Mortgage programs

Lending will allow you to buy an apartment, a private house with a plot of land, a cottage and other property on the primary and secondary markets. Numerous programs will open up a new world of possibilities.

Taken into account:

- Level of solvency;

- Financial situation of citizens;

- Degree of employment;

- Age;

- Social status;

- The level of education;

- Experience;

- Average monthly income.

Many banking products offer good discounts and benefits.

Svyaz-Bank offers the following conditions:

- "Ready housing";

- "New buildings";

- "Military mortgage";

- Refinancing;

- Mortgage secured by real estate.

Better conditions:

- Reduced interest rates;

- Benefits when connecting to insurance;

- Extended repayment period.

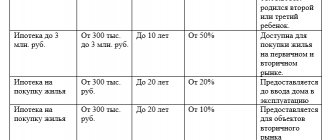

"New buildings"

The category is designed for those who want to buy property still under construction. This will be a new house that no one has lived in before.

Svyazbank puts forward the following conditions:

- Available kit from 300,000 to 50,000,000 rubles.

- Repayment period from 3 to 30 years.

- The first deposit must be 10% of the total amount.

You should not purchase a product whose border reaches the limit. Such conditions can greatly reduce your level of solvency, which will lead to regular delays and debts.

The smallest primary contribution of 10% is available to young families who use maternity capital. Standard payers who do not participate in loyalty programs must pay a one-time fee of 15%.

"Ready housing"

They provide for purchase on the secondary market. You can get a loan, the amount of which will reach 50,000,000 rubles. The loan period can be up to 30 years.

The smallest down payment is 15% for ordinary customers who do not participate in loyalty offers. When purchasing a ready-made complex, it will be able to provide you with up to 50,000,000, the repayment period will be up to 30 years.

When considering applications for lending, it accredits the secondary complex. Without it, you will not be able to get a mortgage to purchase real estate from the secondary market. Individual entrepreneurs must pay a one-time fee equal to 30% of the total amount of property, private business owners pay 40%.

Military mortgage

A special offer that involves the active support of the state. The military fits the bill.

Svyaz-Bank imposes the following conditions for preferential mortgages:

- The down payment will be 50% of the total cost of living space.

- The repayment period of the debt is from 3 to 30 years.

- The minimum volume is 300,000 rubles, the maximum is 30,000,000 rubles.

- The main condition is that the purchased property is pledged to a credit institution.

Military personnel who have participated in the NIS for more than 3 years have the opportunity to obtain a preferential loan. You can buy real estate under the best conditions:

- The largest loan volume is 2.6 million rubles.

- Repayment period up to 20 years.

- Contributions from maternity capital are allowed.

It is allowed to buy only accredited real estate if we are talking about the secondary market.

Conditions of the Military Mortgage program

Due to the military’s participation in the savings-mortgage system, he has the right to preferential lending conditions and assistance from the state in paying off the mortgage.

Svyaz-Bank sets fairly low interest rates at 11.5%.

The loan term ranges from 3 to 20 years.

The property being purchased or the right of claim against the developer is taken as collateral if housing under construction is purchased.

The down payment on the mortgage is made from the accumulated funds of the military, but you can also make your own savings, so the amount varies from 20% to 90%.

The larger the down payment on a mortgage, the lower the interest rate and the higher the loan amount may be.

The military is offered two types of loans - personal and title, and the latter is mandatory, and in case of refusal, the interest rate may increase.

There are also a number of restrictions regarding early repayment and withdrawal of commissions on it.

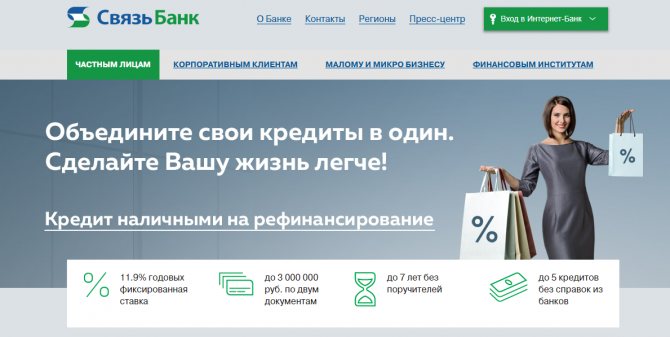

Refinancing

The mortgage refinancing program at Svyaz-Bank will allow you to get more favorable conditions and reduce the current load.

The following settings apply:

- The maximum amount available for receipt is 50,000,000 rubles;

- The payment period is up to 30 years.

Look at the same topic: Mortgage insurance at VTB 24 bank: calculate mortgage insurance online

It is possible to calculate not only the mortgage product, but also:

- Consumer loans;

- Car loans;

- Valid credit cards;

- Debts from micro-organizations that provide loans.

Conditions

Using a housing loan, you can purchase real estate in a new building or ready-made housing, including a country house or townhouse with a plot. When applying for a military mortgage at Svyaz Bank, other lending conditions should be taken into account:

- loans are issued in rubles, and the maximum amount is determined individually (from 700,000 to 2,815,000 rubles);

- You can use not only funds from the target program as a down payment, but also your own savings;

- the minimum lending period is 3 years, and the maximum term is 25 years, although it should not exceed the borrower’s service life;

- the military mortgage in Svyaz Bank is repaid with monthly payments, the security is a pledge of rights under the DDU or real estate (depending on the type of housing);

- it is necessary to issue an insurance policy for the collateral if we are talking about the purchase of a finished object, or an agreement with the insurer is concluded upon completion of construction.

The maximum amount for a Svyaz Bank military mortgage available for a loan is determined based on the rate, savings contribution and loan period.

Refinancing

Sometimes a borrower wants to avoid defaulting on a loan or ease their financial situation.

A client who has a lot of debts in different organizations turns to a bank (for example), which pays overdue payments for him. Now the consumer already has one, new loan.

Advantages of refinancing at Svyaz-Bank:

- Payment of all loans, overdue;

- Now, instead of several loans, the borrower has one main one. There is no need to run around to different branches, counting money for different debts;

- Financial savings;

- Time saving;

- It is possible to extend the payment period;

- The interest rate decreases.

This is a convenient service that benefits users. It allows you to reduce the financial burden on the consumer, relieve him of delays and charges of pennies on top of the loan.

The only downside is the reluctance of banks to cooperate in such a transaction. It is not always possible to break a contract with them.

Conditions for refinancing from Svyaz-Bank:

- Reduced interest rate to 10.25%;

- Possible approved amount is up to 26 million rubles;

- The payment period is up to 30 years.

Conditions for refinancing a mortgage at Svyaz-Bank

Svyaz-Bank also provides for a reduction in the rate on existing mortgages from third-party organizations. To do this, you need to use refinancing.

According to the current conditions, potential clients can count on the following offer:

- maximum amount – from 400 thousand to 30 million rubles;

- interest rate – 10.25% (before transfer of real estate as collateral – 11.25%);

- term – from 3 to 30 years;

- the type of housing purchased does not matter;

Approval requires that the debtor has been making regular payments to the third-party bank for at least a year.

The requirements for debtors thinking about reducing monthly payments through refinancing do not differ from those imposed on those wishing to take out a standard mortgage.

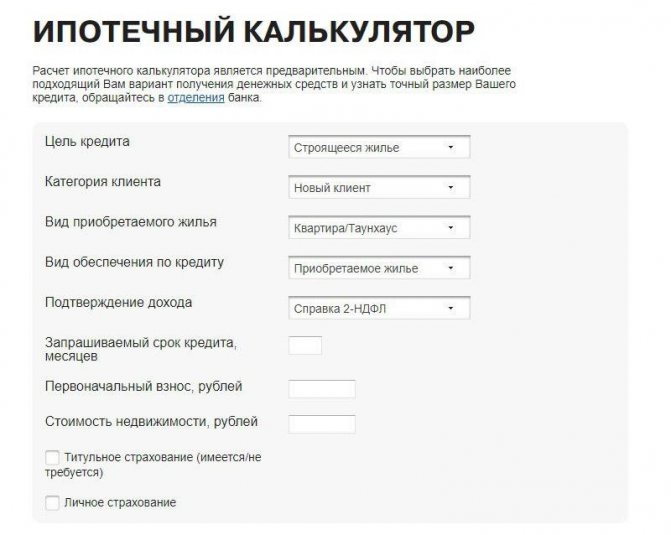

Mortgage calculator Svyaz-bank

The bank's official website has a special visual tool - a mortgage calculator. A potential borrower can always go to the resource, use the counter, which will help make a preliminary analysis and compare the client’s desires and capabilities.

The final data is provided to the borrower in a simple form that is understandable to the average person. It is clearly written there:

- How much money can a bank allocate for a mortgage? Your personal data is taken into account: salary, work experience, length of service.

- The main parameters are entered. The desired amount, loan term, amount of the down payment, interest rate, amount of the final overpayment for the entire time.

The mortgage calculator allows you to:

- Save time;

- Schedule a payment schedule in advance;

- Make adjustments to your plans.

Svyaz-Bank interest rate

When a client chooses a bank, he is most interested in the interest rate. The lower it is, the more profitable the banking product will be. There are organizations that deliberately increase interest rates, but approve the product for everyone. This is a guarantee of their protection in unforeseen circumstances.

Svyaz-Bank operates on a different principle. A positive answer will not be given to all consumers; candidates undergo a strict selection process to obtain a mortgage. The more information about you, the lower the interest rate.

Mortgages at good interest rates are approved by:

- For those who are an active client (interest rate from 10.2%).

- Salary users of the bank.

- If the person has an institutional debit or credit card.

- If you have a good and long credit history.

The minimum mortgage interest rate at Svyaz-Bank is 9.7%. Loyal conditions also apply for:

- Orphans;

- Military;

- Teachers;

- Doctors.

You need to find out more details from a consultant by phone, or you will have to stop by the office.

What expenses will be required to apply for a loan?

You can receive funds to purchase an apartment or house after completing all stages. The borrower will have to spend money on some of them.

Recommended article: Uralsib Bank Mortgage: programs, conditions, documents

- A mandatory cost item is the real estate valuation procedure. You need to contact a company approved by the bank. According to the lender's estimates, this will require about 5,000 rubles.

- The next item that involves costs is the purchase of an insurance policy. On average, the price of insurance is 1% of the loan size. They purchase it from companies accredited by the bank.

- The state fee for registering a loan is another 1-2 thousand rubles. It is entered at the time of submitting papers for state registration.

Additionally, you may need to rent a safe deposit box (about 30 rubles per day), but if you take into account reviews of military mortgages at Svyaz Bank, such a service is not needed. The vast majority of borrowers do without it.

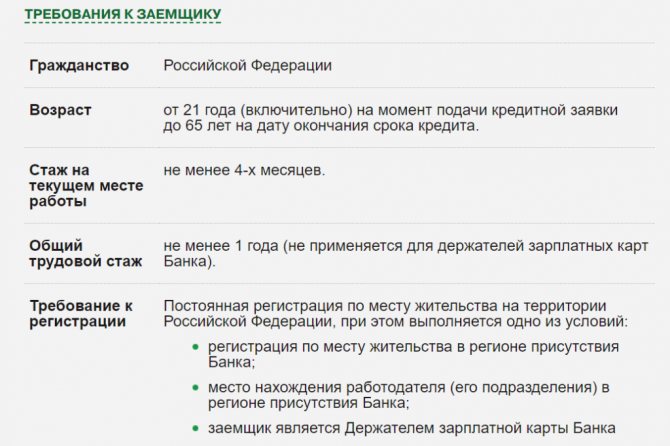

Requirements for the borrower

Svyaz-Bank puts forward the following requirements for borrowers:

- You must be a citizen of the Russian Federation;

- Availability of permanent registration in the area where the representative office of Svyaz-Bank is located;

- Age from 21 years;

- Maximum age – 65 years;

- Work experience of 6 months;

- The organization where the payer works must be registered at least 1 year ago.

Look at the same topic: Military mortgage from Svyaz-Bank in [y] year

Requirements for the property

The subject of collateral under an agreement with Svyaz-Bank can only be housing that meets its requirements. These include:

- accreditation of Rosvoenipoteka;

- availability of communications;

- compliance with sanitary, epidemiological and social standards;

- restrictions on location and distance from the city where the bank operates, etc.

The living space should not be municipal or social housing, nor should it be on the register of dilapidated, emergency real estate.

Objects with high liquidity and comfortable living conditions for a potential buyer are accepted as collateral.

Accredited facilities

On the Svyaz-Bank website, military personnel can study the list of accredited facilities for new buildings.

In a special form, using a filter, you can select the region of the Russian Federation of interest and available development companies that are partners in the sale of housing for military personnel.

After applying the filter, the user will have access to information about the residential property (residential complex) and the address of its location.

IMPORTANT! For convenience, there are direct links to the website of the selected developer and residential complex.

Stages of the transaction

The first stage includes submitting an application to Svyaz-Bank. This can be done at the representative office, or on the website, after first going through authorization. After reviewing the application, the manager calls the client and provides the necessary information to further go through all stages.

The transaction is carried out:

- First, the bank employee collects the necessary documentation;

- An assessment report is prepared;

- The contract is signed in advance;

- The submitted documentation is being verified;

- Insurance is taken out;

- A loan agreement is signed;

- Ownership rights are registered in the State Report.

How to apply step by step

Obtaining a mortgage loan for the military is subject to the following steps:

- Preparation of the necessary package of papers.

- Submitting an application to Svyaz-Bank.

- Submitting an application to the Credit Committee and making a decision within a period of at least 5 working days.

- Providing a housing assessment report (for secondary housing).

- Opening bank accounts for payments.

- Conclusion of a loan agreement (the participants are 3 parties: Svyaz-Bank, Rosvoenipoteka and a military serviceman).

- Conclusion of a purchase and sale agreement (or DSA).

- Payment of the down payment by transferring funds from Rosvoenipoteka from the borrower’s personal savings account.

- Buying insurance.

- Registration of the transaction in Rosreestr and encumbrance of real estate.

- Transfer the remaining amount of money to the seller.

Insurance

Svyaz-Bank always offers borrowers to take out insurance. This is a guarantee of protection of your property, health and life.

The following types of insurance exist:

- Real estate. This service will provide compensation for the debt to the bank and funds for the real estate in case of fires, floods, robberies, robberies and other insured events.

- Your health and life. The company will reimburse you for all medical expenses. If you are recognized as completely incapacitated, the company pays the debt to the bank for you.

- Title. It will protect you in case of threat of recognition of the transaction as invalid.

Payment

Payments are made either to a special debit card or in cash at Svyaz-Bank branches.

To get a mortgage you need:

- Have work experience;

- Be a citizen of the Russian Federation;

- Collect a package of necessary documents;

- Come to the bank's representative office for a consultation.

Mortgage lending is a complex banking service that requires having a permanent job and high solvency.

Documentation

In order for you to be approved for a mortgage at Svyaz-Bank, you need to provide a number of the following documents:

- Properly completed (in advance) consumer questionnaire;

- Passport of a citizen of the Russian Federation;

- A copy of the man's military ID, if he is under 27 years old;

- A copy of the work book, which is certified by the boss;

- Certificate of income;

- Report from the BKI department;

- The result of an independent property assessment;

- Deed of sale and purchase;

- Marriage certificate;

- Certificate of divorce;

- Child's birth certificate;

- Certificate for maternity capital;

- TIN;

- Tax return.

What documents will be required?

The future borrower fills out an application form and also provides the bank with a set of documents to verify his creditworthiness and the legal purity of the transaction.

First you need to provide:

- copy of passport, SNILS or TIN;

- military ID (for men of military age);

- credit application;

- a copy of the work book;

- certificate of income (2-NDFL, according to the bank form);

- permission from the guardianship and trusteeship authorities to pledge the residential premises.

If the preliminary loan application is approved, you will need to order a real estate appraisal report. Svyaz-Bank requires that the statute of limitations for the assessment be no more than 3 months before the date of submission to the bank. Along with the appraisal report, other documents are submitted to the bank that will help to get an idea of the housing that has been chosen for purchase.

You will also need:

- real estate valuation act;

- extended extract from the Unified State Register of Real Estate;

- BTI technical plan;

- archival extract from the house register;

- real estate documents, seller’s passport;

- permission from the guardianship and trusteeship authority (if the seller has children);

- consent of the seller’s spouse to the transaction.

If the borrower is a family person, then you will need to provide copies of marriage and birth certificates. If you have a maternity capital certificate, you will need a copy of it. Applicants for military mortgages will need a copy of the NIS participant certificate.

Entrepreneurs and business owners will need to confirm registration, show tax returns and provide an extract from the Unified State Register of Individual Entrepreneurs.

Reference. If the borrower draws up a DDU or an assignment of claims agreement, the bank will require documents about the developer (copies of constituent papers, state registration certificates), the agreements themselves, and project documentation.

Filling out an application form for a mortgage loan

The application will need to provide all information about the family’s financial income and expenses. Based on this data, it will be assessed whether the future borrower will be able to pay loan payments or not.

In the application form you must indicate the amount of the loan that is required, the amount of the down payment, the availability of maternity capital, and additional income.

To make a positive impression on bank specialists, you need to tell in detail about your existing assets - apartments, cars, dachas and even garages. The more property the borrower describes, the greater the chance that he will receive a loan.

But information about alimony obligations that reduce earnings, large payments on other loans can complicate the issuance of a new loan. It makes no sense to withhold information about loans. The bank will easily check the borrower’s credit history through its channels.

Reviews

Clients who have already taken advantage of a mortgage from Svyaz-Bank are happy to share their impressions online.

Petrovs Anna and Ilya, Sochi. Good evening! We would like to tell you how we became participants in the program for the military. After the birth of our second child, we immediately began collecting documents for a mortgage. We were interested in many loan products. We heard an advertisement from Svyaz-Bank about a 6% rate, at first we thought it was some kind of joke! We quickly took the documents and went to the office. Everything was done in the evening!

Ksenia, Vladivostok. Hello, we highly recommend Svyaz-Bank. We got a mortgage from them, the most favorable conditions. An interest rate of 10.25% is very easy to obtain. The consultants are very responsive and explain everything clearly.

Egor Mikhailovich, Stavropol. Good day! Svyaz-Bank was pleasantly surprised by its program for purchasing a country cottage with a mortgage. I have long dreamed of having my own home, now my wishes have come true. I got a mortgage quickly and included additional home insurance. I like being a partner of this bank.

Reviews from bank clients

Svyatoslav, 40 years old: “I took out a mortgage at Svyaz-Bank 10 years ago. I became eligible to participate in the savings-mortgage system starting in 2005, so the required amount had already accumulated in my account. I bought an apartment in a new building; at that time it was still undergoing finishing work. No difficulties have arisen, and monthly mortgage payments are regularly calculated, since I serve in good faith. We already moved to a new apartment several years ago and are incredibly happy!”

Margarita, 38 years old: “My husband is in the military, a couple of years ago he was transferred from one unit to another, so I had to think about moving. My parents stayed in the old apartment, and we decided to purchase a home with a mortgage. The closest branch of Svyaz-Bank was located, and the conditions pleasantly surprised us. To me, as a person who is not very well versed in all these subtleties, the registration procedure seemed long, but my husband, using the example of his colleagues, told me that it went much faster than in other banks. We almost paid off the mortgage, since we initially used not only military savings, but also my maternity capital.”