Buying real estate has become a great luxury if you do not have large funds. But there is a way out; mortgage lending allows people with different income levels to purchase real estate. Sberbank is a leader among other banks in issuing mortgage loans, thanks to its low interest rate.

A mortgage from Sberbank allows all citizens of the Russian Federation to improve their living conditions.

If you are a regular user of Sberbank services, this will be an advantage when applying for a mortgage. Special bonuses and offers are available for clients of this bank.

Early repayment of a mortgage loan

Mortgage lending has become one of the ways for Russians to purchase housing. When purchasing real estate on credit for a long term, many try to pay it ahead of schedule . Monthly payments involuntarily suggest that it is time to pay off the bank. It is of course beneficial for the bank if you make payments throughout the entire term, because the overpayment amount is quite large. But is this beneficial to the borrower? Of course not. Therefore, you decide for yourself how long you want to repay the debt; it is not necessary to pay the entire term.

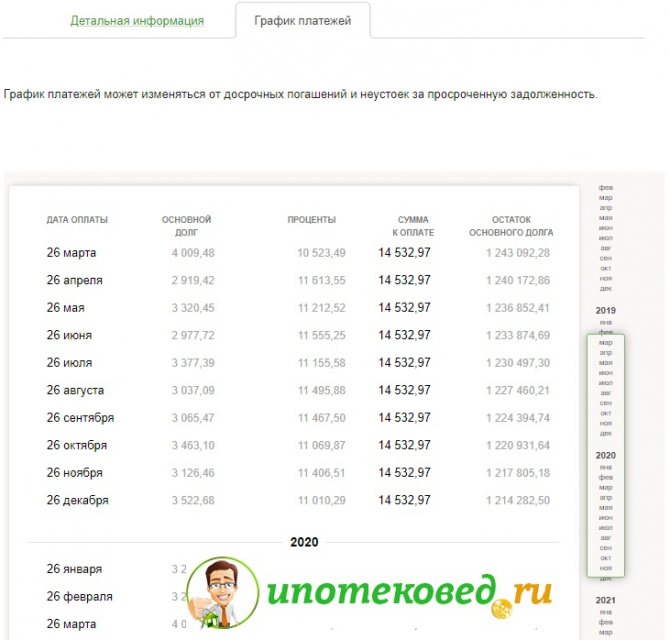

The bank evenly calculates and distributes the interest rate on overpayment across all payments; when a large amount is deposited, the interest rate on overpayment is reduced, and further payments become smaller. Obtain a new payment schedule from the bank operator; due to changes in the total amount, the monthly payment is revised.

When mortgage lending first appeared , Sberbank set a time frame within which full or partial payment of the loan was possible; several years had to pass and only then could you deposit a large amount and fully repay the debt . Today there is no such rule, so you can deposit the required amount at any time. Even 30 days after taking out the loan. All you need is a written notification that you want to repay the entire amount in advance.

Remote loan repayment using the mortgage agreement number

We'll tell you how to repay a mortgage or consumer loan from a third-party financial institution early in Sberbank Online.

The procedure for repaying a loan received in another financial institution. institution, through Sberbank online banking looks like this:

- the borrower is authorized;

- in the payments and transfers section, finds the function of paying for loans from other banking organizations;

- selects the function of transferring to third-party finance. BIC institution;

- indicates the necessary data from the loan agreement and proceeds further;

- In the form, indicate information about yourself: full name, phone number;

- indicates the details of the loan agreement and the transferred amount;

- After checking the entered data, confirms the transaction with a time code

After this, the transaction receives the Completed status.

Before making an early payment on a mortgage in Sberbank Online, the borrower needs to notify the lender about this. To do this, you must submit an application to the financial institution about your desire to repay the mortgage loan before the specified date. This is done both in a bank branch and online. This must be done at least one day before payment. Otherwise, the funds will be credited in the coming month.

Recommended article: Mortgage for employees of the Ministry of Internal Affairs

You must indicate all the parameters of the mortgage loan (amount, period, interest rate, etc.). The document also contains the client’s personal information.

An application must be submitted to the bank office where the loan product was issued. The application form is issued to the borrower upon presentation of the original Russian passport.

For remote submission you need:

- pass authorization;

- go to the loan repayment section;

- indicate the account from which funds should be debited, the date of payment and the amount of the deposit;

- To confirm the operation, specify the temporary password from the message.

Note! This way you can only reduce the monthly payment. If you want to shorten the loan term, you should visit the office of the financial institution and inform the manager.

We'll tell you how to repay your mortgage early through Sberbank Online. For this:

- We call the lender and find out the correct amount to close the loan;

- log in to your virtual bank account;

- We find the section for complete loan closure;

- indicate the amount reported by the Sberbank operator;

- We confirm the transaction and send the application to the bank.

How to repay the entire amount early

For long-term lending, an agreement between the borrower and the bank is drawn up, which specifies all the points that all parties must comply with. The agreement must specify in detail that the borrower has the right to partial and full early repayment of the mortgage. If the loan is repaid early, the borrower can contact the bank to recalculate interest, but only if this clause is specified in the agreement. Recalculation of interest on the loan significantly reduces the payment amount.

Algorithm of actions for early repayment of a mortgage at Sberbank, you need:

- Contact the bank operator to clarify the remaining loan amount;

- Provide a written statement stating the exact amount contributed by the borrower;

- Deposit the amount into the account;

- After paying off the mortgage debt, obtain documentary evidence of the fulfillment of your obligations to the bank;

- Terminate the mortgage agreement;

- Close the account to which the loan payment was received;

- Contact the insurance company for a refund of the insurance policy premium.

It is necessary for the borrower to complete all actions so that new circumstances related to non-payment of the loan are not revealed later.

Methods

There are a lot of options for paying for a bank loan; we list the features of the most common ones:

- Bank operating cash desk. One of the simple and accessible, and most importantly, reliable methods used by older people. On the day of payment, or better yet in advance, visit the branch with a loan agreement, personal passport and the required amount. Tell the operator your personal information and contract number and make the payment. The advantages of this option are undeniable: money is credited to the account accurately, without commission, but you need to calculate the time, since there may be a line at the cash desk.

- ATM/terminal. Payment through remote access devices is carried out in two ways - using a card or cash, for which you select the appropriate menu item. But please note that the operating hours of ATMs and terminals may depend on the work schedule of the premises in which they are installed.

- Sberbank online , including a version for mobile phones. The most comfortable methods, since payment can be made from any locality, 24/7, but require access to the Internet and some skills in using software applications.

The borrower, depending on technical capabilities and experience, chooses the most comfortable method for himself. But, unfortunately, mistakes made can lead to the formation of debt on obligations, which is associated with the accrual of penalties. To avoid miscalculations, we will present an algorithm of actions on how to pay for a Sberbank mortgage in different ways.

Recommended article: How to pay for Sberbank mortgage insurance - online, in Domklik

Step-by-step loan payment

If you have a large amount of money and you decide to partially pay off your mortgage , then this is a good idea. Partial payment of the debt reduces the amount of further payment. Before making a payment, you need to write an application and indicate the payment amount. After which the operator must recalculate the remaining amount and issue you with a new payment schedule. Today, many are trying to pay off their debt to the bank within 5 years in order to improve their financial situation.

Benefits of using Internet banking

The main advantage is the ability to pay your mortgage from home or office at any time of the day. No need to stand in line, track the work schedule of the Sberbank branch. Transfers between accounts in the same bank are carried out instantly and without making additional payments. Receipts confirming transactions can not only be received electronically, but also printed. And when the payment schedule is followed, the client does not face any penalties for failure to comply with the terms of the agreement, and the credit history will not be damaged.

Full payment of the amount

A one-time mortgage payment saves you from a large overpayment on the loan.

The procedure for full repayment of a loan is no different from partial repayment, only in that the entire amount is paid. You must fill out the application correctly 30 days before the desired payment. The bank approves this procedure for you, and you deposit funds into your current account. Make sure you enter the correct amount, if the amount is incorrect and insufficient payment is made, late payment interest will apply.

Remember! Under no circumstances can the bank prevent early deposits of loan funds. Early payment is your personal right, which is stated in the contract! By repaying your debt to the bank ahead of schedule, you will relieve yourself of a heavy financial burden.

Remote service agreement in Sberbank

The mortgage repayment service using an ATM is available to clients who have signed a remote banking agreement. This document regulates the provision of the following services:

- Opening and servicing of deposits;

- Registration of international bank cards;

- Opening of impersonal metal accounts;

- Rent of a safe deposit box;

- Conducting financial transactions using remote service channels and ATMs;

- Depository and brokerage services.

To sign the contract, the client must fill out an application and present a passport. Execution of an agreement is allowed if the client has an international Sberbank card.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

Download the Sberbank UDBO agreement

Payment via Sberbank Online

Today, the online payment system has made life much easier for modern people. No queues, easy access to the system saves our time, nerves and money.

There are several payment methods:

- Through the cash register;

- Payments Sberbank Online ;

- Transferring funds through an ATM.

One of the simplest and most convenient methods is payments through the Sberbank Online payment system.

The procedure is quite simple. Every modern person has the Sberbank Online , through which a large number of monetary transactions are carried out; it has made the life of a modern person significantly easier.

Also, through your Sberbank personal account, you can view the amount of the remaining debt and all transactions performed.

If you want to pay your loan debt online early, you must:

- Sberbank personal account (enter your login and password that you received when registering the bank online;

- Open the “Loans” section. Your entire credit history will open; you need to select the one you need.

- You will see the functions “partial repayment”, “early repayment” of the loan, select the required tab.

- The system will require you to enter data: the bank card number linked to this loan, the repayment date and the amount.

- After entering all the data, double-check the information and click “Submit Application” (you can submit an application even if you do not yet have the required amount in your account). Bank employees will review it on the same or the next day.

Funds will be debited from your account exactly on the day you indicated in the application. Therefore, do not worry, the system will automatically withdraw the required amount.

All receipts are saved and you can easily print them out if necessary. Paying online eliminates the need to enter incorrect data; some of your data has already been entered into the system, so what you enter manually will be checked by the support service; if the data is incorrect, you will be asked to enter it again. By using the services of Sberbank, you ensure complete security of your personal information and funds.

Treat this procedure responsibly, save all receipts and receipts for transactions. The most important thing is to get a certificate from the bank that your loan has been repaid, it is an official confirmation that you have paid the bank.

Sequence of payment using a card

If you pay for a loan using plastic, the sequence will look like this:

- First, insert the plastic into the ATM. To do this, you must first enter a password in the menu.

- Next, select the item called “Payments”.

- In the window that opens, go to the section responsible for paying for loans.

- Choose exactly how you will pay - by the number of the entered agreement or using a special barcode. The second method is suitable for those who have a receipt. If the latter is available, then it is enough to attach the code to a special reading device.

- If, on the contrary, you are going to make a payment using the number, you will need to enter the invoice from the loan agreement, which contains twenty numbers.

- If all the information is entered correctly, information about the debt and your account will appear on the screen. It is necessary to check the accuracy of the output data.

- Next, enter the amount you want to debit from the card.

- Once again, make sure that you have entered all the data correctly and click on the “Pay” button.

After confirmation of payment, the required amount will be debited from your card. In this case, you will be given a receipt, which it is advisable to keep to confirm payment.

You should remember that the loan is not credited immediately as soon as you deposit money into the ATM, but after a certain time when it arrives in your account. This may take from one or two minutes to several days. It is important to take this point into account when paying off a loan and pay the loan several days in advance, and not on the day the funds are written off.