Why do you need a certificate of interest paid?

According to current legislation, when purchasing residential real estate using a mortgage loan from a bank, the buyer has the right to receive a tax deduction on interest. This means that he can get back the income taxes that were withheld from his wages. The maximum compensation is 390 thousand rubles (13% of 3 million). It is paid in installments - every year. As the borrower pays interest on the mortgage.

Important! The mortgage deduction is only available for the amount of interest actually paid. You can confirm the fact of payment, as well as the amount of funds spent, using a certificate of interest paid.

An individual submits to the tax office:

- declaration 3-NDFL;

- a certificate of mortgage interest paid for the past year;

- copy of passport;

- a copy of the loan agreement;

- a standard application with your bank account details;

- title documents for the purchase of real estate.

On their basis, a tax deduction is provided for the payment of mortgage interest.

Only working citizens who pay income tax at a rate of 13% have the right to receive it. You must submit a complete package of documents to the tax office within three years from the date of withholding of income tax. Therefore, there is no need to postpone this procedure.

This compensation is not available to non-working pensioners, women on maternity leave, who receive only social benefits.

Why do you need a certificate?

Today, Russian citizens are given the opportunity to return a certain part of the expenses they incurred while paying off their loan debt. This right is called a tax deduction and must be documented. The rules and procedure for obtaining compensation are clearly regulated by law.

A certificate of the amount of interest paid is one of the required documents to be submitted to the tax office in order to obtain a deduction for tax payments. In the absence of such paper, the citizen will be denied the return of budget contributions.

Currently, the tax deduction procedure is characterized by the following features:

- provided to citizens one-time;

- compensates for part of the costs associated with the purchase of housing, including in the situation of purchasing with your own funds or on credit;

- presupposes a number of conditions, without the fulfillment of which a refund of income tax is impossible;

- the amount is limited and established at the legislative level.

An income tax refund is possible on amounts that were previously withheld from wages. Pensioners with unemployed status, women on maternity leave and recipients of social benefits cannot count on compensation.

How to get it from Sberbank

More than 50% of all mortgage loans are issued at Sberbank. This institution has the largest customer base, is a participant in all government mortgage programs, and offers favorable lending conditions. These factors can explain the high demand for mortgages at Sberbank. Current mortgage interest rates in 2020 can be found here.

The 3-NDFL declaration is submitted to the tax office along with a certificate of interest paid on the mortgage at Sberbank.

The procedure for obtaining a mortgage certificate:

- The client or a person authorized by the client contacts the bank branch.

- At the reception, the employee signs an application for issuing a certificate and provides the accompanying documents.

- The certificate can be collected in person from the service manager after it is issued.

Important! The tax office accepts only genuine certificates with a signature and blue seal of the bank. Therefore, you need to receive the document in person - a printed copy of the electronic document will not work.

The right to pay a tax deduction arises the next year after the loan is issued. For example, the mortgage was issued in 2020. The borrower must submit documents to the tax office in 2020. This procedure is repeated annually until the loan is paid off and the deduction limit is selected (390 thousand rubles).

For what purposes is a certificate needed?

You can make a request for a tax deduction. The amount will be returned from both the cost of housing and interest on the loan. At the same time, you need to remember the restrictions - the maximum possible return for the purchase of housing is 260 thousand rubles, and for paying interest - 390 thousand rubles. However, this is a good help for the budget, so it is worth spending time collecting a package of documents and contacting the inspectorate for a deduction.

Recommended article: How many days does VTB consider a mortgage application?

What papers will be required:

- certificate of ownership or extract from the Unified State Register of Real Estate;

- tax return;

- income certificate in form 2NDFL;

- bank statements;

- copies of the purchase and sale agreement;

- application for tax deduction;

- payment schedule (if attached on a separate sheet).

Documents are checked by an inspector for up to 4 months.

Are you going to repay the loan early and recalculate the interest? You can request a certificate of mortgage interest paid from Sberbank online. The certificate is needed for a package of documents submitted to the Federal Tax Service or the accounting department of your enterprise.

Advice: if you are not sure that you can fill out and collect all the paperwork yourself, you can contact Sberbank for a paid consultation. The employee will do everything for you.

Where to get a certificate

The document is issued by Sberbank. However, to receive it, you need to come to the branch in person with a package of documents - you won’t be able to order a document by phone. But you can order it from Domklik through your personal account on the website. The certificate is issued to the borrower the next day or on the day of application.

What documents will be needed

A certificate of mortgage interest paid is issued only to the borrower or his authorized representative. To do this, you need to contact a Sberbank branch and provide the following documents:

- Application for a certificate.

- Borrower's passport.

- Loan agreement.

- Power of attorney from the borrower, if the documents are submitted by a representative.

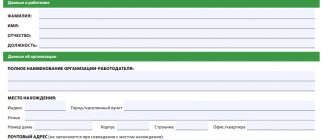

The application form for the certificate will be issued by the manager during the reception. The text indicates:

- personal data of the mortgage borrower;

- number of the loan agreement and the date of its signing;

- essence of the request;

- interest repayment period (for example, from 01/01/20 to 12/31/20).

The application is certified by the signature of an individual and submitted to a bank employee for processing.

What you will need when visiting the Federal Tax Service

The certificate alone does not have much significance if the applicant does not prepare the remaining papers.

Among them:

- 3 Personal income tax (filled out independently or for a small fee from any accountant);

- photocopy of passport pages (checked by the operator when accepting documentation);

- certificate from the employer 2NDFL;

- application (it is better to download it in advance on the inspection website online);

- details of the organization where the client is employed;

- original bank agreement and a copy;

- photocopy of all paid fees;

- certificate of interest paid;

- payment schedule with the dates of the first and last payment.

Important! If there are no receipts, you will have to contact the bank and order a statement, the production of which will take 3–7 days.

Production time and cost

All information that is indicated in the certificate is already in the program used by Sberbank. It will not be difficult to form it. The official document is provided within one business day.

According to the current tariffs of the financial institution, no commission is charged for issuing.

In most Sberbank branches, starting from 2020, a certificate of interest paid for the tax office is issued immediately upon contacting a bank employee.

What other documents are required to return interest?

In order to receive an interest deduction, you must provide the following documents to the tax office:

- declaration in form 3-NDFL for the last calendar year,

- certificate of income from place of work 2-NDFL,

- certificate of interest paid on the mortgage loan,

- a certified copy of the borrower's passport,

- application for tax deduction,

- a copy of the mortgage agreement,

- loan payment schedule (if it is not included in the text of the agreement).

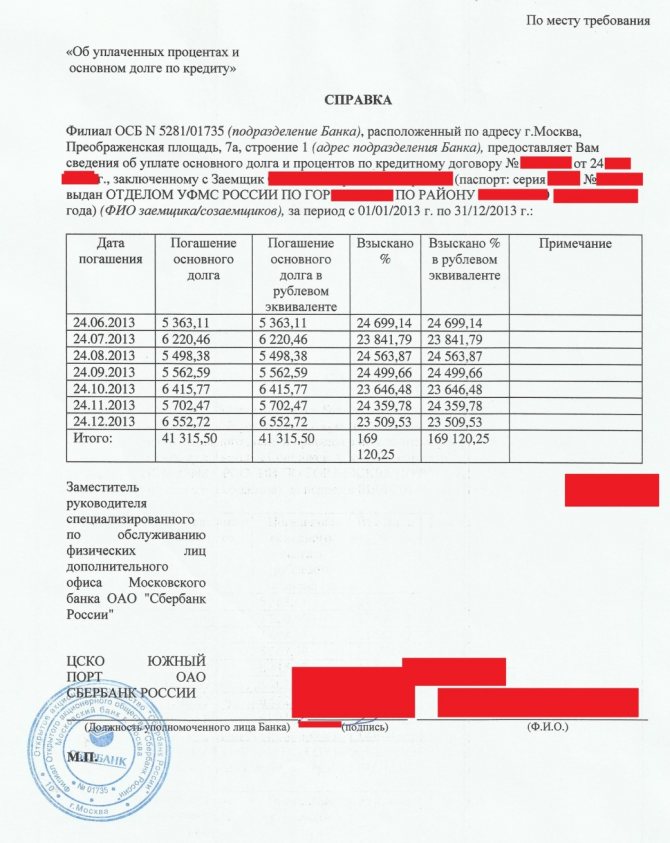

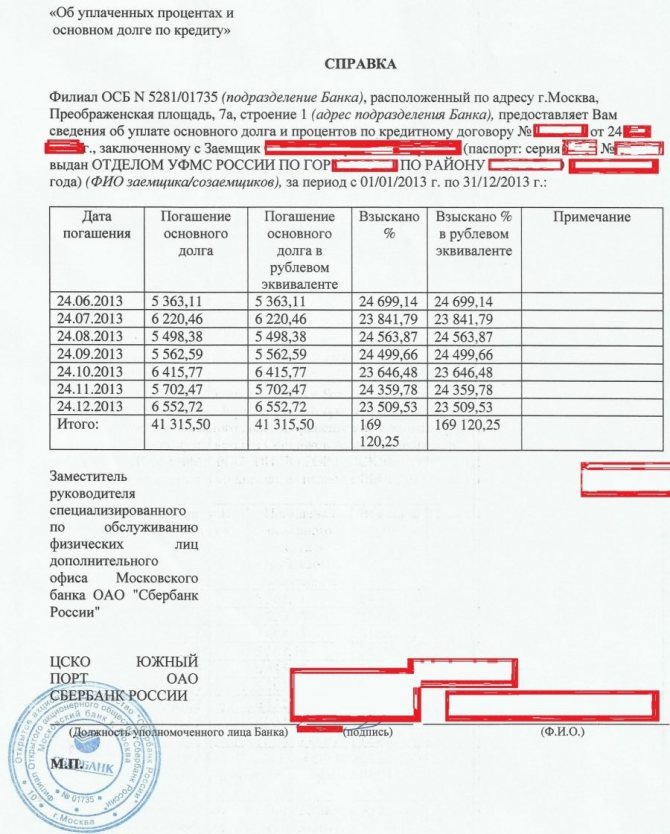

Sample Sberbank certificate

This document is issued in the name of the mortgage borrower. Sberbank has approved a single form of certificate of interest paid, which contains all the necessary data for the tax inspectorate. Conventionally, it can be divided into three blocks.

The first part includes:

- borrower data (full name, passport, registration address);

- information on the loan (agreement number, date of signing, size of the loan provided, transaction currency);

- information about the pledge (description of the property, its value).

The second part is presented in the form of a table. It states:

- date of making the monthly payment in the format 01/01/1900;

- the amount of the repaid principal debt in rubles (loan body) for each month;

- the amount of interest paid in rubles monthly;

- the total amount of the loan and interest paid over the past year.

The third part is the signatures of authorized persons of Sberbank, seal. The certificate must include the originating number and the date of issue.

If the mortgage is issued in a foreign currency, then payments for its payment are prescribed in the same currency and converted into rubles at the Central Bank exchange rate. All data is indicated to the nearest kopeck, there should be no rounding. A sample of this document is presented below.

Important! Please check the issued certificate carefully. All information must be reliable; errors and corrections are unacceptable. Otherwise, the tax office will not accept the document and it will need to be redone.

Certificate of repaid interest

The declaration for the Federal Tax Service is filled out using a special form (3-NDFL). An important criterion is to complete everything without errors. If the return is approved, 13% of the taxes paid by the borrower are calculated. It is possible to draw up a declaration only after obtaining certificates of payment of the principal debt and interest paid in Sberbank.

To provide confirmation to the tax officer that the applicant for compensation for a partially repaid loan will return the remaining interest rate, a certificate of repayment is obtained from the bank. If you buy real estate at a lower cost in the future, you can get the missing amount by purchasing the next property.

Where to get it

You can order a certificate at any Sberbank office upon presentation of your passport, if it is inconvenient for the user to visit the office where the housing loan was issued. However, branches must be located within the same region.

To issue a certificate, you need to make a special application. You should provide information very carefully, since if errors are identified, the time frame for preparing the paper will be delayed.

Each credit institution has its own deadlines for preparing documentation, which vary from 1 day to a month. Sberbank will prepare a certificate within 1 business day. The following information must be included in the certificate:

- Loan agreement number, terms and date of signing.

- Full name of the payer.

- Detailed statement of contributions on individual lines.

- The total amount of the repaid loan.

- The total amount of interest paid.

- Remaining debt.

Attention! All numbers are written down to the nearest kopeck, otherwise the certificate will be invalidated.

You should carefully check all the information on the certificate when you receive it, including each number. Errors can appear anywhere, so you should pay attention to all the details, right down to periods and commas.

Additionally, the certificate indicates the details, the date of issue on the top right, the position of the responsible employee and his initials on the bottom. It is also necessary to have the seal of the banking organization and the signature of the person responsible for the accuracy of the information presented and the absence of errors.

The certificate is issued in the name of the borrower; if the consumer’s spouse is indicated as a co-borrower, then the form will contain the data of both persons. The request can be submitted annually, so the certificate must reflect the amount for the period of compensation. If the loan agreement was signed in 2020, then the first payment is available in 2020. The algorithm is repeated until the mortgage debt is fully repaid.

The package of documents and the received certificate should be submitted to the tax office that corresponds to your place of registration.

Where can I see my mortgage balance?

To track credit debt in the Sberbank online system, you must perform the following steps:

- Select the “Loans” tab, where all existing obligations will be highlighted.

- Click on mortgage loan.

- Click on the “Detailed information” tab, where all the information on the mortgage will be presented: the total loan amount, its breakdown into principal and interest, the loan rate, loan terms, contract details, as well as the remaining debt amount. If you wish, you can also view an electronic payment schedule here, where previously deposited funds will be taken into account.

So, we have examined in detail all existing methods of tracking the balance of mortgage debt at Sberbank. As you can see, you can get the necessary information in any convenient way, both in person and using Internet resources anywhere. And this is another reason why many clients prefer this bank.