Many citizens of the Russian Federation are interested in purchasing real estate, but not everyone can independently accumulate the necessary amount of money to purchase a suitable property. Substantial assistance is provided by lenders who provide large loans. When lending, a down payment is almost always required, but not everyone has the appropriate amount, which is why borrowers resort to such tricks as overpriced mortgages. At the moment, overestimating the cost of an apartment with a mortgage is a common practice, which is quite difficult for financial institutions to combat.

Difference in market and cadastral value

For any real estate, upon registration of ownership rights to it by the owner, the necessary technical documentation is additionally provided. In addition to certain information, it contains the cadastral value of the object. This value differs from the market price in the following ways:

- Over a long period of time, the value does not change and corresponds to the value specified in the document.

- The cadastral value of an object can be artificially low, since taxation is determined based on this value.

- The market price of an object reflects the current condition of the property and is established directly upon sale by the seller.

- The cadastral value is not affected by the current level of real estate prices in a particular region.

- These values are calculated in completely different formats and have different purposes in relation to the object.

Despite the presence of a number of differences, these two values are inextricably linked, since based on one value, another price tag is formed and vice versa. This practice is observed during the registration and subsequent sale of an object on the secondary real estate market.

Important! It should be understood that the artificial value of the market value cannot be excessively underestimated or overestimated several times in comparison with the cadastral price established in the relevant document.

Why do you need a down payment?

Almost all mortgage lending programs require a down payment, which ranges from 10 to 45 percent of the cost of the purchased property (some banks allow up to 65%). This mandatory contribution has the following main purposes:

- assessment by the lender of the solvency of the borrower who is interested in obtaining a mortgage and applies to the bank;

- established requirements of the Central Bank of Russia in relation to certain mortgage lending programs;

- reducing the lender's risk of incurring losses when providing a loan to an dishonest borrower;

- certain guarantees of the legal purity of the transaction for the acquisition of real estate.

At the moment, many lenders provide for issuing a mortgage without a down payment, however, they establish other requirements for borrowers, or require the presence of collateral. In other situations, the initial payment is a prerequisite for issuing funds to the borrower for the purchase of real estate.

Property value: market value or?

To register a pledge of an apartment, residential building or other property, the bank requires the market value. The term is defined in many legal acts. We will not burden the reader with complex valuation categories, let’s simply say: this is the value at which an object can be sold on the free real estate market, at a price that suits both the seller and the buyer, provided that the parties make their decision without the pressure of negative circumstances.

The term "salvage value" is often used. It is interesting to the lender because it informs them how much money can be gained from a quick sale of the property if, for example, the borrower is not creditworthy.

A “rough” calculation of the indicator that is sometimes used is the market value reduced by 20-30% or minus the down payment.

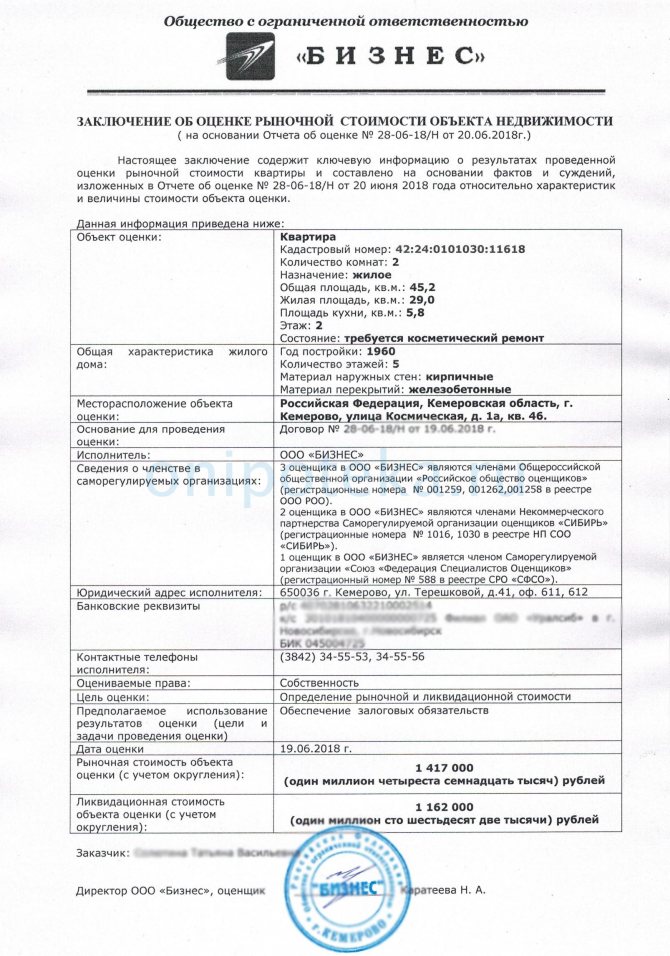

Extract from the assessment report

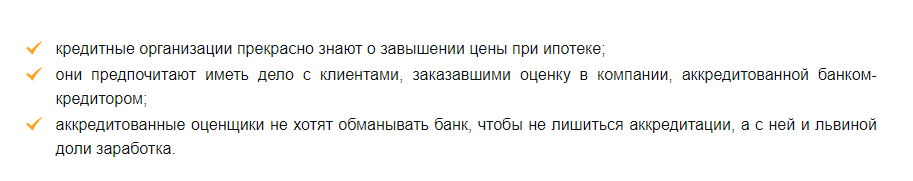

The value of collateral is assessed by expert appraisers. The result of the expert’s work will be a reasonable indicator of market value, which will be reflected in a document - a report. Lending banks are not ready to work with all appraisers, but in order to select the best, they carry out an accreditation procedure. The work rules that guide the expert appraiser are professionalism, independence of judgment, objectivity and impartiality.

For the lender, the correctly calculated market value is the “starting” figure for the calculation:

- mortgage down payment amount. Depending on the lending program, equal to 10-30% of the indicator;

- loan for the purchase of real estate. Lenders aim to lend 70-80% of the property's value.

Therefore, banks pay close attention to the assessment result obtained. If the borrower turns out to be insolvent, the property is put up for sale at the value calculated by the appraiser.

I also note that overvaluation is a fairly common reason for refusing a mortgage on such a property. That is, if there is a positive decision from the bank regarding the borrower, the bank also carefully considers the property. Each bank has an acceptable price range for all objects. Therefore, if you try to greatly inflate the price, the bank will certainly refuse. Or, at best, it will issue less mortgage money, while increasing the down payment.

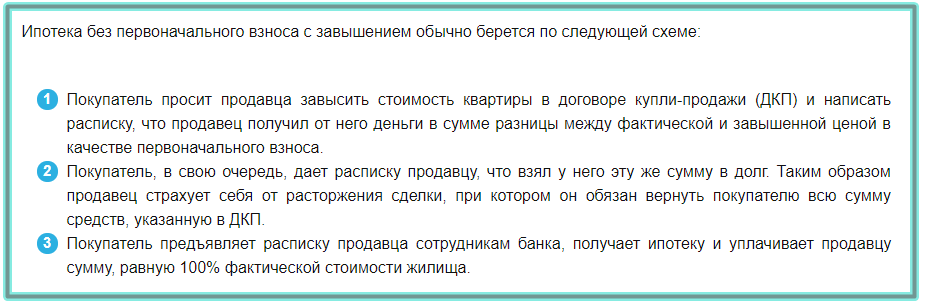

Why do they inflate the cost: diagram

In practice, when contacting Sberbank or any other lender, a small advance payment is required only for the purchase of certain types of housing. As for the secondary market (housing is most often purchased on the secondary market), a preliminary payment of 20 percent or more of the cost of the property is provided. That is why there is a scheme to inflate the market price of an object, when the borrower applies for a larger loan, while making a smaller initial payment. The situation looks like this:

- a borrower interested in a mortgage does not have enough money to make an advance payment;

- certain agreements are made with the seller to artificially increase the price of the real estate;

- the seller writes a receipt stating that the buyer provided him with a certain amount of advance payment for the subsequent execution of the transaction;

- in such a situation, the lender receives a certain guarantee that a certain percentage of the borrower’s funds is already participating in the transaction;

- further, the size of the required down payment is reduced, and in addition, the loan body itself increases.

Subsequently, new values are prescribed in the purchase agreement, but the transaction between the seller and the buyer is carried out on the same terms that they initially agreed on.

Important! This option for conducting a transaction is widespread in practice, but it carries certain risks not only for the seller, but also for the buyer himself.

Current problems in the pedagogical practice of distance school: overestimation and underestimation of grades

S.N. Kozlova, computer science teacher, State Budget Educational Institution “TsODT”

Current problems in the pedagogical practice of distance school:

overestimation and underestimation

Mark

is a quantitative expression of the assessment. The mark conventionally expresses a quantitative assessment of students’ knowledge, skills and abilities in numbers, or so-called points. There are facts of overestimation and underestimation of grades given in lessons. Inflating grades leads to a decrease in the level of students' preparation; underestimating grades causes the student to lose interest in learning and lose faith in their strengths and capabilities. Particularly difficult in applying the five-point system is the problem of two. Receiving a bad mark psychologically traumatizes the student and causes negative emotions in him. The psychological impact continues even when it is corrected by subsequent marks. Because of this, fair grading of students is important. The difficulty of using the five-point system is due to the fact that the established rating standards are average and indicative.

After all, if a child’s knowledge is assessed correctly, then it is easier for him to draw conclusions and, if necessary, pay more attention to a subject in which he is not strong. Or, on the contrary, it becomes possible to identify the presence of abilities in any area. The complexity of the problem lies in the fact that teachers are not always to blame. Sometimes children simply slander their teachers in order to somehow justify themselves to their parents for the bad grades they deservedly received. Therefore, in order to understand who is really to blame, the student or the teacher, the necessary measures should be taken. For example, it would not be a bad idea to involve a school psychologist in solving this problem. Conducting open lessons also helps to identify the causes on this issue. Sometimes the bias of teachers, namely inflating grades, is associated with the presence of children with wealthy parents who take part in the financial life of the school.

The optimal solution to prove your knowledge is to participate in the All-Russian Olympiad for schoolchildren in a controversial subject. Winning even at the school stage will demonstrate a sufficient level and quality of knowledge, which will be the best proof of the teacher’s bias.

Any parent understands that knowledge is more important than a formal number in a diary, but for a child, especially in elementary school, a grade plays a big role in creating motivation to study and forming internal self-esteem. For high school students, the grade affects the average score on the certificate, in addition, the opportunity to receive a gold or silver medal also depends on the ratio of “A’s” to “B’s” in graduating classes.

Every parent needs to know that it is simply not profitable for a teacher to artificially lower grades, since at the end of each quarter he reports on the quality of academic performance. And based on the results of his report, a conclusion is drawn about the quality of his teaching.

A middle-level student or high school student can approach the teacher and ask himself why, in his opinion, the grade is underestimated. As a rule, it is not difficult for a teacher to explain the criteria for completing written work and assess its degree of compliance with them. It is more difficult with an oral response. However, parents should be aware that according to modern educational standards, simply retelling a textbook is not practiced. Schools are moving towards project-based activities, and the project is usually carried out as a team, with parental participation encouraged.

And, besides, teachers are not only “people too”, but also “parents too”; they know children not only from work and often see where the child is being cunning, where he is not doing enough, where he is cheating

Reasons for overestimation:

- for efforts (mostly children justify themselves, they begin to try, knowing that they can get a good grade).

- for stimulation (if the child is not stimulated, he will lose all interest in learning. He will always think: try, don’t try, they won’t give you more than a “3”).

- weak students (hope that next time he will answer with a solid C, but often hopes remain hopes)

- poor students (because there is an unspoken order from above to push such children to get a C, even if they don’t want this, and the authorities don’t care whether the child is trying to get a C or doesn’t care)

- reluctance to give a “2” to oneself (since the authorities accuse the teacher of having a “2” for a student - it means you are a bad teacher, you don’t know your subject. As a result, this leads to the understanding by some students that they won’t give a 2 anyway, but instead of a 2 I’ll get 3 in the end, and I don’t need more)

- the influence of the mark on the overall picture of the quality of knowledge (every semester the teacher reports on the quality of knowledge and the degree of training, and receives or does not receive points for this)

I believe that it is not worth inflating grades at all, only in cases where there is some effort on the part of the student. In any case, independent or test work shows real results.

Reasons for underestimation:

- negative attitude towards the student

- to create the psychological effect he needs (the student perceives the grade given to him by the teacher as a certain measure of the level of his knowledge. By lowering the grade, the teacher stimulates the student to make additional efforts)

- distrust that the student completed the task independently

- due to some conflicts

- as a kind of punishment for bad behavior of their students

- lowering the grade, the teacher offers tutoring

A school mark

is a number assigned for written or oral completion of a task according to the curriculum. She is a link in the “school, child, parents” community.

Let us consider this relationship in detail from the point of view of the pros and cons of school grades.

The first chain is “school – assessment – child”

.

It’s no secret that a school grade in a journal not only evaluates academic performance, but also creates a stamp for each student: some are “excellent”, some are “good”, some are “average”, some are “underachieving”. " The grades a student receives per day, week, month accumulate, affecting his psychological state, confidence and awareness of his capabilities, self-esteem, and awareness of his “I”. And, as a rule, children who perform poorly in elementary school rarely become “good” or “excellent” students in middle and high school.

A low grade creates negative expectations, and thus failure arises, sometimes seriously affecting development. At school, knowledge is valued, and a student who fails is not respected. And he, denying school values, loses interest in learning, violates discipline, and seeks self-affirmation outside the walls of the educational institution.

Sometimes there are cases when the teacher underestimates or overestimates the grade.

If a student tried and put a lot of work into completing a task, and received a satisfactory or bad grade, then he may perceive it as unfair. In this case, the teacher must carefully and objectively analyze the student’s work and determine how much the child’s expectations diverge from the teacher’s assessment.

The teacher lowers the grade when he already has a negative attitude, and he does not believe in the strength of the student’s knowledge, does not believe that the student himself did his homework and did not copy from his classmates. Then the child will have to be patient and prepare well the next task, and maybe more than one, in order to convince the teacher with his negative expectations. However, most often such a student begins to think that the teacher always lowers his grades, and he stops doing work on his own, preferring to copy from his classmates or from the GD.

Inflated grades, as a rule, are not perceived by the student himself as undeserved.

Overvaluation or undervaluation can be treated differently.

An inflated assessment can also be gentle, supporting an underperforming student, and this trust can become an incentive for further improvement. And just a low grade can be an impetus for achieving your goal - to study well.

Now let’s look at the next link – assessment – child – parents.

In this community, sometimes passions of joy and sometimes indignation rage, and almost always there is a tense expectation of parents: “What will their beloved child bring in his diary from school?” And a child who has received a good grade runs home with ease, anticipating the praise of his parents and anticipating a reward for the grade he received. And a child who receives a low mark - a bad number - wanders home with heavy legs, anticipating the threat of punishment and the anger of his family teachers. But it is precisely in this case that if a child fails, sympathy and support from parents are needed. It is very important not only to love your child, but also to know his abilities, interests and inclinations, taking into account his physical condition. It is unrealistic and unsafe to expect excellent grades in all subjects from a child with poor health.

Ignoring this, parents force children to lie, tear out sheets with bad grades from diaries and notebooks, and twist in every possible way so as not to incur the wrath of their parents. And the circuit is closed!

A bad grade means an unsuccessful student – a negative attitude towards the school of the student and his parents.

A good grade means a successful student means a good attitude towards the school of the student and his parents.

So what should we do? Cancel rating? Not really. It is the teacher who must optimistically and soberly assess the success of his student, celebrate all his even the most insignificant achievements, see progress towards his goal, help cope with self-doubt, provide moral support, and show compassion and sympathy in case of failure. And it is the teacher who sets the final price (mark) for student work. And a mark in school is comparable to the Quality Mark in trade; if there is this mark, the quality assessment is high, but if not, the quality mark is low. And this sign of the quality of educational activity, given by the teacher at school, remains with the student throughout his life.

(the meaning of the word “mark” from one of the dictionaries is mark, spot)

So, truly believe in the student’s strengths, and your expectations will certainly come true, and a good grade, as a sign of quality, and not a mark, will be the key to the student’s success and a good attitude towards the school by himself and his parents.

Risks of overstatement for the seller

Such a development of events can lead to adverse consequences. This involves some deception and some benefit for interested parties. In practice, in such a transaction there are the following risks for the seller:

- if the transaction is not approved, then formally the seller of real estate undertakes to return to the buyer funds that he did not receive in practice;

- provided that such a situation is revealed, liability for complicity in a fraudulent scheme is provided;

- such a procedure may delay the sale of real estate for a long period of time;

- Additionally, publicity may be observed, which subsequently will not allow the seller to profitably sell his real estate.

A special point should be made regarding the subsequent withholding of tax from the seller in the amount of 13 percent of the proceeds from the sale of an apartment or other property.

Can part of the mortgage be spent on renovations?

Mortgage loans are a type of targeted loans, when the bank issues funds for strictly regulated needs. You cannot spend the loan at your own discretion or withdraw part of the amount. The payer does not receive the money in hand - the bank makes the transfer directly to the account of the real estate seller.

On a note. The mortgage loan amount cannot be set at will. The official price is announced by the developer or named by an individual - the owner of the apartment. The bank does not take the seller’s word for it, but requests an examination from an independent appraisal company. Why do an apartment appraisal with a mortgage?

The amount of the mortgage loan cannot exceed 80% of the final cost of housing, announced after an independent examination. Thus, inflating the cost of a renovation mortgage is an illegal operation that is very easy to detect . Overpriced mortgage: risks for seller and buyer.

To believe that you will be able to get a mortgage from a bank for an apartment and renovations at the same time, and then withdraw the difference from your account, is, to say the least, naive. The loan officer will be sure to check market prices in the region and will do everything possible to facilitate the sale of the property in the event of non-payment of the balance of the debt. The bank will not agree to issue a loan for the full market value of a residential property.

Recommended article: Mortgage for a room in a communal apartment or dormitory: banks, conditions, list of documents

What to do if you have already purchased an apartment, but there is not enough money for repairs? Where can I find funds for a registered deposit? Is it possible to take out a loan rather than a mortgage for renovations when the documents are signed? Let's take a closer look at the options for receiving funds.

The danger of overpricing for the buyer

As with the seller, borrowers who are interested in purchasing a property may face some sticky situations. The buyer's risks are as follows:

- the most harmless set of circumstances when fraud is detected is a refusal to provide a loan to purchase an apartment or house;

- a more serious consequence can be the blacklisting of such a client, which will make it almost impossible to subsequently obtain any loan;

- the most dangerous situation when a scheme is identified is criminal prosecution under Article of the Criminal Code of the Russian Federation No. 159 “Fraud”;

- In addition, if the document is executed incorrectly, the borrower risks additionally remaining a debtor to the seller.

It should be understood that it is very problematic to prove in court certain agreements with the seller that are not written down in documentary form, which is why, based on the resolution, the borrower may owe the seller the amount of funds specified in the receipt. You may encounter such a situation if you come across an unscrupulous owner of a property.

Important! Additionally, mortgage lending often involves the participation of an expert in assessing market value, which is why the buyer or seller may incur even more significant waste or face bias in the procedure.

Buyer's risks when the mortgage is overstated

Taking out a mortgage on an apartment without investing any of your own funds into it is profitable and convenient. But remember that a scheme to inflate the cost of an object is illegal. This means that it has its own quite significant risks. Both sides take risks, but now let’s talk about what risks the buyer bears.

Risk 1. They will refuse a mortgage and blacklist you

Do not think that financial institutions are not aware of such fraud. When studying documents, bank specialists will definitely pay attention to the significant difference between the cadastral and market values.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

The mildest punishment that awaits the buyer is refusal of a loan. Then the buyer is blacklisted. Do not forget that banks transmit information about unscrupulous borrowers to the Credit Bureau, and in the future you will not be able to take out a loan from this or any other financial institution.

Risk 2. The seller will not return the overstated amount.

The bank transfers the entire value of the property to the seller. He, in turn, must give a certain part to the buyer. In this regard, situations may arise when the apartment owner simply refuses to do this. Therefore, it is necessary to draw up a receipt for the refundable amount. She won’t go to the bank, but she will protect the buyer.

How to inflate your valuation

In order to inflate the assessment, it is necessary to perform a series of sequential actions step by step. Typically, for such a scheme you will need to do the following:

- Select the most suitable property (you should choose apartments for free sale by owners).

- It will be necessary to enter into an appropriate agreement with the seller for the conditional transfer of a large advance.

- The seller draws up a receipt in triplicate stating that he has received the agreed amount of money from the direct buyer.

- One copy is sent to the bank, where they receive confirmation that a certain percentage of the cost of the property has already been paid.

- Next, a receipt is drawn up stating that the parties do not have any claims against each other regarding the money.

- The lender approves a loan to the borrower, which in fact will cover the full cost of housing.

- Subsequently, the main agreement is drawn up for the transfer of property rights to the buyer on the basis of an agreement.

Next, all that remains is to register the property rights, and then provide the financial institution with the necessary list of documents for confirmation. Subsequently, the full amount that the bank provided to the borrower will have to be repaid.

Important! Such fraud involves making a small upfront contribution, or its complete absence, however, if it is detected, there are some risks and possible consequences.

We assess the risks of participants in an overpriced mortgage transaction

What are the risks involved in the transaction? As for the buyer, his possible losses are minimal. Moreover, even in a situation of insolvency and the return of the apartment to the owner, he can benefit from a property deduction for expenses on interest paid.

What are the bank’s motives and why the borrower may be refused, the reasons are simple:

- if the loan applicant was unable to collect a sufficient amount for the down payment (deposit), then the risk of his insolvency is high;

- It is unrealistic to sell mortgaged property at an inflated price, since the market is saturated with housing without encumbrances. If the debtor fails to fulfill his obligations, the sale of the expensively priced apartment will be carried out at a discount, which for the bank means an outstanding loan and losses;

- The above scheme is accompanied by the transfer of receipts that are not confirmed by real actions, and this is already fraud.

The seller’s risks when overestimating the cost of an apartment for a mortgage are high. If the property has been owned for less than three years, according to the law, when calculating income tax, the income received from the sale is included in the tax base. A tax deduction cannot always reduce the calculated amount, so the seller will have to pay an inflated tax to the budget. This is the first.

Secondly, for objective reasons the deal may be terminated. Reasons for termination may include violations of the property rights of minors or incapacitated persons who previously lived in the apartment. (For more information on the risks that must be included in the purchase and sale agreement, see the article: Sale and purchase agreement with a mortgage - important points for the seller and buyer). In legal language, two-way restitution is possible when the parties return to their original positions. Then, the residential premises are returned to the seller, and the money is returned to the buyer, and in the amount that was specified in the purchase and sale agreement.

Recommended article: Reverse mortgage – what is it and where to get it

The overstatement procedure requires the participation of one more party - an appraisal company, which will perform an unreliable assessment, thereby violating the principles of its work. In addition to reputational damage and loss of accreditation, it faces a lawsuit from the lender to compensate for losses incurred if the borrower turns out to be insolvent.

In any case, the parties to the transaction need to realize that actions according to such a scheme fall under the article of the Criminal Code of the Russian Federation of fraud.

Mortgage lending support

In order not to engage in various scams for which criminal liability is imposed, it is recommended to contact an intermediary agency, where assistance can be provided in obtaining a profitable mortgage. Here, the borrower can qualify for support in completing the application, selecting a real estate property, and also support the procedure until the registration of ownership of the apartment. These institutions work closely with lenders, which is why when submitting an application through a mortgage broker, favorable conditions are selected, and in addition, the chances of approval of the application are increased. For their services, such companies retain from 5 to 10% commission. Among the mass of mortgage brokers, the DomBudet project from Center Finance LLC should be highlighted, since it provides the most acceptable conditions, and in addition, an individual approach to each client.