Conditions for obtaining a mortgage in ATB

Asia-Pacific Bank offers mortgages for the purchase of finished and under construction housing, as well as a refinancing program and a loan secured by existing real estate.

The down payment on the mortgage is at least 20%. When using maternity capital, it can be reduced to 10%. The mortgage term reaches 30 years, and to increase the loan amount you can attract up to 3 co-borrowers.

Insurance of the collateral (real estate) against the risks of destruction or damage is a mandatory condition of the mortgage. Life insurance is available upon request, but if it is not available, the rate will increase by 0.7%.

ATB

from 8.8% rate per year

Go

- up to 10 million rubles;

- up to 120 months;

- do not require collateral;

- the bank does not require proof of income;

- the decision is made within an hour;

- no need to report on money spent;

- There is a promotion “Refer a friend, reduce your monthly payment”.

More details

ATB mortgage programs

The Asia-Pacific Bank offers 11 different programs at once. This includes almost all possible types of lending. Such a large selection is due to the needs of the population in purchasing real estate.

Mortgage for a new building

You can get a loan for square meters in an apartment building under construction under the following conditions:

| Annual percentage | Initial investment | Period | Issued funds |

| From 10.5% and above | 15% or more | Up to 30 years old | Up to 20 million rubles. |

The interest rate directly depends on the initial funds deposited. A rate of 10.5% is valid for deposits of 50% or more. If you invest only 15%, it will be 11.75%. Other indicators should be clarified using the loan calculator on the official website.

ATB provides its clients with two types of discounts. The first is 0.25%. To obtain it, you need to buy real estate in the Far Eastern Federal District or the Baikal region. The second operates under the “Housing for the Russian Family” program and is intended for families with three or more children. Discounts here are calculated individually; they can reach 4%.

A number of surcharges also apply. The first is the absence of a 2-NDFL certificate confirming income; it is 0.5%. The second is the lack of personal life and health insurance; this adds an additional 0.7%. There is no premium for not purchasing title insurance.

The bank imposes some conditions on the purchase object itself: it must be on the list of accredited objects (available on the ATB website) and built in accordance with Federal Law No. 214 “On participation in shared construction.”

There are two options for this loan: maternity capital and “easy mortgage”. Using maternity capital allows you to reduce the initial investment by up to 10%. And use the funds themselves as payment for this first installment. “Easy mortgage” is intended for obtaining a loan with a minimum package of papers (without proof of income). However, in this case the rate and the down payment (35%) increase.

For secondary housing

You can take out a mortgage on a ready-made property under the following conditions:

| Rate per year | First investment | For a period of | Funds for issue |

| From 10.5% to 11.75% | From 15% | From 3 to 30 years | From 300 thousand to 20 million rubles. |

The annual interest rate again depends on how much money is initially invested.

The same premiums are provided here as in the previous program: for the absence of 2-personal income tax and personal insurance. But there are no discounts anymore. With this loan you can also use the options “easy mortgage” and maternity capital. The conditions for their provision remain the same.

An important point for issuing a loan is that the property being purchased must be pledged.

When registering a new property, the borrower can transfer the property to himself, to several people (common shared property), to himself and his spouse, and to his children.

Family mortgage

It operates under the state program to support large families in which the birth of a second, third and subsequent children is planned by the end of 2022. The conditions are:

| Percent | First amount | For a period of | Will issue |

| 6% for grace period | From 20%, but you can do without it | Up to 30 years old | From 500 thousand to 12 million rubles. |

The grace period, when the rate is 6%, is calculated as follows: upon the birth of a second child before 2022, this period will be 3 years; If another child is born at the same time, the period will increase by 5 years. The maximum duration of preferential lending is 8 years. When this time expires, the annual interest will be calculated as the key rate of the Central Bank at the time of signing the agreement plus an additional 2%.

Standard loan premiums continue to apply. There are no additional discounts or bonuses. The “easy mortgage” option is also possible to use; here it does not increase the interest rate, but increases the down payment to the required 35%.

Family mortgages are available both for the purchase of housing in a new building and for real estate in the secondary sector. It also applies to loan refinancing services.

A variation of this program is “Mortgage for Young People”. It is intended for borrowers whose age does not exceed 35 years and whose family has at least one born or adopted child. “Mortgage for Young People” provides a three-year grace period, during which the monthly payment amount is reduced.

Look at the same topic: Application form for a mortgage from VTB 24 bank - sample filling and form for downloading

this program is also allowed to use maternity capital. You can purchase any type of real estate: new building, resale, cottage or separate room. An important condition for participation in this program is a document confirming the need for new housing.

Military mortgage

Loans for military personnel of the Russian Federation are provided on special conditions:

| Percent | Contribution | Term | Sum |

| 10,3% | From 20% | From 3 years | From 500 thousand to 2.5 million rubles. |

The interest rate is fixed. It can only increase due to a premium for the lack of personal insurance. There are no discounts.

To receive this type of loan, the borrower must have a certificate of participant in the savings-mortgage system (NIS). It is issued three years after the serviceman joins this system. At this time, he opens a personal account where savings will begin to flow. In 2020, the annual contribution will be 280 thousand rubles. However, according to the new law, they can be used only after 10 years of military service.

The loan is provided to military personnel whose age does not exceed 42 years, since after 3 years - at 45 - the program ceases to operate.

You can make an initial contribution either from your personal savings or from the funds of a targeted housing loan (CHL), which is provided to all NIS participants. Money from the Central Life Bank is not limited if an account is opened in the banks Zenit, VTB, Svyaz, Sberbank, GPB. In other cases - no more than 1.4 million rubles.

The serviceman chooses the housing to purchase independently. It can be anything: in a new house, in a secondary building, outside the city. All additional costs (realtor services, real estate valuation) are borne by the borrower. Sometimes this costs up to 100 thousand rubles, so it is more profitable to buy a new building.

Using a military mortgage is associated with some risks, the main one being the loss of benefits. If a person whose service life was less than 10 years was fired (or part of him was disbanded), then he is obliged to return all the preferential funds issued to him and repay the loan himself.

Mortgage secured by real estate

A targeted loan secured by an apartment or other living space is provided on the conditions described below:

| Rate per year | Initial investment | For how long | Amount received |

| 11% | 30% | From 3 to 30 years | From 300 thousand to 20 million rubles. |

The interest rate is fixed, but if the borrower does not confirm the intended use of the loan, the rate will rise by 4%. The program applies to classic premiums; discounts and options are not provided.

It is advisable to obtain such a mortgage in situations: buying real estate in a new building, building your own home, when there is insufficient funds to pay the down payment.

The loan amount issued directly depends on the value of the collateral: it cannot exceed 70% of this indicator.

Any type of real estate can be used as collateral, but it is important that it has a value close to the market value. An apartment is best. It may not necessarily be owned by the borrower: it is allowed to use the housing of third parties as collateral, but with their consent.

Apartment share or room

At ATB you can get a loan to purchase a share in an apartment or a room in a communal apartment (not in a dorm!) on the following conditions:

| What's the rate | What is the fee | For how long | What amount |

| 11% per annum | From 25% | From 5 to 25 years | From 350 thousand. The maximum threshold is calculated individually |

Regular premiums apply to the program. No discounts are provided, but it is possible to use maternity capital to pay the down payment.

The purchased property must be located in the city where one of the ATB branches is present, or at a distance of no more than 100 km. From him.

The living space that is already at the borrower’s disposal can be used as collateral.

Mortgage for a private house

You can get a loan for the purchase or construction of a cottage in ATB on the following conditions:

| Interest rate | Deposit amount | Duration | Amount of funds |

| 11.5% – for finished housing, 12.25% – for construction. | From 50% | Up to 30 years old | From 300 thousand rubles. |

The loan is subject to surcharges for incomplete insurance. An option is available whereby a mortgage is issued using two documents.

Look at the same topic: What will happen to the military mortgage upon dismissal?

The collateral can be a private house being purchased or an existing one. It is important that it is suitable for living all year round and is located on private land. In a construction loan, real estate owned by the borrower is taken as collateral.

Loan for apartments

The difference between apartments and ordinary apartments is that they are not part of the housing stock and are non-residential premises, but they have everything necessary for life. The apartments are located in administrative buildings and hotels. They also cannot register for registration. But their prices are 20-30% lower than for apartments. A loan from ATB is provided on the following terms:

| Rate/year | First deposit | For a period of | Issued funds |

| 11% | From 20% | Up to 25 years | Up to 20 million rubles. |

The apartments being purchased must be on the list of real estate properties accredited by the bank. The list is on the website.

Mortgage for improvement of living conditions

This type of mortgage is issued as a targeted loan, on the same terms, secured by your own apartment or other real estate. There is currently no separate program with bonuses and discounts.

Refinancing

On-lending at ATB is carried out on the following basis:

| Percent | Amount to be deposited | Period | Sum |

| From 10.5% | From 20% | Up to 30 years old | From 300 thousand to 20 million rubles. |

The rate may be increased if the borrower lacks more than 50% of the property value.

To refinance, the loan had to be paid for at least 6 months without delays and without debt. Any past loans from third-party financial institutions are subject to refinancing.

Mortgage for maternity capital

Maternity capital – 453,026 rubles. – can be spent on purchasing real estate with a mortgage (primary and secondary sector). When using it, the borrower has the right not to confirm his income, and the application will be considered in priority order.

| Bid | Contribution | Credit term | Issued funds |

| 19% | Absent | 150 days | From 150 thousand rubles. |

The borrower gets the opportunity not to make payments every month - the Pension Fund does this for him within 150 days.

Programs and interest rates

| The name of the program | Sum | An initial fee | Bid |

| Purchase of finished housing | up to 20 million rubles — in Moscow and St. Petersburg, up to 10 million rubles. — in other regions | from 20% (from 10% - when using financial capital) | from 9% |

| New building | from 8.75% | ||

| On-lending | not provided | ||

| Targeted loan secured by an existing apartment | from 9.25% | ||

| Military mortgage | up to 2,486,535 rub. | from 20% | 9% |

Mortgage calculator

Using the calculator on the official website of ATB, you can calculate the size of the monthly mortgage payment by indicating:

- cost of the apartment;

- the amount of the down payment;

- desired loan term;

- method of income confirmation (2-NDFL certificate or without confirmation).

Example . Apartment worth 5 million rubles. purchased with a 20-year mortgage with a down payment of 1 million rubles. Every month you need to pay 36,635 rubles on the loan, and a mortgage will be approved with an income of 61,058 rubles.

What lending programs does the bank offer?

ATB has developed eight different areas of the mortgage loan program. This variety allows clients to choose the best loan option for themselves. Clients can use one of the following lending programs:

- Ready housing.

- Mortgage for military personnel.

- Share building.

- Lending against the provision of collateral.

- Refinancing.

- Young family program.

- Issuing a loan to purchase a room or share in a shared apartment.

- ATB mortgage for the purchase of country real estate.

In addition to these programs, the financial institution also offers some additional opportunities that make the conditions established by the bank more acceptable . In particular:

- the possibility of obtaining an “Easy Mortgage” (the loan is issued upon provision of only two documents);

- parents who have a Maternity Capital certificate can use it as a down payment or use it to pay the interest part of the loan;

- clients can apply for a mortgage under the Apartment program for a period of up to 30 years, subject to a down payment of at least 20.00% at an annual rate of 9.00–9.25%.

All loan conditions can be found on the bank’s official website

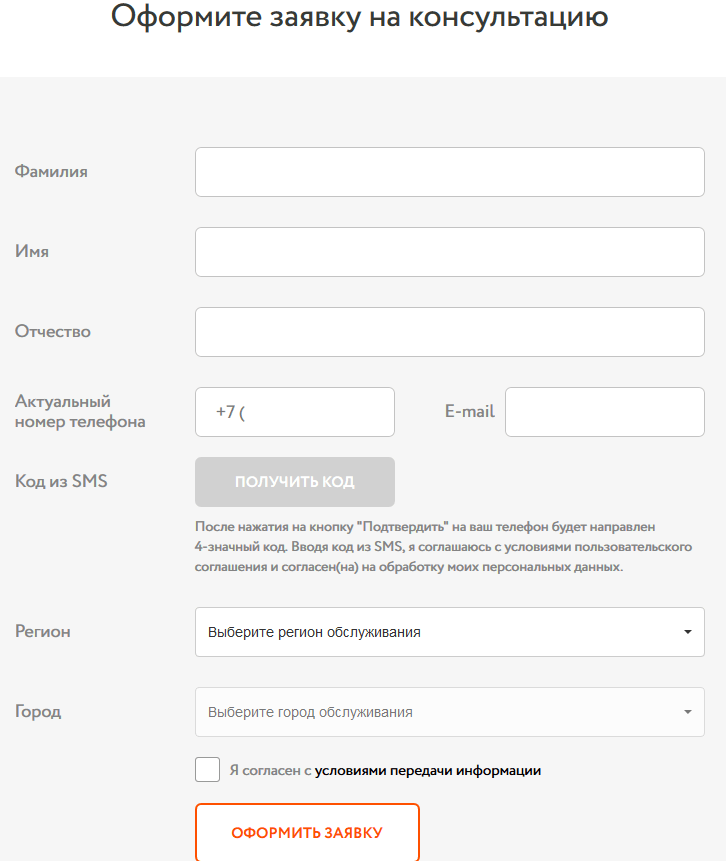

How to submit an online mortgage application to ATB

A preliminary application for a mortgage can be submitted from the official ATB website. To do this, you need to indicate your full name, phone number and city in which it is convenient to apply for a loan. Before submitting your application, you will need to confirm your phone number using a code sent via SMS.

Next, the manager will contact you. He will help you choose the optimal lending conditions and agree on a convenient time to apply for a mortgage.

How to get a mortgage in ATB

A positive decision on an application is valid for 3 months. During this time, you need to select an apartment to buy. It needs to be assessed by a specialized company, and after receiving the assessment report, contact the ATB again to approve the purchased property. Then you can negotiate with the seller and set a time for the transaction.

The last stage in the registration process will be the registration of property rights in Rosreestr. To do this, you will need to submit a purchase and sale agreement and a mortgage note to the MFC.

Requirements for the borrower

ATB issues mortgages to citizens of the Russian Federation who are employed, operate as individual entrepreneurs or are business owners. The minimum age at the date of conclusion of the contract is 21 years, and the maximum at the time of planned repayment is 65 years.

Employees must have been employed by their current employer for at least 6 months. The minimum period of activity for business owners and individual entrepreneurs is 2 years.

List of required documents

At ATB you can apply for a mortgage using your passport and a second document (SNILS, driver’s license). But in this case, the minimum down payment will be increased to 50%, and the rate will increase by 0.5%.

The standard package of documents for obtaining a mortgage at ATB includes:

- passport;

- a copy of the work book;

- income certificate;

- military ID (for men of military age).

Individual entrepreneurs and business owners can confirm income using tax returns.

History of the creation of PJSC Asian-Pacific Bank

ATB was founded in 1992. The financial institution offers its clients a full range of banking services tailored to the needs of legal entities and individuals. The main office of ATB is located in the Amur region (Blagoveshchensk). In 2015, the bank received a general license from the Central Bank of the Russian Federation, AIB was included in the state deposit insurance system .

The branch and structural network of the Asian-Pacific Bank includes more than 250 divisions actively operating in 110 settlements located in 20 Russian regions from the Urals to Kamchatka.

In terms of its main financial indicators, ATB is included in the leading rating of the hundred largest and most developed banking structures in the Russian Federation. And among banks in Siberia and the Far East, ATB is the leader in terms of its assets. The list of main owners of ATB includes a group of developed entrepreneurs, owners of a controlling stake in PPFIN-Region. The owner of about 99.90% of ATB shares is the Central Bank of Russia.

The main directions of ATB's work are the provision of lending products to commercial entities and the private population, as well as the active involvement of citizens in opening deposits. The Asian-Pacific Bank is quite active in the securities and foreign exchange markets. Since last spring, the financial organization has been undergoing a procedure aimed at financial recovery under the control of the FCBS Management Company.

ATB is distinguished by low mortgage lending rates

Is it profitable to refinance a mortgage with the Asia-Pacific Bank?

In 2020, by refinancing a mortgage at the Asia-Pacific Bank, you can reduce the rate to 8.75%. Due to this, the monthly payment and the total overpayment on the loan will be significantly lower.

Example . Initially, the mortgage was issued at 12.5%, the balance of the debt is 3 million rubles, and the term is 15 years. The monthly payment under the current contract is RUR 36,976. After refinancing at ATB at 8.75% with the loan term unchanged, the payment amount will decrease to 29,543 rubles, and the total overpayment will be less by 1,338,026 rubles.

To refinance, you must contact any ATB branch, providing your passport, salary certificate, work record book and a valid mortgage agreement. The new loan will be issued without commission, and you can choose a convenient payment date.

Bank advantages

There are the following advantages of mortgage lending from the Asia-Pacific Bank:

- low interest rates – from 11.25%;

- the minimum down payment is 15%, and when using family capital - only 5%;

- minimum terms for reviewing loan applications - generally, a decision can be received already on the 3rd day;

- The requirement for work experience at the current place is only 1 month;

- a mortgage can be issued with just one document;

- Not only properties with a standard layout, but also housing with complex technical characteristics can be financed.

Asia Pacific Bank offers a wide range of mortgage products with varying terms and conditions. If the borrower has a family capital certificate, the down payment will be only 5%.

In addition, funds can be used for early repayment. Other borrowers are also not left unattended - low rates and minimum requirements apply to them.

How to get a mortgage for teachers is described in the article: mortgage for teachers. Read about commercial mortgages at Sberbank here.

What mortgage insurance is is described in this article.