Who benefits from the refinancing service?

The refinancing service may change the following:

- Loan terms . The longer you have to pay off your home loan, the less you will have to pay to the bank. That is, anyone who is afraid of financial problems in the future should go to Tinkoff Bank;

- Amount of mandatory payments . The point is related to the previous one. The longer the loan terms, the less money you will have to pay each month;

- Currency . An application for refinancing can be submitted in cases where it is necessary to change the payment currency.

Useful video:

- Interest rate . The most common reason for refinancing. A mortgage costs millions of rubles, and interest plays a huge role here. So, if there is an opportunity to reduce them, then it is worth taking advantage of;

Important to remember ! No one is immune from the fact that the exchange rate of a certain currency relative to the ruble will not change. Therefore, the last refinancing option is quite risky.

Documents for obtaining a mortgage from Tinkoff

Debit card from Tinkoff

- Up to 30% cashback

- Up to 6% per annum

- Free service

More details →

Before submitting an application on the official website, the user must make sure that he has all the documents necessary to obtain a mortgage from Tinkoff Bank. Let's highlight those that are required:

- Passport of a citizen of the Russian Federation;

- TIN;

- Certificate of payment of all tax contributions;

- A copy of the passport of a citizen of the Russian Federation;

- Copy of TIN;

- Second ID:

- SNILS;

- TIN;

- Pensioner's ID.

Other banking institutions add to the list a certificate in form 2-NDFL , since it is this document that certifies the user’s income level and official employment, however, Tinkoff Bank does not limit its clients in this regard - they can bring a certificate to reduce the interest rate, but this is not necessary.

Did you know that there is a magazine “Mortgage and Credit”, which covers all banking organizations and their terms of service?

There is another alternative - a certificate in the form of a bank. It sets out the norms recognized in a particular organization. Accordingly, the contents of the document vary depending on the selected financial institution.

The difference between the papers is that the first certifies the official place of work and, accordingly, white wages, while the second contains information about the “black” way of earning money without paying taxes.

As soon as all the papers have been verified, the banking institution will proceed to analyze the credit history of the individual. If it turns out to be negative, then the probability of refusal from the financial company will increase significantly, but even in this case there will still be a chance of receiving a loan, albeit with a smaller limit restriction.

If the user’s credit history is neutral or positive, the bank will have no reason to refuse. It is important to always remember that the more accurately the client pays the debt, the more accurately he sends funds to the account, the better his terms of service will be in the future.

Refinancing procedure at Tinkoff Bank

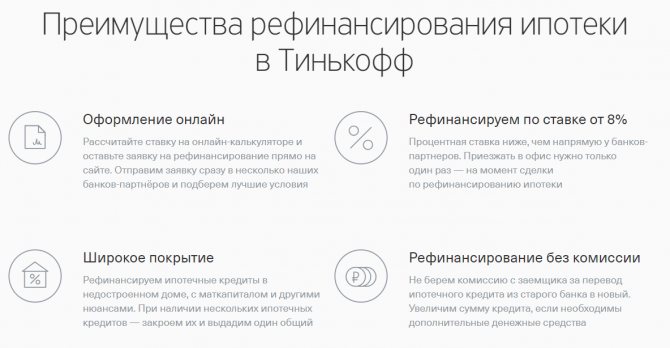

Tinkoff Bank offers its clients the opportunity to online refinance a loan that was issued at another financial institution.

So, you can submit an online application through your Tinkoff personal account, after which the bank will send it to its partner institutions .

Partner banks

Tinkoff Bank, through its partners, offers very favorable refinancing conditions, and its consultants are always ready to advise you on all issues related to refinancing.

What are the conditions for refinancing a mortgage at Tinkoff?

Tinkoff Bank itself does not provide refinancing services, acting through partner institutions. That is, Tinkoff will contact you

Good to know ! Working through Tinkoff Bank, you have an excellent choice, because approval for refinancing may come from several other banks at once.

Basically, Tinkoff, represented by its partners, offers the following conditions for mortgage refinancing :

| Sum | Deadlines | Interest |

| Up to 100 million rubles | Up to 25 years | From 8% |

The final interest rate will be determined by the lender who agrees to refinance. It all depends on the required amount of money, the loan repayment deadline, and the “parameters” of each individual borrower .

Mortgage calculator Tinkoff Bank. Online mortgage calculation Tinkoff Bank 2020.

- Mortgage calculator online

- Tinkoff Bank

Select a Tinkoff Bank mortgage loan for online calculator calculation

Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 8% 100 000 000 up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 8% 100 000 000 up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 10.25% 100 000 000 up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 13.35% 100 000 000 up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 8% 100 000 000 up to 25 years

36 398

1 367 793

4 367 793

| payment date | Principal payment | Duty | Interest payment | Interest | Monthly payment | Remainder | Principal balance |

| October 2020 | 16 398,28 | 20 000,00 | 36 398,28 | 2 983 601,72 | |||

| November 2020 | 16 507,60 | 19 890,68 | 36 398,28 | 2 967 094,12 | |||

| December 2020 | 16 617,65 | 19 780,63 | 36 398,28 | 2 950 476,47 | |||

| January 2021 | 16 728,44 | 19 669,84 | 36 398,28 | 2 933 748,04 | |||

| February 2021 | 16 839,96 | 19 558,32 | 36 398,28 | 2 916 908,08 | |||

| March 2021 | 16 952,22 | 19 446,05 | 36 398,28 | 2 899 955,85 | |||

| April 2021 | 17 065,24 | 19 333,04 | 36 398,28 | 2 882 890,61 | |||

| May 2021 | 17 179,01 | 19 219,27 | 36 398,28 | 2 865 711,61 | |||

| June 2021 | 17 293,53 | 19 104,74 | 36 398,28 | 2 848 418,07 | |||

| July 2021 | 17 408,82 | 18 989,45 | 36 398,28 | 2 831 009,25 | |||

| August 2021 | 17 524,88 | 18 873,39 | 36 398,28 | 2 813 484,36 | |||

| September 2021 | 17 641,72 | 18 756,56 | 36 398,28 | 2 795 842,65 | |||

| October 2021 | 17 759,33 | 18 638,95 | 36 398,28 | 2 778 083,32 | |||

| November 2021 | 17 877,72 | 18 520,56 | 36 398,28 | 2 760 205,60 | |||

| December 2021 | 17 996,91 | 18 401,37 | 36 398,28 | 2 742 208,69 | |||

| January 2022 | 18 116,89 | 18 281,39 | 36 398,28 | 2 724 091,80 | |||

| February 2022 | 18 237,67 | 18 160,61 | 36 398,28 | 2 705 854,14 | |||

| March 2022 | 18 359,25 | 18 039,03 | 36 398,28 | 2 687 494,89 | |||

| April 2022 | 18 481,65 | 17 916,63 | 36 398,28 | 2 669 013,24 | |||

| May 2022 | 18 604,86 | 17 793,42 | 36 398,28 | 2 650 408,38 | |||

| June 2022 | 18 728,89 | 17 669,39 | 36 398,28 | 2 631 679,49 | |||

| July 2022 | 18 853,75 | 17 544,53 | 36 398,28 | 2 612 825,75 | |||

| August 2022 | 18 979,44 | 17 418,84 | 36 398,28 | 2 593 846,31 | |||

| September 2022 | 19 105,97 | 17 292,31 | 36 398,28 | 2 574 740,34 | |||

| October 2022 | 19 233,34 | 17 164,94 | 36 398,28 | 2 555 506,99 | |||

| November 2022 | 19 361,57 | 17 036,71 | 36 398,28 | 2 536 145,43 | |||

| December 2022 | 19 490,64 | 16 907,64 | 36 398,28 | 2 516 654,79 | |||

| January 2023 | 19 620,58 | 16 777,70 | 36 398,28 | 2 497 034,21 | |||

| February 2023 | 19 751,38 | 16 646,89 | 36 398,28 | 2 477 282,82 | |||

| March 2023 | 19 883,06 | 16 515,22 | 36 398,28 | 2 457 399,76 | |||

| April 2023 | 20 015,61 | 16 382,67 | 36 398,28 | 2 437 384,15 | |||

| May 2023 | 20 149,05 | 16 249,23 | 36 398,28 | 2 417 235,10 | |||

| June 2023 | 20 283,38 | 16 114,90 | 36 398,28 | 2 396 951,72 | |||

| July 2023 | 20 418,60 | 15 979,68 | 36 398,28 | 2 376 533,12 | |||

| August 2023 | 20 554,72 | 15 843,55 | 36 398,28 | 2 355 978,40 | |||

| September 2023 | 20 691,76 | 15 706,52 | 36 398,28 | 2 335 286,64 | |||

| October 2023 | 20 829,70 | 15 568,58 | 36 398,28 | 2 314 456,94 | |||

| November 2023 | 20 968,57 | 15 429,71 | 36 398,28 | 2 293 488,38 | |||

| December 2023 | 21 108,36 | 15 289,92 | 36 398,28 | 2 272 380,02 | |||

| January 2024 | 21 249,08 | 15 149,20 | 36 398,28 | 2 251 130,94 | |||

| February 2024 | 21 390,74 | 15 007,54 | 36 398,28 | 2 229 740,20 | |||

| March 2024 | 21 533,34 | 14 864,93 | 36 398,28 | 2 208 206,86 | |||

| April 2024 | 21 676,90 | 14 721,38 | 36 398,28 | 2 186 529,96 | |||

| May 2024 | 21 821,41 | 14 576,87 | 36 398,28 | 2 164 708,55 | |||

| June 2024 | 21 966,89 | 14 431,39 | 36 398,28 | 2 142 741,66 | |||

| July 2024 | 22 113,33 | 14 284,94 | 36 398,28 | 2 120 628,33 | |||

| August 2024 | 22 260,76 | 14 137,52 | 36 398,28 | 2 098 367,57 | |||

| September 2024 | 22 409,16 | 13 989,12 | 36 398,28 | 2 075 958,41 | |||

| October 2024 | 22 558,56 | 13 839,72 | 36 398,28 | 2 053 399,85 | |||

| November 2024 | 22 708,95 | 13 689,33 | 36 398,28 | 2 030 690,91 | |||

| December 2024 | 22 860,34 | 13 537,94 | 36 398,28 | 2 007 830,57 | |||

| January 2025 | 23 012,74 | 13 385,54 | 36 398,28 | 1 984 817,83 | |||

| February 2025 | 23 166,16 | 13 232,12 | 36 398,28 | 1 961 651,67 | |||

| March 2025 | 23 320,60 | 13 077,68 | 36 398,28 | 1 938 331,07 | |||

| April 2025 | 23 476,07 | 12 922,21 | 36 398,28 | 1 914 855,00 | |||

| May 2025 | 23 632,58 | 12 765,70 | 36 398,28 | 1 891 222,42 | |||

| June 2025 | 23 790,13 | 12 608,15 | 36 398,28 | 1 867 432,29 | |||

| July 2025 | 23 948,73 | 12 449,55 | 36 398,28 | 1 843 483,56 | |||

| August 2025 | 24 108,39 | 12 289,89 | 36 398,28 | 1 819 375,17 | |||

| September 2025 | 24 269,11 | 12 129,17 | 36 398,28 | 1 795 106,06 | |||

| October 2025 | 24 430,90 | 11 967,37 | 36 398,28 | 1 770 675,16 | |||

| November 2025 | 24 593,78 | 11 804,50 | 36 398,28 | 1 746 081,38 | |||

| December 2025 | 24 757,74 | 11 640,54 | 36 398,28 | 1 721 323,64 | |||

| January 2026 | 24 922,79 | 11 475,49 | 36 398,28 | 1 696 400,86 | |||

| February 2026 | 25 088,94 | 11 309,34 | 36 398,28 | 1 671 311,92 | |||

| March 2026 | 25 256,20 | 11 142,08 | 36 398,28 | 1 646 055,72 | |||

| April 2026 | 25 424,57 | 10 973,70 | 36 398,28 | 1 620 631,15 | |||

| May 2026 | 25 594,07 | 10 804,21 | 36 398,28 | 1 595 037,07 | |||

| June 2026 | 25 764,70 | 10 633,58 | 36 398,28 | 1 569 272,38 | |||

| July 2026 | 25 936,46 | 10 461,82 | 36 398,28 | 1 543 335,91 | |||

| August 2026 | 26 109,37 | 10 288,91 | 36 398,28 | 1 517 226,54 | |||

| September 2026 | 26 283,43 | 10 114,84 | 36 398,28 | 1 490 943,11 | |||

| October 2026 | 26 458,66 | 9 939,62 | 36 398,28 | 1 464 484,45 | |||

| November 2026 | 26 635,05 | 9 763,23 | 36 398,28 | 1 437 849,40 | |||

| December 2026 | 26 812,62 | 9 585,66 | 36 398,28 | 1 411 036,79 | |||

| January 2027 | 26 991,37 | 9 406,91 | 36 398,28 | 1 384 045,42 | |||

| February 2027 | 27 171,31 | 9 226,97 | 36 398,28 | 1 356 874,11 | |||

| March 2027 | 27 352,45 | 9 045,83 | 36 398,28 | 1 329 521,66 | |||

| April 2027 | 27 534,80 | 8 863,48 | 36 398,28 | 1 301 986,86 | |||

| May 2027 | 27 718,37 | 8 679,91 | 36 398,28 | 1 274 268,49 | |||

| June 2027 | 27 903,16 | 8 495,12 | 36 398,28 | 1 246 365,34 | |||

| July 2027 | 28 089,18 | 8 309,10 | 36 398,28 | 1 218 276,16 | |||

| August 2027 | 28 276,44 | 8 121,84 | 36 398,28 | 1 189 999,73 | |||

| September 2027 | 28 464,95 | 7 933,33 | 36 398,28 | 1 161 534,78 | |||

| October 2027 | 28 654,71 | 7 743,57 | 36 398,28 | 1 132 880,07 | |||

| November 2027 | 28 845,74 | 7 552,53 | 36 398,28 | 1 104 034,32 | |||

| December 2027 | 29 038,05 | 7 360,23 | 36 398,28 | 1 074 996,27 | |||

| January 2028 | 29 231,64 | 7 166,64 | 36 398,28 | 1 045 764,63 | |||

| February 2028 | 29 426,51 | 6 971,76 | 36 398,28 | 1 016 338,12 | |||

| March 2028 | 29 622,69 | 6 775,59 | 36 398,28 | 986 715,43 | |||

| April 2028 | 29 820,18 | 6 578,10 | 36 398,28 | 956 895,25 | |||

| May 2028 | 30 018,98 | 6 379,30 | 36 398,28 | 926 876,28 | |||

| June 2028 | 30 219,10 | 6 179,18 | 36 398,28 | 896 657,17 | |||

| July 2028 | 30 420,56 | 5 977,71 | 36 398,28 | 866 236,61 | |||

| August 2028 | 30 623,37 | 5 774,91 | 36 398,28 | 835 613,24 | |||

| September 2028 | 30 827,52 | 5 570,75 | 36 398,28 | 804 785,72 | |||

| October 2028 | 31 033,04 | 5 365,24 | 36 398,28 | 773 752,68 | |||

| November 2028 | 31 239,93 | 5 158,35 | 36 398,28 | 742 512,75 | |||

| December 2028 | 31 448,19 | 4 950,09 | 36 398,28 | 711 064,56 | |||

| January 2029 | 31 657,85 | 4 740,43 | 36 398,28 | 679 406,71 | |||

| February 2029 | 31 868,90 | 4 529,38 | 36 398,28 | 647 537,81 | |||

| March 2029 | 32 081,36 | 4 316,92 | 36 398,28 | 615 456,45 | |||

| April 2029 | 32 295,24 | 4 103,04 | 36 398,28 | 583 161,22 | |||

| May 2029 | 32 510,54 | 3 887,74 | 36 398,28 | 550 650,68 | |||

| June 2029 | 32 727,27 | 3 671,00 | 36 398,28 | 517 923,41 | |||

| July 2029 | 32 945,46 | 3 452,82 | 36 398,28 | 484 977,95 | |||

| August 2029 | 33 165,09 | 3 233,19 | 36 398,28 | 451 812,86 | |||

| September 2029 | 33 386,19 | 3 012,09 | 36 398,28 | 418 426,67 | |||

| October 2029 | 33 608,77 | 2 789,51 | 36 398,28 | 384 817,90 | |||

| November 2029 | 33 832,83 | 2 565,45 | 36 398,28 | 350 985,07 | |||

| December 2029 | 34 058,38 | 2 339,90 | 36 398,28 | 316 926,69 | |||

| January 2030 | 34 285,43 | 2 112,84 | 36 398,28 | 282 641,26 | |||

| February 2030 | 34 514,00 | 1 884,28 | 36 398,28 | 248 127,26 | |||

| March 2030 | 34 744,10 | 1 654,18 | 36 398,28 | 213 383,16 | |||

| April 2030 | 34 975,72 | 1 422,55 | 36 398,28 | 178 407,44 | |||

| May 2030 | 35 208,90 | 1 189,38 | 36 398,28 | 143 198,54 | |||

| June 2030 | 35 443,62 | 954,66 | 36 398,28 | 107 754,92 | |||

| July 2030 | 35 679,91 | 718,37 | 36 398,28 | 72 075,01 | |||

| August 2030 | 35 917,78 | 480,50 | 36 398,28 | 36 157,23 | |||

| September 2030 | 36 157,23 | 241,05 | 36 398,28 | -0,00 |

The Tinkoff Bank online mortgage calculator will calculate all the data.

We have added the ability to select the Tinkoff Bank mortgage lending program so that you can immediately start calculating and not have to think about what percentage to set.

Rate data is updated daily, so you can be sure that interest rates and Tinkoff Bank mortgage programs are up to date.

You only need to indicate the amount you want to borrow and select the mortgage term. By changing this data, you can select online the necessary parameters of a mortgage loan, which you will be comfortable paying monthly.

Advantages of our Tinkoff Bank mortgage calculator:

- Free, no registration required

- Formula for calculating monthly payments Tinkoff Bank

- We regularly update data on conditions and interest rates for calculating a mortgage loan at Tinkoff Bank in 2020.

- Mortgage calculator Tinkoff Bank calculates both annuity and differentiated payments

To make a mortgage loan as profitable as possible for you, you should use our special financial tool - the Tinkoff Bank online mortgage calculator. It will help you:

- Select a Tinkoff Bank mortgage lending program. Get interest rates

- Choose the optimal monthly payment amount based on your income

- Get detailed information about payments (how much you pay on interest, how much on principal)

- Calculate the possibility of early repayment of the mortgage

Who is our Tinkoff Bank mortgage calculator suitable for:

- For individual entrepreneurs

- For pensioners

- For individuals

- For legal entities

- Of course, Tinkoff Bank provides the most favorable conditions for salary card holders

We use the formula for calculating consumer loans specifically from Tinkoff Bank, so you can be confident in the results of loan repayment.

If you need to calculate a consumer loan at Tinkoff Bank, use the Tinkoff Bank loan calculator for 2020

Mortgage refinancing calculation example

In 2020, many online resources offer their clients to use a special calculator to calculate mortgage refinancing, and we are no exception:

Let's look at an example of how exactly the loan is calculated. Let's say you took out a mortgage at 14% per annum .

Today you must repay 1.5 million rubles , and the remaining loan term is another 10 years . The overpayment for this period will be 1,294,800 rubles .

But, you decide to contact Tinkoff Bank and choose a refinancing program. After considering your application, one of Tinkoff’s partner financial institutions agreed to refinance you at 10% per year .

Your loan was issued for the same 10 years , but now you will have to overpay only 878,760 rubles . That is, you can save as much as 416,040 rubles .

What's the benefit?

Let's give a figurative example that clearly demonstrates the advantages of refinancing an “expensive” mortgage. Let's say you bought an apartment on credit, the annual rate of which is set at 13%. The balance of the unpaid debt is 2 million rubles, while it must be paid for another 10 years. The total overpayment on the loan is about 1,583,500 rubles.

By deciding to refinance with Tinkoff, and having received consent from the bank offering a 10% rate, you can significantly reduce the final overpayment. So, its amount will decrease by approximately 400 thousand rubles, which, you see, is a significant saving.

Documents required for refinancing

To be approved for refinancing, you must provide :

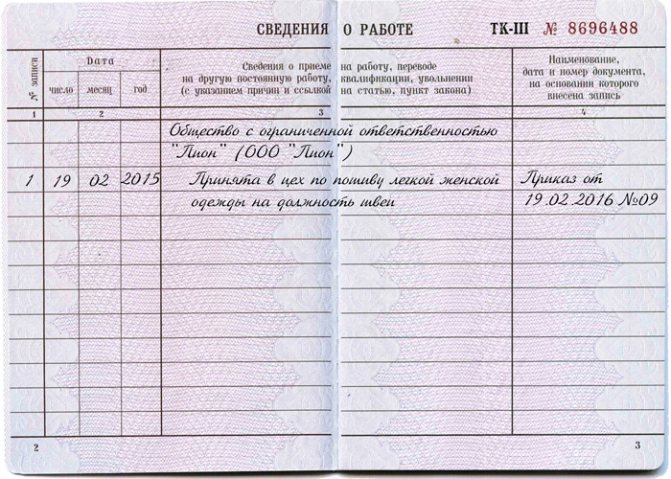

- Work book;

- Russian passport;

- Certificate of income 2-NDFL.

Photo gallery:

All you need is a passport

Employment history

2-NDFL

Important ! This list may be different, since if necessary, the bank may require additional papers. That is, the package of documents can be purely individual.

Mortgage refinancing process at Tinkoff Bank

Mortgage refinancing at Tinkoff Bank is carried out in stages :

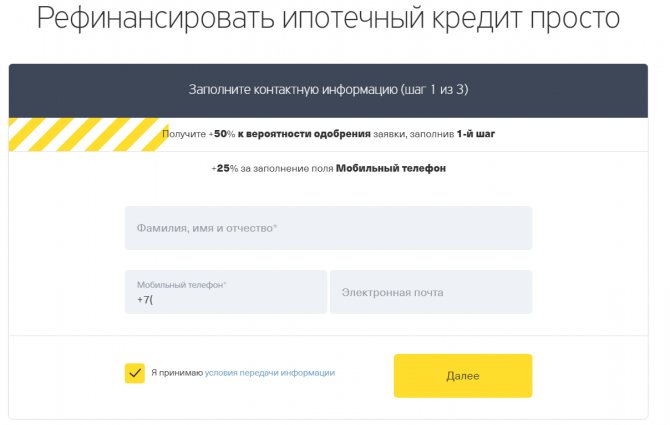

- The application is submitted online on the official website;

Application example

- A bank employee will contact you and tell you what documents need to be prepared;

- After sending the papers, they are sent for study and review;

- Then you will see a list of companies that are ready to refinance your mortgage;

- As soon as all formalities are completed, the financial institution sends the required amount of money to your account.

Requirements for the borrower

Those borrowers who meet the following requirements can count on approval of an application submitted to Tinkoff for mortgage refinancing in 2020:

- Age from 20 years and not more than 65 years. Moreover, the upper threshold is set at the time of full repayment of the loan;

- Availability of a regular income sufficient to pay the loan and the ability to confirm the level of income.

The main documents requested include:

- Passport;

- Certificate 2-NDFL or certificate in the bank form;

- A copy of the work record;

- Certificate confirming ownership of residential real estate;

- Acceptance and transfer acts.

Also, when considering an application for mortgage refinancing, Tinkoff may request additional documents. Each case is considered individually. The manager assigned to you will definitely inform you about all the nuances.

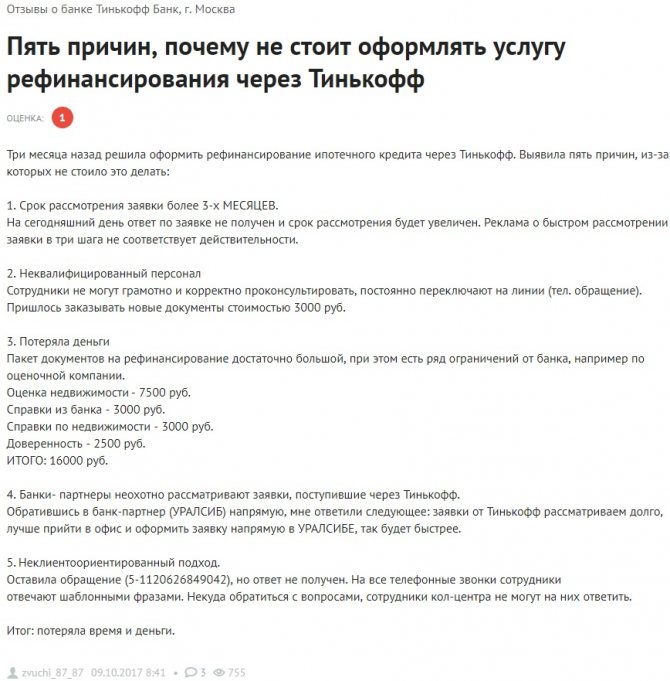

Borrower reviews

What do borrowers who refinanced their mortgages in 2020 say about the service:

Vladislav Ivanovich, 39 years old, Chelyabinsk : “Many thanks to Tinkoff for the positive decision on the mortgage! I once seriously damaged my credit history, lost my job, and simply didn’t see a way out. But, nevertheless, Tinkoff found several banks, one of which simply suited me perfectly in all conditions! Special thanks to consultant Sergei, who will help me save a lot of time!”

Elizaveta Olegovna, 41 years old, Voronezh : “I would like to sincerely thank Tinkoff Bank for the prompt refinancing of my mortgage loan! The main plus is that everything worked quickly, and for me with the most favorable conditions. My mandatory payment amount was reduced by almost 1.5 times. I recommend!"

Pavel Igorevich, 28 years old, Moscow : “My wife took out a mortgage for me. But after the divorce, everything changed - I myself could not afford such a large sum, and there was no place to live. A friend advised me to contact Tinkoff. I came to the office with the documents ready, talked to the consultant, and after a few minutes they showed me a list of 15 companies ready to refinance me. Of course, I found what I was looking for.”