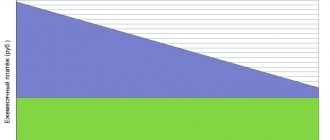

Annuity payments

This method of loan repayment is the most common in international banking practice.

The debt amount is added to the accrued interest and divided into equal shares. A person does not need to remember a large number of numbers. It is enough to fix in memory the size of the annuity, which does not change throughout the entire term of the contract. An annuity payment involves priority repayment of the interest component. The amount of accrued interest will decrease as the debt is closed. Unscheduled transfers of funds for extraordinary debt repayment involve a significant overpayment and are not beneficial for the borrower.

Is it possible to change an annuity to a differentiated one?

Switching from one chosen method to another is fraught with considerable difficulties. It is required to obtain the consent of the financial institution that issued the mortgage loan.

The possibility of transfer must be reflected in the signed contract, otherwise the request for reconsideration becomes simply meaningless. The absence of a corresponding clause will not prevent early repayment. The amount of the remaining loan amount is not specified, and there is a chance to become a full-fledged home owner before the due date.

How to transfer money from a Citibank card to a Sberbank card?

An application must be submitted containing a detailed statement of previous payments, detailing the exact numbers, percentages and amount owed. In this case, there is no commission fee and you will not have to overpay. A kind of refinancing is taking place and it is advisable to have the required amount to close the issue.

Differentiated payments

This repayment scheme is suitable for wealthy citizens. This method of debt repayment implies priority repayment of the debt body. The peculiarities of a mortgage loan with differentiated installments are that first of all the borrower will have to pay large amounts. After this, the contribution begins to gradually decrease.

This scheme is often used by people who plan to pay off their debt early. It involves a smaller amount of overpayment than the annuity loan repayment option. Differentiated payment allows you to save significant amounts on the payment of insurance premiums (remuneration depends on the amount of debt).

Is there any benefit to a mortgage with graduated payments?

Finding a bank that issues a mortgage with differentiated payments is problematic. This is due to two factors.

- The first is the bank’s desire to benefit from the loan; with the annuity scheme, the profit percentage is much higher. Even if the borrower decides to close the loan early at any stage. With a differentiated scheme, the amount of overpayment is smaller due to regular recalculation of debt and interest.

- The second factor is the low income of most clients. Not every person is able to withstand the financial burden of a mortgage with large down payments. When taking a housing loan, the borrower is often required to make an initial payment, and then it is difficult to pay a lot at once. In order not to take risks, banks prefer to issue mortgages with an annuity debt repayment scheme.

But the benefit for the borrower is obvious - differentiated payments allow you to save in total. If you have the opportunity to deposit a large amount at once or plan to receive income (increase in salary, inheritance rights, etc.), then it is better to choose this option. It is also more profitable to repay the debt to the bank ahead of schedule with differentiated payments, since interest is not paid immediately, but gradually, depending on the size of the debt.

Are there any disadvantages to differentiated payments?

On the one hand, it is obvious that the overpayment under the annuity is much greater than under the differentiated scheme. But the latter also has its drawbacks:

- The borrower will be required to provide proof of fairly high earnings, since the initial payments are large.

- Since the risk of non-repayment increases slightly, the bank can hedge its bets and lend a smaller amount than it would provide for repayment under a conventional annuity scheme.

- In addition, the bank may offer less favorable conditions by increasing the rate, insurance premiums, etc.

The borrower himself also has a certain risk. With a differentiated scheme, he must ensure that large monthly amounts are provided to repay the mortgage. In the case of an annuity, you can simply transfer equal contributions. And to save on overpayments for interest, pay off the debt ahead of schedule, paying a slightly larger amount than required.

Note! In most cases, banks provide mortgages and other loans with an annuity repayment scheme. Thanks to this, they reduce their risks and the risks of the borrower himself.

Reviews

It is not possible to unequivocally evaluate responses to mortgage repayment methods. Opinions are divided and related to material well-being.

Sergey, Ekaterinburg:

I took out a mortgage and decided to go with the annuity option, especially since Sberbank insisted on this. I liked the principle itself and the opportunity to deposit the same amount while paying off obligations. This helps you calculate your budget and not be afraid of overpaying.

Power of attorney in Alfa Bank

Ekaterina, Moscow:

I took a new position and my monthly income increased sharply. I sold my old apartment, got a loan and bought excellent housing in a new building. We had to wait a little before putting it into operation. Differentiated returns are reflected in costs, but we are pleased with the opportunity to pay minimal money in the future.

Andrey, Voronezh:

The transition to a good job led to the idea of moving into housing, especially after the wedding and the expectation of the first child. At the very beginning, repaying the loan was not too difficult; the salary clearly allowed it. The crisis led to the closure of the company, and it was necessary to look for another place. It became unprofitable to pay large sums and I had to quickly switch to the annuity method with debts to Sberbank, where the monthly contribution is precisely known.

Annuity or differentiated payments: how to choose for a mortgage and what it is

The terms “annuity” and “differentiated” refer to concepts in the lending sector and represent loan repayment options. The main difference is the way interest is calculated and deducted. With an annuity payment, monthly payments are equal throughout the entire term of the loan agreement.

The tranche amount consists of the following parts:

- parts of the debt;

- accrued interest;

- additional commission amounts.

When choosing the option with annuity payments, throughout the entire term of the mortgage agreement, the amount of the monthly payment does not change and remains equal. This option is convenient if there are no additional sources of income and the desire to repay the loan early. The debtor knows exactly the amount of the monthly payment, which eliminates the risk of misunderstandings.

With differentiated payments, the monthly tranche amount is not a constant value. It is gradually reduced in equal shares, and interest is charged on the remaining balance of the debt. This scheme involves a significant financial burden at the initial stage, which decreases every month. It is beneficial to borrowers who have good solvency and are ready for large monthly payments, as well as those considering the possibility of closing the loan earlier than the agreed period.

Mortgage annuity or differentiated payments: which is better

When applying for a mortgage, any borrower is concerned about at least two things: how long it will take to repay the loan and how large the final overpayment will be. If we compare the option with annuity and differentiated payments according to the criterion of the cost of using borrowed funds, then the second scheme will be more profitable.

When paying in equal installments, the borrower repays a smaller part of the balance; in the end, taking into account the accrued interest, the amount turns out to be greater, but this method has a number of advantages.

The advantages of the annuity method are considered to be:

- A wide range of offers, since most banks pledge annuity payments as part of standard conditions;

- Possibility of obtaining transparent conditions, an accurate idea of the amount of the monthly payment;

- Possibility to count on a larger loan amount;

- Less burden on the family budget, which makes the loan repayment process easier;

- Minimal risk of errors and violation of the payment schedule, and as a result, minimal risk of fines due to delays or incorrectly paid amounts.

Using the annuity calculation method allows you to count on approval and receiving a larger loan amount from the bank. When determining the maximum possible loan volume, a credit institution takes into account the client’s financial capabilities. Equal payments allow you to painlessly allocate an amount from the income received, and payments spread over time evenly distribute the burden on the budget.

With differentiated payments in the first half, the borrower has to “strain”, since the amounts during the first years can be significant. Such a nuance requires a careful assessment of the possibilities for allocating such an amount from the family budget. In the banking industry, the rule is that the cost of the monthly loan tranche should not exceed 40%. It might be interesting! Is it possible to take out a mortgage for two people and under what conditions?

A significant disadvantage of annuity payments is the larger amount of overpayment on the mortgage. The loan principal decreases more slowly, so taking into account accrued interest, the cost of the loan increases. The borrower receives the convenience of a fixed payment amount and the ability to plan a family budget, which is convenient in terms of financial discipline. At the same time, one cannot count on a reduction in load in the future, which is one of the main advantages of differentiated payments.

The advantages of the differentiated payment scheme are considered to be:

- less overpayment on the loan;

- gradual reduction of financial burden;

- Great opportunities for early repayment.

The disadvantage of the option using differentiated payments is the large payment amounts in the first half of the term. When determining the maximum loan amount, the client’s ability to contribute such a tranche is taken into account. As a result, the approved loan amount in most cases turns out to be less than under similar conditions in the situation of choosing the annuity method. The borrower is forced to periodically check the approved payment schedule, since the amount of the payment differs with each next payment.

Is it possible to change the annuity payment to a differentiated one?

Once a mortgage agreement has been concluded, the loan repayment scheme cannot be changed. Banks give mortgages under certain conditions, and annuity is more profitable for them. But if the client wants to save money and has additional funds, then it is possible to repay the mortgage debt ahead of schedule.

There is no need to pay an early repayment fee.

To do this, you must notify the bank orally or in writing (early repayment requirements are specified in the mortgage agreement) of your intentions. Indicate the amount to be deposited and the date of the transaction. After the money is credited to the account, the amount of principal and interest will be recalculated, and the client will be given a new payment schedule. The operation can be carried out an unlimited number of times, the amount of contributions does not matter.

Be sure to notify about partial or full repayment ahead of schedule to avoid confusion and banking errors.

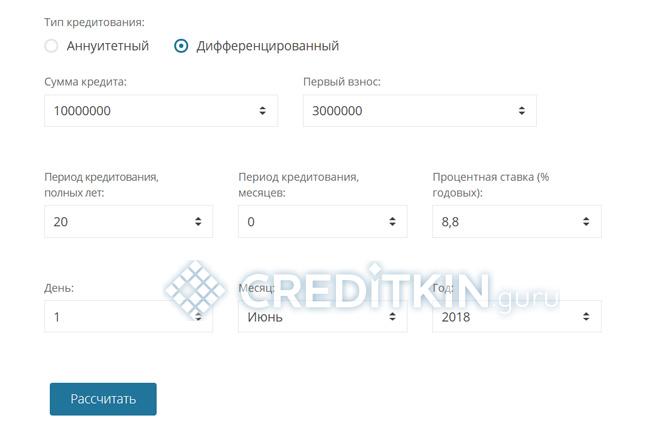

Annuity and differentiated payment - what is it and how to calculate it?

When applying for a mortgage loan, the bank asks the borrower to select loan parameters. They largely depend on the chosen debt repayment scheme. The loan is repaid in monthly payments - this is the only established banking system. The borrower needs to return the loan amount and the interest accrued on it. You can pay the amount in equal parts - an annuity, or deposit money in different amounts - differentiated payments.

Annuity payment

The annuity scheme involves making equal monthly contributions.

The bank sets the amount of the regular payment depending on the size of the loan and the chosen term. Interest is immediately charged on the entire loan, and the bank divides the amount of interest and loan by the number of months. The amount is calculated using a special algorithm and the employee announces the amount of the monthly payment to the client before concluding the contract. An annuity payment is convenient, but making early repayments with it is pointless; the savings will be minimal. The annuity scheme is designed to pay mostly interest at first and less of the loan body, but by the end of the term everything changes. Because of this, when asked to recalculate the loan amount, it turns out that all interest has already been repaid, and the bank cannot reduce the amount of the loan itself.

Each of the schemes has its own characteristics, but it is difficult to find the second one in the banking market.

Differentiated payment

In an alternative method of repaying a mortgage loan, the bank calculates the amount of the monthly installment depending on the balance of the debt. Every month the amount of interest decreases and it is easier to pay the loan. But initially the client will have to deposit large amounts, where the interest part is significantly less than the loan amount. With a differentiated payment upon early repayment, the borrower can save, since the amount of interest is calculated from the balance of the debt, and it has already been repaid to a greater extent. But you need to find out not only which banks provide mortgages with differentiated payments, but also what are the conditions for calculating the amounts.

Due to the financial burden on the client in the first months of the mortgage, a loan with differentiated payments is not approved for everyone. Only borrowers with high official income can count on it. Since, according to the law, the payment amount should not exceed 50% of the monthly salary.

Bank programs

At Rosselkhozbank you can get from 100 thousand to 60 million rubles. for up to 30 years. The minimum down payment is 15%. The rate depends on the size of the loan, the category of the borrower, and the type of property.

More favorable conditions for young families - down payment from 10% and interest rate from 9% per annum.

RSHB requirements for borrowers:

- age from 21 to 65 years (up to 75 years, you can get a loan if there are co-borrowers, and also if at least half of the loan term has passed before the borrower’s 65th birthday);

- Russian citizenship and registration;

- at least 6 months of work experience at the last place of work and at least 1 year of total work experience over the last 5 years.

Gazprombank also provides a choice between annuity and differentiated payments. Let's consider the conditions of several programs of this bank: mortgage under two documents, primary market and secondary market.

In the primary market, you can take out a mortgage on an apartment, apartment or townhouse. Rates start at 10.5%. The minimum down payment depends on the type of property. For an apartment – 10%, for a townhouse and apartments – 20%. The maximum loan amount is 60 million rubles, the minimum is 50 thousand rubles. Loan term – from 1 year to 30 years.

On the secondary market, you can use borrowed funds to buy an apartment, the last share in real estate, as well as a townhouse. The minimum down payment for an apartment and share is 10%, for a townhouse – 20%.

The bank adds 0.3% to the rate if the borrower is not a salary client or does not buy real estate from a partner. Another 1% is added if you cancel life insurance.

Within the framework of a mortgage according to two documents, the down payment amount is at least 40%, the maximum loan amount is 10 million rubles.

The requirements for a borrower from Gazprombank are as follows:

- citizenship of the Russian Federation;

- registration or permanent residence in Russia;

- age not less than 20 years and not more than 65 years;

- continuous work experience at the last place of work of at least 6 months (total work experience of at least 1 year).

Banks that issue mortgages with differentiated payments in 2020

The vast majority of banks in the Russian Federation (almost 99% of the total) issue mortgage loans with an annuity system of debt repayment. Lenders, who previously practiced allowing the client to choose a debt payment system convenient for him, today also switched to annuities.

Below is a table with the conditions for obtaining a mortgage in banks with differentiated payments that offer such a system to their clients.

| Bank | Mortgage program | Amount of borrowed funds | Interest rate, % per year | Return period | Share of the down payment, % of the price of the purchased housing |

| Gazprombank | Primary market | From 500 thousand rubles | From 4.5 | Up to 30 years old | At least 10 |

| Secondary market | 8,1 | ||||

| Rosselkhozbank | Primary market | From 100 thousand to 60 million rubles | From 4.7 | 1 – 30 years | From 15 |

| Secondary market | From 100 thousand to 8 million rubles | From 8 | Up to 25 years | At least 40 |

Both Gazprombank and Rosselkhozbank first take into account the type of debt service desired by the potential borrower. After a detailed analysis of the client’s financial situation (primarily his creditworthiness and the quality of his credit history), the Credit Committee makes a final decision on the method of debt repayment.

Mortgage lending conditions in both credit institutions are among the best and most profitable offers on the Russian market. Low interest rates, ongoing promotions and special offers, as well as the ability to choose a differentiated payment system contribute to the constant growth in demand for mortgage loans and maintaining leadership positions in many areas.

"Gazprombank"

At Gazprombank, the borrower is provided with two types of payment schemes - annuity or differentiated. The latter is possible for all home loans with the exception of military mortgages. Thus, a borrower can refinance a mortgage loan from another bank and thereby switch from an annuity to a more profitable payment system.

Refinancing options:

- rate from 8.8%;

- term – from 42 to 360 months;

- credit limit – from 500 thousand to 45 million rubles.

For non-salary clients there is a surcharge to the rate of 0.5 percentage points.

Rosselkhozbank

Housing mortgage lending from Rosselkhozbank allows you to purchase the following types of real estate:

- apartments and apartments (primary and secondary market);

- a private house together with a plot of land or a townhouse;

- piece of land.

The loan amount is issued in the range from 100 thousand to 60 million rubles, interest rates start from 8.95%. When registering, the client can independently choose the payment procedure.

Advantages of mortgage refinancing at Rosselkhozbank

No loan fees

Possibility of choosing a loan repayment scheme (annuity / differentiated)

Early loan repayment without restrictions

Possibility to change the loan term and payment amount

Ability to confirm income using bank form

"KubanCredit"

The bank provides loans for the purchase of real estate under the “Ready Housing” program, which includes apartments, including those with a plot of land, and private houses. Financing is provided both by annuity and differentiated schemes.

The mortgage is issued at 10.99% per annum for a period from 1 to 30 years. The minimum loan size is 300 thousand to 7 million rubles. For salary card holders, the rate is reduced to 10.49%.

“Ready Housing” program at Kuban Credit BankLoan amount

from 300 thousand rubles to 7 million rubles

loan terms

from 1 year to 30 years

loan rate

from 10.99% per annum

* - for salary clients the rate is reduced to 10.49%

Housing loans are provided only in the territory of the bank's presence (Rostov region, Krasnodar region, Republic of Adygea). In this case, the borrower is an individual and can have registration in any region of the Russian Federation.

Thus, along with a huge number of bank offers for mortgages with annuity payments, the choice of products with a differentiated scheme is limited. However, it is impossible to definitively answer the question which payment option is better. Firstly, the conditions for issuing funds according to different systems differ slightly and the reason for this is only the internal policy of the bank. As confirmation, you can cite any program that provides a choice of calculation scheme for monthly payments: rates, amounts and terms do not change. Secondly, it is necessary to take into account various factors: your own capabilities and lending goals. In some cases, it is more profitable to rent an apartment from the key developer of Sberbank and receive a rate of 7.9% than to contact KubanCredit for a differentiated payment and an overpayment percentage of 10.99% per annum.

After familiarizing yourself with the pros and cons of each of the schemes, each borrower will be able to independently decide on their choice.

Does VTB have differentiated mortgages?

VTB Bank offers various mortgage lending programs:

- for the purchase of new buildings and secondary housing,

- mortgage for the military and with state support,

- even with just two documents.

For all these types of lending, an annuity repayment model is provided. The company’s official website does not say anything about whether there is a differentiated mortgage at VTB24 or not.

On banking portals where offers with differentiated payments are listed, there are also no programs from this bank.

But you can find out everything for sure yourself by calling the hotline personally. This way you will receive the most up-to-date information.

Does Sberbank provide mortgages with a differentiated method?

It is necessary to move on to specific lending programs associated with the offers of the largest financial institution. The borrower is offered:

- purchase finished or under construction housing at an interest rate of 12 to 12.5 percent;

- start building your own house (13%);

- buy a plot of land or a private house (from 12.5 percent);

- choose a plot for the construction of a garage (from 13 percent).

Military mortgages are presented separately. Maternity capital, which helps solve the housing problem for large families, has not been forgotten.

Bank specialists deliberately promote the annuity option. The proven scheme is known and reduces the debt burden. This is especially important in the first period after loan approval and home purchase.

The current financial situation in the country forces Sberbank to take special security measures. An annuity is now being practiced, reducing the risks for both parties to a minimum.

Which bank has differentiated mortgage payments in 2020?

Banks offering mortgages with differentiated payments are not widespread enough, since by registering these clients, financial institutions miss the opportunity to benefit from the interest paid by the debtor.

A differentiated payment, as an alternative choice of repayment method, is a monthly mortgage payment, which, in turn, consists of different parts, principal and variable. Another important feature of the differentiated payment is that with each reporting month it decreases according to a special formula. Roughly speaking, the borrower pays the minimum minimum payment by the end of the mortgage, while the entire principal portion of all interest was paid at the beginning of the term. The difference in mortgage repayments with annuity and differentiated payments The main question that worries the population is which bank has a mortgage product with differentiated payments in 2018? This list includes the following organizations:

- Gazprombank. The largest well-known Russian bank, which has in its arsenal many profitable mortgage offers with low rates, comfortable conditions for borrowers, and most importantly, the ability to make differentiated loan repayments.

- Rosselkhozbank. This financial company is also meeting its population halfway and is launching the process of creating differentiated mortgage payments. This has almost doubled the number of potential citizens applying for a mortgage loan.

What do you need to get approved for a mortgage with differentiated payments?

It is difficult to obtain a mortgage with a differentiated payment scheme, because banks are strict with potential borrowers due to the high risk of non-repayment. A person must:

- Be officially employed. The request is submitted to clarify the total length of service for the last five years (must be more than a year) and length of service at the current place of work (from 6 months). The lender is also interested in how valuable the employee is and what his career growth is. Therefore, a request is often made to collect additional information.

- Have a high salary. Its size should be enough to pay the largest payment assigned by the bank for the mortgage. Official income is taken into account, confirmed by a 2-NDFL certificate. The bank tells you either the exact salary required to take out a mortgage or the percentage required for repayments.

To increase the chances of approval for a mortgage with differentiated payments, a person can:

- Provide collateral. It is necessary to invite an appraiser to establish the exact amount, or indicate it yourself when submitting an application. But you shouldn’t lie or exaggerate; the bank regards such actions as an attempt at fraud and automatically denies the loan.

- Invite guarantors or co-borrowers. Up to 2-3 people are allowed to bring to the bank to increase the mortgage amount or receive a differentiated scheme. Their income is taken into account.

- Provide information about your ideal credit history. You can pre-order it free of charge from BKI to ensure compliance with banking requirements. If any errors are found, they must be corrected before submitting the mortgage application.

The more documents the borrower provides in support of their financial stability and security, the greater the chance of receiving approval for a mortgage with differentiated payments.

Mortgage refinancing: differentiated payments and other conditions

Refinancing programs appeared on the lending market relatively recently, but quickly became popular among citizens. The essence of such proposals is that the borrower has the opportunity to receive more favorable lending conditions compared to the previously concluded agreement.

Possible benefits include:

- getting a lower rate;

- extension of the loan term;

- changing the payment system;

- replacement of the contract currency;

- change of the main creditor;

- combining one or two loans into one.

To conclude a new agreement, a citizen can contact his own bank or another credit institution. Over the past few years, there has been a trend in the banking sector towards lowering loan rates, which allows borrowers to obtain a new loan on more favorable terms. The emergence of refinancing programs is also due to the fact that the number of clients with a good credit history continues to grow steadily, and banks are forced to increasingly fight for each new borrower.

Before contacting a credit institution, you must carefully consider the feasibility of renewing the agreement. Additional costs will be required to renew the insurance contract and pay for the services of an appraiser, which should be taken into account when calculating the parameters of a new loan under the refinancing program. If the reason is related to the deterioration of the financial situation and the inability to pay a large amount according to the differentiated payment schedule, then you should first consider the option of obtaining a deferment or “credit holiday” from the bank.

Today, a significant number of banks enter into lending agreements using an annuity payment system, but in some organizations clients have the opportunity to choose the repayment method. Each option has a certain list of advantages and disadvantages, so it is necessary to take into account financial capabilities and personal preferences.

Difference between differentiated and annuity payments

When drawing up a mortgage agreement, the bank offers the client a choice of debt repayment scheme - annuity or differentiated.

A differentiated mortgage payment involves paying the loan itself in the first months. Interest will be accrued monthly depending on the balance of the debt. Therefore, when the loan body is repaid, the borrower will only have to pay the interest.

For people with low earnings, this scheme does not bring benefits, since the point is to quickly repay the loan amount. Differentiated payments allow you to save on interest, especially if you pay off most of the debt during the first months.

An annuity payment is easier to calculate, because here the bank initially charges interest on the entire amount of the debt relative to the term and withdraws a monthly amount for repayment. Interest is paid first, and only after that the money is used to pay off the debt itself. Interest accrues with a certain regularity, depending on which bank you took out the mortgage from. Therefore, the schemes may vary slightly in terms of conditions.

An annuity payment is not beneficial for a person who proposes early repayment, because he will already pay all the interest to the bank.