A mortgage from SMP Bank allows you to purchase any type of real estate, including non-residential buildings, so every client of the mentioned financial institution will find a suitable program for themselves. Non-targeted lending secured by the borrower’s property is also permitted, with the exception of cases of receiving money for business purposes. The only drawback of mortgage loans in SMP is the lack of special offers for young families and military personnel. At the same time, a number of large competitors provide these categories of clients with preferential conditions that allow them to save on the purchase of housing.

But the above does not mean that lending will be unprofitable. The financial institution cooperates with construction companies, therefore, in order not to overpay for the use of borrowed funds, it is enough to purchase an apartment from the bank’s partners. But before that, it is recommended to study all the options presented below.

Mortgage lending programs

Current lending programs are closely related to the type of property purchased:

- new building;

- finished housing on the secondary market;

- non-residential real estate;

- non-targeted loan secured by real estate.

Additionally, there are programs created in partnership between the lender and construction organizations. They allow you to reduce your interest rate to 6.99%. But to receive such favorable conditions, you need to contact an accredited company and make an entry fee that allows you to participate in the promotion.

In addition, clients are able to obtain a mortgage loan using 2 documents. People who decide to use this program should take into account that such conditions increase the risk that the lender will have to take, so such loans are less accessible. This is due to the fact that the rate turns out to be noticeably higher. In some cases the difference exceeds one and a half percent.

Conditions for obtaining a mortgage at SMP Bank

If we discard the partners’ proposals, the terms of the mortgage at SMP Bank are as follows:

- the amount is not limited and depends only on the solvency of the borrower;

- there is no minimum start-up payment, clients are able to do without initial payments (such a step will negatively affect the interest rate);

- the repayment period cannot exceed 25 years (for non-residential real estate - 15);

- the minimum interest rate is 10.6%, except for cases of special promotions (for non-residential real estate and non-targeted loans - 13%).

That is, the listed mortgage loans are distinguished by their availability, since to obtain them you do not need to worry about a down payment or collecting a large package of documents. But you will have to pay extra for accessibility.

Requirements for the borrower

You can get a loan:

- citizens of Russia;

- having permanent residence in the country;

- having continuous work experience at their last job for at least six months.

There are no age requirements for clients, but it is advisable to be 21 years old. At the same time, the credit company states that it is ready to consider any application and meet the borrower halfway if he does not meet the stated conditions, but is ready to prove his own solvency. To find out more details and find out whether you can get your application approved, it is recommended to call toll-free 88005552555 and get advice from a contact center employee.

Package of documents

The list of documents does not contain anything unusual. Borrowers will have to prepare:

- passport;

- SNILS;

- a copy of the work record book or contract certified by the employer;

- certificate confirming receipt of income;

- marriage contract, if any.

You will also have to provide an application form and similar documents from co-borrowers. The maximum number of co-borrowers cannot exceed 3 people.

Later, you will have to transfer the documents for the purchased property (appraisal examination and title documents of the owner) to the service manager so that the bank employee can make sure that the building meets the requirements.

Terms of mortgage programs: mortgage rates

Currently, potential clients can apply for any mortgage loan from SMP Bank under the following programs:

- Special offers;

- real estate in a new building;

- ready housing;

- bail money;

- refinancing;

- non-residential real estate.

Each product has its own characteristics and design conditions. Let's look at the terms of the SMP Bank mortgage in detail.

Ready housing

SMP Bank's "Ready Housing" mortgage program is intended for the acquisition of living space with already registered ownership on the secondary real estate market. Key conditions are presented in the table below:

| Minimum down payment, % of the cost of housing | Interest rate, % per year | Amount of borrowed funds | Maturity | |

| Basic conditions | 10% - when using maternal capital; 15% - when purchasing an apartment or apartment; 40% - when buying a house with a plot | 10.29 – for retail clients; 9.99 – for preferential categories of borrowers | From 400 thousand to 30 million rubles | Up to 25 years |

| According to 2 documents | 40% | 12.7 – for retail borrowers; 12.2 – for preferential clients |

The indicated loan rates will only apply if the borrower enters into a comprehensive insurance agreement. If you refuse such a service, the rate will increase by at least 1 percentage point.

Lending conditions based on 2 documents are available for clients who are ready to provide the bank with only 2 documents - a Russian passport and SNILS.

New buildings

Under SMP Bank’s “Real Estate in a New Building” mortgage program, you can buy an apartment in any of the properties accredited by the bank. This can be either a regular apartment or an apartment. To do this, borrowers have access to the following terms and conditions:

| Loan rate, % per annum | Minimum down payment, % of the housing price | Amount of borrowed funds | Return period | |

| Basic conditions | 10.29 – for retail clients; 9.99 – for preferential categories of borrowers | 10% - when using maternal capital; 15% - when purchasing an apartment or apartment | From 400 thousand to 30 million rubles | Up to 25 years |

| No down payment | 14 | 0% | Up to 15 million rubles | |

| According to 2 documents | 12.7 – for retail borrowers; 12.2 – for preferential clients | 40% | From 400 thousand to 30 million rubles |

The selection of the purchased property occurs in agreement with the bank. A list of accredited facilities is available on the official website of SMP Bank. Accreditation outside the current list is possible upon additional verification and analysis of the developer company.

IMPORTANT! In addition to the basic conditions and registration of two documents, potential borrowers have access to a mortgage without a down payment at SMP Bank. The rate will be maximum (14% per year), but the loan amount will be 100% of the housing price. SMP Bank mortgages without a down payment are issued only from previously accredited developers specifically for this program.

Mortgage without down payment

You can get a mortgage loan without paying a down payment from the client’s own funds in two cases: under the “New Building” program and under special offers (apartments in the residential complexes discussed above).

Due to increased risks, lending conditions will be less attractive than compared to basic requirements, when you need to contribute at least 15-20% of the price of the purchased property.

Important! As soon as 15% of the cost of the apartment is paid, it will be possible to reduce the interest rate by 2% at the request of the borrower.

Another option here is to provide benefits when purchasing an apartment or apartment in the specified residential complexes and using maternal capital funds. Then the amount of borrowed funds will simply be reduced by the amount of this state aid (453 thousand rubles or less).

NOTE! For basic conditions, more stringent requirements will be applied to clients applying for a loan without a down payment, including with regard to insurance and other restrictions on income and the quality of credit history.

Secured by real estate

SMP Bank's line of mortgage products includes a non-targeted loan issued against the security of existing real estate. The purpose of obtaining such a loan can be absolutely any, with the exception of financing business activities.

Parameters of a loan secured by real estate:

| Amount of borrowed funds | Interest rate, % per annum | Debt maturity |

| From 400 thousand rubles | 12.5 – for clients with benefits; 13 – for retail borrowers | From 3 to 15 years |

The category of preferential borrowers usually includes participants in salary projects, employees of bank partner companies, and trustworthy bank clients with a long history of cooperation.

If the loan amount is more than 5 million rubles, the bank has the right to require confirmation of the intended use. The maximum amount for lending purposes cannot exceed 60% of the price of the collateral.

Mortgage refinancing at SPM Bank

Customers with existing loan agreements secured by real estate with third-party banks can refinance them under the following conditions:

| Amount of borrowed funds | Return period | Interest rate, % per year |

| From 400 thousand rubles (no more than 60% in the case of pledging your own real estate and up to 85% in the case of pledging a purchased property) | Up to 25 years | 9.99 – 10.29 (if mortgaged real estate is pledged); 12.5 – 13 (if you pledge your own living space) |

For borrowers who take out only property insurance, the rate will increase by 2 percentage points to the rates indicated in the table.

Until the collateral is encumbered in favor of SMP Bank, when refinancing a mortgage, an increased interest rate of +2 percentage points will also apply. to the established rate.

Mortgage for non-residential real estate

With the help of this program, potential SMP Bank mortgage borrowers can purchase non-residential properties on the primary and secondary real estate markets. The loan terms are as follows:

| Loan terms | Interest rate, % per annum | Share of the first payment, % of the property price | Amount of loan funds |

| 3 – 15 years | 12,99 | From 30 | From 400 thousand to 50 million rubles |

By taking out such a mortgage, the client will be able to purchase non-residential properties that meet the bank’s requirements: warehouses, retail, office, industrial and other premises and complexes.

In the process of analyzing the submitted application, banking specialists study the liquidity of the property applying for purchase and make their decision on the advisability of issuing a loan.

Mortgage promotion

Since November 2020, SMP Bank has been running a promotion on mortgages - a special rate of 9.79% for preferential categories of clients and 9.99 for others. Under this program, you can purchase an apartment in a new building, on the secondary market, or refinance. A prerequisite is a minimum down payment of 25%. In this case, the minimum loan size will depend on the region in which the property was purchased.

So, for a purchase in Moscow and Moscow region, the minimum mortgage starts from 5 million, in St. Petersburg and Leningrad Region from 4 million, and in the region they can get a mortgage on a promotional basis with an application amount of 2 million rubles.

SMP Bank mortgage calculator

Knowing the terms of the loan, potential borrowers are able to find out in advance what the monthly payments will be and find out the total amount of debt, taking into account accrued interest. To do this, you need to use the mortgage calculator at SMP Bank. Its use is extremely simple and requires the user to specify the loan amount, the repayment period and the estimated interest rate, calculated based on the type of property and the selected mortgage program.

But it is important to note that the mortgage calculator only calculates approximate values, since it is impossible to know the exact interest rate in advance. Therefore, before signing a loan agreement, it is recommended to re-examine its terms so as not to run into trouble later. The precautions taken by the borrower can save him from many problems.

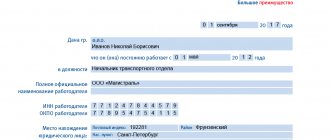

How to apply

The easiest way to apply is to visit the official website of the credit company and fill out a special form. It requires you to honestly indicate your own income, provide personal information (last name, gender, age), and select appropriate lending parameters (amount, term). After that, all you have to do is click the button that sends the application to the credit manager and wait a little for a response. It usually arrives within half an hour. The maximum time for consideration of an application is three days. After receiving a response with approval, all you have to do is follow the advice of the service manager.

Mortgage refinancing at SMP Bank

The conditions for refinancing a mortgage at SMP Bank are extremely similar to the conditions for standard mortgage loans:

- the amount is limited only by the value of the collateral and cannot exceed the amount of debt (an additional limitation is no more than 90% of the size of the loan being refinanced);

- lending is carried out in rubles;

- the repayment period of the debt should not exceed 25 years (minimum period - 3 years);

- interest rate – from 10.6%.

In addition, it is possible to refinance non-mortgage loans secured by the debtor’s real estate. In such situations, the maximum loan amount cannot exceed 60% of the value of the mortgaged property.

How to pay for a mortgage

Repayment of debt under the issued loan agreement is carried out in accordance with the payment schedule, which is an integral part of it. The borrower cannot make less than the specified monthly payment.

Payment is made in any convenient way to the borrower's loan account. Both remote payment channels (via Internet banking, terminals, ATMs and other services) and depositing money through the bank’s cash desk are available.

Most debt repayment options involve instant deposit of money, however, when using interbank transfers, you should take into account the time allotted for such an operation (usually from 1 to 5 business days).

A mortgage in SMP Bank is paid without commission at ATMs of SMP Bank and partner banks.

Customer reviews about SMP Bank mortgages

To get rid of the last doubts, it is recommended to read customer reviews on loans. They talk about things that usually go unnoticed in the early stages, but unexpectedly become clear later. It is important to take into account that many reviews are written under the influence of emotions (satisfied borrowers rarely share their experience with others) and do not contain anything important or interesting. Therefore, when deciding to find useful information, you should separate truly valuable advice from useless comments that do not contain anything of substance. This approach will allow you to obtain more information about lending and servicing, but will eliminate unnecessary negative impressions from what you read.