Bank experience requirements when applying for a mortgage

Any bank sets specific requirements for potential borrowers to obtain mortgage lending. Among the criteria, one should highlight the length of work required to obtain a mortgage. This indicator is needed to assess the client’s solvency and integrity. Banks request the total period of employment, as well as the duration of employment at the last place of work. Let's consider the main criteria of the country's financial institutions.

| Banks of Russia | Minimum experience for applying for a loan program | |

| At my last job | General work activity | |

| Sberbank | More than six months | More than 1 year in the last 5 years |

| Rosselkhozbank | For salary clients who have the opportunity to receive income into the lender’s account for 3 months (for new borrowers from six months) | For persons who are salaried clients for 6 months (a year for new borrowers) |

| VTB | 1 month after probationary period | Over 1 year |

| Raiffeisenbank | 3 months (total experience 2 years), six months (total experience from 1 year), in first place 12 months | More than 12 months |

| Promsvyazbank | 4 months | From 1 year |

| Alfa Bank | More than 1 month | At least a year |

| ICD | Six months | 36 months |

| Bank opening | 3 months | 1 year |

| Uralsib | 3 months | More than a year |

| Absolut Bank | Six months | More than 12 months |

| Gazprombank | Over six months | More than 12 months |

| Renaissance | Six months | More than 2 years |

To expect a positive banking decision, a formal employment contract must be concluded with the employer. An entry in the work book and the necessary confirmation with the credit company for lending are also provided.

Important! Borrowers have the opportunity to get a mortgage without official work experience in some banks if there is real estate collateral.

Mortgage from Sberbank upon employment for three months

Your steps to get your mortgage approved at Sberbank

Your steps to get your mortgage approved at Sberbank

The share of approved mortgage applications at Sberbank reaches 3/4. How to increase your chances of getting into the coveted 75%? The main requirements for a borrower at Sberbank are listed in the article on the conditions for issuing a mortgage loan: work experience at the last place of work - at least 6 months.

How long do you need to work and earn to get a mortgage?

How long do you need to work and earn to get a mortgage?

Let's consider the basic requirements for the level of experience and income for a mortgage loan in order to understand whether the application will be approved by the bank or not.

How to get a mortgage for an apartment: where to start

- Minimum as well as maximum rate for the proposed loan;

- Down payment and its size;

- The ability to repay part of the debt using maternity capital;

- Payment amount at the proposed interest rate;

- Participation of the bank in programs providing for debt restructuring;

- Loan amount;

- Prices for real estate insurance and other programs developed for borrowers;

- Possibility of providing benefits for certain groups of the population.

How long do you need to work to get a mortgage?

If a borrower plans to open a home loan from a bank, then he must thoroughly prepare for this process. After all, the agreement with the bank will be long-term. The bank, in turn, tries to minimize risks and carefully checks each of its borrowers according to various parameters. One of the most important is the client’s employment and salary level.

What you need to get a mortgage

Important! Pay attention to all the details and do not hesitate to ask questions that are unclear to you, since often advertising brochures and even the consultants themselves are silent about some features of the banking product.

Some features include additional insurance, commission payments, issuance of a bank card, and so on.

How long do you need to work to get a mortgage?

Similar requirements are imposed on borrowers of PJSC BINBANK.

If there is doubt about the client's solvency, they may require a guarantor or co-borrower.

- Having a good credit history.

- Status of a young family, military personnel, pensioners, etc.

What documents are required?

To obtain a mortgage loan you must prepare:

- Passport proving your identity and another document, such as a driver's license.

- A certificate of income of the borrower, which determines the maximum loan amount intended for a given person.

- A copy of a work record with at least six months of experience; it happens that banks issue mortgages to persons with four months of experience.

- A copy of the employment contract, if a person works in two places, then a copy from both places of work.

- A copy of the tax return if the borrower rented out an apartment, car, etc.

- Copies of diplomas, certificates, etc., that is, documents confirming the borrower’s education.

- A copy of papers on ownership of real estate and vehicles.

- Document on ownership of securities.

- Copies of loan agreements, both repaid and outstanding.

- Entrepreneurs are required to have a package of documents about their own business.

What documents are needed to confirm work experience?

When considering the required length of service to obtain a profitable mortgage, you will need to clarify the documents that the bank requests for confirmation and assess your own risks:

- It is necessary to provide a copy of the work book with employer stamps (all pages with information).

- If the borrower officially works in several places, according to the requirements, copies of the employment contract are attached.

- In certain situations, extracts from the organization’s orders are provided (in such a situation, it is important to supplement the document with a certificate for a specific period).

- For an individual entrepreneur, tax returns for the reporting period will be required.

- For a legal entity, as well as the founder of a small business, statutory documentation may be required.

To apply for a loan program for the purchase of an apartment or other housing using two documents, the client’s salary certificate 2-NDFL or the bank’s form is used as confirmation.

How important is work experience?

Most borrowers believe that only the size of the salary plays a decisive role. This is not entirely correct. Income helps determine opportunities, but is not a fundamental factor. Mortgage lending is long-term, so bank specialists must predict whether a person will be able to pay the loan in the future. To ensure that the information is as reliable as possible, that is, as much as possible, work experience and overall length of service are taken into account.

Without work experience, the borrower will not be able to obtain an income certificate in Form 2-NDFL. It must be received within a certain period, usually six months. Many people believe that the bank needs this paper only to confirm the amount of income, and not the length of service, but they forget about the requirement regarding how many months of income they need to show. By requesting a certificate for 6 months, the lender receives confirmation that the potential client not only receives a salary, but also works for a relatively long time.

Official employment is confirmed by a copy of the work record book. It is certified by the employer. This allows the bank to obtain information not only about current employment, but also to view where the person worked before. Everything is checked thoroughly and carefully. The position that the potential bank client held at different times, why he quit, and how long he worked is taken into account. Based on this information, the expert determines the person’s trustworthiness. This plays an important role in making a mortgage decision.

Banks are wary of frequently changing jobs, since this fact suggests that in the future a person will not always be able to make payments on time. Today he works, and in a month he will decide to quit and default on his mortgage. No lender wants such consequences. There is a chance that a person will quickly find a job, but searches and interviews take time, and payments will not come.

Submitting an original or a copy of a work book in a package of documents when submitting an application for a loan is perceived positively by banks, but there are some nuances here. It can play both a positive and negative role. It all depends on what records it contains. Negative factors include:

- frequent job changes;

- demotion down the career ladder;

- breaks in work experience of one month or longer;

- work for an individual entrepreneur.

This data allows you to understand what kind of client banks want to see. Lenders prefer to issue large and long-term loans such as mortgages to those who work steadily in one job, remaining in their position or moving up in their career, which leads to the borrower’s income level increasing. Lack of work for several months often becomes the very factor that leads to refusal of a mortgage loan. People working for individual entrepreneurs are also not reliable for creditors. An individual entrepreneur can close at any time, that is, be liquidated, and the borrower may be left without work.

How long do you need to work after maternity leave?

How much experience is needed to apply for a mortgage after maternity leave? This question is also asked by many women after the birth of a child. In accordance with the current legislation of the Russian Federation, all time spent on this vacation is equal to the official period of working activity. In cases with such borrowers, each bank, when applying for a loan program, is guided by its own policy.

Most financial institutions establish the need to work after maternity leave for a minimum period. A number of banks in the country, on the contrary, allow you to apply for a loan immediately from the moment you return from vacation, and eliminate the need to work for additional periods of time if you have a sufficient and stable income. In such a situation, processing a loan may require more documents, of which the lender will immediately notify the client who has applied for the mortgage lending program.

Important! The age of the child plays a significant role in this situation; if the child is 1.5 years old, then the chances of getting a loan are lower than when returning from vacation at the time of the 3rd birthday.

Where can I get a mortgage with a minimum experience?

What should people do if their total experience is less than a year, but they want to purchase an apartment with a mortgage? There are many options for them to solve this problem. For example, they can become participants in a salary project (this is a service provided by banks for companies, in which the bank transfers salaries to employees onto debit cards issued by it).

Another option may be the bank’s loyal attitude towards the borrower. Let’s say a person has worked for 10 or 11 months, but the bank’s conditions are at least a year of work, in this case the bank agrees to a meeting when issuing a mortgage and can make a positive decision regarding the borrower.

A borrower, even at the beginning of his career, has a good chance of getting a mortgage. In this case, he will need to issue it using two documents, that is, provide a civil passport and some other personal document (IIN, SNILS, international passport or driver’s license).

This is done for the purpose of concluding a comprehensive insurance contract. This type of insurance is issued to help the borrower fulfill his obligations in the event of unforeseen circumstances (for example, a person loses his job).

If a person has always worked under a civil contract, then in order to obtain a mortgage he will need to provide a copy of it, and if the client’s income level is acceptable to the bank, then he can count on a positive decision. Such an agreement is considered as an auxiliary source of income. These applications are handled by the banking organization Globex. This bank has many profitable programs for mortgage lending.

What to do if your total experience is less than a year

A citizen needs to work for a sufficient amount of time to obtain loan approval from the bank. It is not always possible to work out the minimum length of service to obtain a profitable mortgage. To approve an application for the required amount, you can work less than the minimum period in the following situations:

- participants in salary projects can get a mortgage from a Russian financial institution without sufficient experience;

- concessions are made for citizens whose minimum period of employment does not last a short period of time;

- You can negotiate special conditions with the lender (for example, agree to make a down payment that will cover more than 35-50% of the cost of the property);

- You can get a mortgage from a bank, which does not provide for checking periods of employment, but can be obtained using two documents;

- Also, if it is not possible to work until the specified time, you can use collateral, a guarantee, or the services of co-borrowers.

Financial institutions often issue loans to clients who agree to any conditions, including a high interest rate, as well as full insurance. All aspects are individual and are discussed with the lender directly when applying for a loan.

If you have no experience, there is the “Two Documents” program

If it is impossible to document the existence of experience or it is absent altogether, then you can take out a mortgage under the “two documents” program. Many banks operate under such a program and all have one thing in common - the availability of an amount for a down payment of at least 35%, or even 40-50% of the cost of the purchased home. According to the terms of this program, you can present your passport and another document (driver’s license, SNILS card) to the bank, and that’s enough. But in reality, the financial institution will in any case check the applicant and check all possible data with the employer indicated in the application form. Despite the apparent simplicity of the difficulties, obtaining a mortgage under such a program can be a way out of the situation.

Banks will certainly offer more stringent lending conditions to borrowers with minimal work experience:

- increased interest rate;

- shorter period for debt repayment;

- issue a loan amount less than specified in the application;

- require additional collateral for the loan.

Even if you have sufficient experience, the client’s profession (how quickly he can find a new job if necessary) will play a big role in making a decision on a loan.

The place of work is also taken into account - with a high risk of loss of income (gambling business, small enterprises, real estate agencies).

Perhaps you were looking for:

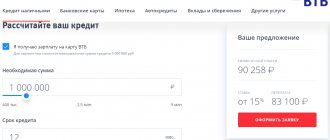

- how much work do you need to do to get a mortgage at VTB;

- how long do you need to work to get a loan from VTB;

- how long do you need to work to get a loan from VTB;

- how long do you need to work to get a loan from VTB;

- how much work do you need to do to get a mortgage from VTB;

- how long do you need to work to get a loan from VTB;

- How long do you need to work to get a mortgage from VTB?

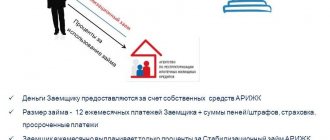

Is it necessary to deposit my own funds for the apartment into a bank account?

Mortgage lending without experience

Considering the question of how long a borrower needs to work in order to be given a mortgage on favorable terms, it is necessary to highlight a number of methods when it is permissible to receive a loan without proof of experience:

- Credit companies actively provide mortgage lending programs based on two documents with a minimal probability of refusal (this includes a passport, as well as SNILS or INN, but a positive credit history of the client is required).

- Providing the lender with a civil law agreement if the borrower does not work in accordance with the Labor Code of the Russian Federation, but on the basis of the GAP (only some financial institutions in the country, including Globex, consider applications under this document).

- A borrower who applies for a mortgage secured by the property they own can eliminate the need to confirm their income level and work experience.

- Russian banks give clients the opportunity to take out a loan without sufficient experience, but to do this, a person must make an initial payment, which will cover from 35-50% of the cost of the property, and also apply for an appropriate loan program.

- If you involve a guarantor or co-borrower in the transaction who is officially employed and has the necessary experience, the bank can cancel this requirement in relation to the borrower.

All situations are individual, and any financial institution has every right to refuse an application if there are significant risks of incurring losses after providing a mortgage to the client. The likelihood of a negative decision being made is not high if the borrower meets other requirements of the financial institution that are provided for as part of the selected loan program.

How to get a mortgage from Sberbank

The greatest weight in making a positive decision regarding a borrower is his stable income.

InfoStable income The most important criterion, confirmation of which means for the bank that the borrower has enough income to repay regular payments on time. What features are clear advantages in the eyes of the bank:

- Official work based on an employment contract.

- Work experience at one and last place of work is 1-3 years.

In order to take out a mortgage, you need to work in your last job for at least six months, but long work experience and the absence of “runaways” significantly increase the chances of a positive answer. - Being married provided that the spouse works.

- Higher education.

How much do you need to earn to get a mortgage loan? The minimum monthly salary must be twice the amount of upcoming payments.

What else are banks looking at?

When considering how much a borrower needs to work to get a profitable mortgage, there are a number of indicators that are also taken into account by banks when processing an application:

- Family status must be taken into account (for legally married clients with a family, the likelihood of the application being approved is higher).

- Financial institutions take into account the presence of registration (with permanent registration it is easier to get a mortgage).

- The lender takes into account the client’s level of education, which is necessary to earn sufficient income.

- The credit history, as well as the size and regularity of payments on existing loans, are properly assessed.

- Lending companies take into account the availability of liquid property in the borrower's property, as well as available capital.

- The level of income for applying for a mortgage, as well as the client’s present expenses, must be taken into account.

To receive a loan to purchase real estate, all these indicators must meet the lender's requirements. In such a situation, even problems with insufficient experience are often not taken into account, which makes it possible to apply for a mortgage. The reliability and solvency of the borrower are fully assessed, since these points have a significant impact on the possible risks of a financial institution facing losses when completing a transaction with the borrower.

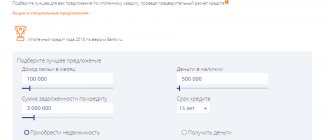

Income calculator

When considering the question of how long a client needs to work in order to take out a profitable mortgage, it is necessary to highlight the opportunity to use a convenient calculator to calculate the borrower’s income. This program allows you to determine the following:

- the amount of mortgage that a citizen can apply for if he/she uses the services of a financial institution;

- the final overpayment to be paid taking into account accrued interest for the entire loan period;

- the amount of the monthly payment needed to regularly repay the mortgage debt;

- the approximate interest rate that the borrower may qualify for when applying to the bank.

All calculations are for guidance only, as final figures may differ significantly. To carry out the calculations, you will need to indicate the amount of your official income, the down payment, the value of the property, as well as the desired loan term.

Important! There are various comments on the Internet regarding the length of service required to apply for a loan program in a Russian institution, but you should not focus solely on reviews, since all parameters for the client are selected individually.

Having the necessary work experience to apply for a mortgage is a mandatory requirement for most Russian banks. The lender's risks are protected by established criteria for selecting borrowers. Therefore, it is recommended to clarify information about restrictions in advance, which will eliminate some difficulties during the registration process. Of course, all bank offers are individual, and even borrowers who do not meet the requirements can apply for a loan, but this will require discussing all the details directly with the credit manager.