Conditions for refinancing a mortgage at Gazprombank

Gazprombank offers potential borrowers a mortgage re-issuance program in order to reduce the loan burden and obtain more favorable conditions. The main parameters of the product in question look like this:

- amount – from 500 thousand rubles;

- debt repayment period – from 3.5 to 30 years;

- form of loan issuance - one-time disbursement.

The maximum amount of borrowed funds is determined by the estimated value of the property pledged to Gazprombank and cannot exceed 45 million rubles.

Real estate on the primary and secondary housing market (including the pledge of property rights of claim), fully complying with the restrictions of the future lender, is accepted as collateral.

If the client initially purchased an apartment on the secondary market, then Gazprombank will issue no more than 90% of its cost. If you bought an apartment in a new building, then no more than 80%.

What loans can be refinanced at Gazprombank?

It is possible to refinance a consumer loan, a mortgage, or both options at once at Gazprombank.

In addition to refinancing, Gazprombank also carries out restructuring . That is, if you are a client of this bank and you have financial difficulties (dismissal from work, temporary incapacity, loss of a breadwinner, etc.), you can apply to review the terms of the contract. During restructuring, the bank can offer:

- credit holidays (for 1-3 months the client pays only interest);

- full deferment, that is, the client does not pay either interest or the principal of the loan (the bank offers this extremely rarely);

- change in basic conditions (may reduce the interest rate or increase the loan term, which will reduce the size of monthly payments).

It is important to emphasize that it is necessary to submit an application for refinancing or restructuring before the delay occurs. If the bank imposes a fine or penalty for failure to pay the monthly payment on time, it will be difficult to refinance such a loan, since for the new lender you will be an unreliable borrower.

Typically, refinancing is resorted to in the following cases:

- The client wants to receive a lower rate and more favorable lending conditions than those on which the agreement was concluded;

- The borrower has lost his job, gotten sick, or faced other circumstances in which he needs to reduce his monthly loan payments.

When concluding an agreement to refinance a loan with Gazprombank, you can choose a convenient payment schedule.

Mortgage refinancing conditions

When submitting an application for mortgage refinancing at Gazprombank, you can add a consumer loan to it, since the maximum amount under this program is as much as 45 million rubles. Other conditions : _

- The rate is from 10.5% per year (general conditions), and until 05/31/2019 a promotional rate of 9.7% is valid;

- Loan term – from 1 year to 30 years;

- The maximum amount is 45 million rubles ;

- Currency – Russian rubles.

If a consumer loan and a mortgage are combined during refinancing, the loan should not be more than 30% of the total refinancing amount. When refinancing a mortgage, the amount cannot be more than 85% of the cost of housing, and the end of the loan period must be at least 3 years.

Apartments, but not shared housing, or a private house are suitable for refinancing. It does not matter whether the apartment was purchased on the primary or secondary market. It is worth emphasizing that all bank conditions are determined individually for each borrower. The bank may refuse to refinance without explaining the reason.

Conditions for refinancing consumer loans

The conditions for refinancing a consumer loan at Gazprombank are slightly different from the conditions for refinancing a mortgage. Let us indicate the main conditions:

- Loan rate – from 10.8% per year;

- Duration – up to 7 years;

- The maximum amount is 3 million rubles;

- The amount of the loan issued may exceed the amount of the debt. Thus, the borrower can receive additional funds for personal needs;

- The minimum amount is 100,000 rubles ;

- Review times range from 1 to 5 days.

Repayment of the loan during refinancing can be carried out either in equal payments or in different ones. In the second case, the amount of payments decreases towards the end of the loan term. To improve the terms of the loan, a co-borrower may be involved. The amount limit is largely determined by the age of the borrower.

Requirements for an individual:

- Age – more than 20 years;

- If the borrower is over 60 years old at the time of loan repayment, the bank will not give him 3 million rubles. In this case, you can count on up to 600,000 rubles;

- Citizenship of the Russian Federation;

- Registration;

- Experience - at least six months in the last position for all clients, except salary clients. Salary clients can work in their current place for more than three months;

- Good credit history;

- Income sufficient to cover loan payments.

If a person wants to repay the loan early, he can do so without penalties or additional fees.

Interest rate

The minimum loan rate for a refinanced loan is 8.8% per year. This percentage will be available to salary clients who agree to enter into a full insurance contract (property and personal).

The bank may apply the following surcharges to the indicated base rate:

- +0.5 p.p. – for clients who are not participants in salary projects;

- +1 p.p. – applies until the moment of encumbering the collateral in favor of Gazprombank if there is a power of attorney on behalf of the borrower in favor of a bank representative for the transaction registration procedure;

- +2 p.p. – before encumbrance in the absence of a power of attorney for the bank representative for the purpose of registering the transaction in Rosreestr.

NOTE! Gazprombank reserves the right to consider each application in an individual format, including the use of personalized interest rate approval grids.

Mortgage refinancing rate

You can refinance your mortgage at Gazprombank at an interest rate of 10.2% per annum. But such a rate is available only for salary clients who have given their consent to full insurance, i.e. We took out property insurance, title insurance, life and health insurance.

Additionally, the client can take advantage of the following benefits.

He can receive:

- +0.5% to his regular rate, but only if he does not receive his salary on the Gazprombank card;

- +1. But this rate is valid until the property is transferred as collateral to a financial institution or when the borrower issues a power of attorney in the name of the lender when registering the encumbrance;

- +2%. This rate is valid until the client registers the encumbrance without issuing a power of attorney in the name of the credit institution.

Additional premiums for the borrower can be set by the financial institution itself. But this is done after carefully studying the questionnaire.

For example, a client may receive a credit card in conjunction with a mortgage agreement.

According to it, he can borrow 100,000 rubles at 23.9% per annum, and monthly he will pay 5% of the current debt. But only those borrowers who can pay two loans at the same time can take advantage of this program.

Additionally, Gazprombank also offers some promotions.

This:

- "Promotion 9.2%."

Here's the borrower:

- receives a rate of 9.2% regardless of the debt balance and the term of the loan agreement;

- receives the balance of the debt up to 80% of the total cost of housing;

- can use the loan for 30 years;

- may receive a response to your application within 1 day;

- must undergo the borrower's personal insurance procedure.

- “Promotion 8.8%.”

Here's the client:

- receives 8.8% regardless of the debt balance and the term of the loan agreement;

- can receive a debt balance of 80% of the total value of the purchased property;

- can use the loan for 30 years;

- receives a response to your application within 1 day.

Additionally, here the client receives:

- +0.5%. But this rate applies to those clients who do not receive salaries on a Gazprombank card.

Special promotions

Currently, Gazprombank has a single rate for refinanced loans for 2020 for salary clients of 8.9% per annum. The idea is to establish a fixed interest rate - 8.9% per annum - for all mortgage loans with any outstanding balance and maturity date.

Basic conditions for applying the promotion:

- term – up to 30 years;

- residual debt – no more than 80% of the property price;

- The deadline for making a decision on the application is from 1 day.

Flat rate for all other clients – 9.4% per year for mortgage refinancing.

The conditions are exactly the same. You can refinance loans issued for the purchase of a new or finished apartment.

Description of the mortgage offer

Gazprombank offers quite favorable terms for on-lending. Firstly, low rates and long loan terms (up to 30 years).

Secondly, the minimum amount of debt is 500 thousand rubles, although in many banks it starts from 1 million rubles.

Refinancing conditions:

- rates from 8.8-9.2% per annum in rubles;

- balance of debt – up to 80% of the cost of housing;

- minimum amount – from 0.5 million rubles, but not less than 15% of the value of the property;

- the maximum loan amount is 45 million rubles, but not more than 80-90% of the collateral price;

- loan term from 3-30 years.

The loan term may be increased compared to the loan period established by the loan agreement concluded with the primary lender , but should not exceed 30 years. The period until full repayment of the loan under the agreement is at least 36 months from the date the client applies for refinancing.

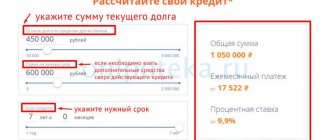

Mortgage refinancing calculator at Gazprombank

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

On the official website of Gazprombank, the client is given the opportunity to make preliminary calculations for the loan being reissued. To do this, in a special form you must indicate the type of property (primary or secondary), city, debt balance and repayment period.

As a result of such actions, the bank’s offer will be formed in the form of a monthly payment, the size of the loan rate and the minimum income required to service the loan agreement.

An alternative way to get your final mortgage estimate is to use our mortgage calculator. The user will be required to fill out:

- amount;

- payment system (annuity or differentiated);

- date of loan issuance and loan term;

- interest rate;

- use or non-use of maternity capital.

The result of using such a tool will be obtaining visual information about the amount of the monthly loan payment, the total cost of the loan, indicating the overpayment for the entire term and the minimum income.

Is it difficult to initiate on-lending?

The first thing you should pay attention to when contacting Gazprombank is the profitability of refinancing. To clarify the new rate and overpayment of interest, you should contact the bank specialists or make a calculation using the online calculator on the website. All additional payments must be taken into account. These include compulsory collateral insurance, voluntary life and health insurance, and other commissions.

If Gazprombank can offer you a more favorable rate compared to the existing one, you can safely submit an application for consideration. You can contact the manager in the office and fill out an online form on the bank’s website. The application will be reviewed within a few days, after which you will receive a response.

The preliminary examination is quite simple; most of the clients who apply receive a positive decision. Then you need documents for refinancing the mortgage and submit them to the bank. If the answer is yes, you will be invited to sign an agreement to refinance the mortgage debt.

In the process of applying for a new loan, the real estate pledge should be re-registered in favor of Gazprombank. As before, you will have to insure it. If the debt is not paid, the bank has the right to claim the property in court to pay the debt.

Another important point that interests many borrowers is how many times can you refinance with a given financial institution? The bank's answer is disappointing - only once. You will no longer be able to apply for mortgage refinancing again.

Requirements for the borrower

A client applying to Gazprombank for refinancing of a mortgage issued in another bank must meet the following basic requirements:

- Age limit: from 20 to 65 years.

- Availability of Russian citizenship and registration in the city where the bank operates.

- Full legal capacity.

- Neutral or positive credit history.

- Work experience in the current place for at least six months with a total work experience of at least one year.

The bank also accepts for consideration mortgage applications from persons permanently residing in a constituent entity of the Russian Federation in which a Gazprombank branch is present.

Is it worth changing the terms of the loan?

Refinancing is an important decision and must be taken carefully. Evaluate all the advantages and disadvantages of a new loan before you sign the documents for refinancing. As a rule, with an annuity debt repayment scheme, refinancing is beneficial only at the beginning of the term. The thing is that the second half of the payment schedule mainly consists of the body of the loan, and in the beginning you pay most of the interest. Although, if there is a serious difference in the interest rate, such refinancing may be attractive.

What are the advantages of applying for a new loan at Gazprombank:

- Extending the existing mortgage payment period.

- There are no hidden fees or charges.

- You can get a loan in any currency.

- Reduced monthly payment.

- Early repayment without restrictions.

- If the amount of debt is small, you can release the property from collateral by providing only a guarantee.

- There is a system of reducing interest rates for regular bank customers.

Of course, there are downsides to refinancing. The consideration can be very long, especially if the client does not have a credit history with Gazprombank. It is necessary that the amount of debt be at least 15% of the cost of the apartment. Additional costs will also arise, in particular, insurance of the collateral and its assessment at the stage of consideration of the loan application.

Refinancing should be carried out when there is a real benefit for the client. If you approach the issue of refinancing wisely, you can save hundreds of thousands of rubles just on interest overpayments. In this case, it definitely makes sense to start transferring the loan to Gazprombank.

Mortgage loan requirements

The refinanced home loan must:

- be issued at least 6 months before submitting the loan application;

- have a positive history of payments made (long delays in payment of current debt are unacceptable);

- be received for the purchase of an apartment.

Applications for on-lending loans with collateral in the form of houses, cottages, garages, apartments, land plots, etc. will be rejected.

As for the loan currency, it can be any. Gazprombank is ready to reissue a mortgage previously issued in foreign currency, converting it into Russian rubles.

IMPORTANT! The bank takes into account the stage of construction of an apartment in a new building. Objects that are at the development or excavation stage must be accredited by the bank in order to participate in the mortgage refinancing program at Gazprombank.

When should you consider refinancing your mortgage?

You can refinance an existing mortgage if the borrower, the property and the condition of the previous loan meet the requirements of Gazprombank. It is definitely worth applying for refinancing if the original loan was issued at a high interest rate several years ago (in 2014-2015), when there was a sharp jump in mortgage rates. Now the market situation has changed, and this is a reason to help the family budget.

You should not consider refinancing if there are large or long-term arrears on your existing debt, or if there are problems with repayment - the program will simply not be approved.

Refinancing is intended to reduce the debt burden for the future and is not used to solve existing financial problems. If you have difficulties with repayment, you need to contact your bank to restructure the debt.

What documents need to be collected to refinance a mortgage at Gazprombank

The borrower will have to prepare two complete sets of documents: for himself and for the collateral property. Let's look at the list of each in more detail.

By borrower

The client collects the following documents:

- Russian passport (copies of all pages);

- application form for refinancing;

- SNILS;

- documents confirming receipt of income (certificate in the form of a bank/certificate 2-NDFL/bank statements with facts of periodic receipts of wages);

- documents confirming labor activity (civil contract or copy of the employment contract).

Additionally, the borrower will have to provide Gazprombank with comprehensive information and documents on existing loan obligations that are planned for re-issuance. This:

- a copy of the loan agreement;

- a certificate from the bank about the balance of debt and the quality of debt service, signed by an authorized employee or manager.

For mortgage

Documents for housing transferred as collateral under a new loan agreement must include:

- A copy of the loan agreement;

- Certificate about the amount of the outstanding balance on the mortgage (the certificate must not be older than 30 days).

- Documents confirming title (certificate of ownership, written contract, agreement of gift, exchange, privatization, etc.).

- Documents confirming payments for real estate made over the current 3 years.

- Housing appraisal report (issued exclusively by an accredited appraisal company recommended by Gazprombank).

- A single housing document or an extract from the house register.

- Cadastral passport.

- A certificate from the HOA or other authorized body confirming the absence of persons (especially minors) registered on the premises.

- Certificate from the HOA confirming that there are no debts to pay for housing and communal services.

VTB 24

VTB 24 has a special refinancing direction “Mortgage refinancing”. Basic conditions presuppose the following conditions:

- Interest rate from 9.5% for the entire loan term;

- The maximum permissible period is 30 years;

- The loan amount is up to 30 million rubles, but this also has its own characteristics. Thus, the refinancing amount should not exceed 50% of the estimated value of the property, provided that the service is executed using two documents, or no more than 80% of the estimated value of the collateral property if the client provides a full package of documents;

- Issued exclusively in national currency without charging any commissions;

- The loan agreement allows early repayment without penalty or any restrictions.

I would like to pay special attention to the requirements that are put forward to the borrower himself. There are no requirements here such as a minimum work experience of 5 years, duration of work at the last place of work, etc. At least, there is no information about this on the bank’s website, as, for example, in Sberbank. Here, on the contrary, there are even quite loyal requirements: it is not necessary for the client to have a permanent place of registration, his income can be taken into account both for his main job and at the same time for his combined work, and income can be confirmed in various ways and with documents.

To receive refinancing, you must leave an application for such a product on the bank’s website and, after confirming it by a bank employee, come for a preliminary interview with a bank employee who will clarify the package of necessary documents.

Refinancing procedure

You can refinance a mortgage existing at another credit institution by taking the following steps:

- Careful study of the terms of the mortgage refinancing program at Gazprombank.

- Preparation of a complete package of documentation (it is necessary to make a new assessment of the apartment).

- Submitting an application (via an online form on the bank’s website or at any convenient service office).

- Consideration of the application by the Credit Committee of Gazprombank and making a final decision (may take from 1 to 10 business days, depending on the specific case).

- Conclusion of a new loan agreement.

- Transfer of the remaining debt to the previous creditor.

- Registration of the transaction in Rosreestr and transfer of the collateral in favor of Gazprombank.

In the case of re-issuance of a mortgage on a secondary home, the bank will definitely request a report on its assessment, even if one was issued for the previous lender.

As you can see, Gazprombank does not require official consent from a third-party lender and registers the transaction after settlement with it.

Conditions

A loan for mortgage refinancing from Gazprombank in 2020 is issued without commissions in Russian rubles in the amount of 100 thousand to 45 million rubles.

In this case, the minimum amount cannot be less than 15% of the cost of the mortgage housing.

The minimum period for which a loan is issued is 3.5 years for housing with registered ownership and 12 months for housing in houses under construction.

An on-lending loan is issued in one amount.

An application for a loan is considered within 1 to 10 business days after the applicant submits all necessary documents to the bank.

Mortgage loans for which there have been no more than 2 delays for a period of less than a month during the entire period of using the loan are subject to refinancing.

Moreover, delays should not have occurred within the last year.

The loan is issued:

- for refinancing mortgage loans secured by real estate with registered title;

- to fully repay a mortgage issued by another bank.

You can get an additional amount from the bank, which will be used to repay a consumer loan or car loan.

In this case, the loan size cannot exceed 30% of the amount issued to repay the mortgage.

Insurance

According to Russian legislation, property insurance of collateral against loss and damage is mandatory. If the subject of the loan agreement is the purchase of an apartment with already registered title, then title insurance is added to the mandatory insurance.

Life and health insurance of the client is issued exclusively on a voluntary basis, at his discretion. Pressure or imposition of services is unacceptable.

An insurance contract can only be concluded with an insurance company accredited by Gazprombank.

Required documents

To use the loan closure procedure, the user must provide the following documents to the bank.

- Questionnaire. It is usually downloaded from the website owned by the financial institution.

- Passport of a citizen of the Russian Federation.

- SNILS.

- A photocopy of the work book.

- Certificate of income in form 2-NDFL. It can also be issued on a form taken from a given financial institution.

- The account number to which the financial institution will transfer funds to the borrower.

- Valid loan agreement.

- A certificate received from a financial institution indicating the current status of its debt.

- Certificate of ownership of real estate or share participation agreement.

- Extract from home book.

- Housing assessment report.

Additionally, employees of a financial institution may require the borrower to provide them with technical documents for the collateral.

Pros and cons of refinancing a mortgage at Gazprombank

The obvious advantages of applying for a mortgage loan refinancing program will be:

- favorable interest rate;

- bank reliability;

- benefits for clients participating in salary projects;

- possibility of submitting a preliminary mortgage application;

- large loan amount - up to 45 million rubles;

- the ability to confirm income using a bank form or using bank statements;

- long repayment period - 3.5-30 years.

There are significant disadvantages:

- You can only refinance a loan issued for the purchase of an apartment under construction or a finished one;

- the need to collect a complete package of documents;

- mandatory title insurance when mortgaging an apartment on the secondary real estate market.

Gazprombank: refinancing mortgages from other banks to individuals

Refinancing a mortgage loan is the repurchase of an individual’s loan from a third-party bank with the subsequent re-issuance of the agreement on more favorable terms. The service is positive for both the client and Gazprombank.

In the case of a borrower, you get the opportunity to:

- reduce the interest rate;

- extend the payment period, which helps reduce the monthly payment;

- take advantage of additional services on preferential terms;

- take part in the current promotional program;

- gain access to modern virtual services.

A banking organization receives a new client who has signed an agreement for the provision of services for a long period. Potentially, such a user can take advantage of a number of other debit or credit offers and attract new customers, which contributes to increased financial profit.

You must first familiarize yourself with the current conditions and the list of documents required for submission by individuals.

Necessary documents and requirements

- application form (the application form and writing sample will be issued by the bank employee himself);

- passport (you must have both the original document and its copy);

- a copy of the work book;

- agreement concluded with the first bank (a copy of the agreement is required);

- a certificate containing information about the remaining debt and that the applicant has not been late in repaying the loan debt (if there are delays, the bank will definitely receive a refusal);

- written consent for the encumbrance to be formalized again;

- a certificate confirming the level of income received by the applicant (account statement, 2-NDFL, certificate in the bank form).

Gazprombank shares

GPB regularly holds promotions for mortgage borrowers. An example would be an offer to issue a credit card with a limit of up to 100,000 rubles. The interest rate on the banking product is 23.9%. The card will be offered to customers whose solvency will allow them to pay off 2 loans at the same time.

An equally interesting promotion is offered to clients who are participants in the salary project. They have a fixed interest rate of 8.9%. It does not depend on the amount unpaid on the previous loan and the period required to fully repay the debt.

Gazprombank constantly develops attractive preferential products for its clients, information about which is posted on the official website.