How to purchase confiscated housing

When applying for a mortgage loan, the apartment/house purchased with borrowed funds remains pledged to the lending institution.

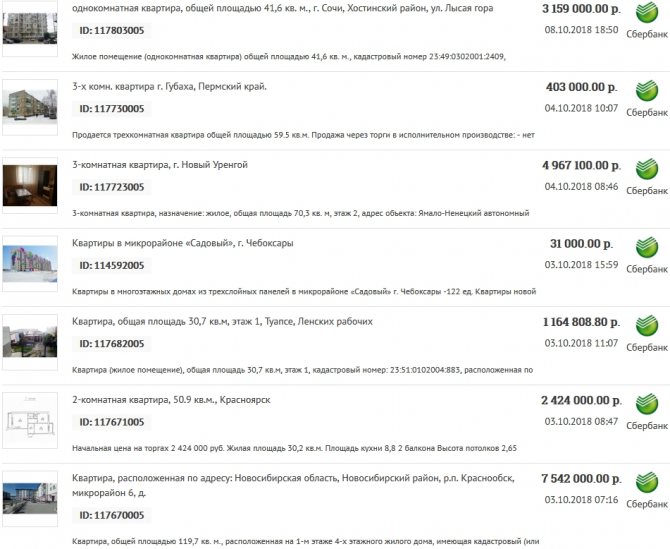

If for some reason the client cannot properly fulfill his obligations, the pledge holder (bank) has every right to seize the property based on a court decision and sell the confiscated objects. The sale of Sberbank's collateral property is possible only after a court hearing, if the dispute cannot be resolved by other means. The main advantage of such a purchase is the reduced cost. After all, it is important for the bank to at least partially compensate for the losses incurred. One of the disadvantages is the fact that the home cannot be viewed in reality. Its condition can only be assessed from the photographs posted on the website.

There are several ways to buy a mortgaged apartment from Sberbank:

- Purchase directly from the debtor. Having reached an agreement with the financial institution and drawn up a written agreement, the mortgagor can sell the property himself. In this case, the ownership right is registered with an encumbrance. After all the calculations have been made, the new owner of the property removes it. Information about the encumbrance is reflected in the Unified State Register extract;

- Receive through debt assignment. The buyer provides the financial institution with a package of papers for re-registration of the agreement. In this case, an expert assessment of the property is not carried out. After checking the provided documentation, the procedure for re-registration of the mortgage is carried out. The new owner of the home pays the loan on the same terms as the previous owner;

- Buy from the bank. The sale of confiscated property is carried out through auctions. All documentation is prepared by an accredited realtor. The balance of the debt is placed in a safe deposit box or transferred to a deposit. After completing the re-registration procedure, the credit institution receives money, and the acquirer receives real estate.

The sale of mortgaged apartments in Sberbank is carried out at the price prescribed in the court decision. Often the cost of a home is 25% below market value.

The buyer's down payment covers the seller's loan debt.

This is ideal when the remaining loan or mortgage debt is small. But the seller decided to alienate it because the opportunity arose to buy more spacious housing or move to another city or country.

The purchase of an apartment secured by Sberbank and the actions of the parties are carried out according to the following algorithm:

- the buyer submits a package of documents to the lender for approval of a mortgage or mortgage loan and receives approval;

- the seller receives Sberbank’s consent to early repayment of the mortgage and alienation of the apartment;

- the parties enter into a preliminary alienation agreement and the buyer makes an initial payment as a deposit, for which he rents a locker at Sberbank;

- on the appointed day, the initial payment is credited to the seller’s credit account and his obligations to the bank are closed, about which the bank draws up a document;

- Sberbank credits the buyer for the remaining amount, reissues the mortgage to a new mortgagor, or draws up a document for the submitted other mortgage. At the same time, opens a current account for the seller, where the remaining money for the transaction will be credited;

- the parties go to the Registration Chamber to register the alienation agreement, mortgage and re-registration of the encumbrance.

Recommended article: Gazprombank mortgage without down payment

In mortgage lending, a mortgage can be issued both for the apartment being financed and for any other liquid real estate. When taking out a mortgage for housing under construction, the mortgage is drawn up for the apartment being purchased.

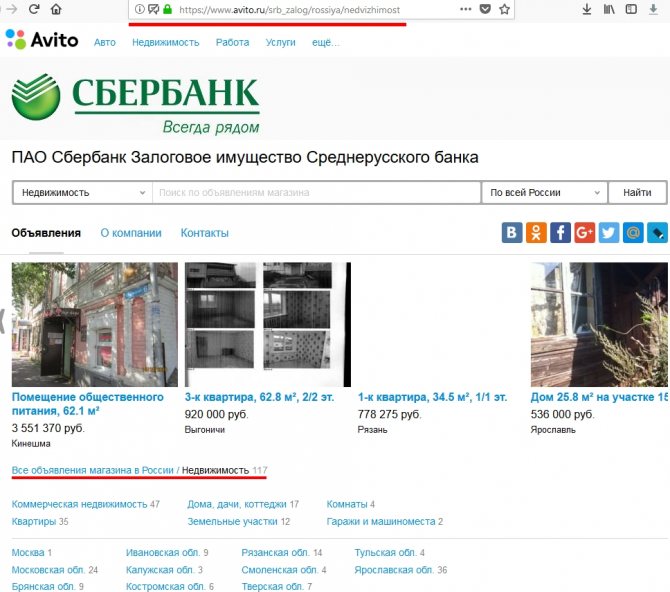

Conditions for the sale of seized real estate

- Mortgage housing is located in 21 regions of the Russian Federation, including Moscow and Moscow Region, and St. Petersburg. As a rule, auctions are held at the place of registration of the property;

- The sale of property takes place through the official website, where each house or apartment is described in detail;

- Buyers are notified about the auction a month in advance through local media, the Internet and information publications of the region where the auction is planned;

- After completion of the auction, the acquirer has ten days to repay the debt to the credit institution. If it is not possible to pay the amount within the specified period, it is possible to take out a mortgage or consumer loan.

The auction is considered valid only if more than two people took part in it and a price higher than the starting price was offered for the property.

What determines the price tag of confiscated housing?

The cost of collateral real estate is calculated based on a discount; determining its size depends on the following factors:

- Terms of the mortgage agreement;

- Liquidity of the property on the real estate market;

- Borrower's credit history.

The discount also includes possible expenses for conducting bidding and legal costs in the event of litigation.

Advantages and disadvantages of buying a mortgaged apartment

The purchase of a mortgaged apartment is a specific type of transaction, the transparency of which is not clear to all real estate buyers. The main advantages of such a deal are:

- legal purity of the acquired property;

- the purchase price is 5-20% lower than the market average.

Before accepting a residential apartment as collateral for a loan, bank specialists carefully check the premises for possible encumbrances in the form of third party rights, rent arrears, etc. The buyer does not need to additionally check the real estate purchased from the bank.

The auction price rarely exceeds the market average, and if the first stage of bidding does not take place, then participants in the second stage have the opportunity to buy an apartment at an even lower price.

The disadvantages of buying mortgaged apartments from a bank include:

- the need to remove the encumbrance;

- inability to view the living space before purchasing;

- possible claims from debtors who previously lived in the apartment under a mortgage agreement.

The encumbrance of the living space in the form of collateral remains after purchasing the apartment without bidding directly from the debtor. Removing the encumbrance by the new owner may take time. When buying a home directly without bidding, it is recommended to use a safe deposit box to transfer payment to the seller.

It is important to remember that bank debtors can challenge the sale of their mortgaged apartment in court if they prove that they are able to pay the bank on their own.

In addition, if the debtor has minor children registered in the living space being sold, it can significantly complicate the process of registering ownership of the purchased apartment.

Insurance

Selling and buying collateral real estate is a certain risk, so it would be a good idea to insure the property. The client has the right to choose any accredited company approved by the Savings Bank. The official website contains a complete list of organizations that can issue an insurance policy.

The borrower has the right to choose a third-party company, but in this case the documentation takes much longer to check. The review period may take up to one month.

Kerimov raised $1 billion from Sberbank using Polyus shares as collateral

According to the results of trading on the Moscow Exchange on Friday, October 9, the capitalization of Polyus amounted to 2.28 trillion rubles, and Said Kerimov’s stake (76.8%) amounted to 1.75 trillion rubles. ($22.8 billion).

At the end of 2020, PGIL’s debt to its only creditor, Sberbank, amounted to $3.7 billion. Previously, of the 76.8% of Polyus owned by Kerimov, 67% of Polyus was pledged to this bank. But in 2020, the holding released 16.74% of Polyus from encumbrance, so by the beginning of 2020 the collateral was reduced to 50.26%. In April 2020, it rose to 58%.

Read on RBC Pro

How to behave correctly when interrogated by an investigator: seven harmful myths Why top managers of the largest banks dream of returning everyone to the offices How the late release of the iPhone will hit Apple suppliers Bookshelf from McKinsey: what leaders read in the summer of 2020

For 2020, PGIL paid its sole shareholder, Wandle Holdings, $434 million in dividends. For the first half of 2020, PGIL accounted for approximately $334 million in dividends.

In September, PGIL reduced its authorized capital by $1.47 billion - from approximately $2.9 billion to $1.4 billion. “It is highly likely that this transaction was carried out with the aim of paying $1.5 billion to the shareholder,” notes the head of ACRA’s sustainable development risk assessment group Maxim Khudalov. According to him, the Kerimov family is known for its broad business interests and does not focus on the development of one direction, and a crisis is a good time for a shareholder with the means to strengthen its position in related areas. Taking into account loans, reduction of authorized capital and dividends, since the beginning of 2020, the Kerimov family could have consolidated more than $3 billion.

Why France released Suleiman Kerimov Business

According to Forbes, in addition to Polyus, the Kerimov family now only owns Makhachkala International Airport OJSC.

Claims of the French authorities

Suleiman Kerimov was detained at Nice airport in November 2020 on suspicion of money laundering and tax evasion.

The reason for the investigation was the purchase of villas on the Cote d'Azur, including Hier, which in the interests of Kerimov could be bought by his business partner for €127 million, while according to documents the price of the property was €35 million. But in June 2020, the French authorities withdrew Russian senator all accused of undeclared transactions when purchasing real estate in the south of France for the purpose of tax evasion.

In March 2020, the Nice prosecutor's office brought new charges against him. Kerimov had to leave a deposit of €20 million. He denies that he is the owner of the villas on Cape Antibes. Their nominal owner is a Swiss businessman, Kerimov’s business partner, Alexander Studhalter, who is also accused of complicity in tax evasion and released on bail of €10 million.

$100 million fine

PGIL’s reporting also states that Kerimov’s company had to pay $101.3 million in compensation in November 2020 for the failure of a deal with a bidder to purchase a “significant non-controlling stake” in Polyus, which had been in negotiations since 2020. The report does not specify the name of this applicant.

We pulled out of the deal: why the sale of a stake in Polyus to the Chinese fell through Business

It is known that negotiations on the sale of about 10% in Polyus for $900 million in 2020 were conducted with a group of Chinese investors led by Fosun. In January 2020, Polyus announced that the agreement with the Chinese consortium was terminated “due to failure to fulfill a condition precedent.” A source close to Fosun told RBC that the company did not receive such compensation. RBC sent a request to the Fosun press service.

“Compensation of $100 million is too much for the end of negotiations. But, on the other hand, the company’s capitalization in 2018 exceeded $10 billion, so the amount of the fine could be about 1% of the capitalization,” Khudalov noted.