Conditions for refinancing from Rosbank

A refinancing program is taking out a new loan in order to pay off the old one.

The refinancing program can be used by:

- clients who received a foreign currency mortgage from Rosbank and wish to convert it into a ruble one;

- citizens who received a housing loan from other financial companies.

The minimum amount of a new loan is RUB 300,000. (for residents of Moscow - 600,000 rubles). The maximum you can request is 15,000,000 rubles, but not more than 85% of the value of the property put up as collateral.

Refinancing is possible for a mortgage obtained for the purchase of an apartment or part of it, apartments, or house. It is necessary to register ownership of the property.

The period for which a new contract is concluded must not exceed 25 years.

Refinancing is not possible if less than 6 months have passed since the execution of the previous agreement.

Conditions

Main parameters of mortgage refinancing in Rosbank:

- the mortgage agreement is concluded only in Russian rubles;

- The maximum mortgage repayment period is 25 years. Repayment terms are calculated individually and depend on the age of the borrower, the loan amount, and the size of monthly payments;

- loan amount – from 300 thousand rubles. (for Moscow - from 600 thousand rubles), but not more than 60 - 85% of the real estate price.

You can choose the most suitable loan terms using the mortgage calculator on the official website of Rosbank https://www.rosbank.ru. An electronic calculator will help you quickly calculate the amount of monthly payments, payment terms and the total amount of overpayments on the loan.

When refinancing a mortgage loan at Rosbank, the final interest rate is calculated individually and amounts to 10–11.75% per annum if:

- Loan amount is 50 – 70% of the value of real estate.

- Insurance is issued: the life and health of the borrower, property and the risk of loss of ownership of real estate (if the borrower refuses voluntary insurance, the rate may be increased by 1 - 4%).

- The intended use of loan funds is confirmed and a mortgage is provided.

The interest rate when refinancing a mortgage is affected by:

- loan terms;

- credit history;

- borrower's education;

- Kind of activity;

- number of co-borrowers;

- location of the collateral;

- the type and level of income of the borrower, and its relationship to the size of monthly payments.

The interest rate can be reduced by 1%. To do this, you need to complete all the necessary documents within 3 months and transfer the property as collateral to Rosbank. If this condition is not met, the interest rate will be increased by the bank by 3%.

Interest rates

The annual rate is calculated individually for each client and ranges from 7.19 to 10.94%. Its size depends on various factors, including the amount and term of the loan, the borrower’s consent to enter into an insurance agreement, the amount of the down payment, etc.

The interest rate is reduced if the borrower joins one of the programs offered by Rosbank:

- "Optima" - by 0.5%;

- “Media” - by 1%;

- "Ultra" - by 1.5%.

You can become a participant in the program only at the offer of the bank. This is a paid service. Its cost is from 1 to 4% of the loan amount.

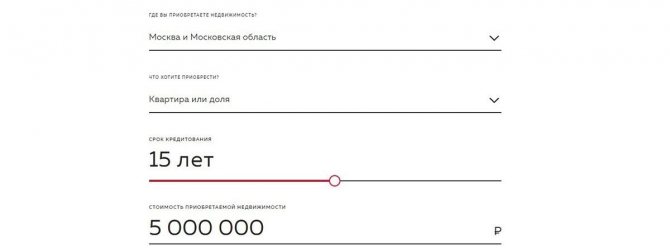

Mortgage calculator

Before contacting Rosbank, the client is recommended to use an online calculator. It will help you find out how much you will have to pay each month.

To make a calculation, you need to fill out a special form on the company’s website:

- type of mortgaged object;

- price;

- the city where the borrower lives;

- How long does it take to pay off the loan?

- annual rate type.

The mortgage calculator calculates monthly payments and interest.

Submitting an application for refinancing at Rosbank

You can submit an application on the bank's website. To do this, you need to fill out a questionnaire consisting of several questions:

- FULL NAME.;

- Date of Birth;

- monthly income;

- the amount the applicant wants to receive on the new loan;

- type of employment;

- whether there were any delays in monthly payments during the last year;

- telephone number and email address to contact the bank manager.

The application is reviewed within 3 working days.

You can fill out the form at the Rosbank office.

Rosbank requirements for mortgage refinancing

You can obtain approval to refinance a mortgage provided that the requirements relating to both the borrower and the collateral are met.

To the borrower

The requirements put forward by the lender to the borrower are as follows:

- age - from 20 to 65 years;

- employment - employee, individual entrepreneur, business owner;

- total work experience - more than 1 year;

- It is allowed to attract up to 3 guarantors.

Russian citizenship is not a mandatory requirement for the borrower.

To the object of collateral

Bank requirements for an apartment or apartment that is the subject of collateral:

- the residential building in which the mortgaged housing is located should not be on the list for demolition, reconstruction, or major repairs, and its wear and tear should not be higher than 50%;

- It is necessary to have a dedicated kitchen and bathroom;

- apartments should not be located in the basement or on the ground floor.

The room put up as collateral must be registered in the Unified State Register of Real Estate as a real estate property.

The lender's requirements for the house or townhouse that is the subject of the pledge:

- suitability of the building for year-round use;

- availability of an access road to the house;

- availability of communications and a bathroom;

- the material from which the building is constructed - panels, monolith, stone, concrete, wood;

- number of floors - up to 3;

- the land plot must have the status of individual housing construction, dacha construction or household plot.

The bank makes demands on the collateral.

Rosbank: refinancing mortgages from other banks to individuals

Reading time: 2 minutes(s) In the classical sense, refinancing a mortgage means changing the lender in order to change the terms of the loan. The need to refinance a mortgage loan may be due to various factors - for example, a change in the financial situation of the borrower or his desire to reduce the amount of the monthly payment for other reasons.

In this article, we will tell you the conditions under which Rosbank refinances a mortgage, and we will also find out how beneficial this procedure is directly for the client.

Terms of service

For borrowers who have taken out a loan from third-party banks, refinancing allows them to close their existing mortgage loan early and get a new one, but on more favorable terms. At the same time, borrowers not only become clients of Rosbank, but also receive the right to use special offers and benefits provided by the relevant programs.

A ruble mortgage issued on the security of a real estate property or part of it can be refinanced at Rosbank. If the loan was received by the client for a property under construction, then by the time the refinancing is processed, the housing must belong to the borrower by right of ownership.

According to the bank’s internal policy, persons aged 20 years at the time of application and up to 65 years at the time of full repayment of the loan can apply for a mortgage loan refinance from Rosbank. At the same time, both employees and entrepreneurs, as well as founders/co-founders of companies can become borrowers of this organization.

The client's citizenship does not matter to the bank.

Minimum loan amount:

- for Moscow and Moscow Region: 600 thousand rubles;

- for other regions: 300 thousand rubles.

Maximum loan term: 25 years.

Interest rate

Refinancing rates of 10 to 11.75% apply if:

- the loan amount is from 50 to 70% of the value of the property;

- insurance has been taken out for life and health, property and the risk of loss of ownership of real estate (if the borrower refuses voluntary insurance, the interest rate may be increased by 1-4% depending on the type of risks for which insurance is not provided);

- the intended use of borrowed funds was confirmed and a mortgage was provided.

The amount of the approved bet is affected by:

- refinancing term;

- borrower's credit history;

- the level of education;

- type of work activity;

- number of participants in the transaction;

- location of the collateral;

- type of income;

- ratio of income and expenses.

It should be noted that before confirmation of the targeted expenditure of funds and provision of a mortgage, the refinancing rate ranges from 11 to 14.75%, subject to the conditions listed above.

Procedure

The procedure for applying for mortgage refinancing is somewhat different from the standard algorithm for applying for a loan. At the very beginning, the client independently carries out the necessary calculations and contacts a Rosbank employee. After this, the lender analyzes the information and documents provided. The procedure ends with the issuance of the amount necessary for early repayment of the debt and the re-registration of the collateral to Rosbank.

The borrower can submit an application for mortgage refinancing in any convenient way:

- during a personal visit to a bank office;

- by calling the hotline at 8 (800) 200-54-34;

- from the official website at the link https://www.rosbank.ru/ru/persons/ipoteka/detail/products/Refinansirovanie.

Using the above link you can also find a built-in calculator and calculate the amount of future loan payments.

Required package of documents

Along with the mortgage refinancing application, the bank must provide:

- copies of all pages of the passport;

- documents confirming solvency (2-NDFL certificate or bank form/tax returns/management reporting);

- a certified copy of the work record book (for military personnel - a certificate of the established form);

- documents for the previous loan (loan agreement/certificate of debt balance/extract from your personal account).

Thus, refinancing a mortgage at Rosbank is a good way to change existing lending conditions. However, participants in salary projects of other banks can find more favorable rates in “their” organizations and thereby save significantly on loan repayments.

Did this article help you? We would be grateful for your rating:

0 0

Required documents

You can apply for refinancing at Rosbank only with a passport. But in this case, the annual rate increases by 1.5%. More favorable refinancing conditions are offered to clients who prepare a package of official papers, which includes:

- original and copy of passport;

- financial documents confirming income;

- a copy of the work record book, employment contract or other document confirming employment;

- documents for the pledged property - an extract from the Unified State Register of Real Estate, cadastral and technical passports, an assessment report;

- agreement with the previous creditor and a certificate of the balance of debt.

The passport is the main document for processing refinancing.

Should you trust Rosbank?

PJSC Rosbank is one of the largest banks in Russia.

Controlled by the French financial group Societe Generale (99.95%). Serves more than 4 million private clients in 70 regions of Russia. Article navigation

- Conditions for refinancing a mortgage in Rosbank

- Requirements for the borrower and collateral

- Registration procedure

- Package of documents

- Rosbank mortgage refinancing calculator

Refinancing is a bank service in which it is proposed to reconsider the terms of the loan to reduce the size of payments or reduce the total amount of debt. It is used in various situations; it can be used even when transferring a loan for a house or apartment in foreign currency into rubles. Let's take a closer look at how to refinance a mortgage at Rosbank.

The best mortgage refinance programs this month:

| Compare | GPS(%)* | Maximum amount | Minimum amount | Age limit | Possible timing |

| 7.99 % | 12,000,000 ₽ Application | 300 000 ₽ | 20–75 | 1–25 g. | |

| 9.1 % | 30,000,000 ₽ Application | 500 000 ₽ | 18–65 | 3–30 g. |

Stages of mortgage refinancing

After submitting an application and receiving a positive decision, the client is invited to Rosbank to sign a preliminary agreement. Further stages of refinancing:

- concluding an insurance contract with any company chosen by the client;

- submitting an application to close the debt to the bank where the initial loan was issued and receiving a certificate of debt;

- transfer of loan documents to Rosbank;

- transferring money to the borrower's account for subsequent transfer to the former creditor, obtaining a certificate of debt closure;

- transfer of the certificate received from the former creditor to Rosbank;

- removal of the encumbrance (this is given 30 days);

- signing an agreement with Rosbank;

- transfer of documents to Rosreestr.

If a foreign currency loan previously issued at Rosbank is refinanced, the documents are prepared by company employees.

The borrower only signs a new agreement and re-registers the collateral agreement.

Registration procedure

Citizens interested in applying for a mortgage refinancing program at Rosbank should be prepared for the following algorithm of actions when applying for a loan:

- A request is first sent through the official resource of the lender or its nearest branch.

- With preliminary approval, all documents are prepared, and in addition, real estate is appraised.

- An application is made to the bank branch, where the repeated application is sent for full consideration.

- Upon approval of the loan, he enters into a lending agreement, as well as an agreement to provide insurance.

- Subsequently, the borrower receives funds, after which he makes full repayment of the current loan.

- At the end, confirmation of the intended use of borrowed funds must be submitted to Rosbank.

Subsequently, all that remains is to fulfill your loan obligations in a timely manner, making equal or early payments. At the end of the loan period, it is recommended to obtain a certificate of closure of the account and removal of the encumbrance from the property.

Important! To significantly increase the chances of your application being approved, it is recommended to provide reliable and complete information about yourself.

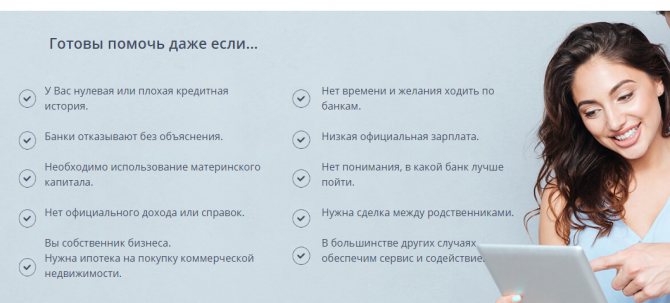

If Rosbank refused to provide such a loan program, you should not apply again, but send your request to an intermediary agency. The chances of getting a loan through a mortgage broker are much higher. Among the operating companies in the Russian Federation, the DomBudet institution stands out, since it maintains transparent statistics and provides only high-quality results. Payment is charged only after the borrower receives approval of the application from the financial institution and the contract is executed.

Additional expenses

The borrower will have to pay for insurance. The only mandatory requirement is to insure the mortgaged property. You can refuse other contracts, but in this case the annual rate will increase.

Insurance of a residential property is a mandatory requirement for refinancing.

The borrower will have to pay for the assessment of the collateral and the state fee for registration in the Unified State Register of Real Estate.

Advantages and disadvantages

Among the advantages of refinancing at Rosbank, clients note the following:

- short period of application consideration;

- the minimum number of documents that the client must provide to the bank;

- borrowers can be not only individuals, but individual entrepreneurs and business owners;

- the lender allows the client to independently choose an insurance company;

- Availability of special programs to reduce interest rates.

The disadvantage of this program is that the client has to independently repay the debt to the previous creditor and re-register documents with Rosreestr. The absence of these services in electronic form in Rosbank also causes inconvenience.

The advantage of refinancing is the availability of special programs with low rates.

Types of mortgage refinancing in 2020

As part of the refinancing program, Rosbank works in two directions:

- issuance of funds to repay mortgage loans issued by third-party credit institutions;

- refinancing of loans from own clients in foreign currency.

In the first case, the client contacts the bank in order to repay the existing mortgage ahead of schedule and change the lender. In the second, the service is provided for existing bank clients who want to change the type of currency in which the mortgage was originally issued. The need for this arises, as a rule, against the backdrop of an unstable financial situation and sudden changes in the exchange rate, which significantly affects the cost of the loan.