VTB Bank clients who have an existing mortgage have the right to contact the credit institution with a request to reduce the interest rate. This service will be especially relevant for borrowers who received a loan before 2020. At that time, our country was experiencing a serious economic crisis, so mortgage rates at VTB Bank were significantly higher.

The credit institution willingly accommodates its clients halfway, reducing the interest rate by several points. It is also important that in March 2018, VTB revised the conditions for providing mortgages. Today, financial institutions issue housing loans to the population at the lowest possible interest rates. This is why customers with an existing mortgage may notice a real difference in interest rates.

When was the last rate cut and what are they now?

The right to apply for a reduction in the rate on an existing mortgage is prescribed at the legislative level. If VTB agrees to provide this service, the borrower will need to sign an additional agreement, which will specify the updated terms of the housing loan.

The rate reduction service itself began operating at VTB back in 2017. Its appearance was associated with the stabilization of the economy of our country. Thanks to this, the Central Bank of the Russian Federation reduced the key rate, which could not have affected the mortgage lending rates of all financial organizations.

Note! In the list of current services of VTB Bank you will not find a reduction in the rate on an existing mortgage loan. The initiative to activate it must come from the client of the credit institution.

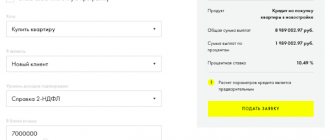

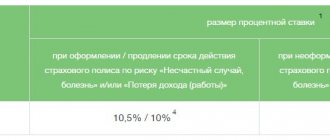

For 2020, all VTB clients who have an existing mortgage with a rate of more than 10.5% have the opportunity to ask the bank to reduce it. If the housing loan percentage is less than this indicator, the service most likely will not be provided.

According to statistics, VTB clients can reduce their rate to between 9.7% and 8.9%. The final amount depends on the current refinancing rate of the Central Bank and the conditions of the previously issued mortgage.

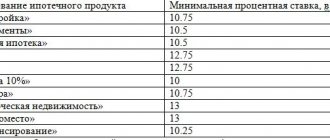

For 2020 – 2020 VTB Bank offers its borrowers the following mortgage programs:

- Finished housing – from 10%.

- Real estate under construction – from 10%.

- Refinancing – from 9.7%.

- Military mortgage – 9.3%.

- Mortgage with government support – 6%.

- Mortgage with 30% down payment – 10%.

- Purchasing an apartment with an area of 65 sq.m. – 9.3%.

- Non-targeted loan secured by real estate – 12%.

In some cases, the above rates may be reduced if the mortgage is taken out by military personnel, VTB salary clients, or when making a substantial down payment.

Conditions for reducing interest rates

Rules that must be followed in order for the key refinancing agreement to be concluded:

- Documentary proof of ownership.

- The mandatory percentage of the effective lending rate must be set at a rate greater than 12%.

- There must be no less than 12 loan payments.

- There should be no debt for more than 30 days on the current loan.

The interest rate reduction cannot be applied to:

- Loans from the Housing Mortgage Lending Agency.

- Non-targeted mortgage loans.

Additional rules for providing refinancing:

- Credit currency is Russian rubles.

- When refinancing, the regular payment does not increase, only the loan term changes (it can be increased).

- The loan amount itself may be increased.

Fee for providing services for concluding a refinancing agreement:

| For residents of the capital of the Russian Federation, the Moscow region and St. Petersburg | Twelve thousand rubles |

| For residents of other regions of the Russian Federation | Six thousand rubles |

Related article:

How to take out and calculate a mortgage at VTB 24 bank without a down payment?

During the refinancing, you will need to complete a special appraisal and its report. The terms of the program require a special process for registering collateral in favor of the bank. Applications for this reduction program can be submitted from the beginning of September 2017. An application can be submitted to the mortgage lending department of the region where mortgage loan services are provided.

VTB 24 Bank also reduces the rate for clients of other financial companies, since this method significantly attracts new people who want to cooperate.

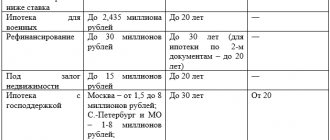

Loan terms for such clients:

- Loan rate from 9.7%.

- The loan term is up to 30 years.

- The amount of loan funds is up to 30 million rubles, but not more than 80% of the cost of the housing that serves as collateral.

- Complete absence of registration commission.

Advantages and disadvantages of this service

In some cases, reducing the rate on an existing mortgage may not be beneficial. VTB clients also often confuse this service with refinancing a home loan from a third-party lending institution. In the second case, the percentage will be at least 9.7%.

It is important to know! By submitting an application for mortgage refinancing to VTB, the client transfers his current debt from the old organization to the new one. Before agreeing to this service, be sure to calculate the benefit you are getting; it may not be there. This can be done using a loan calculator located on the official website of VTB Bank.

Among the main advantages of the rate reduction are:

- Reduced monthly payment.

- Reducing the final overpayment on the mortgage.

- VTB clients can submit an application using a simplified procedure.

In addition to the positive aspects, lowering the percentage has a number of significant disadvantages:

- Mandatory conclusion of a new insurance contract.

- Payment for real estate assessment by an expert.

- Additional payment of state duty and other services.

- Waste of personal time preparing the required package of documents.

- Long wait for a final response from VTB Bank, up to 60 calendar days.

That is why, before applying for a reduction in the current rate, carefully study the conditions being purchased, compare all the pros and cons, and calculate the amount of future benefits.

Requirements for the borrower and loan

To qualify for this service, the borrower and his mortgage must meet a number of mandatory requirements:

- Be a citizen of the Russian Federation.

- Have permanent registration in the region where VTB 24 operates.

- Document your own solvency.

- Have a good credit history.

- Avoid delays under the current mortgage agreement.

- Be fully capable.

- Have no debts on insurance services.

The existing mortgage itself must also meet the bank’s conditions:

- Be issued in Russian rubles.

- The loan must have been received at least 12 months ago .

- The interest rate should be higher 10,5%.

- The balance on the mortgage loan must exceed RUB 500,000 .

- The loan must not have previously been subject to debt restructuring programs.

- The rules for issuing collateral must be followed.

It will not be possible to reduce the rate on a housing loan if it was taken out under the “Military Mortgage” or “Social from Russian Railways” . All other clients who repay the current loan in good faith can contact the VTB branch with a request to activate the service.

How to reduce the rate on an existing mortgage

If you decide to reduce your current mortgage rate and meet all the requirements, you need to adhere to the following algorithm of actions:

>

- We contact the VTB branch.

- We are writing a corresponding statement.

- We give the employee all the necessary papers.

- We are waiting for the decision of the financial institution.

Important! It is better to clarify in advance how to submit an application and what documents are needed for this in order to receive the service as quickly as possible. This can be done by calling the VTB hotline number - 8-800-100-2424.

Contact the VTB branch

An application for a reduction in interest on an existing housing loan must be submitted to the VTB corporate branch where the mortgage agreement was previously concluded. In addition, this service can be obtained at a specialized mortgage center of a financial organization or a multifunctional office. Lastly, all VTB banking services are provided without exception.

Note! You can view the addresses of the nearest VTB24 offices on the official website of the credit institution – www.vtb.ru. To display information correctly, do not forget to first select your region of residence.

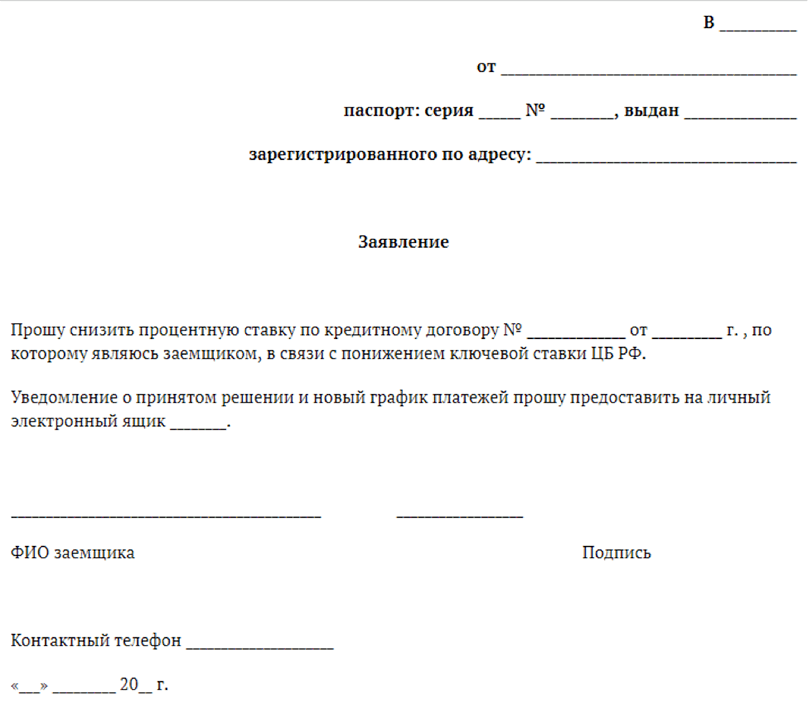

We are writing a statement

An application for activation of the service is written in free form addressed to the head of the VTB branch. The paper must contain the following mandatory information:

- Full name of the applicant.

- Full information about the current mortgage agreement: number, term, amount, debt balance, rate, effective date.

- Indicate why you want to reduce the percentage.

- Write down the limits within which you want to receive a new rate.

- Feedback data.

A sample application looks like this:

If the mortgage was taken out jointly with co-borrowers, the written consent of all persons is required to submit the application. The paper itself can be written by one person. A sample application can be obtained at the office or on the VTB Bank online resource.

We collect the required papers

Together with a handwritten application, the client of the financial institution is required to provide a complete package of required documents. It includes:

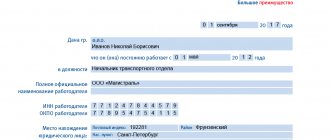

- Passport of a citizen of the Russian Federation.

- Work book/employment contract certified by the employer.

- Help 2-NDFL.

- Documentary assessment of the property.

- Mortgage agreement and its copy.

- Current payment schedule.

- Papers for collateral.

- Insurance policy.

- A receipt confirming payment of the insurance premium.

Participants in the salary project will be able to limit themselves to a minimum package of documents. If the mortgage was issued at the previously existing VTB Bank of Moscow, additional duplicate documents may be required.

How to reduce the interest rate on a mortgage at VTB 24 on an already taken out mortgage

Changing the terms of a mortgage agreement by agreement of the parties is regulated in Article 450 of the Civil Code of the Russian Federation. To take advantage of the opportunity to lower the interest rate, you must express your request in writing. The application is drawn up in free form personally by the borrower. If the mortgage was taken out by several co-borrowers, then the written consent of one of them must be provided. The application must indicate:

- Client data (Last name, first name, patronymic, place of registration);

- The reason for the rate change (favorable reduction);

- Mortgage agreement number;

- Date of loan issue;

- Current rate;

- Required rate;

- Mortgage term;

- Residence or email address where the updated payment schedule should be sent.

The application is submitted to the branch of the bank that issued the mortgage. To apply, you only need a passport.

Important! If a co-borrower participated in the registration, the bank will require his written consent.

VTB 24 offers profitable opportunities to refinance a previously taken out mortgage. To do this you will need to collect a package of documents:

- Passport;

- SNILS;

- Military ID;

- Certificate of income form 2 personal income tax;

- Employment history;

- Mortgage agreement;

- Written consent from the lender to refinance.

In the process of refinancing a loan, the borrower expects additional expenses for appraiser services and insurance.

What to do after receiving a positive decision

After a positive decision is made, an employee of the credit institution contacts the borrower and asks to come to the office for a personal meeting. So the client will have to enter into an additional agreement, which will become an integral part of the mortgage agreement. The papers will also contain an updated schedule for making monthly payments, the amount of which will be calculated based on the current interest rate.

Over the phone, a VTB employee will set a specific date and time based on the client’s wishes and capabilities, so that he does not waste his time waiting in line. The updated mortgage rate will take effect immediately after the papers are signed. All information will be contained in the additional agreement. Be sure to review it at the VTB branch and ask any questions to an authorized employee.

It is important to know! It is possible to lower the VTB mortgage rate only once.

Is it worth reducing the rate and is it profitable - pros and cons

The positive aspects of VTB's mortgage rate reduction boil down to the following:

- significant savings on the total amount of overpayment;

- reducing the size of the monthly contribution and, as a result, the burden on the family budget.

The disadvantages of this action depend on the method by which this reduction is achieved. If we are talking about filing an application to revise the terms of the current contract on the basis of Art. 450 of the Civil Code of the Russian Federation, the disadvantages of such a step are exclusively intangible:

- The wait for a bank response can be up to 2 months;

- significant probability of failure.

If the rate reduction is achieved by applying for refinancing, then this entails additional costs for re-evaluating the property.

In addition, if payments were made under an annuity scheme and more than half of the amount has already been returned, obtaining a new loan may not be advisable, since the difference in the overpayment will be minimal.

Is it profitable to reduce the rate?

Why VTB can refuse a service

VTB Bank has the right to refuse to reduce the rate on an existing housing loan without necessarily explaining the reasons. Even the most trustworthy borrowers who have not previously made a single late payment may receive a negative answer.

Speaking about the main reasons for refusal, we can highlight the following:

- The borrower does not meet VTB requirements.

- The loan was issued less than a year ago.

- The remaining amount of mortgage debt is less than 500 thousand rubles .

- A VTB client has a military mortgage or a special Russian Railways program.

- The current mortgage rate is less than 10,5%.

- The borrower is the owner of a damaged credit history.

- The client made numerous delays on the loan.

If you receive a negative decision, you can independently analyze the reasons and eliminate them or apply for a similar service from another credit institution. VTB does not prohibit its clients from submitting an application again.

VTB 24 mortgage rate reduction

VTB 24 is a large financial organization. The company issues loans at the federal level. As the bank develops, it strives to create favorable conditions for borrowers and improve the level of service. The lender develops advantageous loan offers and products. VTB 24 has the opportunity for mortgage holders to apply for a lower loan rate.

Important! A reduction in the mortgage rate can only be considered on the personal initiative of the borrower.

Changing your rate will help significantly reduce your monthly payment. In order for the bank to consider an application to reduce interest on a loan, the following conditions must be met:

- More than 1 year has passed since the loan was issued (at least 12 monthly payments have been made);

- There were no arrears or debts during the loan period;

- The principal debt on the mortgage at the time of application is more than 500 thousand rubles;

- The interest rate on the current mortgage is more than 10.5%;

- This loan has not previously undergone restructuring.

Important! The rate reduction does not apply to military mortgages.

An application to reduce the established percentage is considered up to 60 days. Each request is dealt with individually. The bank takes into account your credit history. If there were delays in payments, VTB will make a negative decision.

The availability of other banking products is taken into account. Priority is given to clients whose relationships with the bank are regular. For example, a salary card has been issued, there is a deposit in the bank account, an insurance contract has been concluded, the funded part of the pension has been transferred.

The availability of preferential conditions for the borrower increases the chances of approval of the application:

- Guarantees are involved in the loan;

- Maternity capital applied;

- The client belongs to a preferential category of citizens - he is a government employee;

- Social government programs for the purchase of housing were used.

Lowering the interest rate is optional. In any case, the credit institution calculates its own benefit. If a decrease in the annual percentage leads to a loss of profit, VTB may not satisfy the client’s request. If a positive decision is made, the loan receives an updated mortgage payment schedule.

Important! Experts recommend lowering the rate if less than 50% of the loan is paid off.

The borrower must take into account that in the first years of the loan, almost 70% of the monthly payment goes to interest payments. The principal debt begins to actively decrease only in the second half of the loan term. When recalculating, only the amount of the repaid debt is taken into account; overpayments of interest are not taken into account. To get the maximum benefit, it is better to think about changing the rate after a year of using the loan.