Federal State Institution “Federal Administration of the Savings and Mortgage System of Housing for Military Personnel” (“Rosvoenipoteka”) is an organization that provides assistance to military personnel participating in the “Military Mortgage” housing program. It is in charge of not only keeping track of savings, but also facilitating the process of purchasing real estate, from informing participants to processing and issuing targeted loans for the purchase of housing. Program participants can receive some of the services online using their Rosvoenipotek personal account.

Personal account features

The Rosvoenipotek personal account allows registered users to use the full functionality of the site and perform the following actions:

- Receive an answer from a specialist to a personal question regarding the operation of the mortgage savings system.

- View information about the status of your personal savings or mortgage account.

- Get acquainted with current programs for purchasing housing from system partners.

- Use the help section containing contacts, procedures for participating in the mortgage program and other useful information.

- Manage your subscription to mortgage savings program news.

- Make changes to your personal profile settings.

How can you use your military mortgage savings?

The funds available in a serviceman’s account can be accessed only after he has completed more than 20 years of service in the Army. After the death of an NIS participant who dies while performing his official duties, the right to use the accumulated funds passes to the heirs.

Funds can be used to pay off civilian real estate loans for the following categories of military personnel:

- dismissed due to health;

- dismissed due to retirement age;

- dismissed for family reasons or as a result of layoffs.

If the length of service is more than 10 years, then the mortgage payment contribution stops, and all obligations to repay the home mortgage are transferred to the owner. If a serviceman leaves before reaching ten years of service, his account is canceled and the funds are returned to the federal budget.

You can use your right to accumulated funds to purchase real estate with collateral, purchase housing through equity participation, as well as to pay the down payment for mortgage lending and monthly payments. Although the acquired housing space becomes the property of the soldier, it continues to be pledged to the bank and the state until the last payment for the home mortgage is paid off.

I would like to note that after reaching 20 years of military service in preferential terms, a participant in the mortgage system can use the accumulated funds at his own discretion and spend them not only on the purchase of real estate.

The number of requests for payment of their savings is also not limited by law, if the soldier continues to serve and has already used funds from an individual account once. Military personnel who have served 10 years but were dismissed on preferential terms also have a similar right.

If a soldier resigned from service in the Army on non-preferential grounds, but already used the money for the purchase of an apartment for its intended purpose, then it will need to be returned to the state within ten subsequent years from the date of dismissal, and the mortgage loan must be paid on its own, including interest, which will already be equal to refinancing rate of the Central Bank of Russia.

According to a request to the FSSP of Russia, funds that are in special NIS accounts are not the participant’s income and cannot be withheld to pay alimony to minor children and persons equated to the category to which alimony is due.

You can read more about military mortgages upon dismissal in nuances in a separate post.

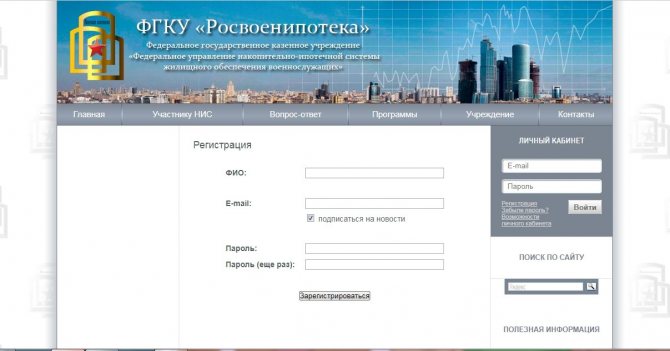

Registration and login to your personal account

Registration of a personal account is available to everyone, and not just current program participants, through the official website of Rosvoenipoteka. To implement it you need:

- In the upper right corner of the main page of the site, find the “Personal Account” section and select the “Registration” tab.

- In the window that opens, enter your full name, email address, desired password with confirmation and click “Register”.

- Upon completion, a window will open confirming your registration. Now access to the personal section of the site is available by e-mail and created password.

Next, current participants in the savings program are recommended to completely fill out their profile in the appropriate tab. This will allow you to request information on the status of your personal account in the future.

You can also recover the password to access your Rosvoenipotek personal account from the main page of the site by selecting the “Forgot your password” tab under the fields for entering your login and password and entering your registered email address. Instructions for data recovery will be sent to the specified e-mail.

- Official website: https://rosvoenipoteka.ru

- Personal account: https://rosvoenipoteka.ru

- Hotline phone number: +7 495 693-56-49

Military personnel's personal savings

A citizen who decides to connect his life with service in the armed forces of the Russian Federation automatically becomes a participant in the savings-mortgage system (NIS). The program provides for the opening of a personal account in the name of a military personnel. Funds are credited from the budget to the personal account to ensure the housing obligations of the Ministry of Defense to the contractor.

Personal savings are formed annually. The opportunity to purchase housing with a military mortgage appears before retirement, but not earlier than 3 years after registration in the NIS register. During this period, the amount of personal savings of the serviceman will be enough to provide a down payment on the mortgage.

At the beginning of 2020, the rules are relevant, but the government is developing amendments to the Federal Law on military mortgages. There are proposals to increase the time period allowing a citizen to take advantage of the benefit:

- Under current conditions, a contract soldier can use the savings after 3 years of service.

- According to the new rules, such an opportunity will arise only after 10 years of service.

Under the terms of a military mortgage, a citizen must be in service for at least 20 years, with the exception of a number of circumstances. During the entire period, savings are credited to the personal account in the amount provided for by the federal budget.

Registration

The registration procedure is quite simple and does not require additional confirmation. Absolutely anyone can register it; you just need to indicate your individual registration number, as well as the date of entry into the NIS register. Only after registering the client in this register will he have access to government support in the form of a preferential mortgage.

To complete the procedure, you should enter the address rosvoenipoteka.ru, then click the “Registration” link. When all the data is filled in along with the login and password, the site will confirm the success of the operation.

Look at the same topic: Electronic registration of a mortgage through Sberbank - what are the benefits? Advantages and disadvantages

Welcome to your personal account

Registered users of the website rosvoenipoteka.ru, along with logging into their personal account (PA), have access to some additional features:

- find out the amount of funds accumulated in the personal account of an NIS participant available for the purchase of a home;

- find out/clarify how much money goes into your personal account every month;

- receive a certificate of accruals and related deductions from salary;

- ask any question regarding the savings-mortgage system to the specialists of Rosvoenipoteka or find the answer by going to the tab of standard questions and answers on NIS.

A big inconvenience that the owner of an account on the Rosvoenipoteka website should prepare for is that it takes at least a month to wait for a response to each request sent from your personal account. But the point here is not the slowness or sluggishness of the administration of the web resource - this order is established by legal acts.

It should also be remembered that a request sent from the personal account or from an electronic mailbox to the email of the Federal State Institution "Rosvoenipoteka" is not considered by it as an official request. To receive a response from the institution in the form of an official document, you need to apply in one of two ways:

- By Russian Post (preferably by registered mail).

- Through the electronic reception of the head of Rosvoenipoteka on the website of the Ministry of Defense of the Russian Federation.

The login form for your personal account is located at the top in the right sidebar (column) of rosvoenipoteka.ru.

Immediately below it are hyperlinks to the pages:

- registering a new user;

- password recovery;

“Personal Account Features”, which contains instructions on how to register on the site and use the Personal Account.

The registration procedure is simple, logging into your account is even simpler. And although tracking a package of Rosvoenipoteka documents online is possible without authorization on the site, it won’t hurt to gain access to the functionality of your personal account.

How to find out the amount of funds in your account

The task of the office is to provide complete data on the status of an open personal account. In order to obtain information about the total amount of savings, you just need to send a request. You will receive an answer from the employees within a month. At the same time, you can order an electronic duplicate of your NIS certificate along with a schedule of your debt.

Look at the same topic: How to get advice on a mortgage at Sberbank: contacts and phone numbers

The website states that the answers sent are in the nature of a consultation. They cannot be further used as official information. To obtain a truly official response, a written request must be submitted. It must be sent to the legal address of the organization or via electronic mail. The response period for such a message is also limited to 30 days.

Rosvoenipoteka is a large enterprise that helps military personnel obtain housing. The organization keeps track of savings, studies the procedure for purchasing real estate, and informs its clients about innovations. The organization also provides assistance in obtaining mortgages and targeted loans.

What is it and why is it needed

A personal account is needed for clients and NIS participants. To access it, you need to create a personal account.

Clients receive a more complete range of available services:

- Possibility of online chat-type communication;

- Clarify information on the mortgage system;

- Subscribe to news;

- Monitor information on payments and balances of mortgage and savings accounts;

- Learn about new programs for the purchase of various forms of real estate;

- Use the help services, which indicate contacts and rules for participation in the program;

- Change credential settings;

- Apply online to participate in the NIS;

- Get information about all the intricacies of taking out a mortgage;

- Register in the official register;

- Arrange for home insurance services yourself;

- Monitor new advertisements for the sale of real estate;

- They can ask questions, and so that they are not duplicated, they recommend that you first carefully study the “Model Answers” and write to the chat when there is no similar question.

Accrual conditions

The size of the state subsidy for the military does not depend on rank, length of service, salary, or region. The amount is the same for all participants in the military mortgage.

If the contract is terminated before 10 years of service, the state stops payments. If a serviceman managed to use the mortgage funds and left service, he is obliged to reimburse everything with personal funds.

Changing the rules for creating savings

- Until 2020, personal savings were transferred to the account monthly. The total annual amount provided for by the federal budget was divided into 12 equal parts. A decision was made to make a one-time transfer of savings at the beginning of the year. The date for crediting funds was determined to be the period until March 20 of the current year.

- Since 2020, the amount of savings has been constantly changing, due to inflation. In 2020, the one-time benefit for military mortgages amounted to RUB 268,465.6. In 2020, the amount increased and is equal to 280,009.7 rubles.

- The bonus of innovations is the interest that goes to the military’s personal account from the income on the deposit. The greater the amount of savings, the better the financial situation of the account owner.

- The savings limit for military mortgages increases annually. You can count on this amount when purchasing a home. In 2020, the state assumed the obligation to pay mortgage payments in the amount of up to 2.2 million rubles. In 2020, the limit increased to 2.4 million rubles. This condition does not limit the serviceman’s choice of housing. But if its value exceeds the established limit for a military mortgage, the citizen will have to pay off the difference from his personal income.

Look at the same topic: Mortgage for a family with 2 children in [y] year: conditions, state support for mortgages