Today, living on credit is a normal phenomenon and many Russians take advantage of this opportunity by taking out apartments and houses on a mortgage.

The state is trying in every possible way to support its citizens, especially when it comes to young families, military personnel, and young professionals. Banks even have separate mortgage lending programs for such citizens.

Everything would be fine if you don’t take into account the fact that banks have not yet developed an individual lending program for people with disabilities.

How can you get a mortgage for housing for disabled people and is it even possible to get an apartment if you are a disabled person of group 1, 2 or 3?

Is it possible for a disabled person to take out a mortgage? Is it realistic to do this?

A person with disabilities who has a Russian passport is a citizen of this country, and therefore has the same rights as all other citizens. This means that no one prohibits such persons from taking out a mortgage, and banks should not refuse them simply because the borrower has become disabled.

Banks do not provide separate mortgage lending conditions for persons with disabilities; they have the right to apply under general conditions.

It is possible for such persons to obtain a mortgage only if the following conditions are met:

- if the borrower has real estate that the bank can use as collateral;

- if such a person is a working disabled person;

- the borrower must confirm his high level of income so that the bank gets the impression that he will actually be able to fully repay the mortgage;

- a person must carry out his labor activity at his last place of work for at least six months. It is also desirable that he prove that no one will fire him soon or that he himself will not quit;

- The borrower's health must be acceptable. This means that persons with disability groups 2 and 3 can count on getting a mortgage, but borrowers with group 1 disabilities will have a problem getting housing on credit.

Is it possible to get a mortgage loan with a group 2 disability? Is it possible for a disabled person of group 2 to get a mortgage?

Good afternoon, Elvira! Let's see what Sberbank offers to disabled borrowers when applying for a mortgage.

Can disabled people get a mortgage?

If Sberbank’s conditions do not suit you, contact other banks in Russia.

To do this, just visit a special service and send an online application: For the vast majority of Russians, a mortgage is the only way to purchase residential real estate.

Therefore, preferential lending programs have been developed for certain categories of Russian citizens, when they are supported by the state. Disabled people also fall into this category.

Banks also provide mortgages to disabled people, because for the lending institution they are the same borrowers as all other clients. The main thing is that disabled people have good solvency and meet the requirements of a specific financial institution.

Such people can get a mortgage under the following conditions:

• General; • Preferential.

Mortgage on general terms

Even with limited opportunities, people can be employed and receive a good monthly income, which allows such disabled people to easily receive loans on general terms.

But when registering, a person will have to face some difficulties that healthy people do not have:

1. The bank will not take into account the pension of a disabled person. If a person with disabilities cannot prove to the bank that he regularly receives income, he will be denied a mortgage;

2. There may be problems with insurance. The bank may impose a strict condition on personal insurance for a disabled borrower, because such a client is classified by the institution as a high risk, so the lender seeks to insure as much as possible;

3. Difficulties will await the disabled person and the insurance company in order to collect a package of documents indicating the health status of the borrower. An insurance company usually offers more stringent conditions to a disabled client because such people have a higher chance of becoming completely disabled or, having lost a job, not being able to find a similar one;

4. The bank will also have stricter loan conditions for a disabled person. If you refuse insurance, the rate will rise; if you agree, you will have to pay the insurance company handsomely. Plus, the bank can increase the down payment and shorten the loan repayment period.

Mortgage on preferential terms

So far, there is no special mortgage program for disabled people. Therefore, citizens with disabilities can count on benefits under the general “social mortgage”.

Assistance from the state can be expressed in payment:

1. Loan parts;2. Down payment;3. Parts of interest.

You can also receive a housing subsidy certificate. It can be used to make an advance or repay a certain part of the loan.

Disabled people also have access to such types of preferential housing loans as mortgages using maternity capital and for:

1. Young families;2. Teachers;3. Scientists, etc.

Sberbank and alternative options

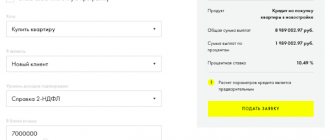

It was said above that not a single bank has a special mortgage program for disabled people. Therefore, Sberbank offers a mortgage to a person with disabilities on general terms: • Down payment - 50%.

If a young family takes out a mortgage, the advance is reduced to 15; • Rate from 12.5%, with state support – 11.4.

If there are government subsidies, you can refuse the 50% advance or take out a mortgage with a minimum rate. Insurance will be required.

If refused, Sberbank may raise the interest rate to 5% or refuse the client a mortgage.

There are several alternative options:

1. Contact brokers. The overpayment will be large, but this will be the only opportunity to buy housing;

2. Try to get a loan from a commercial bank. The rates and entry fee may be higher, but the likelihood of approval will be greater;

3. Contact the municipality and get on the waiting list for housing. But how long we will have to wait is unknown.

infapronet.ru

Can a non-working disabled person get a mortgage in 2020? How can a disabled person get a mortgage?

Some people with disabilities believe that their disability pension may be enough to pay their mortgage. But the state has a different opinion on this matter.

Banks are prohibited from approving the candidacy of a disabled borrower if, in addition to state support, he has no other means of subsistence. That is, the bank does not have the right to take into account the pension.

It’s another matter when a person with a disability has an official job that brings him a considerable income . In this case, the bank, having seen the income certificate, may not even pay attention to the fact that the borrower is a person of limited legal capacity.

Therefore, people with disabilities should contact the bank for a mortgage only if they are officially employed citizens and receive a high salary, which should be enough to pay off the debt.

When choosing a property, such borrowers should look for more modest housing options, for example, an apartment on the secondary real estate market.

Are mortgages given to disabled people of group 1?

When a person with disabilities applies to a bank with a request for a mortgage, banks pay attention not only to the primary or additional income of the potential borrower, but also to his disability group.

Banks often refuse to issue a mortgage to citizens with the first disability group, since such persons, firstly, usually do not work anywhere, since they have incurable serious illnesses, and secondly, banks take a great risk with their finances by deciding to issue a mortgage to such persons.

Are mortgages given to disabled people of the 2nd group?

People with the second group of disabilities are more likely to get a mortgage loan. These are citizens who are diagnosed with a severe form of the disease and require long-term treatment or special procedures.

Such persons can actually obtain bank approval for a mortgage only if they are officially employed and receive a good salary and if they have some property that they can use as collateral.

The type of disease also plays a big role when issuing a mortgage . So, if a person is a group 2 disabled person due to pulmonary insufficiency or has had an organ transplanted, then he has a better chance of getting a loan than someone who suffers from mental disorders (the bank reasons that such persons cannot sensibly assess the situation and take responsibility for your actions).

Is it possible for disabled people of group 3 to get a mortgage?

Persons with the third group of disabilities have the best chance of getting a mortgage approved . Such citizens usually do not suffer from serious health problems, and it is not as difficult for them to get a job as for people with disabilities of the first two groups.

Therefore, if a potential borrower proves to the bank his solvency, insures his life and health, and in addition also offers collateral property that belongs to him, then in almost 100% of cases he will receive the approval of the financial institution.

Preferential mortgage for disabled people of groups 1, 2 and 3 in 2020: how to apply

A mortgage for disabled people in 2020 is one of the most accessible ways to obtain housing rights.

The issue of purchasing housing is relevant for most Russians. Not many people have the means to make a purchase, but getting residential space from the state is quite problematic, even regardless of the availability of benefits.

Despite the fact that the preparation of special programs for targeted lending to disabled people has already been completed, this banking product is not widely used.

Can a disabled person get a mortgage?

The possibility of drawing up agreements on providing mortgage loans to disabled people did not previously exist.

Currently, banks are showing increasing interest in attracting solvent clients.

Considering that a citizen’s disability may be the reason for his inability to work, lenders put forward a range of requirements for potential borrowers.

These should:

- it is mandatory to insure the purchased housing;

- make a down payment using your own funds;

- be able to bear credit obligations, i.e. be solvent;

- have a positive credit history;

- obtain approval for a subsidy from the state.

The chances that a preferential mortgage will be approved are greater for those clients who have official employment and receive wages.

The presented list of requirements is the same for all disabled people who intend to receive a housing loan, as well as parents with a child whose capabilities are limited.

Decor

To determine how to apply for a mortgage loan, you need to understand what steps you will need to follow to achieve the desired result.

Receipt of state material support for persons intending to become mortgage borrowers is carried out if such entities have the following characteristics:

- solvency, which is justified by receiving a social pension or income at the place of official work;

- the absence of unfulfilled obligations, the recipient of which is government agencies or housing and communal services organizations;

- availability of compulsory insurance, both of the purchased object and of the life and health of the person being financed;

- providing all documentation requested by the bank;

- registration of a person as a recipient of a subsidy from the state.

The potential borrower must belong to the category of persons who are entitled to receive a one-time social payment associated with the payment of the loan.

If a person has the specified characteristics, the bank offers mortgage conditions that imply the use of a reduced interest rate.

With 1st group disability

Persons who have a group 1 disability are characterized by complete physical limitation.

They need constant care. Parents are called upon to carry it out in relation to minors, and legal guardians are appointed in relation to adults.

A person whose security is entirely provided by social payments will not be able to obtain a mortgage. A parent or guardian can purchase housing for it.

With 2nd group disability

Representatives of disability group 2 are classified as citizens with partial ability to work, which allows them to be recipients of social and labor pensions.

The request of such a client sent to the bank can be satisfied if the income he receives covers the amount of monthly loan obligations.

This category of citizens may qualify for a special type of subsidy provided by the state in order to improve the person’s living conditions. Such payment can cover no more than half of the loan funds.

With 3 group disabilities

The presence of a person with a 3rd group of disability does not entail incapacity for work, but serves as the basis for the disabled person to receive a social pension.

As additional payments justified by the execution of the mortgage agreement, they are provided with a subsidy covering loan obligations by no more than 50%.

For families with children with disabilities

A family with a disabled child, recognized as low-income, with many children, or with another status, can apply for the purchase of housing through mortgage lending, with the government providing a subsidy covering borrowed funds up to 50%.

You can use such funds as a down payment. In this case, the transaction will be completed no earlier than the date when financial assistance from the state is approved.

Benefits from Sberbank

Sberbank is the largest representative of the banking sector implementing programs to provide mortgage loans to people with disabilities.

Lending at Sberbank is carried out on the following terms:

- marginal reduction in interest rates;

- writing off a certain part of the loan;

- reducing the amount of overpayment depending on the area of the purchased housing;

- providing a grace period when returning amounts received.

The list of privileges presented applies only to those borrowers whose physical capabilities are limited.

Refinancing

Russians whose physical capabilities are limited due to disability, as well as those dependent on disabled minors, can take advantage of the right to a reduction in the monthly financial burden, justified by the purchase of residential premises under mortgage programs.

This service is provided by every Russian bank whose programs provide for lending to disabled people with state support.

Such actions are aimed at creating equal opportunities for all Russians to obtain home ownership, regardless of whether they have a disability, expressed in health conditions.

: Mortgage 2020: how much will a home loan cost?

We recommend other articles on the topic:

Source: https://lgotyvsem.ru/invalidy/ipoteka-dlya-invalidov-kak-oformit.html

Features of insurance for persons with disabilities when taking out a mortgage

When drawing up a mortgage agreement, banks oblige borrowers to insure the property they take out as a mortgage . At the same time, life, health or title insurance is not mandatory; the borrower can decide at his discretion whether to take out this type of insurance or not.

Another situation arises when a person with disabilities wants to take out a mortgage . Banks strongly recommend that such borrowers take out insurance not only for their property, but also for their health and life.

Of course, disabled people have the same rights as other citizens, and therefore have the right to refuse additional insurance. However, then they should not count on banks to approve their mortgage applications.

Use of maternal capital

The money is used to repay part of the loan or pay the down payment. The conditions are the same as in the resale purchase program, but the rate will be from 8.9% per annum. You can submit a request to build a house, the key conditions will differ only in the rate, from 10% per year.

Advantageous mortgage offers from Sberbank of Russia ⇒

If you are interested in building or purchasing country real estate, you will have to find 25% for the first advance, and the percentage starts from 10% per year. The easiest way to get a housing loan for people with disabilities of groups 2 and 3 is from Sberbank, as the chances increase.

You might also be interested in these articles:

But there are no additional benefits from the largest lender, although they will take the housing certificate into account. It will not be superfluous to play it safe and make a higher down payment, then you will be able to obtain a loan on more compromise terms.

Are there any mortgage benefits for disabled people?

Despite the fact that banks do not provide individuals with disabilities with individual mortgage programs, benefits for such categories of citizens still exist in Russia and are implemented within the framework of the following programs:

- Social mortgage with state support - issuing mortgages for socially vulnerable citizens, which include persons with disabilities. In order to receive a social mortgage, a person must register with the local state administration and indicate the reason why he can be provided with housing on preferential terms - the current lack of an apartment or house to live in. The disadvantage of such a program is the long queues, so in order to count on any assistance from the state, a person with a disability will have to wait a long time for his turn.

- Mortgage program "Housing" . Under this program, the state issues a subsidy to the borrower, thereby helping to repay the mortgage debt. To receive housing under this program, the borrower must register as needing new housing.

Alternative ways to solve the problem

There are actually few options that satisfy people with low incomes. It is recommended to do the following:

- Be sure to get in line for a subsidy.

- You also need to apply for registration with the local government authorities involved in the distribution of social apartments. Disabled people have the right to be allocated municipal housing under the terms of a rental or sublease agreement.

- Study other government programs. Perhaps one of them will fit the criteria.

As a last resort, there is the option of purchasing an apartment through the services of a brokerage office. You will have to pay for them. But the specialists will take care of all relationships with the lender.

In what cases can a person with a disability register to obtain a mortgage?

Persons with disabilities can be registered to receive a mortgage loan for disabled people only in the following cases:

- if a person does not have his own home;

- if he lives in a room, apartment or house that is in disrepair;

- if the current housing does not meet technical and sanitary conditions;

- if the person is registered in a dormitory or communal apartment;

- if a person lives in an apartment with several people, and each resident is allocated an area of less than 15 square meters. m.

Peculiarities

Whether people with disabilities are given a mortgage in principle and on what terms they do so can greatly depend on the terms of a particular bank. But in general, loan programs of this type are characterized by the following features:

- When calculating solvency, a disability pension is usually not taken into account, but only income from the main/additional job. The disabled person will need to prove his fairly high solvency and provide guarantees that he will continue to receive wages.

- A large down payment may be required, about 50% of the total cost of the home.

- To obtain a mortgage for a sufficiently large amount, the participation of a healthy and employed person may be required, who will act as a guarantor of solvency.

- To apply for insurance, you may need to undergo a medical examination and attach numerous certificates confirming your health status. Although the examination can be carried out at the expense of the insurance company, in the end the insurance rate will still be increased.

Often the cost of insurance is significant. Therefore, you need to calculate what will be more profitable - take out insurance or take out a mortgage loan at an increased rate.

How to get a mortgage for a person with a disability?

The process of obtaining a mortgage for such persons is no different from obtaining a loan for a healthy citizen:

- First, the borrower must decide on the program under which he wants to get a mortgage (on a general basis, social, “Housing”).

- Choose a bank with suitable lending conditions, go there and write an application.

- If the application is approved, prepare the necessary documents, select housing, and arrange insurance.

- Pay the down payment.

- Conclude a purchase and sale agreement with the real estate seller and a mortgage agreement with the bank.

How can I further reduce the interest rate on my loan?

Not all citizens with disabilities are military personnel, public sector employees, or family men with two or three children. The inability to participate in the preferential program leaves the only option - taking out a mortgage on a general basis. However, there are several additional options for improving your loan terms that are not based on disability.

Sberbank is ready to accommodate its clients halfway, so it further reduces the interest rate for the following factors:

- Receiving salary using a Sberbank plastic card. This also removes the requirement for total work experience, making only the length of work at the last place of employment important. For regular customers, the rate is reduced by 0.5%.

- Submitting an application through the DomClick electronic service. Here are real estate properties already verified by the bank. The rate is reduced by 0.1%.

- Insurance of the client's life and health reduces the loan rate by 1%.

Considering the average mortgage size for home purchases, a discount of 1.6% provides an opportunity to significantly save money.

An additional advantage will be an increase in the size of the mortgage, which is subject to tax deductions. It is 13% of 2 million rubles. Thus, with the help of this tax provision, up to 260 thousand are saved.

Improving living conditions with the help of mortgages for disabled people of group 2 at Sberbank is a realistically achievable action. Favorable conditions are determined by a significant number of promotions and special programs available to every citizen.

How can a disabled person get an apartment?

A mortgage for disabled people in 2020 is one of the most accessible ways to obtain housing rights.

How can a disabled person be guaranteed to get housing with a mortgage?

In order for banks to approve a borrower with disabilities, he needs:

- Provide collateral in the form of real estate that is registered in his name.

- Provide the bank with co-borrowers or guarantors who, if necessary, will share the burden of the mortgage with it.

- Get on the waiting list for housing (if the borrower has no other housing).

- Prove your solvency (provide a salary certificate from your place of work).

- Accept all the bank's conditions, including additional types of insurance.

Conditions for obtaining a mortgage

Sberbank is characterized as a tolerant institution with loyal requirements for potential borrowers. Including people with disabilities. That is why people with somewhat limited abilities or who are completely unable to work can get loans here. However, they must still have an official income. To do this, you can use alternative types of resources.

1 group

The possibility of taking out a mortgage and repaying it on time should be considered from the point of view of the income level of a disabled person. Moreover, the presence of disability directly determines a person’s ability to work. As you know, the first group is completely disabled. This is why it is most difficult for this category of people to get a mortgage from Sberbank.

If the income is characterized as high (or rather, sufficient to pay off the mortgage debt monthly and leave money for personal needs), then it can satisfy Sberbank. However, this level and frequency of profitable transactions must also be continuous (stable).

At the same time, the nature of the disability is also important, since Sberbank avoids issuing mortgages to citizens for whom the risk of non-repayment is increased. Abandonment of debt obligations on a mortgage may occur due to deterioration of health and death of a disabled person. To mitigate such risks, it is allowed to connect voluntary insurance for a disabled payer.

2 groups

If we consider it thoroughly, then this group is also non-working. It is extremely difficult for such citizens to find work. However, there are only restrictions that can be circumvented by observing certain concessions: a shorter work day, more frequent and longer breaks, and easier functionality.

The legislation provides for the following types of income accepted by Sberbank on mortgages for disabled people:

- Renting out existing real estate. To account for it, you must own the rental property and deduct income tax.

- Implementation of intellectual property results.

- Remuneration under contractual civil law relationships.

- Private practice.

- Pension based on age or long service (including early).

The listed points are not suitable specifically for this category, but for disabled people of groups 1, 2 and 3. In any case, the same priorities apply here as for the previous disability group considered regarding the nature of income, insurance not only of real estate, but also of the disabled debtor himself.

3 groups

The third group is characterized by the presence of significant health problems, which are not an obstacle to the employment of a disabled person. Therefore, for this category of people in need of housing, mortgages are issued as usual. If you have a good income, a citizen is not at all obliged to advertise the presence of diagnoses to Sberbank.

It is worth noting that, along with the main employment, a disabled person has the right to offer income from a part-time job for consideration. And this is in addition to the previously mentioned list of sources of money (in the second disability group). People are not forced to take out insurance, as in other groups. But this condition is also beneficial for the borrower himself, as it reduces the interest rate.

As for any benefits, Sberbank does not provide them. There are special programs for needy families and military personnel, but not for the disabled. For these citizens, Sberbank does not connect finances from the state budget. You can apply for reduced mortgage parameters due to the consent of the disabled client to certain terms of service, which is carried out on a general basis.

Mortgage for families with a disabled child

Families in which a disabled child is growing up often need comfortable living conditions, so the issue of obtaining a mortgage is relevant for them.

Unfortunately, today banks do not offer individual mortgage lending programs to such families . All such families can count on is help from the state.

The government has provided social programs, according to which the state can compensate part of the mortgage payments and pay the down payment.

To receive at least such benefits, one of the parents must register with the local government as one who needs improved housing conditions because he has a disabled child and does not have his own housing (or it does not meet regulatory requirements, per person the area falls below the established one).

Are mortgages given to disabled people of the 2nd group?

The housing issue worries the majority of citizens of the Russian Federation. Getting an apartment from the state is difficult, and buying one is unrealistic for many. Therefore, preferential programs of state support for beneficiaries are being created and implemented in the country. They are intended to help the military, large families, youth and public sector employees.

But a special mortgage for disabled people has not yet been developed. That is, there are programs for this category of citizens for 2019, but using them is not so easy.

How can a disabled person buy housing?

There are two ways to solve the housing problem, suitable for citizens with physical disabilities. Both are complex.

These include the following types of mortgage lending:

- on general terms;

- preferential loan.

Each path is theoretically open to people who have been assigned a disability group.

However, it is quite difficult to take advantage of the offers. And that's why:

- A regular loan is issued by a bank. He issues mortgages only to working, solvent disabled people. These include people who received groups 2 and 3.

- Only citizens who meet certain criteria can receive preferential preferences from the budget. At the same time, the state acts as a guarantor of the borrower, therefore, banks become more loyal and reduce the level of requirements.

Disabled people receive loan benefits on a first-come, first-served basis. And she is not small, which reduces the chance of purchasing her own meters.

Complexities of mortgages on general terms

A working citizen can apply for a bank loan. Unfortunately, disabled people are treated more strictly than everyone else.

In order to use borrowed funds, such a person will have to provide the credit institution with a number of evidence of his own solvency.

These include:

- sufficient level of income to make payments;

- certain period of employment:

- at least six months before applying;

- guarantees of continued salary receipt;

- a state of health acceptable for engaging in productive activities.

- your life and health;

- purchased property.

Social disability pension is not taken into account by credit institutions when calculating income. If there is no salary, then the mortgage will definitely be denied.

Banks check their borrowers. They are interested in a refund. A mortgage for disabled people of group 2, for example, is issued with the requirement of special insurance conditions.

The borrower is required to insure:

The amounts of life and health insurance for disabled people are higher than for healthy citizens. They reach 15% of the cost of the apartment for which the loan is issued.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Subtleties of interaction with banks

Conditions for lending with state support

Registration criteria

Namely, people who:

- do not have their own housing and live for a long time in the living space of state, municipal or public housing funds on the terms of renting or subletting housing or in rented housing;

- live in premises that do not meet:

- area standards approved in the region;

- sanitary and technical conditions;

Article 17 of Federal Law No. 181-FZ of November 24, 1995 obliges government agencies to register citizens who meet the above criteria as those in need of improved housing conditions. In addition, disabled people suffering from severe illnesses have priority rights to the allocation of budget funds. This is written in Part 2 of Art. 57 of the Housing Code of the Russian Federation.

In exceptional cases, the budget fully pays the mortgage for citizens with health limitations. Download to view and print

Some features of subsidizing disabled people

When solving this type of issue, the state prioritizes the balance of the needs of citizens and the capabilities of budgets at different levels.

At the same time, registration of citizens does not depend on the disability group.

Some preferences are provided to disabled children. However, a person is required to work in order to be able to repay his own portion of the loan.

All rights to support people with disabilities are given locally. Regional conditions vary. You should check with your local authority for details of mortgages for disabled people.

Government support for people with disabilities in terms of housing improvement is provided in two ways:

- the certificate pays the first installment or part of the debt;

- the state budget covers the difference in interest rate (it is reduced for beneficiaries).

To receive government support, you need to contact the authorities in order to find out who is responsible for such issues.

Disadvantages of mortgage programs

- Despite the government's desire to provide support to people with disabilities, in practice everything is not so simple. The line of beneficiaries is growing, but no money is being added to the budget. In 2019, we have to note small successes in solving this problem.

- In addition, the subsidy is allocated only to people who have been able to prove that their living conditions do not meet regulatory requirements. Other disabled people are simply not allocated money from the budget.

- Banking institutions are also reluctant to issue loans to people with disabilities. Often they are simply refused. The financial institution is afraid of non-repayment of funds. That is, the problem of providing housing for disabled people has yet to be solved. For now, work is at a low level.

Source: https://dragkameshki.ru/dajut-li-ipoteku-invalidam-2-gruppy/

Answers to questions on the topic

Question : “Can I count on getting a mortgage if I am a disabled person of group 1? I don’t officially work, but I receive a disability pension.”

Answer : If there is no official income, the bank will refuse to issue a mortgage. And the disability pension is not taken into account as a source of income.

Question: “I took out a mortgage on an apartment, a disabled child was born. Can the bank reduce the mortgage interest rate?

Answer : The laws do not say anywhere that the bank is obliged to reduce the rate, so this issue is solely within its competence. The borrower can go and write an application for refinancing or restructuring the mortgage, thereby changing and slightly easing the lending conditions.

Question: “I am a healthy working person, and my husband is a group 1 disabled person. Is it realistic for us to get a home with a mortgage?”

Answer : If the borrower is a healthy citizen and not a person with disabilities, then it is quite possible to obtain the bank’s approval. True, you still need to prove your solvency.

Question: “Which bank is best for a person with a disability to get a mortgage?”

Answer : It is best to contact government agencies. You can try to submit an application to Sberbank. It has a large list of mortgage programs and preferential programs.

Mortgages for disabled people are issued by banks on a general basis . Those borrowers who are officially employed, receive high salaries, and agree to take out additional insurance are more likely to receive bank approval.

Citizens with disabilities can count on receiving benefits from the state when applying for a mortgage . To do this, they must register with local authorities as citizens who demand improved living conditions.

Questions regarding lowering the mortgage interest rate for persons with disabilities or the lack of a down payment are resolved only by the bank.

Mortgage for disabled people of groups 1, 2 and 3, benefits - features of registration in 2020

Disability and mortgage are two practically incompatible concepts, since banks operating in Russia try to avoid such loan agreements, and special government programs that can effectively help the least protected segments of the population do not yet exist. The preferential conditions existing in 2020 are designed for a small number of citizens, since the amount of budget funds allocated to subsidize mortgages and purchase of housing is not designed to provide financial assistance to all those in need.

As a result, people with disabilities have to either wait until it is their turn to receive subsidies, or look for alternative solutions to purchase a home. True, choosing an alternative mortgage program will be extremely difficult.

Mortgage for disabled people - legislative framework

Currently, it is legally established that people in need of housing are entitled to government support for the purchase of real estate.

However, this requires meeting several conditions:

- There must be difficult financial conditions and a difficult financial situation that precludes independent improvement of living conditions;

- potential recipients of subsidies do not have their own living space, or the existing living conditions do not meet sanitary and technical standards;

- the listed difficulties with finances and housing are recorded and documented.

True, receiving government assistance has a significant drawback, which has already been stated above. The government can only allocate predetermined amounts from the budget.

As a result, the available money is not enough to cover the needs of everyone, so potential recipients of benefits are forced to apply to social security services and take a place in a long line of others in need.

The length of the resulting queue leaves little hope for a quick solution to the problem; as a result, the wait for subsidies stretches out for years.

Difficulties in obtaining a mortgage for disabled people

If you step back from the state assistance program and focus purely on mortgages for disabled people of group 1 (or any other), it turns out that there are several significant difficulties that interfere with obtaining a loan:

- There are currently no special mortgage programs for disabled people (they exist for young families with children and military personnel);

- banks try to avoid lending to high-risk clients;

- there is a high probability of receiving a refusal without explanation (decision-making managers may not explain their own actions to clients);

- There may be difficulties with life and health insurance, which will be noticeably more expensive than for other borrowers.

In simple terms, you will have to receive a loan on a general basis, and therefore the chance of approval of the submitted application is small.

Conditions for obtaining a mortgage for disabled people

Considering that the conditions for obtaining a mortgage by people receiving a disability pension do not differ from the standard ones, potential borrowers should prepare for the fact that most lenders issue mortgage loans:

- citizens of Russia;

- who have reached the age of majority (sometimes 21 years old), while at the time of repayment of the debt their age cannot exceed 65 years;

- must have a job in the last six months;

- Of these, the last 3 months of work experience must be in the current workplace.

That is, fulfilling the above conditions is extremely difficult and often impossible. The solution would be to obtain a loan using two documents or attract co-borrowers. But even such decisions do not rule out a 100% refusal.

Recommendations for interaction with banks

Given these difficulties, potential borrowers should:

- prove your own ability to work or, if the client does not work, solvency;

- offer collateral that can convince the bank of the seriousness of the person’s intentions;

- take out a standard consumer loan;

- submit an application to a large institution known for its loyalty to clients, for example, Sberbank;

- take out life and health insurance.

It is important to emphasize that lending organizations do not require you to talk about disability, but you should not try to deceive the lender if he asks such a question, since this is illegal.

List of banks lending to disabled people

There is no separate list of banks and credit institutions that issue mortgages to group 2 disabled people. Each situation is individual and requires separate consideration, therefore, in order to purchase real estate, it is recommended:

- submit several applications to different institutions at once;

- try to choose simplified programs that offer an inflated rate, but preferential registration conditions (for example, for 2 documents or for pensioners);

- seek help from professionals involved in processing mortgage loans;

- pay attention to large establishments.

At the same time, the highest probability of approval is in Sberbank, Sovcombank, Transcapital. Additionally, it is worth taking a closer look at consumer loans. They can be a good alternative to a mortgage.

Applying for a mortgage for disabled people - step-by-step instructions

The process of obtaining a mortgage for disabled people of group 3 is no different from the procedure for obtaining a mortgage loan for other people.

To purchase a home and apply for a loan, you will need:

- submit an application to a credit institution;

- obtain pre-approval;

- visit a bank branch with a ready-made package of documents and conclude an agreement;

- choose a suitable apartment (house);

- visit the bank with the selected seller and conclude a purchase and sale agreement;

- register property;

- take out insurance and pledge the property as collateral.

After that, all that remains is to gradually pay off the debt.

Required package of documents

To get a loan approved, you will have to prepare:

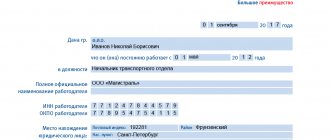

- passport;

- passport of co-borrowers (if any);

- information about income received and work activity (2-NDFL and a certified copy of the work record);

- information about the purchased real estate, including examination, purchase and sale agreement and other papers requested by the manager;

- insurance policy and mortgage.

It is important to emphasize that all of the above is transferred to bank employees not simultaneously, but in several stages. In addition, the manager receiving the documents has the right to supplement the list with additional information.

Alternative options for purchasing an apartment

The best alternative option for purchasing real estate for the least protected category of citizens is obtaining a consumer loan. It is much more affordable than a mortgage, but has several disadvantages:

- the loan amount will be lower;

- the interest rate will be higher;

- the repayment period is much shorter.

In addition, an excellent option would be to attract co-borrowers who will be able to convince the lending institution that there are no risks and timely repayment of money.

Source: https://ipotekyn.ru/ipoteka-dlya-invalidov/

Features of lending to disabled people

There are four main options for obtaining a mortgage for an apartment in state banks if there are no problems with previously taken loans for disabled people of the second and third groups:

- preferential programs from the state;

- loan based on two documents;

- for disability pension;

- registration through a broker.

Preferential programs for obtaining a mortgage

Special Decree of the Government of the Russian Federation No. 901 states that the opportunity to participate in a preferential program for obtaining a mortgage for disabled people and other categories of vulnerable citizens is available under the following conditions:

- the existing housing does not meet sanitary and social standards. standards;

- located in a dormitory;

- is located in a communal apartment with limited amenities;

- located in dilapidated or emergency housing stock.

If these factors are present, it is possible to obtain the right to receive benefits for obtaining a mortgage under a special preferential program. It involves the opportunity to apply for a subsidy from the state aimed at paying the down payment when applying for a mortgage through a bank or for early repayment of existing debt on a housing loan.

You do not need to have a special status for the amount you receive. Disabled people of all groups have the right to stand in line under general conditions; the prerogative in the implementation process is the initiative of regional authorities. If you need to apply for a loan for families with disabled children, all citizens of the Russian Federation have the right to submit a petition at their place of permanent residence in order to get in line for housing expansion on preferential terms.

Loan on two documents

There is a simpler system for obtaining a mortgage, which can be issued using two documents:

- passport of a citizen of the Russian Federation;

- SNILS.

Certificates confirming the availability of medical cards and salary statements are not needed.

All major banks provide such programs, with an average rate of 9-12%. In some cases, the following categories can receive a mortgage:

- officially unemployed;

- with a bad credit history;

- on maternity leave;

- young families.

Important! This loan is available upon making a down payment. The larger the contribution amount, the higher the likelihood of receiving a loan. It is optimal to contribute 50% of the market value.

For disability pension

If a pensioner has a disability pension, he has the opportunity to apply for a standard mortgage product that does not have favorable conditions. If the amount is sufficient to maintain a decent standard of living and it is possible to repay payments on schedule, there is every chance of getting a mortgage loan. The interest rate on such loans is higher, but they are issued more often than others.

Important! Sberbank gives a loan if the pension is issued through an account with this bank. In this case, all movements on the account are visible and it is possible to write off part of the loan.

Preparation of documents through a broker

About 15 years ago, housing loans for families with disabled children or for people with disabilities were more accessible and popular, but now it is possible to get a loan to purchase affordable housing. For many people, using brokerage services is practically the only way to get a mortgage for group 2 disabled people.

Before registration, you need to remember the following nuances:

- You should only trust a company that has been operating on the market for at least 5 years and has positive reviews;

- brokerage services are about 10-15%, this is the intermediary’s commission for providing services for obtaining a loan;

- Be sure to carefully check all documents before signing.

Important! Before signing all documents, you need to make sure that the broker does not provide false information, as this entails refusal.

Preferential conditions

A mortgage for housing for disabled people of group 3, as well as a mortgage for disabled people of other groups, in some cases can be issued on preferential terms. The benefit is provided by the state, and therefore this will be a sufficient guarantee for the bank. But these benefits are provided on a first-come, first-served basis, and therefore the wait can be very long.

Also, more profitable mortgages can be obtained by people who fall under any other government programs. These include:

- Young professionals;

- military/police;

- state employees;

- young families and a number of other categories of citizens.

How to increase the likelihood of your application being approved

You can significantly increase your ability to get approval for a mortgage if you meet three mandatory conditions:

- find a guarantor without a disability who meets the bank’s requirements;

- have a positive credit history;

- provide documents on the availability of liquid movable and immovable property.

Important! If your disability does not appear outwardly and you have a high level of stable income, you do not need to notify the bank about the presence of such social status. If the bank finds out this fact, do not deny it. The security service checks all information about the potential client. Therefore, it is important to prove the bank’s solvency with as complete a composition and number of documents as possible, so that a mortgage is guaranteed to be issued for families with disabled children or for other privileged categories of the population.

Conditions for mortgage loans for disabled people

All housing loans, except military mortgages, are issued for a period of up to 30 years. A military mortgage can be taken out for up to 20 years.

Attention! For all products, the minimum amount to be received is 300,000 rubles. The maximum amount is limited to the estimated value of the purchased housing - no more than 85% of it.

As for interest rates, the minimum - 6% per annum - applies to mortgages with state support for families with children. The average rate for other products is 10–11% per annum.

Disabled people can reduce their loan overpayments by taking advantage of the following options:

- registration of life and health insurance in insurance companies accredited by Sberbank;

- submitting documents to Rosreestr using the “Electronic Registration” service;

- confirmation of the status of a young family;

- transfer of wages to a Sberbank card;

- choosing an apartment through DomClick.

Other conditions for housing loans:

- The period for reviewing a loan application is no more than 8 working days;

- repayment procedure - monthly annuity (equal) payments;

- down payment – from 15% of the property price and above;

- collateral – pledge of the premises being financed, guarantors;

- insurance of the property is mandatory;

- tax deductions - provided in accordance with the general procedure in accordance with Art. 220 Tax Code of the Russian Federation;

- early repayment - partial or full, without charging a commission.