Mortgage lending in Rosbank

The Bank lends to various categories of potential borrowers. The loan program was developed jointly with Rusfinance Bank. You can choose different lending conditions, both secured by real estate and a regular mortgage with a down payment.

Rosbank allows you to solve the housing problem in a new way, offering its clients balanced conditions that allow you to get quick approval.

Advantages of a mortgage

Why have more and more people chosen Rosbank as a lender in the last year to purchase a new apartment or house? There are a number of advantages that distinguish this bank from other companies:

- When considering an application, the bank takes into account the income of each family member (up to four people). This makes mortgages more affordable;

- Instead of a down payment, the bank is ready to accept the loaned person’s real estate or the property of their parents as collateral;

- There are no additional hidden fees;

- The application is reviewed within 5 working days;

- There is a huge range of loan programs that consider both residential and non-residential funds;

These criteria allow the bank to take advantageous positions against other organizations providing mortgage lending.

Expert opinion about Rosbank

At the end of May, the authoritative rating agency Expert RA confirmed the high rating of Rosbank at the ruAAA level with a stable outlook. High trust is due to the objective characteristics of the bank:

- strong market position and competitive loan products;

- high quality of assets and corporate governance;

- strong liquidity position;

- a real opportunity to receive financial support from the parent Societe Generale.

For an ordinary client, all this means that there is no need to worry about the revocation of the license - the invested funds will not “burn out”, and in the matter of a mortgage you can safely rely on Rosbank. It is also important that the bank participates in all state support programs for borrowers.

Interest rates at Rosbank in 2019

The interest rate starts from 7.99% per annum and depends on a number of conditions, namely:

- Selected housing;

- Loan term;

- Down payment amounts;

- Registration of all necessary insurances;

- The borrower has a good credit history;

The bank also offers another way to get a reduction in the interest rate: make payments that are responsible for the reduction in interest. There are three payments:

- Optima – a one-time fee of 1% of the mortgage amount, reduces the rate by 0.5%

- Media – one-time fee of 2.5% of the amount and reduces the rate by 1%

- Ultra – one-time payment of 4%, reduces the rate by 1.5%.

Using various methods of lowering the interest rate, you can save a lot in the end.

Programs and rates

| Minimum contribution | Bid | |

| Ready housing | 15% | from 6.69% |

| Housing in a house under construction | 15% | from 6.69% |

| Ready house | 40% | from 8.19% |

| Garage/parking space | 25% | from 6.69% |

| Apartments | 25% | from 6.69% |

*Minimum rates are indicated within the framework of the Rosbank mortgage for salary clients who take out health, life, purchased real estate and title insurance and apply for a loan from 5,000,000 rubles. (for the Moscow region) or 3,000,000 rub. (for other regions).

In other conditions, the percentage may be increased by 1% - 4% depending on the credit history, length of service, income level of the borrower and other parameters.

Mortgage programs of Rosbank

Rosbank mortgage offers eight different programs. The interest rate and list of documents depend on the choice of conditions. The loan can be taken for:

- apartment in secondary housing;

- room;

- new building;

- construction of a new house or a new apartment;

- buying a house;

- buying a garage;

- apartments;

Next, the conditions of each program will be considered in more detail in order to have a general idea of lending in a given bank.

Apartment or share

| Bid: | From 7.49% to 10.74% |

| An initial fee: | From 5% |

| Term: | Up to 25 years |

| Real estate requirements: | — the building should not be registered for major repairs; — the apartment must have a kitchen and a bathroom; |

| Insurance: | - life; - job loss; — loss of property rights; |

Room

| Bid: | From 7.49% to 10.74% |

| An initial fee: | From 25% |

| Term: | Up to 25 years |

| Real estate requirements: | — the building should not be registered for major repairs; — the apartment must have a kitchen and a bathroom; - if the room is a deposit, you need a document that determines the procedure for using the room; — all rights of purchase between the other owners in the apartment must be respected; |

| Insurance: | - life; - job loss; — loss of property rights; |

New building

| Bid: | From 7.49% to 10.74% |

| An initial fee: | From 5% |

| Term: | Up to 25 years |

| Real estate requirements: | - apartment in a new building |

| Insurance: | - life; - job loss; — loss of property rights; |

Construction of a private house

| Bid: | From 7.99% to 11.24% |

| An initial fee: | From 30% |

| Term: | Up to 25 years |

| Real estate requirements: | |

| Insurance: | - life; - job loss; — loss of property rights; |

Purchasing a finished home

| Bid: | From 8.99% to 12.74% |

| An initial fee: | From 40% |

| Term: | Up to 25 years |

| Real estate requirements: | — a house for year-round living; - stone, panel, concrete or brick; — all add-ons must be registered; — the ability to draw all the necessary lines; - should not be located in protected areas; |

| Insurance: | - life; - job loss; — loss of property rights; |

Parking space

| Bid: | From 7.49% to 10.74% |

| An initial fee: | From 25% |

| Term: | Up to 25 years |

| Real estate requirements: | — the garage is located in an apartment building or a multifunctional complex; - is an independent object; - is not general; - has certain boundaries and a technical passport; |

| Insurance: | - life; - job loss; — loss of property rights; |

Secondary housing

| Bid: | From 7.49% to 10.74% |

| An initial fee: | From 5% |

| Term: | Up to 25 years |

| Real estate requirements: | — the building should not be registered for major repairs; — the apartment must have a kitchen and a bathroom; |

| Insurance: | - life; - job loss; — loss of property rights; |

Apartments

| Bid: | From 7.49% to 10.74% |

| An initial fee: | From 20% |

| Term: | Up to 25 years |

| Real estate requirements: | - must be a separate room; - must be connected to all communications; - must be located above the ground; - there must be ownership; |

| Insurance: | - life; - job loss; — loss of property rights; |

Requirements for the building in which the apartments are located:

- Wear up to 50%;

- At least 2 floors;

- Should not be located in boarding houses;

- The walls are not made of timber;

Rosbank issues loans secured by real estate to those who cannot make a down payment for a mortgage. On the Rosbank website, the 2020 mortgage calculator can be used to calculate more accurate information about terms and overpayments.

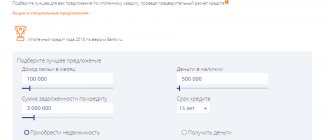

Mortgage calculator

Rosbank's mortgage calculator allows the user to obtain information on the loan agreement and calculate financial expenses for the loan period. A mortgage loan is a loan for the purchase of residential real estate, which will need to be repaid for more than one year, and here you should carefully choose a bank and accurately calculate your budget.

Rosbank is a universal Russian bank, ranked 12th in terms of assets, operating since 1993. More than 99% of the bank's shares are owned by one of the largest French financial conglomerates in Europe, Societe Generale.

An online calculator is a service that provides the user with the necessary mortgage information in a couple of seconds. To use the service, the user needs to know the following information:

- the price of the purchased housing;

- the period for which the loan is provided;

- percentage, according to the selected program;

- the amount of the down payment;

- repayment scheme;

- the size of the commission, if any.

This is information that is necessary for a person who wants to take out a mortgage. The rest of the calculations will be done automatically by the calculator.

Conditions for obtaining a loan

In order to obtain a mortgage, you need to collect a number of documents and meet the bank’s conditions. The decision on approval is made within 5 working days from the date of application.

Each client will be invited to participate in the Rosbank Insurance program, which is aimed at providing for various complex insurance cases.

Requirements for the borrower

The first thing you need to pay attention to when applying for a loan is whether the borrower meets the bank’s requirements. Namely:

- A bank client can be a person who has reached 20 years of age at the time of taking out a loan;

- At the time of repayment of the mortgage, the borrower must not be more than 64 years old;

- Clients do not have to be a citizen of the Russian Federation;

- The loan is issued to both employees and business owners;

- Co-borrowers can be up to 3 people, and not necessarily relatives.

The decision is made after 5 working days after studying all the papers submitted by the borrower.

How to apply

The application can be submitted online or in the branch. To apply online you must:

- Go on the website;

- Select a loan program;

- Click “Submit Application”;

Application for a mortgage at Rosbank

Next, you need to fill out a form that will appear on the screen and wait for the manager to call. He will invite you to the department with all the necessary documents.

Package of mortgage documents

You will need to take the following package of documents with you:

- A copy of all pages of the passport;

- Documents confirming wages;

- A copy of the work record book, which will be certified by the employer;

- Military ID;

- Completed application form;

Rosbank mortgage with maternity capital

- Allows you to use a maternity capital certificate as part of the down payment and/or for partial repayment of the loan.

- As part of the program, a client can obtain a mortgage from Rosbank with a down payment of 10% less than standard conditions

- To participate, you must provide a certificate of the amount of capital from the Pension Fund

- Maternity capital funds must be used to partially repay the debt within six months after receiving the loan

Find out more about the features of mortgage loans using a maternity capital certificate.

Accredited insurance companies

The bank has a number of accredited companies that have the right to carry out insurance activities for clients.

- Insurance PJSC "Ingosstrakh"

- Insurance JSC "VSK"

- LLC "Insurance

- Insurance PJSC "RESO-Garantiya"

- JSC "SOGAZ"

- LLC "Insurance Company "Surgutneftegaz"

- Zetta Insurance LLC

- SOCIETE GENERAL Insurance LLC

- LLC "Insurance

- JSC "AlfaStrakhovanie"

- JSC "MAX"

- Renaissance Insurance Group LLC

- PJSC "Insurance Joint Stock Company"

- JSC "Insurance

- JSC "Insurance

- JOAO Insurance Company DalZHASO

- JSC Tinkoff Insurance

- LLC "Insurance

- LLC "SOCIETE GENERAL Life Insurance"

- JSC "ERGO"

- JSC "Insurance

- JSC "Insurance

- JSC "Liberty Insurance"

- PJSC "Insurance

- Absolut Insurance LLC

- JSC GSK Yugoria

- LLC "Insurance

- PJSC "Insurance

It is best to find out the latest information for 2020 on the official website, as the list of offices is constantly changing. The bank can accredit your company if you have doubts about its suitability.

Rosbank

Rosbank belongs to the international banking group Societe Generale, and it also has two subsidiaries - Rusfinance and DeltaCredit Bank, which is directly involved in issuing mortgage loans.

Mortgage loans are listed in DeltaCredit, and can be serviced at any branch of Rosbank (this also includes payments at ATMs and the use of Internet banking).

In terms of the number of systemically important banks, Rosbank ranks 11th, and according to Forbes, it is the most reliable banking institution in the country.

And now a little about the appearance:

- Societe Generale appeared back in 1864; the publication of the corresponding act of establishment was carried out by Napoleon III.

- In 1872, the bank appeared as an investor in Russian metallurgical organizations.

- The Russian-Asian Bank was founded in 1910, but in 1917 Societe Generale ceased its activities in Russia.

- The bank returned to the Russian Federation in 1973, and the first representative office opened in Moscow.

- In 1993, CB Independence appeared, renamed in 1998 to JSCB Rosbank.

- In 2005, DeltaCredit was acquired by the formation of Societe Generale.

- In 2011, Societe Generale (namely the Societe Generale Vostok bank, which has been present in Russia for more than 140 years) merged with Rosbank.

Rosbank successfully demonstrates its trends towards growth and successful adaptation to changes in the economic situation in the world.

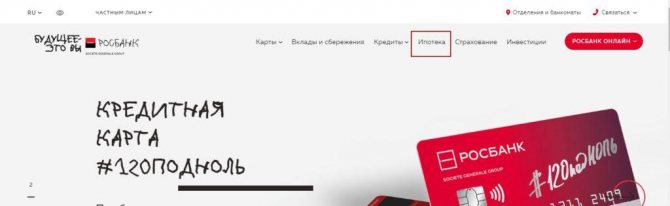

How to find and apply for a mortgage in Rosbank using the website

- Go to the official website https://www.rosbank.ru/;

- Go to the “Mortgage” tab;

Home page of the Rosbank website

- Click the “Apply online” button;

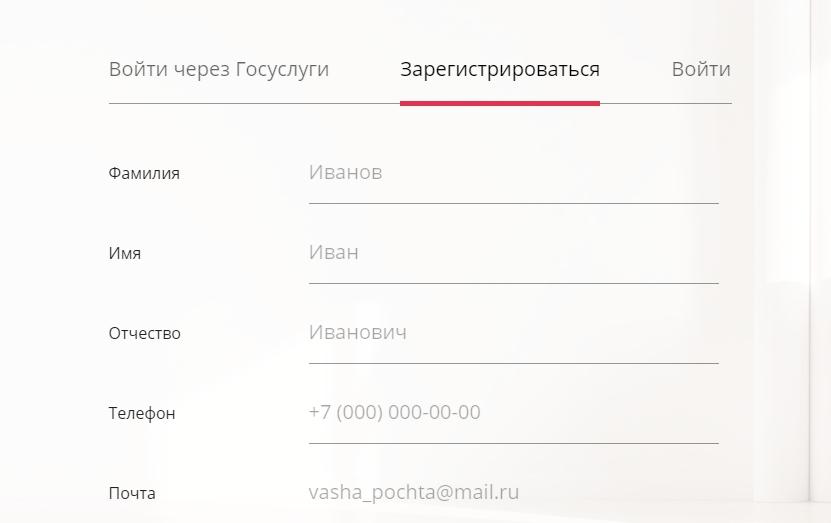

- Register, log in through the State Services website or using a login + password combination if you are a client;

After filling out the form, a manager will contact you, provide a preliminary decision and invite you to the office.

How to calculate and complete an online application?

To apply for a mortgage loan from Rosbank online, go to the company’s official website and click on the “Mortgage” button in the top menu.

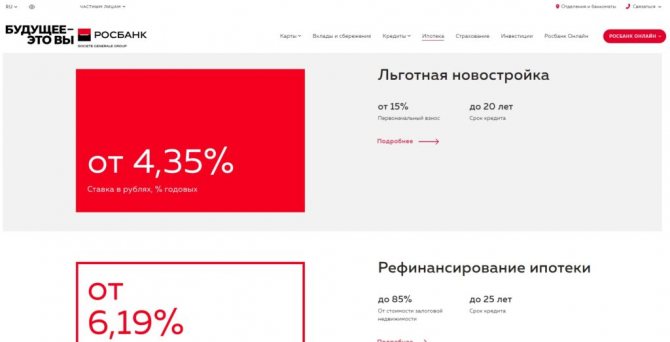

Mortgage in Rosbank

Next, select the program that suits you based on the interest rate and loan term, and click “More details.”

Loan programs

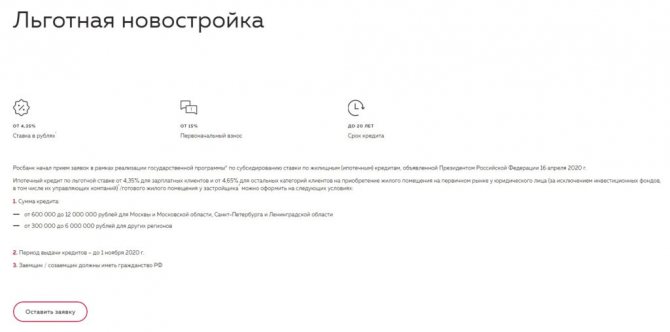

On the next page you can read the detailed terms and conditions of the mortgage.

Loan terms page

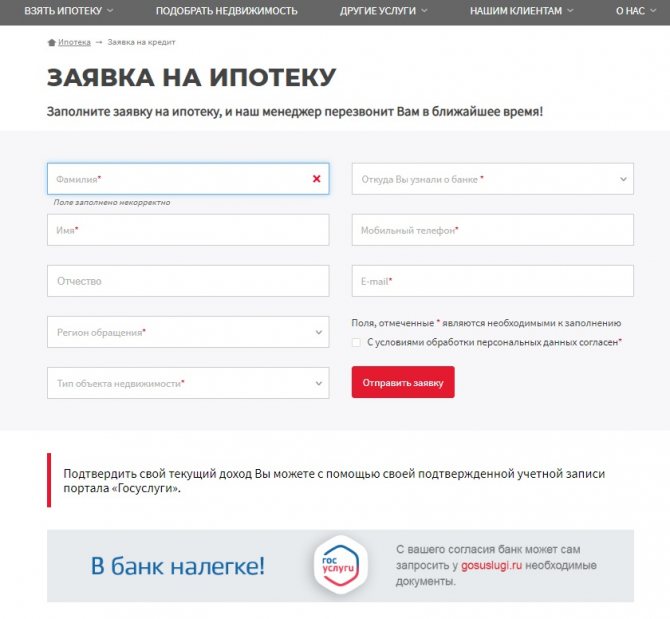

To apply, click on “Leave a request” and indicate your full name, phone number, region of residence, E-mail and type of property.

Online mortgage application

If you wish, you can confirm your income using your account on the State Services portal.

After reviewing your application, you can receive a decision within 5 minutes.

Package of mortgage documents

Prepare the following documentation for review:

- A photocopy of the passport of all borrowers and co-borrowers.

- Certificate 2-NDFL or according to the bank form.

- For business owners - tax return.

- For working citizens, a copy of the work book, certified by the personnel department.

This package of papers is prepared to examine the citizen’s solvency (i.e., whether he can pay the loan). After the future borrower receives approval from Rosbank, you need to collect the necessary documents for the purchased property. The full list can be seen below in the article in the “What to do after approval” section.