Promsvyazbank not only a mortgage, but also a loan for a vehicle, as well as credit cards and loans for any purpose. The rate is calculated individually based on the person’s creditworthiness.

Military mortgage

The bank has a special lending program “For employees of defense industry enterprises and military personnel.” During the loan, the rate may be reduced if payments are made on time.

Mortgage for citizens with children

During the subsidy period, the rate for taking out a mortgage loan is from 6%. To apply for such a loan, you need to provide a large package of documents, including birth certificates of children and a document confirming your marital status.

Family mortgage with government support House. RF

Preferential mortgage lending with state support is provided to families in which a second and subsequent child will be born from 2020 to 2022 inclusive. The loan rate is from 6%, a grace period is provided.

Advantages and disadvantages

Pros:

- low interest rates;

- program for families;

- combining up to 5 credits;

- possibility of remote application submission;

- flexible payment schedule;

- control through online banking.

Minuses:

- additional costs for refinancing;

- the need for comprehensive insurance for low interest rates;

- the need to change insurer;

- high minimum limit.

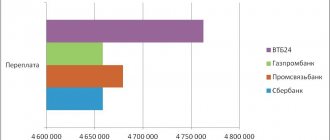

Important! Before refinancing, it is necessary to evaluate the additional costs and the difference between rates. Sometimes refinancing can result in a significant overpayment. To do this, use the calculator on the website.

Advance paynemt

Before refinancing your mortgage at Promsvyazbank, you need to calculate the amount of monthly payments. You can perform this action using a loan calculator. It is located on the offer page. The borrower only needs to indicate:

- family income;

- the loan amount required to repay obligations;

- credit term.

The action is performed using sliders and selecting data from a pop-up window. The system automatically performs calculations. The information is approximate. It is calculated taking into account the minimum interest rate. In practice, the payment amount may differ from the received data.

When can they refuse?

The main reasons for refusal to refinance are the lack of necessary documents, low income and bad credit history. The bank may refuse a loan if the collateral secured by the agreement is in doubt.

Refusal is possible if there are less than 2 years left before the end of the primary loan repayment period.

What can you do to increase your chances of approval?

The chances of approval are increased by a good credit history, absence of arrears and the high value of the collateral.

- If the borrower’s income is relatively small, it is recommended to involve co-borrowers or guarantors in the agreement.

- If you have several small loans, it is better to pay them off before applying. Before submitting an application, calculate the loan amount using the calculator on the PSB website.

Consider additional costs for:

- insurance;

- real estate valuation;

- notarization;

- government fees.

If the benefit is significant, collect the necessary documents, fill out an application and send them to the bank. Based on the results of the review, an employee will contact the borrower.

Reviews about refinancing

Before applying for refinancing, evaluate the savings from refinancing and associated expenses. Some clients are disappointed with the results. Positive reviews are left by those who refinanced their mortgage:

- at a rate lower than the previous one by at least 1.5-2%;

- in the first half of the loan repayment period (this is when the client pays a significant part of the interest).

There are practically no reviews online about refinancing mortgages from other banks at Promsvyazbank. It can be assumed that the main reasons for the low popularity of the product are the rates that do not stand out from market conditions, as well as the small number of branches.

Single reviews of lending at Promsvyazbank describe a large number of difficulties during remote processing due to the requirements for the format of scanned/photographed files.