Apply for a mortgage for a young family without a down payment from Sberbank Sberbank of the Russian Federation has developed a socially oriented mortgage program “Young Family ”. Using it, you will be able to buy any type of housing - an apartment in a new building or on the secondary market - or even build your own house.

Preferential mortgage loan for young families

Conditions for inclusion in the program:

- A citizen of Russian Federation.

- Age up to 35 years. Both spouses are over 21 years old.

- Officially registered marriage.

- It is possible to obtain a mortgage for a single-parent family (one adult and a child), the requirements for the age of the parent remain the same.

Required papers:

- Bank questionnaire;

- Photocopies of passports of future apartment owners;

- Marriage registration documents;

- Birth certificates of children;

- Documentary proof of income.

Features of the program

mortgage conditions are represented by a low interest rate - from 8.5% per annum, a minimum loan amount of 300,000 rubles, which is significantly lower than in other credit institutions, as well as an extended loan term (up to 30 years), benefits in the event of the birth of a child or the departure of a mother on maternity leave (it is possible to provide installments from the bank for a period of 1 to 3 years). When lending under this program, there is no additional commission for early repayment of the loan; in case of late payment, the penalty will be 0.5% of the overdue amount daily.

When calculating a mortgage loan, not only the solvency of the borrower, but also the co-borrower is used. The co-borrowers are the second spouse, possibly the parents. There can be up to 6 co-borrowers in total.

Traditional Sberbank for users receiving payments on a Sberbank card remain valid.

The interest rate varies and depends on the length of the loan term, family income level, and the size of the down payment paid. There are also additional conditions - the cost of the loan increases by 1% in the absence of life and health insurance, by 0.01% if you do not use the bank’s service for electronic registration of property rights.

mortgage more specifically using an online calculator on the bank’s website or by contacting representatives of the Sberbank credit department.

The main benefit is the low down payment, which for young families with children is 15%, and for families without children – 20%. Often this point is a stumbling block. As a rule, a young family does not have savings to contribute such an impressive amount. However, in some cases, a young family can get a mortgage without it.

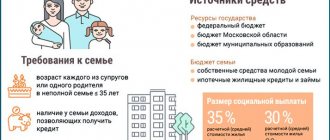

State program “Young Family”

If you are on the waiting list as someone in need of housing, then you can use the “Young Family” program to receive a cash payment. It covers up to 35-40% of the cost of the purchased home, and can be used as a down payment on a loan.

Current loan offers:

| Bank | % and amount | Application |

| Eastern has more chances | From 9% to RUB 3,000,000. | Apply now |

| VTB Reliable | From 7.5% Up to 5,000,000 rub. | Apply now |

| Post Bank Solution in 1 minute | From 7.9% Up to RUB 3,000,000. | Apply now |

| Alfa Bank Solution in 2 minutes | From 7.7% Up to 5,000,000 rub. | Apply now |

| Opening Large amount | From 8.5% Up to 5,000,000 rub. | Apply now |

List of microfinance organizations issuing small first loans at 0% →

You can always see all the banks we work with here ⇒

Loan without refusal Loan with overdue Urgent on your passport Card loans at 0% Installment cards Earning money from home

In order to become a participant, you need to contact the social protection department or the MFC of your city to receive a list of necessary documents to collect and submit them for consideration. The application is also written there; if it is approved, you are included in the general queue. Read more here.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

When you receive a participant certificate entitling you to receive a subsidy, then you need to contact agent banks from the AHML agency. They offer favorable conditions for those citizens who have already started their own family, but can only buy their own home on credit.

According to the terms of the program, at the time of registration, at least one of the spouses must be under 35 years of age. The number of children may vary; families who do not yet have children also take part.

Here are the main features.

- Initial contribution from 10%,

- Low rate,

- The loan is taken for a period of up to 30 years,

- Purchase of finished apartments, including in new buildings,

- Acceptance of maternity capital as a down payment. Such programs are described in this article.

Thus, a mortgage for a young family implies special conditions only in terms of receiving a cash subsidy to pay the down payment. In all other respects, you can choose the conditions yourself: bank, program, possibility of early repayment, etc.

Participation in the State program “Young family - decent housing”

The state program provides free compensation of 30% of the cost of real estate; if there are children, it increases to 35%. To take part in it, the family must be registered with government agencies as a waiting list for housing. The compensation is counted as the first payment for the apartment.

Conditions for joining the Federal program “Decent Housing for Young Families”:

- The size of your home is less than the standards required by the legislation of your region.

- The borrower and his spouse are under 35 years of age.

- Confirmed official income and work experience.

- Registration of both spouses in the same area.

An application for a subsidy must be submitted to the housing department of the municipal government.

Mortgage conditions for a young family

Preferential mortgages are provided for the purchase of secondary housing and the purchase of an apartment in a building under construction.

Support for newlyweds is provided in 3 types:

- Federal program “Young Family - Affordable Housing”. State assistance consists of subsidies to pay off debt or pay part of the cost of housing. If there are no children, the state pays up to 35% of the cost of housing, and for each child the subsidy increases by another 5%. There is also a rate subsidy program for families in which the second and third child was born after 01/01/2018.

- Regional support. In many cities there is a social mortgage, with which you can get a discount when buying an apartment or taking out a mortgage loan. For example, the Moscow administration provides assistance in paying mortgages to families with children and offers favorable conditions for the purchase of city-owned apartments.

- Bank help. For example, Sberbank provides a young family with a discount of 0.5% of the base rate.

The minimum down payment is 0 - 20%. In Sberbank it is 15%, in VTB - from 10%, and in Gazprombank, as part of a partnership with the group, you can purchase housing without a down payment. It is allowed to use mat as a down payment. capital, while at VTB, for example, at least 5% of the cost of housing must be paid from your own funds.

Mortgage rates may also vary. In Sberbank for a young family it will be at least 8.6%, and in Raiffeisenbank - 10.25%. If children are born into a family after 01/01/2018, you can get a mortgage with state support at a preferential rate of 6%. It is valid for 3 years at the birth of the second child and 5 years at the birth of the third. Moreover, if the third child is born after the mortgage has been issued, the validity period of the preferential rate may be extended.

Alfa Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Gazprombank

from 7.5% rate per year

Go

- Amount: from 500 thousand to 60 million rubles.

- Rate: 7.5%.

- Duration: from one year to 30 years.

- Age: 20 - 65 years.

- Down payment: from 10%.

- Review of the application from 1 working day.

More details

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Also read: Mortgages with state support at VTB: conditions and rates, documents and reviews

The term of the mortgage depends on the bank you choose. At Tinkoff it can be up to 25 years, and at Sberbank - 30. Insurance of the purchased home for the entire term of the mortgage is a mandatory condition. Life insurance is usually taken out upon request, but if you refuse it, the loan rate increases by 1%. When applying for a mortgage under the state program for families with children, the purchase of a life and health insurance policy is required.

You can pay off your mortgage early without penalties or commissions at any bank. But you need to follow certain rules. For example, Sberbank allows early repayment on any business day, and Rosselkhozbank only on the date of the monthly payment.

Use of maternity capital

You can use maternity capital money as a down payment for an apartment. In this case, two agreements are concluded with the bank - one for the amount of maternity capital, and the second for the remaining part of the loan. Then you need to send an application to the Pension Fund of the Russian Federation to transfer funds to pay off the mortgage.

When choosing this method of paying the down payment, the bank puts forward the following conditions: the mortgage loan is issued to the holder of the maternal capital certificate; before purchasing, it is necessary to determine the shared ownership of the people registered in the apartment.

The procedure for obtaining a “Young Family” mortgage loan from Sberbank

If you have read all the conditions and assessed your capabilities, you can submit documents to the bank. Do this when visiting the bank in person or through the personal account of the official partner of Sberbank, the DomClick service.

Sberbank a response to the initial application within three days via SMS to your phone number. If the decision is positive, you need to contact the branch, find out the final amount approved by the bank, and collect documents for the second stage of applying for a mortgage . After signing the loan agreement, insurance contracts and collateral papers are drawn up with Sberbank .

Features of mortgage lending to a young family without a down payment

Today, there are many credit institutions that offer long-term housing loans without a down payment. These include mortgages for newlyweds. Here is an approximate list of banks with a mortgage program for a young family without a down payment:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- Sberbank;

- Raiffeisenbank;

- VTB 24;

- Gazprombank;

- Pervomaisky.

For your information,

mortgages to a young family without a down payment were especially common until 2008, when the economic crisis struck. After which many financial institutions were forced to abandon such mortgage programs.

When issuing a mortgage without an initial investment, the bank risks. This means the fact that if the borrower fails to fulfill his debt obligations, the lender will have to sell the pledged property himself (Article 334 of the Civil Code of the Russian Federation). And this is fraught with financial losses, since the value of the collateral can be significantly reduced due to a possible default. It is for this reason that mortgages without a down payment for young families and other citizens are issued at rather inflated rates.

Along with this, when applying for a mortgage loan to a young family without a down payment, many banks require you to provide any valuable collateral (in addition to the purchased real estate). Typically, this role is played by an already owned apartment (house). Under similar conditions, you can easily take out a long-term loan from Sberbank and other large banks.

If you want to take out a mortgage without a down payment for a young family, it is worth considering that most banks will require life and health insurance for the borrower and the property being mortgaged. While in the case of a consumer loan, such an action is voluntary. This is necessary to cover losses if the property is sold at a low cost.

All aspects of providing a mortgage loan to newlyweds are regulated at the legislative level:

- Civil Code of the Russian Federation: articles 37, 131, 209, 246, 260, 488;

- Federal Law of the Russian Federation No. 102 (reveals the essence of the transfer of property as collateral);

- Federal Law of the Russian Federation No. 122 (specifies the procedure for registering rights to housing purchased with mortgage funds).