Do I need to pay tax on an apartment if it is purchased with a mortgage? On the one hand, the property does not belong to you completely, because the loan has not yet been repaid. On the other hand, this real estate has a special legal status described at the federal level.

According to Russian legislation, paying taxes is an annual obligation of all individuals who own real estate.

Next we will talk about how the tax on an apartment with a mortgage is paid, what is its size, what are the features of fulfilling tax obligations, is it possible to make payments via the Internet, is it possible to avoid paying property tax and who is officially exempt, are there any benefits, pay Is there a tax for pensioners?

Features of apartment tax in a mortgage

The Tax Code of the Russian Federation lists categories of persons exempt from paying taxes . Penalty measures have also been established for those who evade prescribed payments or have debt.

If you are in doubt whether you need to pay property tax if the apartment is mortgaged, read Article 400 of the Tax Code of the Russian Federation. Citizens who purchased real estate under a bank loan program are required to pay tax on an apartment with a mortgage.

Homeowners are required to make a fiscal payment based on the cadastral value of the home. Payment must be received no later than October 1, otherwise the payment will be considered late.

Houses, apartments, garages, rooms, cottages, other buildings and premises, shares in a property acquired with a mortgage are subject to taxation.

Do I need to pay tax if the apartment is encumbered with a mortgage?

The apartment, which has a mortgage, is pledged to the bank.

Does this mean that the buyer must pay property taxes on the property in question? How is tax calculated in this case? Do I need to pay property tax for an apartment with a mortgage? Paying property taxes if the apartment is under mortgage is the legal obligation of its owner. The property belongs to him by right of ownership. The fact that an encumbrance is placed on the apartment before the mortgage is repaid does not matter. The tax on an apartment with a mortgage is paid in full - as if the apartment were without encumbrance. Likewise, the owner of such real estate has the right to enjoy various benefits. The tax is paid regardless of the citizenship and age of the apartment owner.

- to the Rosreestr branch;

- to a banking institution;

- to house management;

- to the notary's office.

What are the risks for the buyer Disadvantages of the transaction: The buyer can pay the specified amount And the encumbrance will not be removed If the encumbrance is not removed The transaction cannot be completed until the situation is cleared The paid amount can be returned Only after a legal battle, and not always completely Even in that case If the buyer is able to purchase an apartment that is under encumbrance, he will become the full owner, but also a debtor to the bank. The process of re-registration of the apartment will be longer and more problematic. The bank will control the situation until all funds on the mortgage are paid. There are also such risks: The funds will be calculated not sure If payments are late, penalties and fines may be charged.

Do I need to pay property tax for an apartment with a mortgage?

- Moscow and region: +7-499-350-97-04

- St. Petersburg and region: +7-812-309-87-91

- Federal ext. 149

Deadlines for tax payment The tax must be paid by December 1 of the year following the year in which the tax was accrued for real estate due to its being owned by the taxpayer.

The number of months and for which month the tax was calculated does not matter.

It should be borne in mind that tax payment is carried out on the basis of a notification from the Federal Tax Service. It must be sent to the apartment owner by the tax authorities before the end of November of the year following the one in which the tax was calculated. It is worth highlighting a rather rare but common scenario in practice - when the Federal Tax Service sends a notification later than the deadline for sending it or even the deadline for paying the tax.

Questions and answers

This may be related:

- With the fact that the calculated tax amount is less than 100 rubles.

As a rule, such cases are associated with a short duration of apartment ownership - about 1-2 months, with a small area. However, as soon as at the end of the billing period the tax amount becomes equal to 100 rubles or more, the Federal Tax Service will send a notification. It will also send it if 3 years have passed since the tax was calculated - regardless of the payment amount.

- With the fact that the Federal Tax Service for some reason does not have information on the object of taxation (while a person is its owner and must, in principle, pay tax).

Such cases are rare, since Rosreestr itself sends information about real estate transactions to the Federal Tax Service. Tax authorities almost always know when and for how much a person bought an apartment.

Is it possible and how to sell a mortgaged apartment?

Important

Who has the right to a property tax deduction Citizens who have income taxed at a rate of 13% can receive a property tax deduction. First of all, these are those who are employed and have a “white” salary.

Attention

If the salary is “gray”, then you can count on a deduction only from the official amount of income. If a citizen works simultaneously in several jobs, then you can get a deduction from the income from all jobs.

In addition to salary, there may be other income taxed at a rate of 13%. For example, income from leasing property, from the sale of securities or other property, etc. You can receive a property tax deduction for such income. If a citizen is an entrepreneur and uses a special tax regime (“simplified”, “imputed”, etc.), then he does not have the right to a property tax deduction on income received as a result of entrepreneurship.

How to sell an apartment with a mortgage encumbrance

- the owner of the property in whose name the mortgage is issued;

- a buyer who agrees to purchase a home with a mortgage;

- bank, which is the lender;

What are the types? Types of encumbrances: Mortgage, in which the consent of the bank must be obtained for sale Rent Consent to the sale must be given by the rentee Seizure For the premises if there are debts on utility bills (sale is possible after repayment of the debt) Hiring Sale is possible, but eviction of tenants - not yet the contract will not expire Registration It is possible to register a tenant against his will after purchasing the property only in court Servitude They can use land that is not owned by the person Regulatory regulation When applying for a mortgage loan, you must be guided by the provisions of Federal Law No. 102, which was adopted in July 1998 .

Taxation on mortgages

Although there is one specific point. When a citizen contacts an institution for advice, he also has the right to ask to transfer ownership rights from a credit company. Buyers can purchase mortgage housing under preferential programs.

For example, the bank offers to pay only 20% as a down payment. Disadvantages for the borrower - since you will have to contact an intermediary bank, you need to pay interest on the transaction amount.

And the price of the apartment may be sufficient to pay off the debt, but it will be lower than the market average. If with maternity capital The buyer faces another risk if he buys housing with an encumbrance that was purchased by the owner using maternity capital funds.

Buying an apartment with a mortgage encumbrance where children are registered will present some difficulties. The owner is legally obliged, after repaying the debt and removing the encumbrance, to allocate a share of the apartment to the children. Be sure to contact the guardianship and trusteeship authorities, where they receive permission to sell this housing and purchase another apartment.

Only after this can the purchase and sale transaction be completed and the contract signed. They immediately submit a package of documents to the Rosreestr office in order to register the ownership rights to the object being sold and purchased. If you approach the transaction wisely, it will be safe. If you are not sure that you can handle it on your own, go to realtors.

For them, drawing up such agreements, when the object of purchase is housing encumbered by a mortgage, will not be difficult.

If a person’s right to a benefit did not arise from the beginning of the year, then it is applied when calculating tax, starting from the month following the one in which such a right arose.

For example, if a benefit, as an option, appeared due to the fact that a citizen retired, appeared on November 29, then the tax will no longer be calculated from December.

That is, it will be accrued over 11 months. Let us note that the actual federal tax benefit can be called a reduction in the tax base for a real estate property - by the established size of the area.

This benefit is regulated by clauses 3-5 of Art. 403 of the Tax Code of the Russian Federation.

So, if the object of taxation is an apartment, then the Federal Tax Service will calculate the tax on it based on the fact that its taxable area should be reduced by 20 square meters.

meters. If the object of taxation is a room, then a benefit is applied in the form of a reduction in area by 10 square meters. meters.

But it is possible that, due to technical failures and other circumstances, the Federal Tax Service will not have data on the real estate acquired by a citizen, which is subject to taxation by law.

But in this case, the apartment owner should not ignore the current situation: by law he is obligated to inform the Federal Tax Service about the presence of taxable real estate (at least according to obvious signs) in his property.

If a notification from the Federal Tax Service is not received by the end of November of the year following the one for which the tax should be calculated, the citizen is obliged to contact the tax authorities before the end of the year and inform them in the prescribed form that he owns a taxable property.

Debt repayment is possible at the expense of the seller or buyer. If money is transferred to the seller from the buyer, a preliminary agreement is drawn up, which stipulates all the terms of payment and the deadlines for fulfilling its obligations.

When the debt is repaid, the seller must present a new sample extract from the Unified State Register within the established time frame. The document should contain o.

Only after this can a basic agreement for the purchase of an apartment be concluded.

Removal of encumbrances can also be carried out in court, after which all changes are reflected in the Rosreestr database within 3 days.

If the buyer will remove the encumbrance, the following certificates are needed: All participants in the purchase and sale transaction must appear at the registration chamber. In some situations, it is necessary for an employee of the financial institution to be present.

Removing the encumbrance is not enough. As a result, the taxpayer may incur arrears and penalties, which the Federal Tax Service requires to pay. The requirement to pay tax in this case should be considered as legitimate. But you need to know that the application of penalties in this case is illegal.

Having received such a request from the Federal Tax Service, you need to promptly send there a request to write off penalties. As evidence of their illegal accrual, you can attach postal documents that reflect that the notification of tax payment arrived later than the due date.

The Federal Tax Service, with which the taxpayer is registered, must write off the wrongfully accrued penalties.

If this does not happen, you need to complain about the actions of the inspectorate to a higher structure of the Federal Tax Service. If this does not help, go to court. It happens that the Federal Tax Service does not send a notification, despite the fact that the tax has been calculated.

Source: https://dtpstory.ru/nuzhno-li-platit-nalog-esli-kvartira-s-obremeneniem-ipoteki/

Income tax and deductions when purchasing an apartment with a mortgage

The law provides for tax deductions when purchasing housing, but not all citizens of our country can take advantage of this right.

The maximum deduction in 2020 is set at 13% of 2 million rubles . At the same time, it is allowed to purchase one premises from 2 million rubles, or several at a lower cost.

Homeowners must be employed and receive official income, since tax preferences in the form of deductions are formed from income payments that citizens transferred for the previous period.

If the salary is less than 2 million rubles. per year, you cannot receive a deduction in a single payment . A citizen can only return the amount that he paid earlier.

Apartment owners have the right to submit documents each year to claim payments as part of the tax deduction. To receive larger amounts, it is recommended to submit documents once every 3 years.

Tax benefits when buying an apartment

Since 2014, a new rule has been in force in Russia for providing benefits when completing a transaction for the purchase and sale of residential real estate, which has a positive effect on the processing of mortgage lending by individuals. Since, due to the significant improvement in the conditions for providing benefits and other concessions from the state, citizens are allowed to return at least 260,000 when purchasing real estate.

The main differences between the new legislation and the previous one:

- When applying for a mortgage or purchasing residential premises for cash, the deduction was provided no more than once in a lifetime for each member of society. Now the deduction can be obtained regardless of the amount of real estate purchased, but the total amount of possessions must correspond to 2 million rubles.

- If the maximum established amount for the purchase of real estate is exceeded, the owner receives no more than 260,000 rubles.

- If citizens purchased real estate before 2014 or registered ownership of it, then they will not be able to receive the “missing” deduction.

Purchasing real estate with housing loans has become much more profitable, since the state compensates for part of the costs associated with overpayments on the loan. However, the total amount of compensated funds should not exceed 3 million rubles. The development of mortgage lending is also supported by a gradual reduction in payment rates. A detailed calculation of the total amount of overpayment is made by the creditor.

Conditions for receiving compensation for overpayment on a mortgage:

- Availability of white wages and official employment;

- The total amount of overpayment is 3 million rubles or less for the entire term of the loan agreement;

- The deduction can be provided to each party to the contract, i.e. if real estate is acquired as common property, then each of the parties to the agreement can count on receiving a deduction.

Features of property tax

Despite the fact that an apartment purchased with a mortgage is collateral, the owner is obliged to pay the state and municipal fees accrued on it.

In fact, such an apartment is considered the property of an individual, and the tax authorities impose certain obligations on such property.

Property tax is calculated depending on its value . These requirements are determined by the current provisions of the Tax Code of the Russian Federation.

The Federal Tax Service must send notifications about the need to pay taxes. It is not necessary to make a payment until you receive the document.

If the notification was not received or arrived late, there should be no negative consequences . In this case, it must be indicated that the absence of a notification is due to the fact that tax officials did not send it, and it was not lost in the mail or was removed from the mailbox.

But citizens themselves should not treat this responsibility negligently, otherwise fines will be imposed . The amount of the first fine will be 20% of the original amount of property tax; a repeated violation will entail a penalty of 40%. Fines are imposed for missed payments - this is a month from the date of receipt of the notification.

General information

All individuals who own real estate are taxpayers. They are forced to pay annual taxes on their house or apartment. If you do not do this, a fine will be charged. You can find out about the debt by visiting the tax office in person or using a special Internet resource.

By law, the tax receipt must be sent at least 30 days before the payment is due. That is, a person will have a month to pay off the tax. If he does not do this in a timely manner, then a fine will be imposed. And it is 20% of the tax, and then can increase to 40%. Therefore, it is better not to delay paying tax on housing.

It may happen that the property tax receipt is not sent; for example, it gets lost in the mail or is sent to the wrong address. In such a situation, you should not wait until the problem resolves itself. If the receipt did not arrive on time, you should get it yourself. To do this, you can use the Internet and visit the website of the tax service or personally contact the government agency. An invoice will then be issued for payment, which will need to be repaid.

Tax status of an apartment with a mortgage

Housing purchased under the mortgage program has a special legal status. This is due to the specifics of the mechanism for regulating legal relations in the field of mortgage lending.

An apartment with a mortgage has the following features:

- this housing has not been fully paid for by the buyer, therefore it has an intermediate status of collateral;

- Despite the mortgaged status, the apartment is considered the property of the person who purchased it on credit. It can be used and, to some extent, disposed of;

- if you miss the deadline for paying the next mortgage payment, the apartment will be transferred to the lender to pay off the debt;

- the apartment is the property of the borrower, so tax on it is paid in accordance with the general procedure.

Legal status of housing under mortgage

A mortgage is a special type of lending that is issued for the purchase of real estate. The amount of a mortgage loan differs in size from household loans, and is issued for a long period - from 10 to 30 years. Banks work only with those borrowers who have an official stable income that allows them to repay monthly loan installments. But it is impossible to predict the stability of income over a long period of time, so banks cover their risks in a different way.

When you take out a mortgage loan, the lender pays for the purchase and then takes the purchased property as collateral. As a result, the property is registered in the name of the buyer, but the third party to the transaction is the bank. Immediately after receiving ownership rights, an encumbrance is placed on the living space. A mark indicating its presence is affixed to Rosreestr, which does not allow the actual owner to dispose of his property at his own discretion. Such premises cannot be sold or donated until the mortgage is fully repaid and the encumbrance is removed. Any actions in the form of redevelopment, leasing to other persons, registration of citizens who are not relatives can only be carried out with the consent of the banking institution.

Notice of payment of property tax

A notification from the tax authorities about payment of property tax must be drawn up in the form approved by Order of the Federal Tax Service dated September 7, 2020 No. ММВ-7-11/477. By Order of the Federal Tax Service No. ММВ-7-21/8 dated January 15, 2020, adjustments were made to it.

The main innovation in the new form of notification of the calculation of property contributions is changes in the procedure for generating the form in the event of a need to recalculate the previously established contribution amount.

Preparation and distribution of notifications is carried out only for those addressees affected by the recalculation, and not for all taxpayers living in a given region.

When recalculating, the notification form shall indicate the following information:

- the amount of the previously accrued amount;

- amount of reduction or additional payment.

Options for delivering notifications have also been added. The document can be sent in the following ways:

- at the taxpayer's postal address;

- by email - for individuals with a personal taxpayer account.

Deadlines for paying taxes on an apartment with a mortgage

Property tax must be paid at the location of the taxable property . Every year, the Federal Tax Service sets deadlines for payment of contributions to individuals and legal entities. Previously, property contributions were made before October 1 based on accruals for the previous year.

In 2020, the deadlines for transport and property taxes were shifted. Now you need to pay off received notices before December 1. The specified period is valid for all subjects of the Russian Federation.

Legislative provisions allow the payment deadline to be postponed if the taxpayer promptly sends an application to the regional inspector with such a request. For a positive decision, the application must indicate the reasons for postponing the payment deadline. The maximum transfer period is also set at 1 year.

If the deadline for paying property tax is violated without sufficient grounds, the property owner will also have to pay a penalty for the entire amount of the arrears.

Property tax amount

In accordance with Article 32 of the Tax Code of the Russian Federation, property tax is calculated based on cadastral value. Its value is approved at the local level of each region.

In 2020, tax legislation has undergone many significant changes. The procedure for calculating property tax has also changed. By 2020, the new order and the transition to a new calculation system will have to be implemented throughout the Russian Federation.

The tax amount based on the cadastral value is calculated using the following formula: (Cadastral value – Tax deduction) × Share size × Tax rate.

You can obtain information on the cadastral value of property on the Internet. To do this, you need to know the cadastral number of the object or its actual address.

Next, go to the Federal Tax Service website https://www.nalog.ru, select property tax, your region, enter the number and get information about the value of the property.

In the same way, you can clarify the amount of tax for the previous tax period and find out how it was calculated: according to inventory or cadastral value. If according to the inventory, the program will prompt you to enter not the cadastral number, but the inventory value.

You can find out the cadastral number on the Rosreestr website https://rosreestr.ru in the reference information section at the registration address of the property.

The tax amount varies from 0.1 to 2% depending on the region, owner status, and type of property. The exact cost can be clarified at the regional tax office.

Calculation of the final amount involves the following steps:

- Calculating the cadastral value of the property by dividing the total amount by the taxable area.

- Calculation of deductions due to a citizen by law.

The amount of the second point is subtracted from the amount of the first point . Contributions are calculated based on the inventory price of the property. The amount of the tax fee is calculated in accordance with three main indicators: this allows you to determine the amount of payment as accurately as possible.

The final indicator is reduced by the size of the correction factor: this allows for a gradual increase in property collection. In 2020, the coefficient was 0.6, in 2020 - 0.8, from 2020 citizens will have to pay 100% of the accrued fees.

How is tax calculated?

In principle, there is no need to do the calculations yourself. The state does this, and the person only receives a notification of the amount. Therefore, just to check, you can try to do the calculations yourself. The easiest way would be to use the official website of the Federal Tax Service. There is a special service that will calculate the approximate amount. You will need to indicate the cadastral number of the property or address, then write the area and cadastral value. Then you will need to write additional information - share size, holding period, tax deduction, availability of benefits, etc. Based on the information provided, the final result will be generated. But you should understand that the amount is only approximate. Therefore, you should not be surprised if the state calculates a slightly different tax amount. It is the received receipt that you should trust, and not the Internet resource.

Procedure for fulfilling tax obligations

The tax amount is determined in accordance with the cadastral value of the property. If you have not received a notification or the indicated amount seems too high, contact the cadastral service and clarify the cost of the object.

Knowing the amount of the tax fee, you can pay it at a bank, tax office, via the Internet, a payment terminal or private specialists.

Upon receipt of a notice at home, you must pay the amount indicated on the form at the nearest bank branch. Payment is accepted in cash or by transfer.

When contacting the tax authority, a specialist will calculate the required amount and issue a receipt for payment. It is recommended to keep the receipt to avoid misunderstandings in case of penalties.

Payment via the Internet

Payment of property taxes online is available to all citizens . However, a number of conditions must be met. Upon receipt of a notification from the tax service, payment is made through online banking, if your bank offers this option.

The procedure for fulfilling tax obligations via the Internet begins with registration on the tax service portal . To do this, you must enter your passport data and taxpayer identification number. Your personal account indicates the amount of tax collection that the tax service specialists made for you.

If you do not know the exact amount, you can send a request through the Internet portal to the tax office, and you will be given an answer regarding your tax obligations.

On the website of the tax service, you can independently calculate the amount of tax - a service with the appropriate algorithm is available.

The apartment was purchased with a mortgage, is it necessary to pay sales tax?

I bought an apartment with a mortgage in 2009 for 2 million 150,000 rubles. Now we can’t pay the loan, and I want to sell it. I plan to sell for 1 million 850 thousand. With this money I still need to repay the remaining part of the loan - 1 million 720 thousand rubles.

Will I pay 13% tax on the sale of an apartment? You won’t if you use the right to a scheme in which tax is paid on net profit. That is, from your income when selling a home, the amount for its purchase is deducted and a 13% tax is taken from this amount.

If you have not made a profit, then you do not need to pay.§ Art. 220 of the Tax Code of the Russian Federation, but you need to confirm the costs of paying for the purchase of an apartment in 2009, and it does not matter that these were borrowed funds. All documents, including receipts, must be in order.

If you sell your apartment in 2012, then you don’t have to rush with the declaration for this year.

Important

Are there any risks for the seller:

- It is believed that the main risk in a purchase and sale transaction is the possibility of stumbling upon a fraudster who, after completing and registering the alienation of the apartment, will not pay the funds specified in the contract. In this case, the risks are minimal, because here the bank vouches for the buyer, which will send the entire amount to the seller’s personal account using a wire transfer.

You need to understand that the bank does not issue large targeted loans for a long-term period to persons who are not solvent;

- courts always recognize a purchase and sale transaction under a mortgage as invalid if the bank has not sent the funds to the seller’s account;

- there is also minimal risk that the seller will receive counterfeit and counterfeit money.

Sales tax should be 4,000,000 - 3,600,000 = 400,000 * 13% = 52,000? And another question: will the amount of the mortgage be taken into account for the deduction or only the amount that we paid? Natalya 4 years 41 weeks 4 days ago You provided the correct calculation.

The total amount of tax that you and your husband must pay will be 52,000 rubles. Does anyone have experience selling a mortgaged apartment? The mortgage was taken out from Sberbank.

Is tax paid on the purchase of an apartment? The former owner will have to pay income tax, the amount of which in the Russian Federation is 13 percent.

Attention

Also, the new owner does not need to personally notify the tax authorities about the purchase of real estate. They will receive all the necessary information from Rosreestr. Here, as you know, they register property rights after purchasing an apartment.

how much money needs to be deposited; what is the tax rate; the deadline by which payment must be made.

Is it necessary to pay tax on the sale of an apartment with a mortgage from a bank?

Pravoved.RU 180 lawyers are now on the site

- Categories

- Tax law

Last year I bought an apartment with a mortgage. Now I want to sell and pay off the mortgage loan with this money. I won't buy a new apartment. Will I have to pay tax on the sale of the apartment? Victoria Dymova Support employee Pravoved.ru Similar questions have already been considered, try looking here:

Lawyers' answers (1)

- All legal services in Moscow International tax disputes Moscow from 20,000 rubles. Arbitration tax disputes Moscow from 50,000 rubles.

Tax on the sale of an apartment with a mortgage

Reply with quotation Top ▲ 06/17/2010, 08:15 #5 Thanks AZ 2. Today the tax office said the same thing about three years. I hope this is accurate information.

What tax is charged when selling a mortgaged apartment?

Let's find out what features the purchase and sale of real estate by a mortgage buyer has:

- This is one of the most frequent transactions in the real estate market (more than 60% of all cases).

- The seller should not worry that in case of debt or delay in monthly loan repayments by the buyer, the funds will be collected from the parties to the transaction. After the buyer undergoes registration of ownership rights and receives the appropriate certificate, he will be the only responsible person to the financial institution.

- In 99% of cases, the seller receives his funds from the transaction, so the risks of concluding an agreement with the mortgage buyer are minimal.

- In this situation, the buyer is at greater risk, because the seller cannot always say that the alienated living space is under encumbrance or seizure.

Selling an apartment with a mortgage

Tax deduction when buying an apartment with a mortgage It follows that you can get a tax deduction not only directly on the mortgage. According to Art. 220 of the Tax Code of the Russian Federation, when using mortgage funds to purchase housing, you can receive two tax deductions: basic and interest. Let's look at each in more detail.

The property deduction for the principal portion of the mortgage is no different from the tax refund for a regular home purchase. Here we can talk about the following features: Let's say you bought an apartment for 2,700,000 rubles. Tax on the sale of an apartment with a mortgage If you sell the apartment in 2012. You have not previously used any tax deductions.

This means it has been owned for less than three years.

Is it possible not to pay tax on an apartment with a mortgage?

There is no legal mechanism to avoid property tax. Within the framework of tax legislation at the federal level and regional regulations, certain categories of citizens have tax benefits or are completely exempt from them:

- disabled since childhood, groups I and II;

- pensioners;

- Knights of the Order of Glory;

- military personnel who retired due to age with at least 20 years of service;

- heroes of the country;

- military families who have lost their breadwinner;

- WWII veterans;

- spouses and parents of military personnel killed in the line of duty;

- victims of the consequences of the accident at the Chernobyl nuclear power plant or at the Mayak nuclear power plant;

- owners of outbuildings with an area of no more than 50 m² located in areas of vegetable gardening, horticulture, summer cottage farming, and personal farmsteads;

- citizens using property for creative activities and as a cultural object.

Benefits at the local level are usually provided to large families and needy individuals . The exact list can be clarified at the regional tax service.

Benefits apply to only one property. Citizens of the Russian Federation are provided with tax deductions for apartments purchased with a mortgage.

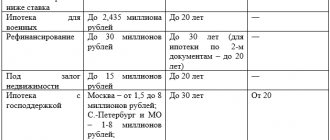

Tax benefits for military mortgages

Military personnel serving under contract or with at least 20 years of service are eligible to receive a fiscal benefit equal to the amount of tax on a military mortgage loan.

To receive the benefit, you must provide the tax service with a certificate from a military unit indicating your personal data. If you do not contact the tax service in a timely manner, the right to a fiscal benefit is still retained, but recalculation is made for no more than 3 years.

Pension benefits

In accordance with Article 407 of the Tax Code of the Russian Federation, pensioners also have certain benefits and privileges when paying state duties on real estate. The right to reduced payments is granted only for one object.

If a pensioner owns several equivalent residential premises, which of them will be given a benefit can choose independently. Preferences are assigned upon availability of an application and title documents.

Do you have to pay for a mortgage on real estate?

The responsibility to pay taxes rests with citizens. This also applies to cases of real estate transactions purchased on credit. By purchasing a mortgaged home, a person becomes the owner of the property, since his rights are registered in Rosreestr. For this reason, payments will need to be made.

Preferential categories of citizens

The categories of persons who enjoy tax benefits are defined in Article 407 of the Tax Code of the Russian Federation. These include:

- Heroes of the USSR and the Russian Federation.

- Persons awarded the Order of Glory of 3 degrees.

- Disabled people classified as groups 1 and 2, as well as those who have been disabled since childhood.

- Participants of the Second World War and the Civil War, other military operations to protect the USSR from among military personnel and former partisans. The civilian personnel of the Soviet army during the Second World War are also included in this category.

- Persons entitled to social assistance as having been exposed to radiation and the dumping of radioactive waste.

- Military personnel and those discharged from service with 20 years or more of service.

- Those who took part in testing nuclear weapons and eliminating such installations.

- Family members of military personnel who have lost their breadwinners.

- Persons who have reached the legal age and receive pensions.

- Performing international duty in Afghanistan.

- Those who have received or have had radiation sickness.

- Parents and spouses of military personnel and government employees killed in the line of duty.

- Owners of premises used as creative workshops, ateliers, studios, non-state museums, galleries, libraries - for the period of such use.

- Owners of real estate with an area of no more than 50 m2, located on land plots provided for personal subsidiary farming, summer cottage farming, vegetable gardening, horticulture or individual housing construction.

In order to take advantage of this benefit, you must submit a corresponding application to the Federal Tax Service. It is accompanied by documents confirming the preferential status, for example, a certificate of a victim of the Chernobyl accident.

The application can be completed electronically and sent via the Internet.

Liability for non-payment

The absence of property transfers after the end of the established period entails the adoption of retaliatory measures:

- accrual of penalties on the entire amount of debt - each day of delay is calculated based on 1/300 of the National Bank's refinancing rate;

- a fine of 20% of the untransferred amount; in case of intentional and prolonged non-payment, the amount increases to 40%;

- if there is no response from the taxpayer within 6 months and the debt exceeds the threshold of 3 thousand rubles. The Federal Tax Service files a claim with the court in order to forcibly collect the debt.

Failure to comply with a court decision may lead to the seizure of money savings and property, and the sending of a notice to the place of work.