Government authorities provide support to qualified young specialists just starting their professional careers.

One of the advantages provided by the federal authorities for this category of citizens is preferential mortgage lending for the purchase of their own living space.

This is due to the fact that most young professionals, especially employees of budgetary institutions, do not have their own savings to purchase their own housing.

Who is eligible?

State legislation establishes certain requirements for a young professional who wishes to take part in the relaxed mortgage lending program.

However, none of the federal regulatory documents contains a clear description of the concept of a young specialist. This status is mainly determined at the level of individual regions.

According to the requirements for this status, you can obtain the right to a preferential mortgage provided that:

- The age category of the applicant must be up to 35 years, and for scientists - up to the age of forty;

- A citizen carries out professional activities in a specialty obtained through full-time education at a secondary specialized or higher educational institution . Also, no more than a year must have passed from the date of issue;

- Official employment, according to the acquired specialization , occurs for the first time.

In addition, each of the specialties has its own restrictions and conditions for the minimum length of service in the position held.

| Industry of activity | Peculiarities |

| Health workers | Only young doctors who move to a permanent place of residence and work in rural areas can receive a preferential mortgage. Also, only qualified doctors can receive it. |

| The age category cannot exceed thirty-five years. It is mandatory to obtain official employment and register in rural areas. | |

| In addition, the minimum employment contract with a young doctor using a preferential mortgage is at least five years. | |

| Scientific figures | The age category of young scientists should not be older than thirty-five years, and for doctors of science - up to their fortieth birthday. |

| Work experience in a scientific institution must be at least five years | |

| Teachers | The age category of a teacher should be up to 35 years, and in some districts - no more than thirty years. |

| Official work experience must be at least one year in a non-profit organization providing training services (school, technical school, college, university) | |

| Military | Housing for young military personnel is provided from the state budget. The only mandatory condition is the participation of a military specialist in the savings mortgage program from the state. |

| Each participant in the savings program who wants to apply for preferential mortgage lending must make contributions to the fund for at least three years. |

State programs do not impose any restrictions on specialties obtained in educational institutions.

This means that a teacher by training who has completed additional studies at a university in another specialty will be able to receive the payment.

In this case, age does not matter.

Who falls into this category?

A young specialist is considered to be a graduate of an educational institution of higher or secondary education under the age of 35, except for doctors of science, whose age limit is 40 years.

The state imposes requirements for the place of employment and specialty:

- employees of budgetary educational, medical and scientific organizations;

- At least 1 year of work experience in a government organization.

Some regions provide additional support to athletes.

What preferential mortgage programs are there?

Today, there are several government programs aimed at subsidizing young professionals’ living expenses.

These are:

- State programs “Housing”, “Maternal Capital”, “Young Family”;

- Special programs provided by municipal authorities that operate at the level of individual regions;

- Mortgage lending on preferential terms from individual companies, with the aim of long-term cooperation with young professionals;

- Providing housing from the housing stock for certain categories of citizens.

The provision of mortgage lending for young professionals is carried out by regional authorities. This is done with the aim of supporting a decent standard of living for aspiring professionals who will help boost the economy of the region.

Citizens working in the public sector can receive a certificate that will allow them to receive the following types of state support:

- Reimbursement of up to forty percent of the total cost of the purchased property (the percentage depends on the region of residence);

- Reduced mortgage rates;

- Down payment of up to fifteen percent of the total cost of housing. It is allowed to make a down payment from mortgage funds.

Relaxed lending conditions apply to both new housing and secondary housing, or the construction of your own home.

Regional authorities are forming a housing stock that is responsible for affordable housing purchased from developers.

Some districts provide benefits for young professionals when moving to rural areas, in the form of financial assistance and free provision of building plots.

All necessary information regarding the provision of housing at the place of residence can be found in the authorized institutions of the regional government.

Which employees are considered young specialists?

A young specialist is a citizen of the Russian Federation who has received a professional education and works in his specialty during the first year after receiving his diploma. There are several professions covered by the program.

Requirements:

- Completed full-time training.

- I studied on a budget basis.

- Successfully passed the final certification and received a diploma.

- Received a referral from a higher educational institution to a company.

- Concluded an employment agreement or contract with a company in accordance with Labor Code standards.

Large banks are involved in the implementation of social mortgages: Sberbank, Rosselkhozbank, housing agency Dom. RF and others.

Teachers

A young teacher has the right to apply for a loan with benefits in any corner of the country. To do this, he contacts the local administration with documents.

Under the terms of the mortgage, the state pays half of the cost of the property chosen by the borrower. After registration, it pays additional monthly payments from the regional budget. The borrower only pays interest.

Characteristics of the employee to participate:

- 5 years of experience as a teacher;

- presence of specialization;

- is a citizen of Russia;

- lack of property in the region where the employee works;

- positive CI;

- the person’s consent to enter into a contract to work in an institution for the next 10 years;

- Application submitted before age 45.

Depending on the policy of the regional government, mortgage lending may be provided on different conditions. In Moscow and the Moscow region, a teacher specializing in primary classes, Russian, can receive a benefit. language, literature, mathematics or English. language.

Researchers

This category includes young scientists and unique specialists. People who participate in the development and implementation of critical technologies and are on the list of in-demand promising professions. The list of critical technologies was approved by the president in 2011 by personal decree. Other criteria:

- Work in design and technological projects, provided that the developments have been applied over the next 5 years.

- Implementation of new technologies.

- Work with defense orders over the past 5 years.

For a scientist, the topics of work must correspond to the priorities for the region in the field of science, engineering and technology.

Requirements:

- work experience at a scientific enterprise or military-industrial complex of at least 12 months;

- age less than 35 years;

- presence of higher education, academic degree;

- there are prizes, grants, prizes or awards.

Must conduct scientific and professional activities.

Doctors

List of doctors who have the right to receive real estate at the expense of the state, but pay interest on the loan:

- surgeon, neurosurgeon, cardiovascular surgeon, thoracic surgeon;

- obstetrician-gynecologist, urologist;

- ophthalmologist;

- traumatologist, hematologist, rheumatologist;

- ENT;

- radiologist;

- cardiologist;

- neurologist, dermatovenerologist, coloproctologist;

- neonatologist;

- nephrologist;

- oncologist and radiologist, radiotherapist;

- ultrasound doctor;

- phthisiatrician;

- pathologist;

- doctor of endovascular diagnostics;

- endocrinologist, endoscopist;

- doctors of laboratory, functional diagnostics;

- transfusiologist

The applicant must have Russian citizenship, no property in the region of residence and work, with an undamaged credit history and be ready to sign an agreement with the clinic for a further 10 years of work.

Characteristics of those working in the medical field:

- More than three years of work experience.

- Age no more than 45 years for female doctors and no more than 50 years for men.

- There is I or the highest category or academic degree in specialization.

Professions of doctors that do not require experience or a category: local therapist, pediatric therapist, anesthesiologist-resuscitator, emergency paramedic and emergency physician.

Military

Military personnel are offered a mortgage loan on other preferential terms. An employee can become a participant in the mortgage savings system. For three years, the state transfers funds for the down payment. Then a participant certificate is issued and you can receive a TSL - a targeted housing loan. Mortgage parameters:

- issue a loan in the amount of no more than 2-2.5 million rubles. depending on the region of Russia;

- a loan is issued from a bank at 9-10%;

- You can purchase housing in a new or under construction apartment building.

To participate in the program, a person writes a report addressed to the boss. Within 10 days, the borrower is included in the register. Under the mortgage program, the employee does not pay his own money to purchase housing - everything is at the expense of the state. But if he wishes, he can add from his savings, since two million may not be enough to buy an apartment.

Other categories of citizens

Mortgages for young professionals have been developed, among other things, for employees of Russian Railways, public sector sectors, and enterprises receiving subsidies. A preferential program “Housing” has been launched, under which people have the right to obtain housing if they are under 35 years of age and meet the conditions for a loan.

Under the program, housing is provided to people in need of improved housing conditions who are registered with local authorities. The amount of the benefit depends on the region of application.

Documents for registration

Initially, a young specialist must be on a waiting list for housing. To do this, you will need to collect a certain list of documentation.

State mortgage lending on preferential terms will be provided upon presentation of:

- Completed application for participation in the program;

- Passport;

- Identification code, or SNILS;

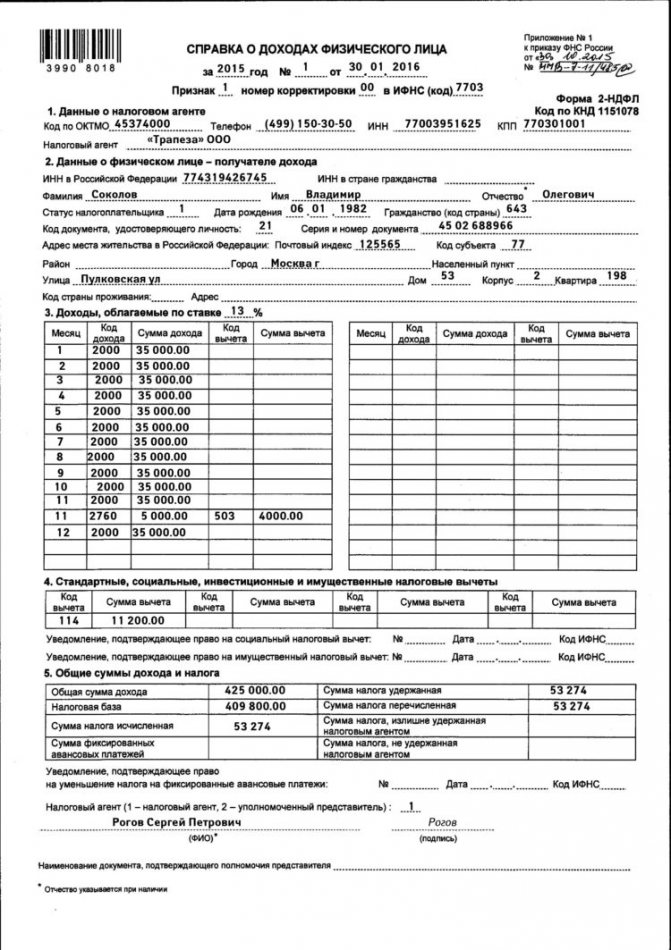

- Certificate of income in form 2-NDFL to confirm the borrower’s solvency;

- Document from the place of work;

- An extract confirming that the young specialist does not have his own real estate.

At the request of employees of the government agency accepting documents, additional papers may be requested for certain professions.

As an example, young scientists are required to confirm their degree with appropriate documents.

Registration of a mortgage

Young professionals have the right to improve their living conditions, but for each profession there are nuances of obtaining a mortgage. The general scheme looks like this:

- The borrower draws up an application and submits it to the relevant ministry.

- Upon passing the selection, an agreement is signed with the institution to work for the next 10 years.

- The program participant then receives a certificate.

- Chooses an apartment.

- Selects a lender and submits an application for consideration.

- Apply for a loan from a bank.

- Buys an apartment.

Banks that participate in the project may differ depending on the region. In the Moscow region, Sberbank, Gazprombank, Vozrozhdenie and Dom cooperate with the Government. RF.

What should I submit?

A set of documents for obtaining a loan for a young specialist:

- application for inclusion in the list of participants;

- consent to the processing of personal data;

- copy of the TC;

- autobiography;

- one photograph with parameters 40x60 mm;

- characteristics from the place of work;

- ILS insurance number;

- salary certificate;

- extract from the house register;

- bank account certificate;

- marriage certificate or document on its dissolution - a copy;

- metric certificates for children - copies;

- passport of the spouse and children, if available - copies.

Additionally, documents on the participant’s specialization are submitted. Young teachers submit a copy of their diploma of higher education and advanced training.

The medical professional provides a copy of the higher education diploma. If this is a paramedic, then about graduating from college. It is required to submit copies of documents on postgraduate internship, professional training or retraining, copies of a document on obtaining high qualifications, information on practical and scientific publications in the media, specialized magazines. Any other information related to the professional activities of a medical worker is also accepted.

Offers from banking institutions

Today, most financial institutions are loyal to newly minted specialists, allowing them to take out quite profitable mortgage loans characterized by special conditions.

This is due to the fact that such citizens, mostly, do not have entries in their work books, which cannot negatively judge their credit history.

The tables below will discuss the conditions for providing preferential mortgages for beginning professionals.

| Name of financial institution | Interest rate per year |

| Sberbank | From 9.5% for loans in rubles, from 8.8% for loans in foreign currency |

| VTB 24 | From 11% |

| Rosbank | From 10.75% |

| Alfa Bank | From 12.25% |

| UralSib | From 11% |

| Bank of Moscow | From 8.9% |

| Delta credit | From 10.5% |

Snezhinsky Bank

| Name | Interest rate (%) | Amount (rub.) | Duration (years) | Down payment |

| Young scientists | 10-10,5 | from 300 thousand | up to 25 | Not less than 10% |

AvtoVAZbank

| Name | Interest rate | Loan amount (RUB) | Duration (years) | Down payment |

| "Young Scientists" | 10,0-11,2% | The loan consists of two parts: the first, depending on the district - up to three million rubles, the second - limited to a federal (regional) subsidy, incl. size of maternity capital | Part 1: 3-25 years Part 2: up to 180 days | from 10% with the possibility of formation at the expense of subsidies |

The list of financial institutions is not limited to the above. Loans can be issued at any convenient bank.

Grounds and categories of employees for receiving privileges

The main condition for obtaining such a loan is the employee’s solvency. The bank is certified by the 2-NDFL certificate provided with the documents.

Below is a sample of a 2-NDFL certificate:

The point of the program is to receive 30% of the loan amount in order to purchase housing and work in the budget area. If the amount of payment on loan obligations does not exceed forty percent of earnings, then there is a chance of getting the mortgage approved.

Conditions may vary for each profession belonging to the budget category of borrowers.

Teachers

Financing for a special certificate aimed at covering 30% of the mortgage debt is provided by AHML.

Reference! Local authorities, after consulting with the education committee, decide to provide benefits to the young specialists they allocate.

To participate in the program, the candidate prepares an application in advance for special conditions for a mortgage loan. His age must start from 21 years and end at 35 years.

Scientists

For young scientists, gender, age and the presence of minor children do not matter.

A candidate applying for preferential loans must submit a corresponding application at his place of work. There he will be added to a special list and all candidates will be submitted for consideration to the Academy of Sciences, where the final decision will be made.

One of the important conditions for such an application is work experience in this specialty, which cannot be less than five years. You can only count on the right of such an acquisition once.

Military

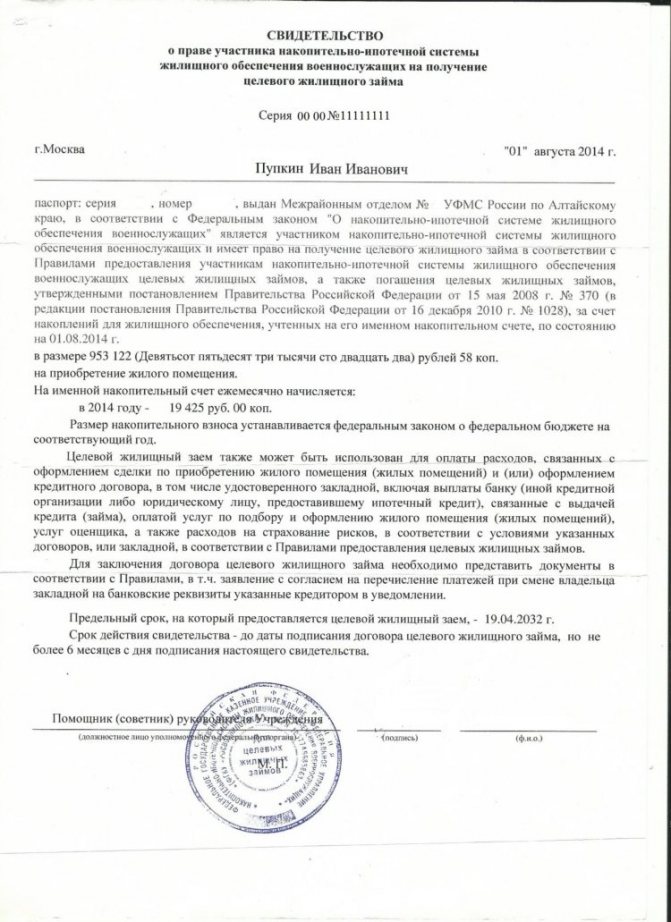

People serving in the army are eligible for loans using NIS, the abbreviation of which means savings-mortgage system. The main condition is that the citizen be a military serviceman and have been a member of the NIS for at least three years. This type of benefit is provided:

- warrant officers;

- officers;

- contract employees.

Note! To obtain a special certificate that must be submitted to the bank, the serviceman needs to contact the unit commander.

After this, authorized persons will handle the procedure and issue a document. The document is valid for 6 months.

You can learn more about the military mortgage program in this material.

Below is a sample certificate of entitlement to an NIS participant:

Doctors

Doctors serving in budgetary institutions can also purchase social security. Preferential mortgages for doctors will be available under the following conditions:

- If the citizen is a young specialist, that is, he is under 35 years old.

- For PhDs, the limit is 40 years.

- Having a doctor's diploma.

Railway workers

Mortgage for young employees of Russian Railways is a program that provides an affordable loan for employees of this organization. The essence of the program is the minimum down payment for housing, which is 10%, and sometimes none at all.

In this case, the borrower purchases a special subsidy, under which the monthly payment becomes minimal. Under the terms of this program, railway mortgages are provided to young employees at a rate of 10.5%, and for more experienced employees at a rate of 12%.

Age requirements include 19 to 65 years of age at the time of calculation. The recommended salary should be twice the pay. Purchasing with such conditions may only be possible for employees of the Russian Railways company.

Russian Railways mortgage for a young specialist

Relatively recently, it became possible for young professionals to obtain a mortgage for their own home using a company current account.

This is done to attract young and talented personnel, reduce turnover and increase labor productivity.

Banking institutions provide reduced interest rates on mortgage lending for businesses. The losses of financial institutions are covered by the companies that hire the employee.

The railway company offers the following conditions:

- Providing a loan in national currency;

- At an annual interest rate of 10.5% (only two of them are charged from the occupying employee);

- No down payment required;

- The duration of the loan is more than twenty-five years.

Each of the Russian Railways employees can apply for a mortgage at their workplace by signing an agreement with their employer.

The issuance of preferential loans provides the railway company with guarantees of work activity for the term of the mortgage loan.

If an employee is dismissed before the deadline, part of the funds will have to be reimbursed back, and the interest rate will also increase.

How to get a social mortgage

If an employee of a budgetary institution, law enforcement agency or Russian army is interested in receiving preferential loans, then he will have to adhere to the following procedure:

- Apply for government support directly through your leadership in a timely manner.

- Wait for approval of the preferential lending program and obtain appropriate documentary evidence.

- Select the most suitable property and contact the bank with documents and an application for a preferential mortgage for a young specialist.

- When the loan is approved, enter into a loan agreement and take out insurance for real estate and other risks.

- Make the initial payment yourself, or use a government subsidy for this.

Subsequently, after registering the property in Rosreestr, transfer all necessary documents to the lender within 90 days. Subsequently, all that remains is to repay the loan on time. In this case, the corresponding subsidy can be spent on repaying the loan in equal shares, or in full with partial or full early repayment.

Important! It should be understood that the state cannot refuse subsidies to an employee if he meets all the parameters; in turn, the lender has the right to refuse a preferential mortgage if the borrower does not meet a number of requirements.

Features of lending at Sberbank and other financial institutions

Banks offer different lending conditions, as does Sberbank for public sector employees with a social mortgage, but all of them are aimed at facilitating a mortgage loan for them.

| Bank | Interest rate and special conditions | Credit term | An initial fee |

| Sberbank | It is not necessary to take out life and health insurance. Rate 9.5% | From 20 to 30 years depending on the loan program | 20% |

| VTB 24 | Rate from 8.5% | Up to 25 years | From 10% |

| Rosselkhozbank | There is a mortgage for military personnel. Rate from 12% | Up to 25 years | From 10% |

Conditions of the “Social Mortgage” until 2018

Let us immediately note that each region and constituent entity of the Russian Federation has its own social housing lending programs, and imposes certain requirements on citizens who want to take advantage of this program. It is for this reason that the conditions in force in your city need to be clarified with the Administration.

What types of government assistance are there:

- Partial subsidization of mortgage interest rates. In other words, the bank assigns you one rate, and the state reduces it by a certain amount. Thus, you reduce your expenses, monthly payment and final overpayment. It is noteworthy that this form of support can be implemented both through government subsidies and through special offers from the bank itself,

- Subsidy for payment of the down payment or part of the cost of the purchased property. In this case, you receive funds that partially cover your debt. On average, it ranges from 30 to 40% of the estimated cost of housing, the exact amount will depend on the number of family members and the cost of one square in your region,

- Sale of real estate from social housing stock. In this case, the price will be preferential, i.e. much lower than market value. Most often it is offered to employees of various government agencies.

It is noteworthy that you cannot choose which form of support you want to receive. The decision in this situation is made by local authorities, who individually select the most optimal solution for each application.

Who can participate in the program

Who can call themselves a young specialist and participate in the program:

- The first and most important thing is a university graduate who gets a job in the first year after graduation;

- The second is that the graduate does not just find a job, but in the direction of a higher educational institution;

- The graduate must be from a budget department;

- Successfully passed the state exam and defended his diploma;

- Employed - officially;

- The participant’s age does not exceed 35 years;

- He is on the waiting list for improved living conditions.

What specialties does this apply to? As a rule, these are budget positions:

- Teacher;

- Military;

- Doctor;

- Scientist;

- Police officer;

- Employees of the Russian Railway and other budget sectors.

But if a private company subsidizes such support for its employees, then they can also participate.

Since the lender is the bank, its requirements for borrowers must also be taken into account. Average parameters:

- Age from 20 to 65 years;

- Citizenship and permanent residence in the Russian Federation;

- Official employment with an income that allows you to pay the requested amount;

- Positive credit history and no criminal record.

The financial institution looks at the length of service at the current place of employment; as a rule, the required period ranges from 3 to 6 months. If a co-borrower is involved, for example relatives, then his income can also be taken into account. The spouse automatically becomes a co-borrower, so the same requirements are put forward to him. You will need a marriage registration certificate, a marriage contract, a passport and the written consent of the spouse.

If the borrower and his spouse have children, they can also submit an application for consideration of a housing loan for families with children. The necessary condition is that there be at least 2 children and at least one child was born no earlier than 2020.

The family of a young specialist can also use maternity capital to pay for the loan.