Reviews about the work of Sberbank in general

This group contains general questions:

- service in branches;

- ease of use of remote access systems (Internet banking);

- Information Support;

- problem solving.

Technical faults cannot be completely excluded. Individual breakdowns (software failures) are detected by self-diagnosis of the ATM, after which the data is transferred to the service center. Recording changes in information online allows you to restore transactions if necessary.

Published reviews contain complaints about lack of competence and errors of line personnel. However, a careful study of the correspondence allows us to note the prompt resolution of problems by responsible Sberbank employees.

Reviews about mortgages

To correctly obtain a mortgage, you must carefully familiarize yourself with the basic terms of the loan product. Insurance of a property, for example, is mandatory for the entire duration of the contract. Preliminary preparation will eliminate errors caused by insufficient personnel competence.

For your information! To study in detail Sberbank's requirements for a potential borrower, study the thematic publication on our website. For qualified advice online, contact the duty lawyer.

A detailed study of the situation made it possible to find out that Sberbank fulfilled its obligations before the expiration of the control period - no more than 30 days from the date of repayment of the mortgage loan. The delay in the removal of encumbrances is explained by the slow update of the Unified State Register of Real Estate (USRN) database. We should not forget that the bank is not able to ensure that entries in Rosreestr are changed. It is necessary to correctly formulate claims against other executors (institutions) related to the mortgage agreement. Sberbank performs the functions of a lender, and therefore cannot be responsible for the actions of the seller or the insurance company.

Documents for mortgage approval in Sberbank

Before you submit your initial application, you will have to collect a whole package of documentation:

- 2-NDFL for 6 months (last).

- A certificate of income in the prescribed form (if the bank provides it).

- The borrower's passport (the co-borrower will also need it).

- Work book (copy).

- Certificate of birth (for children) and marriage (if any).

And don’t forget to take deposit account statements with you. This is necessary in order to confirm the presence of additional income. You can be sure that having one will greatly simplify the whole process. Please note, this is a standard set of papers. And it can be supplemented depending on what kind of loan offer you have.

Of course, if the application is approved, you will have to collect an additional package of documents. Because a mortgage is too high a risk, and the bank cannot get by with one or two checks. He needs 100 percent guarantees. This is despite the fact that the apartment itself, according to the agreement, will be collateral.

Opinion of debit card holders

Typical operations are performed automatically. A commission is accrued for an order confirmed in your personal account. Since the actual use of the bank card has not been formalized, the money is returned to the client’s account.

The attentiveness of bank employees prevents fraudulent activities. However, some security measures can block access to a debit card or bank account. To quickly solve problems, it is recommended to save the hotline number in your smartphone contacts.

If funds are written off incorrectly, contact the bank with a written statement. The text indicates the details of the completed transaction and the reasons why you are right. As a rule, such problems are resolved by the bank without going to court within 1-2 days.

Reviews from borrowers on loans

Applying for a consumer loan remotely is more convenient than a personal visit. In addition to saving time, this method eliminates transportation costs. After entering biometric data, the possibilities for remote access to bank services are expanded. The introduction of new acquiring systems is based precisely on such an identification system. According to Sberbank management, in a few years the development of technology will allow clients to abandon classic bank cards.

The description of each loan contains information about the accompanying documents. It is recommended that you first study the step-by-step sequence of actions when applying for a loan. This approach will help save time and prevent mistakes when communicating with bank staff.

The bank blocks the account due to a valid court decision. To cancel, you must obtain a certificate from the bank about the repaid debt, or confirm the completed transaction with a payment document. The application with evidence of its innocence is transferred to a civil court.

Mortgage from Sberbank or the “convenient” Domklik service.

Good day everyone!

I have a free minute and I want to share with you the “miracles” of the “green” bank when conducting transactions.

ps from 09/10/2020

The insurance company from Sberbank calculated the insurance at 12,000; at Ingosstrakh, insurance would cost 6,000. The difference is twofold.

When I asked the credit manager whether the borrower could buy a policy from another insurance company, the answer simply hit home: And when submitting the application, did you inform that there would be another insurance company? if not, then it’s impossible, approved under these conditions.

So keep in mind those who apply for approval themselves. The bank will scam you out of money in full: expensive insurance, electronic registration, telemedicine, legal check, etc., etc. If you have an experienced agent next to you, he will moderate the costs of the bank and give you what you really need, and not what they want to sell you.

As you know, Sberbank created Domklik for the convenience of mortgage holders, carried out a serious advertising campaign, loans are issued a lot and often, but the service began to suffer.

Now there is no specific manager who conducts the transaction, and questions are answered by those on duty, if of course they answer, otherwise you ask a question and wait, wait, wait, spit and order a call and after a few hours someone calls you back, for example at 8 am or 9 evenings. Very comfortably.

Further, the bank persistently offers all kinds of services, so when submitting an application, be very careful, for example, the current borrower was approved for a loan of 4,400,000, while the apartment being purchased costs 8,000,000, the person was fully confident that he only needed to add 3,600,000 and everything will happen, but no, the bank said that it would give only 50%, and the rest themselves, and this became clear when all the documents were collected and transferred to the bank. Only the bank knows how to inform its customers. It’s good that this money was there, otherwise people wouldn’t understand where to look for the missing amount.

Knowing how the bank prepares the Purchase and Sales Agreement, she offered the buyer to draw it up herself, we had one tricky moment there, the DCP is ready and uploaded to Domklik, the bank considered this a project and now offered to make a DCP for the transaction on its own, for a small fee of almost 3,000 rubles . No comments.

On September 8, the bank approves the object and offers to “choose” the day of the transaction, the buyer is almost running to the station to buy tickets, I propose to wait again for the manager’s call and find out when His Holiness the bank will be free. And then…. The next available date in Moscow is September 16, well, you can choose from the whole end of September, enjoy. Moreover, if you want to refuse electronic registration, then you will be subject to a review of the terms and conditions and the date of the transaction will be postponed indefinitely. So don’t show off and take electronic registration. This again relates to the question of how the terms of the loan are negotiated.

At el. In the summer there were a lot of suspensions from Rosreestr because some documents required notarized identity in email. form. Did you know about this? I do. Do you think the Sberbank manager informed at least someone? That's right, no.

One more thing about places for conducting transactions. A week ago, we went to a deal in Serpukhov in a chain of 4 apartments, all apartments are located in Moscow. We are developing domestic tourism.

The icing on the cake is insurance. The bank offers it approximately 2.5-3 times higher than other insurance companies.

For some reason, I increasingly want to tell people not to get involved with Sber.

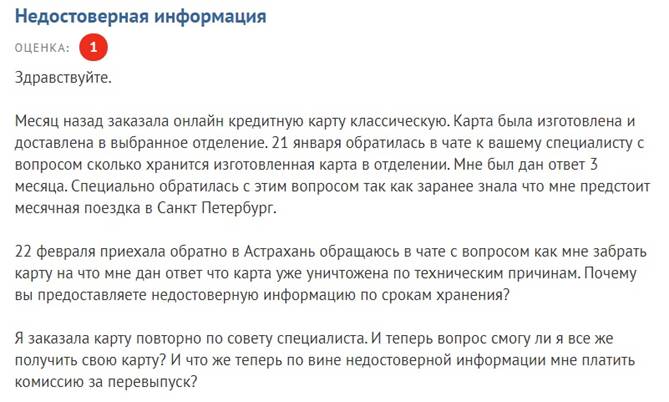

Advantages and disadvantages of credit cards

You should pay attention to changes in customer service rules. According to the new standard, the storage time for a bank card has been reduced to 30 calendar days. Service commission is not deducted if the customer does not pick up the order.

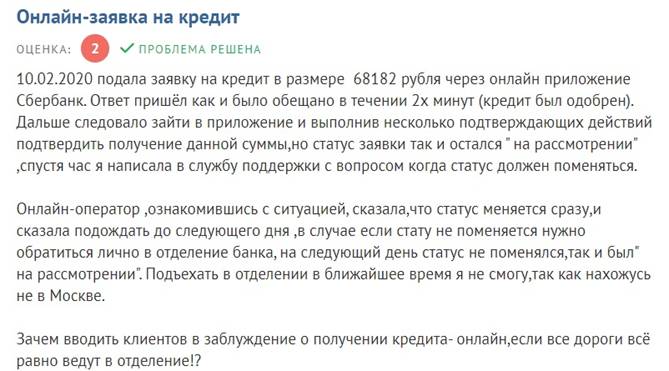

When considering Sberbank services, customer reviews should be assessed correctly. Using this example, we can explore the misunderstanding of advertising offering an online loan. In reality, the remote mode is intended only for the transmission of a preliminary application. A positive response will be received if the basic requirements for the borrower are met. Check:

- age;

- work experience;

- citizenship;

- presence of an official source of income.

To apply for a loan, a personal visit to a bank branch is required. In addition to identifying the individual, the responsible employee makes sure that there are no compulsory actions and assesses the borrower’s legal capacity.

For your information! To obtain a large long-term loan, you may need life (health) insurance. Mortgage loans are issued with real estate as collateral and the mandatory participation of a spouse. Additional guarantees of return are provided by a guarantee.

Negative

Negative comments often appear online about obtaining loans for the purchase of real estate from the country's largest bank. They are mainly devoted to the work of the institution’s branches. In some of them, according to many citizens, the employees are not competent. In some regions the quality of service is low. But Sberbank is making great efforts to correct the situation. Many such reviews appear due to customer inattention. Such comments are also necessary to take into account all the nuances of applying for a mortgage loan at bank branches.

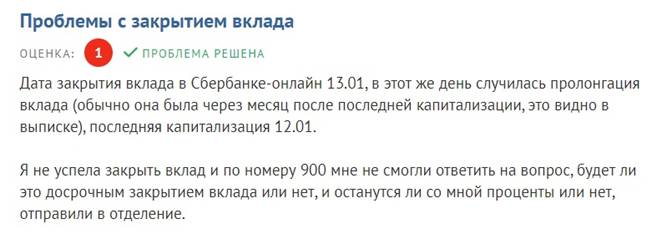

Reviews of Sberbank deposits

If the money is not withdrawn, the deposit is renewed automatically. The new conditions (rates) comply with the rules established on the corresponding renewal start date. After the termination of a certain deposit program, the base rate is set at 0.01% per annum. In this situation, financial resources are placed according to the “on demand” scheme.

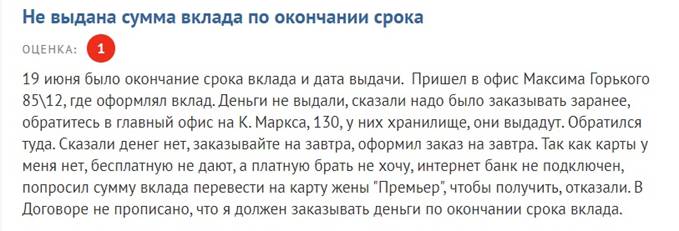

The procedure for issuing cash is organized taking into account the following parameters:

- name of the bank card;

- amounts;

- currencies.

Exceeding the limit is paid at current rates. The possibility of receiving a large amount should be clarified. If necessary, place an appropriate order.

Example for Sberbank Visa Gold card:

- account currency – Russian rubles, USD, EURO;

- free receipt per day - up to 300 thousand rubles. (or equivalent at the current exchange rate);

- tariff – 0.5% of excess limit.

The bank's rules establish the following parameters:

- required balance;

- the ability to withdraw interest (in whole or in part);

- benefits for pensioners and other categories of investors.

For your information! You can receive money at any regional office. The deadline for completing such an application is 3 working days.

Sberbank refused a mortgage due to length of service and inconsistent work

Any bank needs a borrower who not only has an income suitable for repayment, but also a constant one. Those who have an official or stable loan do not always come for a loan. Often the income is floating, received from time to time. For example, there are long breaks in the work record. Since a mortgage is a large and long-term loan, it is important to repay it constantly, every month and not even a single year.

This means that Sberbank also needs a client who can deposit money every month for a long time. Therefore, not just the level of income is checked, but also the length of service for at least the last year. He must be constant during this time. Employment and experience are checked. Also another condition - at least 1 year of work in the last place, no breaks during this time.

Refusal for a mortgage often occurs due to lack of employment or non-compliance with the conditions of Sberbank. For example, the applicant earns a lot, but over the past year he worked only for a few months. Then his employment is considered unstable; there is a big risk that the client will continue to work like this. This means that he will not be able to repay payments on time. The mortgage should be refused.

Solving the problem is not that difficult. It is important to obtain at least 1 year of experience. He should be listed at one place of work, and not at different ones. Then submit your mortgage request again, Sberbank will consider it as new and give you an answer.

conclusions

The presented customer reviews about Sberbank indicate an insufficiently careful study of official information. In particular, the need to carefully evaluate advertising materials should be emphasized. Commercial organizations increase the attractiveness of their offers by skillfully “disguising” the existing disadvantages.

Checking published opinions allows us to draw several important conclusions:

- Sberbank offers many different banking products;

- preliminary familiarization with the conditions simplifies the right choice;

- To study complex rules in detail, you need to use the explanatory materials on our website;

- responsible bank employees respond promptly to requests;

- To fill out applications and solve other practical problems, it is convenient to use remote access tools - Sberbank Online.

Repost. Don't forget to like. If you have any additional questions, use the chat. You can post your own opinion about the bank in the comments to this publication.

You can study in detail typical questions on mortgages in the specialized section of our website.

Sberbank requirements for borrowers

Already at the stage of submitting an application, it may simply not be considered if the applicant does not meet the basic requirements of the bank. For some clients, they may seem harsh, but in this way the lender weeds out possible defaulters in advance. The bank sees as prospective borrowers those who meet the following requirements:

- age from 21 to 75 years;

- total work experience – at least 1 year over the last 5 years;

- at the last job - at least 6 months of experience.

If borrowers meet these three parameters, they can qualify for a mortgage. But fulfilling these conditions does not guarantee that the loan will definitely be given. There are many more factors that are taken into account when making a loan decision.