Brief information about banks

Sberbank operates not only in Russia, but also in other countries.

The number of branches reaches 20 thousand. The most favorable lending and service conditions determine that the bank ranks first among credit institutions in the country.

Many citizens are accustomed to trusting this bank, since since the times of the Soviet Union it has been and remains one of the most reliable.

VTB 24 Bank was created to serve individuals and legal entities.

This is a commercial bank and also has a subsidiary branch, Pochta Bank.

Individuals are offered favorable conditions for lending and opening deposits, transactions with personal accounts; legal entities can also count on commercial programs.

The bank ranks second among lenders that issue mortgages and car loans. Only Sberbank is ahead of it.

Mortgage programs

The mortgage programs of the compared banks differ not only in names, but also in conditions, since each bank modifies them to suit its needs and interests and its clients.

There is widespread support for government programs from both banks.

Video on the topic:

In Sberbank

- Housing in new buildings - it is proposed to participate in shared construction or buy a ready-made apartment from the developer with a mortgage. Interest rates are set at 10.9%, the loan is issued for a period of up to 30 years.

- Purchasing finished housing is a program for purchasing housing on the secondary real estate market, including apartments, houses or rooms. Mortgage interest rates are set at 10.75%, loan term up to 30 years.

- Mortgage plus maternity capital allows maternity capital to be made as a down payment for the purchase of real estate of any type. Interest rates range from 12.5%.

- The construction of a residential building involves independent construction on an existing or leased land plot; a mortgage is issued for the purchase of building materials. Interest rates will range from 12.25% per annum.

- Country real estate - the program provides for the purchase of your own house or its construction in areas intended for these purposes, as well as a summer house or garden house. Mortgage interest rates will range from 11.75%.

- Military mortgage - the program is a support of the state system and provides for lending to military personnel on preferential terms with payments from the state. Interest rates are set from 11.75%.

Useful video:

In VTB 24

- Buying ready-made housing offers clients the opportunity to purchase secondary market real estate on favorable terms, which include interest rates of 12.6% and a down payment of 10%.

- An apartment in a new building - buying housing with a mortgage on the primary development market. The bank offers more than 100 accredited properties and developers who work with VTB 24 Bank and support government programs and preferential conditions. Interest rates are set from 12% with a down payment of 10%.

- Mortgaged real estate - the program offers clients to buy out housing that is put up for public auction after being confiscated from a borrower who is behind on mortgage payments. Interest will be from 12% per annum.

- Mortgages for the military offer military personnel participating in the savings system a mortgage on preferential terms with government payments. The down payment is the amount from the military’s personal account, which must be at least 15% of the cost of housing, and interest rates are set at 12.1%.

- Victory over formalities - a program that allows you to obtain a mortgage using only 2 documents. The interest rate will be from 12.5%.

- A loan secured by existing housing offers more favorable conditions and a waiver of the down payment on the mortgage due to additional guarantees in the form of collateral of the property the borrower already owns. Interest rates will be slightly higher - from 13.6%.

- Refinancing a mortgage loan - provides for the payment of a mortgage opened in another bank using funds received from VTB 24 on more favorable terms. The interest will be from 12.6%.

- More meters - lower rate - a program that is new to the market of banking offers, which provides for the purchase of housing on a mortgage with a large area of 65 square meters, for which the interest rate is reduced by 1%.

Advantages of servicing at VTB

VTB 24 is positioned on the market as a bank for corporate clients and private businesses. But the number of new programs for individuals and interest rates convince us that this structure works with clients of all categories, including individuals.

VTB 24 has developed remote systems for round-the-clock access to accounts for both individuals and individual entrepreneurs, enterprises and corporations. Individuals successfully use the mobile offer for smartphones based on Android and iOS. As well as a full-fledged version of Internet banking via the website.

Lending at VTB

Cash loan from VTB Bank

| Max. sum | RUB 5,000,000 |

| Bid | From 6.4% |

| Credit term | Up to 7 years |

| Min. sum | 50,000 rub. |

| Age | From 21 years old |

| Solution | From 2 minutes |

One of the most common bank services is issuing loans. The most popular product is a cash loan:

| General terms | Minimum | Maximum |

| Interest rate | 10,9 % | 19,2 % |

| Sum | 100,000 rubles | 5,000,000 rubles |

| Loan period | 12 months | 84 months |

The most favorable conditions are provided for clients who receive wages from VTB. But the bank offers all clients a unique offer to reduce the interest rate, both preferential and basic, by 3%. To do this, the borrower will need to apply for a Multicard credit card. Then, in your personal account, enable the “Borrower” option. The interest-free period on the card lasts 101 days.

Credit card VTB Multicard

| Credit. limit | 1,000,000RUR |

| Proc. bid | From 16% |

| No interest | 101 days |

| Price | From 0 rub. |

| Cashback | Up to 4% |

| Solution | 1 day |

The interest rate on the loan is reduced by making non-cash payments with a plastic card. The bank automatically recalculates the interest rate after each payment in a store or restaurant. The bank refunds the plus difference that arose during the recalculation to the card until the end of the next month.

For those clients who find it difficult to obtain 2-personal income tax to apply for a loan, VTB 24 makes concessions. You can fill out a simplified version of the income document - a certificate in the bank form, which will be certified by the employer of the potential borrower. It requires the signatures of the manager, chief accountant and the seal of the organization.

Another bonus from VTB Bank when applying for a cash loan is the planned credit holidays. Once every six months, the client has the right to “skip” one monthly payment. And this will not affect the borrower’s credit history in any way. The only condition is that the payer must notify the bank in advance of his intention to take advantage of the credit holiday. Before the next loan repayment date, you will need to call the hotline or go to the bank office.

Refinancing at VTB

Interest rates under the VTB refinancing program are the same as for cash loans.

Additional benefits that clients receive:

- no need to register a deposit or look for a guarantor;

- it is possible to combine up to 6 loans and credit cards opened in other financial institutions;

- you can submit an application for a larger amount than the currently formed accounts payable and receive free money to solve current problems;

- free transfer of funds received under the refinancing program to other banks to close old loans.

Refinancing loans from VTB

| Max. sum | RUB 5,000,000 |

| Bid | From 6.4% |

| Credit term | Up to 7 years |

| Min. sum | 50,000 rub. |

| Age | From 21 years old |

| Solution | 5 minutes |

VTB offers benefits for salary clients under its refinancing program. There is also an option for credit holidays. In addition, clients receive the following benefits:

- payment is set on one day, and not as before, while there were several loans;

- due to benefits and bonuses, the overall overpayment for using borrowed money is reduced;

- if the monthly payment is too high for the borrower, then VTB individually revises the interest rate or extends the repayment period;

- VTB does not charge fees for issuing funds or for early repayment;

- if under one of the previous loans property was registered as collateral, then it can be withdrawn from collateral, because this program operates as a cash loan;

- When providing data on previous loans, there is no need to take certificates and statements if the client has connected the Internet banks of those credit institutions.

Mortgage at VTB

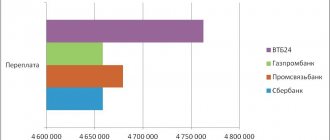

To choose where it is more profitable to take out a mortgage in VTB or Sberbank, you should compare similar products of these banks with each other.

| The name of the program | Rate, % | Duration, in years | Amount, million rubles of the Russian Federation | Down payment, % |

| Secondary housing | 8,9 | 30 | 60 | 10 |

| New building | 8,9 | 30 | 60 | 10 |

| With state support | 5 | 30 | 12 | 20 |

| When purchasing from 100 sq. m | 8,9 | 30 | 60 | 20 |

| No proof of income | 9,15 | 20 | 30 | 30 |

| Refinancing a mortgage from another bank | 9,3 | 30 | 30 | No fee |

To obtain a mortgage, each program has its own set of documents. It can be found on the bank’s official website, in Telebank or in your personal online banking account. A hotline specialist or an office employee can also advise you on this issue in person.

Conditions and requirements for the borrower

In order to get a mortgage from banks, you must meet the following requirements:

- Age restrictions;

- Requirements for stable income;

- You may need to register at the place where the property was purchased (Sberbank);

- Have at least a year of work experience, and at the current place of work - 6 months.

Depending on the chosen program and the benefits it provides, additional requirements may be established for borrowers and co-borrowers.

Bank conditions include interest rates, down payment amount and loan term, which differ depending on the chosen program.

What will Sberbank please?

Sberbank provides loans for the purchase of various types of housing: finished or under construction, as well as country houses.

At the same time, there are privileged categories of borrowers who can receive loans at a lower interest rate, with a small down payment, as well as with a deferment in interest payments.

Such “generosity” is possible thanks to the significant resources at the disposal of the country’s largest bank, as well as government support. This concerns support, first of all, for those who are planning to purchase a new home.

This kills two birds with one stone:

- people get the opportunity to improve their living conditions;

- builders - to sell the products of their labor.

The loan is issued at 12% in rubles. This program has been extended until the end of 2020.

Special attention is paid to young families and families with newborn children. In addition to preferential terms of the loan, it is possible to use maternity capital to repay part of the loan amount. This applies to the purchase not only of new housing, but also of ready-made housing: mortgages are provided at 12.5% per annum.

Read more about mortgages for a young family :

Quite attractive loans are provided for military personnel: although the Military Mortgage program limits the loan period to fifteen years (previous options have an upper time limit of 30 years), the percentage remains at the same level: twelve and a half.

Read on the topic: RKO in Delo Bank

Advantages and disadvantages of banks

Both banks under consideration have both their advantages and disadvantages. Compare them yourself to make your decision. Below we will provide information you should pay attention to.

Video on the topic:

Sberbank

The advantages and disadvantages of Sberbank are presented in the table below.

| Advantages | Flaws |

| High reliability of the bank. | Review of applications and documents takes longer than in other banks due to the large number of clients, as well as the careful procedure for approving the borrower's candidacy. |

| The most acceptable down payment on a mortgage than in other banks in the amount of 10%. | For clients who have not previously cooperated with Sberbank, higher interest rates will be established than for salary ones. |

| The opportunity to use a state housing certificate or maternity capital funds. | Thorough verification of income and registration near the bank branch. |

| Loyal requirements for the object of purchase. | The mandatory participation of the other spouse as a co-borrower is not acceptable for everyone. |

| Low interest rates that are reviewed regularly. | Fines for late payments. |

| Location of the banking network throughout Russia. | — |

VTB 24

The advantages of the bank are:

- Constant development of new offers and improvement of programs;

- No less widely known than Sberbank;

- Possibility to submit applications online;

- Fast review and decision-making procedure;

- Availability of a simplified procedure for 2 documents;

- No registration is required at the place of purchase or at the bank branch - you just need to have an official income.

The following points can be identified as shortcomings of the bank:

- A higher down payment of 20% (however, this is only in comparison with Sberbank);

- A very meticulous procedure for checking the collateral;

- Strict conditions for late mortgage payments.

Product line of Sberbank and VTB 24

Sberbank

The institution is focused on serving all segments of the population; minimum service packages have been developed for each social group. Bank deposits are opened from a small amount at market average interest rates, which allows the institution to confidently accumulate significant funds in its accounts.

Special loyalty programs are developed for pensioners and clients receiving salaries through the bank. The financial institution works a lot with small consumer loans and is involved in servicing social programs.

The bank's priority is to provide services to individuals living in the area where the branch is located. “Alien” clients who do not have a payment history will be forced to use more expensive loans than clients loyal to the bank.

The bank is expanding the scope of online customer service through the development and improvement of the Sberbank Online program, which also has a mobile version (recognized as the best according to Global Finance magazine 2020 in Central and Eastern Europe), and mobile banking applications.

A large flow of clients, high staff workload, and careful selection of borrowers lead to slow consideration of loan applications (from 10 to 30 days).

VTB 24

Focuses on servicing legal entities and individuals of the “middle weight category”. Deposit rates are several points higher than at Sberbank, but the minimum deposit amount starts from 100 thousand rubles. Similarly for credit programs - interest rates exceed the level of Sberbank, but the bank is ready to provide large sums to its clients.

The institution is actively working on loyalty and convenience programs for regular customers, it reviews applications quickly, and has its own criteria for checking the client’s creditworthiness.

The bank is technologically advanced, constantly working to develop and improve its own software products, and has its own excellent Internet banking system, Telebank, which is absolutely not inferior to a similar software product from Sberbank.

Both banks are actively working with real estate lending programs, to some extent they are “trendsetters” in this area and a guide for other banks in interest rate policy and methods for screening out weak clients.

Which bank to choose?

Having considered all the conditions and features of mortgage programs in Sberbank and VTB 24, it can be argued that it is not for nothing that they are both so popular among their clients.

Both offer fairly favorable terms and low mortgage interest rates, as well as an unlimited selection of properties for purchase.

Which bank to choose is up to each person to decide personally, based on the individual characteristics of the situation.

Useful video:

A mortgage from Sberbank can be recommended to older people who are accustomed to trusting this bank and not being afraid of lengthy checks just to be confident in the reliability of the lender.

Young people who, due to their profession and the rhythm of life, are in a constant rush, and are also well versed in computers to apply online, should pay attention to VTB 24 programs. Also in this bank it is possible to take out a loan for a smaller amount without an income certificate, which is convenient for some.

Thus, we recommend paying attention to VTB 24 Bank, which keeps up with the times and also provides large amounts.

Let's summarize:

- When choosing a bank, consider all special conditions

(discounts, promotional rate reductions, the possibility of using benefits, maternity capital, participation in regional programs to improve housing conditions), this will help you save from 12 percent over a loan term of 10 years, and from 25% of the total overpayment for 30 years, and this is only provided that you get a loan at least 1% less than from another bank. - When applying for a loan, soberly assess your capabilities

. It is difficult to be 100% sure that you will not lose your job in the next 10 years. It is better to choose loans for a longer period, but at the same time, if possible, make additional payments that will help reduce overpayments, or gradually reduce the monthly load. - If you are confident that you will be able to repay the loan in a shorter period, then it is better to immediately reduce the loan term

, thereby reducing your upcoming overpayments to the bank. - As for insurance, this is, of course, a good way to reinsure yourself just in case

. And if it is really less than 1%, which the bank will add if it is rejected, then it is better to apply for it. Moreover, in the first year you can apply for it, and the next year refuse it if it is more financially costly for you than if you overpaid interest by 1%.

Reviews

Vasily, 52 years old : “We took out a loan from Sberbank 10 years ago to buy an apartment. We didn’t think twice about it because we have been using the services of this bank for a long time. The meticulousness of the verification procedure did not irritate me at all, but rather pleased me, since this not only shows the bank its reliability, but also its clients. Interest rates are low, and we took out a loan for 15 years, so the monthly mortgage payments are quite affordable, and we don’t have any difficulty paying them off.”

Snezhana, 35 years old : “When we decided to get a mortgage, we were looking for an option that wasn’t very difficult, since my husband often goes on business trips, and I stay at home with the child, so we don’t have time to collect documents and go to different authorities. We settled on VTB 24 bank, since it provides for online processing of almost all transactions, as well as the submission of only 2 documents. We showed up at the VTB 24 bank branch only when we signed the agreement. My husband’s income allows me to easily pay monthly mortgage payments, they are simply withdrawn from his card and now we can live in our own apartment, rather than moving into rented apartments every time.”