Every client thinks about how to reduce their mortgage payment at Sberbank. The loan amount is quite large; monthly payments put a significant burden on the budget. Legislation and several banking tricks make it possible to change the amount of contributions. Prerequisites for this may include temporary disability, job changes and other economic shocks that cause a decrease in income. Below we will consider in detail what legal ways to reduce the burden of paying off a mortgage loan.

What are the monthly mortgage payments made up of?

Payments are calculated based on several constant values, which include:

- Cost of purchased real estate. The higher the price, the more money will be required on credit.

- An initial fee. The contributed part of the cost allows you to make changes to the amount of loan funds.

- Loan terms. The maximum term for a mortgage is 30 years. The longer the period, the greater the remuneration the bank will require for the use of funds.

- The interest rate determines the amount of overpayment on the loan. The indicator is influenced by the category of the client, the terms of the transaction, life and health insurance, and the presence of guarantors or co-borrowers.

Thus, even at the stage of applying for a mortgage loan, you can regulate the monthly payments. For a more correct understanding, the site presents a standard loan calculator into which you can enter all the variables and get the result. By adjusting various indicators, you can choose the best option based on individual preferences.

Mortgage lending offers an annuity repayment system. Contributions are made in equal installments, the amount remains unchanged throughout the entire period of the contract. It includes the principal debt and bank remuneration.

Conditions

The legislation reserves the right of the bank to determine the procedure for early repayment and the timing of notification of its intentions. The conditions for depositing money on a mortgage ahead of schedule at Sberbank look like this:

- Minimum contribution amount . Until recently, it was 15,000 rubles. However, now the bank has lifted this restriction - you can deposit as much as you like. However, if you use Sberbank Online to repay your mortgage, then the contribution amount must be no less than 99% of the next payment. The minimum amount in your personal account is displayed next to the amount, so it is not necessary to make calculations yourself.

- Commission . Sberbank does not charge it. The client is not charged any fines or penalties. That is, he does not suffer financial losses.

- Repayment terms . Sberbank representatives say that early repayment is possible the very next day after the mortgage is issued. At the same time, they assure that no “sanctions” such as subsequent refusals of loans will follow.

- Notice periods . Now there is no need to submit an application 30 days before the date of early repayment. It is enough to submit it on a working day and the recalculation will be made on the next working day.

Sberbank is making mortgages more and more accessible. Early repayment procedures are also being simplified. So, today there are no restrictions on terms and amounts. However, some formalities will still have to be observed.

Read: Buying an apartment with a mortgage step by step: procedure

Is the loan term taken into account?

Most citizens, when applying for a mortgage loan, try to pay off their debt faster, so they choose the minimum repayment terms. This approach is not correct from a practical point of view. This gives a large monthly contribution, which requires not only financial stability, but also frugality.

The maximum possible term of a mortgage loan can significantly reduce the financial burden of the loan. However, overpayments on debt also increase. It is recommended to choose a time frame so that payments do not exceed 30% of income.

Sberbank does not provide penalties for early repayment. Therefore, it is better to take time with reserve when concluding a contract, so that unexpected financial shocks do not lead to delays, for which a penalty is provided. This makes it possible to independently regulate the size of the monthly contribution, as well as pay with a reserve in order to temporarily change the payment amount (if necessary).

Depositing large amounts will allow for recalculation, which will reduce the level of overpayment for the use of borrowed funds. Thus, the client himself decides in what parts to cover the debt and leaves some “safety cushion” in case of unforeseen life difficulties.

Closing a mortgage loan using Sberbank Online software

The Sberbank Online system is a convenient tool that allows you to manage accounts and make money transfers. Unscheduled loan repayment is carried out according to the following algorithm:

- Go to your electronic account and open the menu “Early repayment” - “Partially repay the loan”;

- Specify the account from which the loan will be repaid (menu “Write-off account”);

- Set the date for transferring money;

- Enter the amount you plan to use for unscheduled repayment. The minimum value of this parameter is calculated automatically (the resulting figure is displayed under the “Amount” field);

- Click on the “Submit application” button;

- Check the specified parameters and select the “Confirm via SMS” option;

- Enter the password in the appropriate field (the secret code cannot be shared with third parties);

- Confirm the transfer. Transfer of money from the account will be carried out automatically.

Debt repayment data is indicated in the “Payment History” section. Applications for making payments are registered by the system on working days. If the command to transfer funds was sent on a weekend or holiday, the payment will occur on the next business day. Before sending an electronic application, check your account status. There must be a sufficient amount of money on it.

Before making a transaction, you must verify the information specified in the SMS message and the transaction details. The data must match. Careful attention to transactions performed will reduce the risk of illegal actions by third parties.

Self insurance

When drawing up an agreement, the employee offers to insure the purchased property and the life of the borrower in an accredited company. There are 2 or 3 systems to choose from, but there are many more available. The difference in tariffs reaches 30% of the contract value.

Based on the fact that the term of mortgage lending is usually quite long, by independently monitoring and choosing the optimal insurance rate, you can save a significant amount. The contract with the insurance company is concluded for the entire period of obligations to the bank. In some cases, simply studying the offers will save you up to 100 thousand rubles.

Possibility of early payment of mortgage - legislative framework

The right to early payment of loans (partial and full), including mortgage, is established by Art. 810 of the Civil Code of the Russian Federation. To do this, you must notify the lender of your intention in writing, otherwise the additional money contributed will not be taken into account and will be written off at the next monthly payment.

The question of whether partial or full early repayment of a mortgage at Sberbank is possible raises questions among many borrowers, since in practice, closing a debt ahead of schedule has some difficulties. This position is explained by the fact that the lender does not want to lose potential interest income.

Use of restructuring

Life situations are different; no one is insured against temporary or complete loss of ability to work due to injury. In order not to lose the purchased apartment, you need to get a deferment or reduce your loan payments as much as possible.

Restructuring is based on increasing the loan repayment period, which provides a significant relief in the amount of payments. The amount of overpayment also increases. To receive the service, you will need to provide the bank with the following documents:

- Statement of the established form.

- Passport of a citizen of the Russian Federation with a registration mark.

- Certificates of income level.

- Document serving as the basis for recalculation. Medical certificate of temporary incapacity for work, disability.

- Mortgage loan agreement.

The application is reviewed within 5 working days. After approval, the client is offered new terms and a restructuring agreement is signed. The recalculation made is reflected in the new loan repayment schedule, which is issued to the client at the bank branch.

The extension of the term is limited by the age of the borrower. At the end of the contractual obligations, it should not exceed 70 years. Each case is considered individually.

Is it possible to shorten the mortgage term at Sberbank?

Any borrower who has taken out a mortgage loan strives to pay the lender faster and reduce the amount of overpayment. Clients with unstable incomes and a high credit load, on the contrary, apply to increase the loan term and, accordingly, reduce the current payment. Most borrowers are interested in whether it is possible to change the mortgage term at Sberbank downward after concluding a loan agreement?

At Sberbank, recently, it has become possible to reduce not only the amount of the monthly payment for early repayment of the mortgage, but also the term.

Important point! If you decide to shorten the mortgage term due to early repayment, this can only be done at a bank branch. This form of early repayment is not possible through Sberbank online. In this case, the payment amount must necessarily be greater than the payment according to the schedule!

Current legislation allows early repayment of debt at any time after concluding a loan agreement with the bank without any penalties or additional payments. It is quite logical that for Sberbank early settlement is extremely unprofitable, since it will not receive its interest. However, according to the law, the creditor has no right to refuse the client’s desire to repay the debt or part of it before the specified period.

You can deposit an amount, the amount of which should be greater than the monthly payment amount in the approved payment schedule, according to a pre-drafted application addressed to the bank management. The document can only be submitted offline (usually at the branch where the loan was issued) if you plan to shorten the mortgage term and possibly online if you want to reduce the monthly payment.

Features of early payment in Sberbank:

- the application is accepted no later than 1 working day before the next payment is due;

- money is debited on the day of payment according to the schedule;

- interest is accrued for the days of actual use of the loan;

- the application is drawn up and signed personally by the borrower (no oral agreements are valid).

At the request of the borrower, the bank is obliged to provide a new payment schedule under the loan agreement, taking into account payments made ahead of schedule.

IMPORTANT! If the borrower plans to repay the balance of the mortgage in full, then you will need to contact Sberbank in advance and request the exact amount for payment, including accrued interest, on the planned payment date. This is done to avoid underpayment or overpayment.

Let's consider whether it is possible to shorten the mortgage term at Sberbank for annuity and differentiated payments, as well as in the case of using maternal capital.

When making an annuity payment

The annuity scheme provides for debt repayment in equal installments over the entire loan term. Since in the first half of the term the main part of the payment is interest to the bank with a minority of the loan amount, early repayment will be beneficial and relevant only until the middle of this term.

Experts recommend early payment in this case in the first year after the conclusion of the contract. This could then become a loss-making business. In any case, the necessary calculations should be made to determine the potential benefits.

It is possible to submit a request for early payment through Sberbank.Online. To do this, on the special tab “Early repayment” in the personal account, the client must click the “Partially repay the loan” button and indicate the write-off account, the account and the date of crediting the indicated amount. The completed application will be automatically sent to the bank, and the money will be debited on the specified date.

With differentiated payment

This scheme, on the contrary, provides for a gradual reduction in the amount of monthly payment. In case of early repayment, the system will automatically recalculate the remaining debt on the Sberbank mortgage and, accordingly, accrued interest.

Differentiated payment in this matter will be more profitable than annuity payment. However, at Sberbank, all mortgage loans today are issued only using equal payments.

When repaying with maternity capital

Owners of a maternity capital certificate have the opportunity to repay their Sberbank mortgage debt using the available amount of government assistance. All issues regarding the disposal of this measure of state support are resolved by agreement with the Pension Fund of Russia.

In order to use maternal capital, the client initially orders from Sberbank an official certificate about the status of the current loan debt and the name of the details of the mortgage agreement, which is then presented to the Pension Fund.

At the same time, the borrower applies to the Pension Fund of the Russian Federation with an application to transfer the available amount of capital to repay the mortgage at Sberbank and provides the required package of documents (under the signature of a specialist).

If the outcome of the case is positive, the required amount will be credited to the client’s loan account at Sberbank in a non-cash manner. The balance of the debt will be recalculated in favor of the borrower.

Additionally, you can request from Sberbank an account statement or a certificate confirming the receipt of money from the Pension Fund of the Russian Federation.

Monitoring changes in banking offers

Economic development is pushing financial organizations to develop more profitable lending programs. Therefore, the interest rate on mortgages may differ depending on the year the contract was concluded. Recently, there has been a trend towards a decrease in remuneration for the use of borrowed funds. Sberbank also tries to offer clients the most comfortable conditions.

You can contact a bank employee to review the terms of the agreement. Most often, the company meets its clients halfway and is ready to reissue the loan to a more profitable program. Therefore, it is important to monitor all changes in the terms of mortgage lending and promotions.

To obtain approval to change the conditions, you must be a conscientious performer of your obligations. The bank will not consider the application of a client who is in arrears in repaying the loan. The obligation must be fulfilled exactly, then employee loyalty will be maximum.

The process of removing the encumbrance

And again, Sberbank simplified the task as much as possible. The vast majority of banks say that after cancellation you need to go to the branch, request documents, and bring them to Rosreestr. Sber acts completely differently, making life easier for its clients.

The bank itself initiates the process of removing the encumbrance; the borrower does not need to go anywhere for this. Within two days after the mortgage loan is completely closed, the bank begins the process by informing the client via SMS. Within 30 days, Sberbank will independently transfer the necessary package of documents to Rosreestr.

The former borrower will be given access to his personal account, where he will be able to track the process of removing the encumbrance online.

Following the procedure, the client also receives an SMS about the success of the transaction. And all this is done without visiting the office and writing an application. You can then request confirmation that there are no restrictions on housing. The check is carried out on the Rosreestr website or through the State Services portal. If you order an extract from the Unified State Register of Real Estate, information about the encumbrance will not be there.

Maternity capital as debt repayment

Improving the demographic situation is a priority in domestic policy. According to the law, upon the birth of a second child, the family is allocated funds - maternity capital. Its size is large enough that it will significantly reduce mortgage payments.

After receiving the certificate, it is enough to contact the bank and write an application. The amount is credited towards the repayment of the principal debt, which will reduce the total overpayment on the loan after recalculation. The birth of a child will make it possible to save up to 3-4 thousand rubles every month on paying off a mortgage loan (it all depends on the size of the debt).

How to correctly make partial early repayment of a mortgage at Sberbank

Partial repayment of mortgage debt is carried out only upon application and prior notification of Sberbank. The document is drawn up in free form, but must necessarily contain the following information:

- details of the loan agreement and loan account number (number, date of conclusion and availability of additional agreements);

- FULL NAME. and the position of an authorized employee of Sberbank, in whose name the application is being drawn up;

- Name of the bank;

- FULL NAME. applicant + his passport details;

- the amount and date of the upcoming payment.

The application is written in duplicate in the format of a request to repay part of the debt under a specific loan agreement, indicating the exact amount.

IMPORTANT! Sberbank indicates the deadline for submitting such a document - no later than 1 business day before the date of debiting money from the loan account, but it is recommended to make the transfer at least 3-5 business days, since possible force majeure or other circumstances beyond the control of the client may lead to delays and incorrect calculation of debt.

An example application for partial early repayment can be downloaded here.

Tax deduction

Every citizen who purchases housing with a mortgage is entitled to a tax deduction. It is 13% of the cost. The only negative is that the maximum amount is 2 million rubles.

Thus, if the loan exceeds 2 million, then the net savings is 260 thousand rubles. These funds can be used to repay the principal debt, as well as maternity capital. Due to this, mortgage payments can be reduced by 2-3 thousand on average, depending on the size of the loan.

Reducing the mortgage amount using maternity capital

The procedure for partial early repayment of a loan with maternity capital requires sending a certificate to the Pension Fund of the Russian Federation about the balance of the loan debt. If approved, the subsidy will be transferred to the client's account, allowing the interest and principal to be repaid.

Penalties, penalties and fines cannot be paid with maternity capital.

After the loan is recalculated and mandatory payments are reduced, a new payment schedule can be obtained at a Sberbank branch or mobile application.

Many are also concerned about whether it is possible to reduce the term of a mortgage at Sberbank using maternity capital , to which company employees answer in the affirmative: “No, using a family certificate will only reduce the amount of monthly payments!”

Reducing the mortgage term at Sberbank

At Sberbank, all mortgage products are issued according to the annuity scheme. Debt repayment is made in equal installments throughout the entire duration of the loan. In the first half of the term, the bulk of the contributions is made up of overpayments of interest. It is more profitable to make early payment before the middle of the term.

Important! When wondering whether it is possible to reduce the mortgage term at Sberbank, it is important to consider that the repayment amount must exceed the payment according to the schedule.

Which is better: reduce the term or amount of the mortgage?

During an extraordinary debt transfer, the borrower will have to choose between reducing the loan term and the amount of monthly installments. Bank specialists recommend taking into account the client’s financial situation. With stable income, it is better to leave the payment amount and reduce the term. To reduce the financial burden from loan obligations, you should choose to reduce mandatory contributions.

A loan calculator will help you calculate the difference between the proposed options in monetary terms.

For example, the main debt of citizen Ivanov after an extraordinary payment is equal to 1 million rubles. The borrower decided to change the term from 20 years to 15. The overpayment without insurance is 1.045 million rubles, the amount of mandatory contributions is 11,366 rubles.

In an alternative situation, if the monthly payment is reduced to 10,322 rubles, with a loan term of 20 years, the overpayment will reach 1.477 million rubles. The difference in the amount of mandatory contributions when changing the payment term/amount is 1,000 rubles, and the total overpayment is 432,000 rubles.

When choosing between reducing the term or payment on a mortgage, the answer is obvious - it is more profitable for the client to repay the loan faster than to reduce monthly payments.

How to shorten the mortgage term by making early payments - partial repayment

With the expansion of the company's functionality, many clients were able to solve the problem of whether it is possible to change the term of a mortgage at Sberbank by partially repaying the debt online. Completing the application takes a few minutes. It is enough to perform a number of actions:

- Open a personal account “Sberbank Online”.

- Select an existing product.

- Activate the “Early repayment” tab, follow the “Partial payment” link.

- Select an account to transfer money in favor of the overpayment.

- Specify the payment date, payment amount (Sberbank sets restrictions: maximum 99% of the nearest payment).

- Click the “Submit application” button. The system will offer to check payment parameters and confirm transaction data via SMS.

- All that remains is to receive a notification with the details, enter the password and confirm the transaction.

Advice: if you decide to reduce the overpayment for a mortgage loan, you should consult with the bank manager about possible benefits, subsidies for vulnerable groups of the population, tax deductions, and ease the financial burden of the loan as much as possible.

In 2020, public sector employees, owners of small spaces, or people on the waiting list to receive an apartment or improve their living conditions can reduce the percentage at the expense of state money.

Renting out a mortgaged apartment

Clause 4.1.3 of the Sberbank loan agreement prohibits the rental of collateral housing. The Bank reserves the right to change the decision in exceptional situations:

- the borrower was laid off or fired from work;

- part of the income has decreased;

- temporary restriction of legal capacity.

It is possible to legally rent out collateralized property during encumbrance with the permission of Sberbank. Otherwise, fines and administrative penalties through the court apply.

We transfer the tax deduction for the purchase of an apartment to a mortgage account

The upper limit of the amount for tax deduction for mortgage housing purchased before 2014 is 2 million rubles. Recipients of official salaries can return a maximum of 260,000 rubles. The refund amount is determined by the client's income level.

Example No. 1: Petrov took out a mortgage on real estate worth 2.7 million rubles. His income reaches 70,000 rubles. Monthly PDV deductions to the state fund are 9,100 rubles, for the year - 109,200 rubles. The borrower has access to a tax deduction for 3 years: in the first two periods - 218,400 rubles; last year - 41,600 rubles.

A transaction completed after 2014 allows you to reimburse 3 million rubles over the entire loan period.

Example No. 2: a client bought a home on debt worth 2.1 million rubles, the amount of overpayment was 1.259 million. For a salary of 60,000 rubles, the tax deduction will be: for an apartment - 260,000 rubles; overpayment of interest - 163,670 rubles.

When applying for a mortgage after January 1, 2014, the borrower’s spouse has the right to receive a tax deduction. Pensioners can also exchange the paid 13% tax for a cash equivalent within three years after retirement.

Saving funds on deposit

Funds to repay the mortgage are debited from the client’s personal deposit, where he deposits money. Having additional opportunities will allow you to save large amounts. Early repayment of a loan is a lengthy procedure, so you should not pay in small installments.

The best option is to put aside finances on deposit. By transferring more funds to a bank account than required, you can accumulate a significant amount in a short period. Money in a bank account is more difficult to spend than money in your immediate vicinity.

Having accumulated a significant amount of funds, you can contact the bank with an application for early repayment and a request for recalculation of payments. Provided you choose a longer period and the optimal amount of planned contributions, accumulation will not cause difficulties. Thus, you can reduce the financial burden of a mortgage loan in a fairly short period of time.

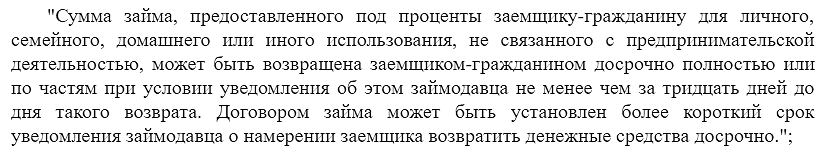

Is it possible to repay early?

Any credit institution considers making a profit its main goal. For them, early repayment of debt obligations by the client always means the loss of part of their income. Therefore, the question about the possibility of depositing money ahead of schedule is not surprising. Here you need to build on legislative measures and the policies of the bank itself. So, in paragraph 2 of Art. 1 of Federal Law No. 284-FZ of October 19, 2011 talks about the possibility of early repayment of a mortgage.

Click to enlarge image

Note ! We are talking about a mortgage issued for personal purposes. If real estate is purchased for business purposes, this rule does not apply.

It also notes the need to notify the lender of early repayment 30 days in advance. However, this period may be reduced by the bank (as specified in the contract).

Renting out purchased property

If the purchased apartment is not the only place of residence for the family, then renting out is an excellent option to reduce the load. The proceeds can completely cover the scheduled payment. Adding your own funds will allow you to pay off your debt to the bank ahead of schedule.

This aspect is specified in the contract and is strictly prohibited. This is due to the possibility of property damage. The purchased object automatically becomes collateral, so the bank needs guarantees of safety in the form of insurance and non-use for commercial purposes. However, if the funds arrive in the bank account on time, there are no overdue payments or debts, then most likely the employees will not check the apartment.

If the debt is paid off only from rental proceeds, then the property will pay for itself. The only negative is the long period. This activity relates to long-term investing. The real estate market is stable, which is why it attracts many.