Read more about the possibility of reducing mortgage rates

Financial and economic experts share advice on reducing mortgage interest rates. Many borrowers who do not want to lose extra funds when paying off loans can do this if they wish. You can reduce your interest rate if you use these simple tips.

:

- You must initially approach the choice of a loan product and lender with utmost care. It is recommended to visit the bank branch where the client has a salary account. There he can count on receiving attractive lending conditions. In turn, the interest rate may automatically decrease by a couple of points.

- If you take out a mortgage loan, it is important to have a good credit history. It’s good if it is in the bank where the client plans to enter into an agreement. For example, he can take out a loan for a small amount or a credit card. After the debt is repaid on time, the client has every hope of receiving a home loan at a reduced interest rate.

- When purchasing real estate, you must make a down payment. It is desirable that it be as reliable as possible. The rate will decrease if the risks for the lender decrease.

- It is recommended to enlist the support of a solvent guarantor, who can be a close friend or relative.

- Providing collateral for a mortgage, for example, another piece of real estate or a car.

- Participation in the “mortgage with state support” program. Counting on budget subsidies, one can hope for a reduction in mortgage rates. However, a family that applies to receive support from the state must meet certain criteria and also have documentation that confirms its rights to benefits.

Knowing how to reduce the interest rate, the bank client will be able to put these recommendations into practice. It is important to note that it is not at all necessary to overpay the bank. The best way is to find compromise terms of cooperation and enter into an agreement under which each monthly payment will be affordable for the borrower.

Situations in which banks are ready to reduce rates

In view of the current situation in the banking sector, many banks are meeting their clients halfway and reducing mortgage lending rates. This is due to the drop in the key rate of the Central Bank of the Russian Federation to 6%.

In fact, the question of how to reduce the interest rate on a mortgage is now quite acute. The client’s legitimate desire is to make the loan as profitable and convenient as possible for himself. Why overpay if you can refinance your mortgage with another bank on more favorable terms? In order not to lose you as a client, the bank may make concessions and lower the mortgage rate!

Back to Contents

When might you need a mortgage rate reduction?

A change in the rate is not always caused by a deterioration in the financial situation of the family; sometimes the reason may be its improvement. As a rule, in practice the following reasons are identified:

:

- the salary was increased or decreased due to a change of position, as well as layoffs;

- dependents appear in the family, children are born, maternity leave or maternity leave is planned;

- retirement, receiving benefits from the state;

- other reasons that caused a change in the financial situation.

When various financial problems arise, banks are ready to offer such options

:

- an increase in the period

when the loan debt must be repaid for a period of three to ten years, due to which the payment amount for each month will be reduced; - Mortgage holiday

– deferment of payments for two years. Interest payments are made throughout the entire period. As for the body of the loan, the main debt can be repaid a little later; - development of an individual payment regime,

taking into account the characteristics of the financial situation of the person who is paying off the debt; - the ability to pay contributions to repay the debt quarterly

, but not monthly, as established by the agreement, taking into account the availability of a standard debt payment schedule; - credit holidays

- bank specialists study in detail the financial situation of the borrower and all existing valid reasons that became the basis for receiving this benefit. When participating in the state program, the interest rate is reduced;

Sberbank offers to reduce the interest rate if the service was issued electronically. Details can be found on the official website of the banking institution. The borrower is assigned a personal manager. Services are paid upon registration. The application to Rosreestr is submitted online.

State support programs

This method of reducing mortgage rates will be relevant for families in which a second or third child has recently been born. The state support program for families with children involves setting the lowest mortgage interest rate at 6%.

Families in which one of the spouses has recently entered military service can also count on a recalculation of the mortgage rate.

Thus, it is possible to reduce the mortgage rate not only at the stage of signing a loan agreement, but also at the stage of making payments. A timely contact with the bank with a request to refinance your mortgage will help you save a considerable amount of money, even in the event of a slight decrease in the interest rate.

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Ways to lower your rate

It is recommended to act differently if the loan is issued and the banking organization wants to reduce the interest rate. The borrower is disappointed - he hastened to conclude the agreement. However, there is also a way out of this situation, since the overpayment is reduced on an existing mortgage loan if you contact a credit institution.

How can you save on interest rates when you have already received a loan? The following schemes to reduce it are available.

Refinancing

A “loan for loan” is taken. This is done at the bank where the mortgage was issued. Then the borrower will not have to collect a large package of documents, evaluate the property, wasting a lot of time on these procedures. When contacting another bank, you need to first calculate and find out whether the savings will be significant and whether concluding a loan agreement will be profitable.

It is advisable to refinance a mortgage loan if the difference in the rate is around 1%.

Restructuring

This procedure makes it possible to reduce/increase the monthly payment and win on overpayment. If the borrower’s income has increased, then it is worth submitting an application to the bank and attaching documents that confirm this fact. Similar actions are also carried out in case of early repayment - the term of the agreement is shortened, payments are made in large amounts.

Subsidization

It's never too late to start participating in government social programs. If the borrower is a member of a young family or entered military service, he can count on subsidies from the state, as well as interest reduction. At the birth of the second child, you will receive a document for maternity capital. These funds can be used to lower your mortgage interest rate.

Court

In many situations, not only the client, but also the bank itself becomes a violator of the lending agreement. If the borrower’s rights are not respected or he has found a certain loophole in the document, then he is recommended to contact the court. A competent approach to court proceedings can reduce the overall overpayment on a mortgage. However, the borrower must be sure that he is personally right. Otherwise, he will still have to pay legal costs. It is worth noting that during court proceedings, you must continue to repay the loan debt according to the schedule, otherwise the bank will impose sanctions against the debtor.

Regarding the loss of property rights to housing, it should be said that some banks necessarily require insuring this risk for the period of mortgage lending (about three years - the limitation period for valid transactions). If the housing was purchased in a new building, then it is not necessary to insure this title.

As a rule, all risk insurance rates are primarily determined individually for all borrowers.

Insurance of any home depends entirely on factors such as the building’s floors, the presence of finishing, the general condition of the home (technical), etc.

other methods

If the apartment was bought in a new building, some banks are ready to provide a mortgage at a fairly high interest rate at the time of construction. After putting a new house into operation, the borrower can draw up a document on ownership, evaluate the apartment, insure it and provide a package of documentation to the bank to reduce the rate to 3%.

How to reduce the interest rate on an existing mortgage

The reduction in the key interest rate of the Central Bank gives the right to citizens who have already taken out a mortgage loan to reduce the established mortgage rate. To do this, just contact the bank with the appropriate requirement. The main conditions for reducing the interest rate are timely repayment of previous payments and confirmed solvency. An additional requirement on the part of the bank may be the mandatory registration of property insurance, as well as the life of the borrower.

There are several main ways to reduce mortgage rates:

- refinancing;

- restructuring;

- receiving government subsidies.

Let's take a closer look at each of the options.

Is it possible to reduce the rate on an existing mortgage?

To receive payment benefits, you need to submit an application to the bank, which will justify the reasons for changing the mortgage agreement. Without this document, the banking organization will not begin to develop an additional agreement within the framework of existing programs for refinancing and debt restructuring.

Another option is to contact an organization that operates with state support (AHML). If possible, apply for participation in the state support program to receive subsidies, which will allow you to repay part of the debt. Typically, money is transferred directly to the bank if it has been accumulated in certain federally funded accounts.

If the borrower meets the requirements of the state support program, they can receive a payment of up to 20% of the total loan amount. It is important that the property falls within the characteristics specified in the rules. There must also be real evidence of the debtor’s current difficult situation and an accurate justification for non-payment of debt.

The borrower can independently submit an application to the financial institution, which contains a mortgage lending agreement. This method of reducing interest is an extreme method, used in cases where refinancing/restructuring is unacceptable due to certain violations of the agreement, the presence of arrears, or the appearance of debts on mandatory payments.

Debt restructuring

Debt restructuring will help change the terms of the mortgage loan agreement if the borrower's income has officially changed significantly - increased or decreased.

If the borrower’s income has increased, then it will be more profitable for him to increase the amount of monthly payments to repay the loan as quickly as possible. Banks often agree to such restructuring; it is enough to provide the credit institution with a certificate of income and a corresponding application.

In the event that income decreases significantly, for example due to job loss, you should under no circumstances stop paying approved contributions to the bank. It is necessary to contact the bank with a request to restructure the mortgage and present documents confirming the decrease in income. A banking institution may offer to extend the loan term, thereby reducing the monthly payment, provide credit holidays, or change the payment schedule.

Law to reduce mortgage rates

The story of the Central Bank raising the key rate from 10.5 to 17% in 2014 is behind us for the mortgage lending market. At a meeting in December 2020, the government reduced the key rate by 0.5 points to 7.75%. Experts say that in 2018, the Central Bank will continue to reduce key rates, thanks to which banks will be able to reduce mortgage rates and also increase demand for real estate.

According to experts, the growth of the mortgage lending market will only continue in the future, in particular thanks to the government subsidy program that was announced by the President of the Russian Federation. It will be available for families whose second/third child is born from January 1. According to expected forecasts, the average rate will decrease to almost 8%.

Mortgage refinancing

Refinancing means refinancing the remaining debt on new terms. Banking institutions value their clients, so they often agree to accommodate borrowers who apply for refinancing. However, if your bank refused your request to reduce the mortgage interest rate, you should not despair. Refinancing can also be done with third-party banks, which are usually willing to offer more favorable lending conditions in order to attract new clients. You do not need to obtain consent from your current lender for this.

Of course, refinancing with your own bank will be less expensive. To carry out this procedure, you do not have to re-assemble the full package of documents or incur additional costs. Refinancing with a third-party organization will incur a number of material costs for issuing a new insurance policy, paying a fee for issuing a new mortgage lending agreement, as well as real estate appraisal. In addition, you will have to spend time collecting documents for the bank.

However, despite the possibility of additional costs, according to experts, even a slight decrease in the mortgage lending rate (by 0.5 percentage points) will bring considerable benefits to the borrower. Thus, reducing the mortgage rate by 2-3 points will lead to a reduction in average monthly payments by 8-12%. Refinancing will be unprofitable only for those borrowers who have already paid off most of the mortgage loan.

How to reduce the mortgage interest rate at Sberbank

Many borrowers who previously took out a mortgage at the interest rate in effect at that time want to renegotiate the terms of the contract due to a reduction in the rate. The bank provides this opportunity only to respectable payers who have made contributions every month without delay.

Since the preferential program at Sberbank has been closed since September 2020, clients are offered alternative exit methods:

- restructuring;

- refinancing;

- revision of the terms of the contract by court decision.

Submitting an application

To reduce the interest on an existing mortgage loan, you must submit the appropriate application in person to the nearest bank branch (by law they are required to accept it) or through the official website of Sberbank. After consideration, the bank will notify the borrower of its decision.

In this case, certain conditions must be met:

- making mortgage payments on time;

- the loan agreement was signed more than 1 year ago;

- the amount of mortgage debt is at least 500,000 rubles.

Applicants' applications are reviewed by the Sberbank analytical department within 10 working days .

Restructuring or refinancing in Sberbank or another bank

If the client is unable to properly fulfill his debt obligations to the bank, he can apply for restructuring of the existing debt. This means changing the terms of the loan provided in order to reduce the size of the payment, obtain a preferential deferment, shorten the terms or change the currency.

By shortening the mortgage payment period, it is possible to reduce the interest rate by 0.5-1% . To carry out such a procedure, the borrower must submit an application to the bank. But to receive a positive answer, you need strong arguments, supported by documents. The reasons may be as follows:

- conscription for military service;

- birth of a child;

- layoffs from work;

- loss of ability to work due to illness or serious injury;

- a significant decrease in cash receipts to the family budget.

The following documents will need to be attached to the application:

- a certificate from your current place of work indicating your current level of income;

- a copy of the order according to which the applicant was transferred to another position or dismissed;

- certificate of pension accrual;

- papers confirming the grounds.

Refinancing at Sberbank

Another option is refinancing. The bottom line is that a new loan is taken out and all existing debt obligations with Sberbank or third-party financial and credit organizations are repaid with it. There is a point in such a step if there is a difference between the rates of no more than 2%.

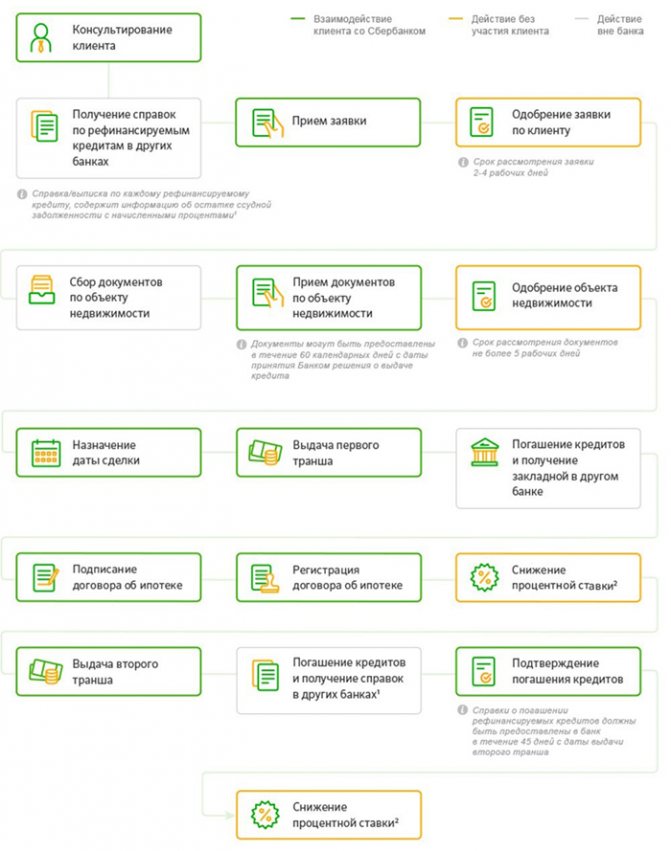

Infographics of mortgage refinancing in Sberbank

The borrower must complete the final 3 steps within 2 months. Otherwise, the bank will begin to collect the loan. If the client does not meet this deadline, he can ask for an extension.

The application can be submitted directly on the Sberbank online resource, but the system immediately transfers it to DomClick. There you will need to log into your Personal Account and go through a short registration procedure through Sberbank Online.

What documents will be required:

- Russian passport;

- statement;

- certificate of current income;

- photocopy of the work book;

- loan agreement with the bank.

Reducing the rate through the court

The issue with the mortgage rate can be resolved through the court. Borrowers are forced to resort to such a step when banking structures, on their own initiative, begin to increase interest rates on loans.

In such a situation, they write an application to the court district at the place of registration. A bank employee is invited to the court hearing to explain why interest charges were inflated. Based on all of the above, the judge makes a decision in one direction or another.

To go to court you will need to collect the following documents:

- a photocopy of a passport or other document identifying the applicant;

- residence permit (if the applicant is not a citizen of the Russian Federation);

- a copy of the mortgage agreement;

- receipts (checks) for monthly mortgage payments;

- a copy of the certificate of ownership of real estate;

- receipt of payment of state duty.

Be sure to take the originals of all documents with you.

During the entire trial, the borrower will have to repay the loan at an inflated rate. If he wins the trial, the bank will reimburse the costs in the future.

Under the state support program for large families and other programs

Reducing the rate on mortgage loans at Sberbank is only relevant for the most common preferential programs, for example:

- For housing under construction . There is an opportunity to buy apartments under construction or ready-made from a specific developer. The rate will be from 4.1% with a down payment of 10%. An amount of 300 thousand rubles is issued. for a period of up to 12/30 years, depending on the conditions of the developer. It is mandatory to insure the collateral apartment.

- With government support . Designed for the purchase of an apartment in a new building, ready or not yet, at a key percentage of 2.6% - with an installment period of 1 to 7 years, 6.1% - over 12 years. Down payment – from 15% of the subsidized amount. Existing surcharges: +0.3% – when refusing electronic registration, +1% – when the borrower does not insure life and health.

- State support for families with children . The mortgage rate starts from 1.2%, the down payment starts from 15%, the maximum limit is RUB 12,000,000. The condition for issuing such a loan is that a child be born in the family between 2018 and 2022.

- With the involvement of maternity capital - it is allowed to use maternity capital. The rate is from 4.1%, with an installment period of up to 30 years. The capital can serve as a down payment. By the way, financial capital can be used as a down payment on a mortgage - read more.

Participation in such programs can significantly reduce the loan burden on the borrower. To exercise your legal right, you must submit an application to the bank. After consideration, the borrower will receive an answer whether he is among the beneficiaries or not. And the conditions are as follows:

- the size of the family budget should not exceed two subsistence minimums in force in the borrower’s region of residence (the indicator is taken for the previous 3 months);

- Mortgage payments take up more than 30% of a family's total income.

The application can be submitted on the Sberbank or DomClick website.

Special programs from developers

This means purchasing housing in new buildings with government support. When registering online, the rate will be from 4.1%. Under the escrow program and with bank financing of construction, the interest rate for the first 2 years will be only 2.6%. The issued limit is up to 12,000,000 rubles, for a period of up to 20 years.

In addition, in the spring, the state launched a campaign to issue preferential mortgages at 6.5% per annum as a measure to support construction and the economy. This step allows citizens to save significantly and purchase better housing. The offer is valid until November 1, 2020 and applies to living space whose cost does not exceed RUB 8,000,000.