About the renovation program in Moscow

This project was launched in 2020. Thanks to it, more than one million Muscovites will receive new comfort-class housing. The list of houses for demolition was determined based on a vote by residents of the capital. According to its results, the program included 5,171 buildings housing 350 thousand families.

According to the approved law, displaced persons are provided with housing of the same area in their area. The global resettlement of Muscovites has already begun in February 2020 and will last until the end of 2032. The list of houses that were included in this project can be viewed

Are banks planning to tighten the rules for issuing loans for apartments in Khrushchev-era buildings?

Sberbank does not plan to tighten the rules for lending to such housing, since, according to the bill and the renovation of the housing stock in Moscow, housing is planned to be exchanged for new ones. Under an agreement on the transfer of ownership of residential premises, this means an automatic transfer of the bank’s collateral to a new housing equivalent in number of rooms and square meters.

DeltaCredit Bank specialists are tracking the series numbers of houses that are planned for demolition. If the list of houses that are planned to be demolished is expanded, this will be the basis for the bank to change its policy regarding these objects. But the bank did not change its preventive policy regarding five-story buildings. Only the Housing Finance Bank announced a complete ban on mortgage loans for housing in Khrushchev-era buildings.

Renovation Fund

The Renovation Fund is a unitary non-profit structure that was registered on 10/11/2017. The main function is to create all the conditions and carry out various activities to renew the capital’s housing stock. The founder of the organization is the Moscow Government.

The Foundation's website contains detailed information about global resettlement. Residents of old houses can receive equivalent housing or expand their living space. But for improvement you will have to pay a certain amount. As part of this program, Muscovites can purchase an apartment with an area of no more than 100 square meters. m. They are given a discount of 10% of its cost.

We discussed housing renovation in Moscow and Russia in detail in our last post. We recommend that you familiarize yourself with seven legal nuances there.

Mortgage conditions under the housing renovation program in Sberbank

The bulk of housing in the capital is purchased with borrowed funds. With the start of the program, the question arose whether banks would give mortgages in houses for renovation. The purchased property acts as collateral for the issued loan. And when the housing is demolished, the financial institution loses it. But officials also resolved this issue. The apartment received by the family is automatically pledged to the lender. All types of encumbrances that were on the old property are transferred to the new one.

But even taking these rules into account, only three financial institutions are ready to provide a mortgage for an apartment in a building for renovation:

- Sberbank;

- Gazprombank;

- Bank "Revival".

The undisputed leader in mortgage lending is Sberbank. More than 50% of all mortgages are processed in its branches.

Under the renovation program, Sberbank issues loans on the following conditions:

- There is no mortgage fee.

- The purchased property (first old and then new) acts as collateral throughout the entire loan term.

- The minimum advance payment is 20%.

- The financial institution provides a 30-year mortgage. You can repay your debt early at any time.

- The minimum loan amount is 300 thousand rubles.

Mortgages are issued only in national currency. During renovation in Moscow, the borrower can improve their living conditions. Sberbank offers favorable lending conditions. This is a great opportunity to purchase the apartment of your dreams.

Mortgage in houses for renovation

Mortgage in houses for renovation is a concept that, in principle, involves providing a mortgage loan to the owner of an apartment located in a house for demolition on more favorable terms. As a result, the borrower gains the opportunity to choose housing for purchase or exchange that suits him, for example, a larger one or in a convenient area of the city. It is worth noting that new buildings proposed by local governments as part of the renovation program do not always suit displaced people.

There is another option for participating in this program, which is as follows: a participant in the renovation program (a resident of one of the houses that is being demolished) puts his apartment up for sale, and a citizen who wants to purchase it takes out a mortgage loan for the purchase. And it must be said that there is a certain benefit in this.

Firstly, apartments in demolition buildings are much cheaper than their counterparts in new buildings.

Secondly, sooner or later the house included in the renovation program will be demolished, and residents will be offered apartments in new buildings with equal living conditions in place of old residential premises, or the cost of lost housing will be compensated.

Thus, a mortgage on an apartment for renovation is a profitable option for purchasing housing on the secondary market or replacing an old apartment with an apartment in a new building.

It might be interesting!

Mortgage risks for the borrower and the bank in Russia

Interest rate for 2020

Under the housing renovation program, mortgages from the country's main bank are issued at the following interest rates:

- holders of Sberbank salary cards – 10.5% per annum;

- clients “from the street” - 10.8% per annum;

- in the absence of documentary proof of income (the advance must be at least 50%) - 11.1% per annum.

If the applicant refuses to pay for a personal insurance policy, the rate increases by 1%. Clients who have received a mortgage should not forget about the effect of the preferential government program. If a second or third child is born in the family, the interest rate is 6%. It will be recalculated by Sberbank and set for three or five years, depending on the number of children.

Online calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

Applying for a mortgage in a house for renovation is a responsible step. You need to realistically assess your financial capabilities so that you don’t lose your home. It should be taken into account that moving to a new apartment may require additional funds. You will want to buy modern furniture and make renovations to suit your taste. But no one will cancel mortgage payments.

Using the online calculator located on our website, in just a few seconds you can calculate the amount of monthly payments and the amount of the total overpayment on the loan. Knowing this information, the client will make the right decision on how profitable the proposed deal is for him.

By inserting his income and the amount of the requested loan into the calculator, the borrower will find out whether banks will give him a mortgage.

Requirements

Preferential mortgages are provided only if both the borrower and the property being purchased meet the established requirements. In this case, much attention is paid to checking information on the client and his solvency. The original deposit will still be taken down. The main thing is to determine its real value.

To the borrower

To receive a home loan, the applicant must meet the following requirements:

- has Russian citizenship;

- is the owner of real estate that is included in the renovation program;

- at the time of submitting the application, the client is over 21 years old;

- before the age of 75, the mortgage debt must be repaid in full;

- the total length of service over the last 60 months is at least one year;

- length of service at the last place of work - from two quarters.

Restrictions on length of service do not apply to holders of Sberbank salary cards.

Important! The applicant’s credit history is also required to be checked. It must be flawless. If there were delays before, then you shouldn’t even hope for a positive decision. You can learn more about how to get a mortgage with a bad credit history from a special post.

The bank carefully checks the level of solvency of the borrower. Sberbank adheres to one rule - the payment on the mortgage issued should not exceed half of the client’s net income. If the applicant’s salary is not enough, then he can attract co-borrowers. In this case, their income is also taken into account. Sberbank also takes into account unofficial income, which does not need to be confirmed with certificates. Therefore, if you do not have enough income, be sure to indicate additional income in the application form.

To the property

Property purchased with borrowed funds must be included in the renovation program. When concluding a purchase and sale agreement, all documents are carefully studied for legal purity. The bank must be sure that fraudulent schemes are completely excluded.

The necessary conditions

The loan is issued on the basis of a residential purchase and sale agreement, which is concluded with the MFR. Borrowed funds can be used to purchase an apartment or room. The loan program does not require a down payment. The loan rate ranges from 8.9 to 9.9% per annum.

The specified values apply subject to the issuance of a policy insuring the life of the borrower. The minimum loan amount is 300,000 rubles. The maximum term of the loan agreement is 30 years. A mortgage loan is provided against real estate, which is transferred to the balance sheet of the Moscow Renovation Fund.

A mortgage loan is issued according to the following algorithm:

- Select a suitable property (an electronic catalog of apartments is available on the website www.stroi.mos.ru).

- Submit an application to purchase housing at the MFR. A receipt confirming the repayment of a security deposit in the amount of 100,000 rubles is attached to the application.

- Submit your application for a housing loan to the bank manager (possibly in electronic form).

- Conclude a loan agreement and a housing purchase and sale agreement.

After the necessary documents are signed, the borrower will be able to receive the keys to the apartment and paperwork for the purchased premises (certificate from the Unified State Register of Real Estate, certificate of acceptance and transfer of housing). Additional information about special mortgages can be obtained from information centers, the addresses of which are listed on the web pages of the Moscow Renovation Fund portal.

Mutual settlements between the buyer and seller of the apartment can be carried out without an additional visit to the bank. To do this, you need to use the one provided by the financial institution. The funds will be transferred to a special account and transferred to the seller’s account after registering the transaction with Rosreestr. The electronic payment method frees counterparties from the need to handle cash and reduces the likelihood of criminal attacks by third parties. Registration takes no more than 15 minutes.

How to apply for a mortgage loan under the renovation program: procedure

Purchasing an apartment under the renovation program has a number of features - significant differences compared to a standard mortgage. We will consider all stages of the transaction below.

Choosing an apartment

To choose an apartment, you must:

- see the list of possible options;

- the apartment must be located in the same area of Moscow - this is a mandatory condition;

- inspect the apartment in person;

- submit an application for the purchase of housing to the Renovation Fund (Ilyinka St., 13);

- While a decision is made on the application, you can proceed to receiving loan funds.

The application is submitted by appointment, filled out and signed in the presence of a Fund employee.

Submitting an application to Sberbank

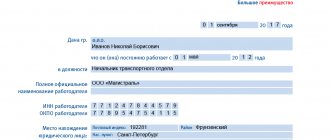

You can fill out a loan application at any branch of a financial institution. The borrower must personally contact the office and provide: a civil passport, a certificate of earnings for the last six months, a copy of the work book. If the borrower receives a salary from Sberbank, then he just needs to bring his passport.

A bank employee will advise the applicant in detail on the terms of the product and tell how the transaction will be concluded. After this, you need to fill out a form. It contains only reliable information that can be documented. False information may result in the application being rejected.

On our portal you can download the application form and a sample of how to fill it out.

Attention! The client must provide as much positive information about himself as possible: what property he owns, what a positive credit history he has, whether he has received a good education, and so on. Even the little things matter a lot.

Waiting for a decision

This stage is the most nervous. It will take Sberbank 2-3 days to make a decision. Applications from payroll clients are processed much faster - within two days, but sometimes in two hours. According to the institution’s standards, the period for consideration of an application cannot exceed five days.

First of all, the bank will check the applicant’s credit history, then the employer’s information. Next, he will determine financial indicators and decide how much loan he is willing to issue to this borrower. The decision will be announced by the manager over the phone. The bank's response is valid for 90 days.

Preparation of documents

If Sberbank has approved the application, then the client can begin to compile a package of real estate documents:

- Certificate of ownership of housing or an extract from the Unified State Register of Real Estate.

- Certificates from the Housing Office confirming that there is no debt in payment of utility bills.

- Copies of passports of all property owners.

- Technical passport for real estate

- Independent expert assessment of property.

Sberbank accepts reports on the assessment of the loaned object only from companies accredited by it. We published a list of them here. These organizations have been thoroughly vetted and are professionals in their field. In this case, the assessment will be truly independent.

During the consideration of the application, Sberbank may require additional documents necessary to make a final decision.

Conducting a transaction

At the appointed time, the borrower must come to the Sberbank branch to sign documents. The manager will prepare all the papers in advance. In particular, the client must familiarize himself with the loan agreement and repayment schedule. You need to sign your autograph only after there are no questions left regarding the mortgage.

Signing an agreement at the Renovation Fund

The borrower needs to contact the Renovation Fund to sign an exchange or sale agreement. The client must provide the original loan agreement received from Sberbank. On its basis, papers will be prepared in the Renovation Fund.

Attention! If during the consideration of the application there are other applicants for the apartment, the Foundation will announce an auction.

Registration of rights

The registration of property rights in Rosreestr is carried out by employees of the Renovation Fund. The buyer of real estate contacts the office and provides previously received documents. To enter data into Rosreestr, the client issues a power of attorney to the Fund’s employees.

So, the scheme for obtaining a mortgage under the renovation program has been fully worked out. If you have any questions, you can ask our specialist. Online consultations are available 24 hours a day. Citizens who have already used this product, please leave your comments after the article.

How to re-register a collateral

In fact, the re-registration is carried out by Rosreestr specialists. Ideally, they should forward documents relating to a particular person's new property to the bank where the person took out the loan.

In practice, if this happens, it happens very slowly and not always. It’s easier to personally contact a financial institution and provide the necessary documents. These include:

- citizen's passport;

- extract from the Unified State Register of Real Estate - it replaces the certificate of ownership of real estate.

A bank specialist will re-register the collateral. The payment schedule, loan term and loan amount remain the same.

Attention: if a credit company tries to force a citizen to sign an amended loan agreement with new conditions (increased interest, etc.), threatening to unilaterally terminate an existing agreement, then this is a direct violation. This is punishable by law and cannot be implemented in practice.

Some experts say that Moscow's resettlement program has stumbled over mortgages. There is a rational grain in this opinion: some banks have indeed stopped issuing loans for the purchase of apartments in buildings for demolition. Therefore, owners of living spaces in unsafe buildings are massively refusing to relocate. However, the current law on Muscovites moving to new homes and loans interact perfectly - banks that are firmly on their feet do not see any problem in this.

Should you agree to loan terms for demolished housing or wait until the current owner receives an apartment in a new building under the relocation program? It all depends on the specific situation - if the family has a place to live, then you can wait a little:

- The bank will be more willing to issue money for new housing;

- In addition, you won’t have to take a “pig in a poke” - what if the new property doesn’t suit you due to some parameters (the floor is too high, not the “right” area, the windows overlook the courtyard, but I would like to be on the highway, for example, and so on ).

If the family has nowhere to live, then bank money for the demolished living space is not the worst option.

What should a Khrushchev-era tenant do with a mortgage agreement? Continue to pay the loan as before. In general, nothing will change for him - the change will occur only in the real estate itself, which is the collateral.

Part 1.

Part 2.

Insurance

According to the terms of the loan agreement, the borrower must insure the collateral throughout the loan term. Payments must be made annually. If this requirement is not met, the bank applies penalties. In particular, it increases the mortgage interest rate by several points. This condition must be specified in the loan agreement. Issues related to mortgage insurance are discussed in this article.

Mortgage conditions for renovation in other banks

In addition to Sberbank, two banks provide mortgages within the framework of the state project: Vozrozhdenie and Gazprombank.

Lending conditions at these institutions are presented in the following table.

| Banks | Rate, per annum | Duration, months | Maximum limit, rubles |

| Gazprombank | 10,50 | 360 | 60 million |

| Renaissance | 9,20 | 360 | 30 million |

Gazprombank program

This institution is ready to issue a loan in an amount that does not exceed 80% of the value of the purchased property. The minimum mortgage size is 500 thousand rubles. Gazprombank accepts applications from clients who meet the following requirements:

- have Russian citizenship;

- age from 20 to 65 years;

- total work experience – from 12 months, and at the last place of work – from six months;

- the income received should be enough to support the family and fulfill debt obligations;

- positive credit history.

The application is reviewed by Gazprombank within 10 days. The requested package of documents is the same as in Sberbank. Full information on mortgages at Gazprombank is presented in this material.

Vozrozhdenie Bank program

This institution is also ready to lend to real estate that is subject to demolition in the near future. Among the three banks, Vozrozhdenie offers the lowest rate - 9.2% per annum. But this is provided that the borrower pays for insurance (title, property, personal). Otherwise, the rate increases by 3%.

Mortgages are provided to hired employees aged from 18 to 70 years. The length of service at your last place of employment must be 6 months. Documentary proof of income is a mandatory condition of the transaction.

Mortgages at Vozrozhdenie Bank are described in more detail in a special post.

Mortgages for difficult properties: the lower the liquidity, the higher the rates

When considering an application for a mortgage, banks evaluate not only the borrower, but also the property itself for the purchase of which the loan is issued. Banks consider the collateral from the point of view of its liquidity in case the borrower is unable to repay the mortgage and the purchased apartment or country house is transferred to the bank’s balance sheet. The higher the liquidity of the property, the softer the conditions for obtaining a mortgage for its purchase. The bankers told us which properties are easier to get a mortgage for, and which properties they try not to finance.

Banking priorities

The liquidity of property for banks is characterized by how quickly the collateral can be sold at the market price. Banks are most willing to issue mortgages for one- and two-room apartments in standard high-rise buildings of economy or comfort class, located in Moscow, a large city within a 50-kilometer zone from the Moscow Ring Road or in one of the cities with a population of over a million, bankers interviewed by the editors of IRN.RU admitted.

Less liquid are country houses and commercial properties. “In the event of a borrower’s default, it will take more time to sell such objects, and their price is more susceptible to a downturn during a crisis,” explains Alexander Tikhonchuk, CEO of the credit brokerage. Hence the increased risks. And the bank includes its risks in the conditions for issuing a mortgage.

Thus, the minimum required down payment under programs for the purchase of suburban real estate is 40% of the cost of the purchased housing, urban - from 10% (in the primary market there are programs with a zero contribution, but they usually require a guarantee from the developer). The mortgage rate for suburban real estate is usually several percentage points higher.

There is practically no difference in the procedure and timing of obtaining a mortgage depending on the type of real estate, experts say. The package of required documents for some objects may be wider. In general, banks' concerns regarding the liquidity of collateral only significantly affect the terms of issuing a mortgage.

“Secondary” apartments: banks are ready to lend even to Khrushchev-era apartments, but there is a “but”

Mortgages for the purchase of secondary apartments are one of the most popular banking products. For example, at VTB24, secondary apartments account for about 47.5% of the total volume of requested mortgage loans, at Absolut Bank, Otkritie and Uralsib banks - about 40%.

When lending to secondary apartments, banks monitor the actual wear and tear and condition of the building in which the potential collateral is located. Housing should not be dilapidated, be included in plans for demolition, reconstruction or major repairs with resettlement, says Andrey Osipov, senior vice president, director of the mortgage lending department of VTB24.

The house in which the apartment is located must “have metal, reinforced concrete or mixed floors; do not have wall material - wood (timber). The apartment must meet sanitary and technical standards to ensure the health and safety of residents,” adds Anna Yudina, head of the development department of collateral products at Otkritie Bank.

According to the terms of Svyaz Bank, the apartment should not contain illegal reconstructions and redevelopments that could affect the market value, clarifies Andrey Tocheny, director for development of lending programs of the department of products and processes of Svyaz Bank.

At the same time, Tocheny continues, the acquired real estate cannot be rooms or shares of real estate. Also not considered are rooms with stove heating, if it is the main one, rooms in which there are no communications (sewage, water, gas supply), and rooms in which there is no kitchen area or bathroom.

Banks have different requirements for the degree of wear and tear of a house. For VTB24 and Svyaz Bank it is no more than 60%, for example. Uralsib has no more than 70%. The bank is ready to approve a mortgage even for an apartment in a five-story building. True, again, if the house does not have wooden floors and it is not in the plans for demolition (after receiving another housing, the mortgage does not automatically transfer to the new apartment).

Otkritie Bank can also approve a mortgage for an apartment in a five-story building. “For apartments located in Moscow in panel buildings built before 1975, with up to five floors inclusive (the so-called “Khrushchev” buildings), a certificate must be provided about the nature of the floors and plans for the demolition and reconstruction of the house,” notes Anna Yudina from the bank "Opening".

If a house with a mortgaged apartment does end up in the demolition program, the borrower will need to contact the bank and change the subject of the mortgage to a new one in the agreement. If a person does not do this and simply quietly moves to a new apartment, the bank will consider such behavior a violation of the terms of the agreement and may demand early repayment of the loan.

Mortgage on a “fence”: rates are higher, paperwork cannot be avoided

Mortgages in the country market are much less common than in the urban housing market, and the share of loans for the construction or purchase of cottages and townhouses in bank portfolios is small. And clients rarely apply for such loans. For example, at Absolut Bank, country houses account for only about 5% of the total volume of requests, at VTB24 - about 1.5%.

This is no coincidence: banks are distrustful of suburban market objects and do not seek to lend to them.

“The problem of reluctance to lend to such objects lies largely in the complexity of their assessment and the discrepancy in the assessment of value between the owner of the object, the appraiser and the buyer,” explains Vadim Pakhalenko, director of the mortgage lending directorate of Transcapitalbank (TCB). “In addition, for suburban real estate there are a very large number of factors that influence the price that ordinary apartments do not have, for example, the presence of a body of water or, say, the quality of security in a cottage community.”

Features of the suburban real estate market are the lack of standards and a high proportion of “self-construction”, as a result of which such properties are significantly inferior in liquidity to apartments, agrees Andrey Osipov from VTB24. According to him, VTB24 lends for the purchase of suburban housing only on the secondary market and in a limited area with a developed suburban real estate market.

You will also have to tinker with preparing documents for a mortgage on a country house on the secondary market, warns Anna Borisova, head of the KASKAD Family mortgage lending department: “Banks ask for a large list of documents that must be ordered by a certain date, and also some documents are requested from government agencies, which also not quickly (from two weeks to a month).”

Mortgages in the suburban market today, in addition to VTB24, are offered by Sberbank, VTB (Bank of Moscow), Rosselkhozbank, DeltaCredit, TransCapitalBank, Svyaz-Bank, Surgutneftegazbank. True, the lending conditions for the purchase of country real estate are very different from the conditions for lending to finished apartments (registered as property).

Firstly, this is an increased interest rate: rates on fenced-in properties may differ from rates on apartments by 0.25-0.5%. Secondly, all banks require a larger (compared to apartments) down payment amount - from 25% (at Sberbank) to 50% of the loan cost, says Irina Vekshina, head of the mortgage lending service at INCOM-Real Estate. “In this way, the bank insures itself against a fall in the value of the property and inaccuracy in its valuation,” explains the expert.

At Rosselkhozbank, which traditionally lends to country real estate, rates for the purchase of a country house with a plot of land start at 11.5%, says Lyudmila Tsvetkova, executive director of MIEL-Country Real Estate. But you can get such a rate only if you have a down payment of at least 50%, and the borrower must be a salary client of the bank. For salary project participants making less than 50% as a down payment, the rate starts from 12.5%. For everyone else – from 15%.

At VTB Bank, you can get a mortgage for the purchase of a townhouse with a down payment of 20%, and for the purchase of a residential building - from 40%. Interest rates start at 12.1%, loan terms are up to 30 years, says Georgy Ter-Aristokesyants, deputy head of the department, head of the mortgage sales directorate at VTB Bank.

However, there are banks that are not at all ready to lend to properties on the country market. For example, Otkritie Bank does not provide mortgages in the suburban market. The bank will provide a loan for the purchase of a townhouse only if, according to the title documents, the townhouse is an apartment. Accordingly, all conditions for lending apartments will apply in this case to the townhouse.

“The easiest way is to get a mortgage for a townhouse if it is designed as an apartment, then for a plot of land with a residential building located on it. The ideal object for lending is a residential building located no further than 60 km from Moscow in a populated area with developed infrastructure and good transport accessibility,” says Irina Vekshina from INCOM-Real Estate. The most difficult thing, according to her, is to get a loan on the country market for a plot of land and a country house due to the low liquidity of such objects.

Mortgage for land and dacha: there are few people willing to give a loan

“We do not lend to dachas, SNT and land plots,” said Andrey Osipov, senior vice president, director of the mortgage lending department of VTB24.

Today, few banks provide mortgages for land plots, states Irina Vekshina from INCOM-Real Estate. The main ones are Sberbank, Rosselkhozbank, Transcapitalbank, Svyaz-Bank, Surgutneftegazbank.

According to her, the bank will only consider a dacha if the purpose of the dacha is residential, and the status of the land is for dacha construction. If the land is allowed to be used for gardening or subsidiary farming, the bank will reject such an application. The most difficult thing is to get a loan for a land plot due to the low liquidity of such objects.

According to Lyudmila Tsvetkova from MIEL-Country Real Estate, one of the lowest mortgage rates for the purchase of land or a summer house is available at Sberbank. For the bank's salary clients, the mortgage rate for the purchase of a plot of land or a summer house (for seasonal residence) ranges from 12% per annum. The minimum down payment is 25% of the cost of the purchased property. The minimum loan amount for the purchase of such country real estate is 300 thousand rubles.

Commercial premises: getting a mortgage is difficult, but possible

The share of loans to individuals for the purchase of commercial real estate usually does not exceed 1-2-3% in bank portfolios. Many banks, including such large ones as VTB, VTB24 and Uralsib Bank, do not lend at all to the purchase of non-residential properties by individuals. Perhaps apartments, for which banks have begun to issue mortgages quite willingly in recent years - see “Mortgages for apartments: getting a loan is becoming easier.”

Loans for the purchase of garages and commercial premises can be obtained from DeltaCredit Bank and Absolut Bank, says Dina Orlova from Banki.ru. Banks issue a mortgage for non-residential real estate secured by purchased square meters. If it is possible to provide an existing apartment as collateral to the bank, then the range of available banks expands significantly, since it is possible to issue a targeted collateral loan, the expert says.

“Absolut Bank” offers its clients “Commercial Mortgage” for the purchase of non-residential real estate at a rate of 17.45% per annum, the bank explained. The minimum down payment is usually 20-30%. The standard loan term is up to 25 years.

“The easiest way to get a loan for liquid, from a bank’s point of view, premises (if we are talking about commercial real estate) is, as a rule, properties located on the first line of busy central streets,” says bank representative Ivan Lyubimenko.

Transcapitalbank also issues mortgages for commercial properties: loan amount - from 500,000 rubles, term - up to 10 years, rate - from 16.5% per annum, down payment - from 50%.

“The main requirements for the facilities are as follows: the building must be permanent, have a non-combustible ceiling, be connected to communications, be located in the region where the bank operates and have a postal address,” explained Vadim Pakhalenko from TKB.

Unaccredited new building: banks are ready to accommodate clients halfway

Thanks to the state program for subsidizing mortgages in the primary market, new buildings have become the most favorite lending object for banks. However, the homes buyers consider are not always accredited. And such situations arise regularly, admits Ivan Lyubimenko from Absolut Bank.

“You cannot buy an apartment in a non-accredited new building, but some banks can quickly accredit a new building. Naturally, the developer himself should be interested in this. In our practice, we have encountered developers who have a limited pool of banks and do not want to expand it,” recalls Alexander Tikhonchuk from the brokerage.

For example, VTB, VTB24 and Uralsib Bank are ready to promptly accredit a new building that meets the bank’s requirements. “The accreditation process itself takes from 3 to 5 working days from the moment the developer provides the necessary package of documents,” says Andrey Osipov from VTB24.

However, there are several programs on the market that allow borrowers to purchase housing in a house under construction without accreditation of the developer by the bank on the security of claims, says Dina Orlova from Banki.ru. For example, “Free Meters” of FC “Otkritie”, “Reasonable Mortgage” of Prio-Vneshtorgbank (Ryazan). Svyaz Bank can issue a loan for an unaccredited new building secured by the purchased housing, but will additionally take other existing real estate as collateral. The rate on such loans is slightly higher (by 0.75 percentage points) or the same (at Svyaz Bank); according to the terms of FC Otkritie, the rate increases by 2 percentage points. until the intended use of funds is confirmed. Other conditions are no different.

A similar program operates at Transcapitalbank. From this bank you can also get a loan secured by existing housing and use these funds to purchase a new building not accredited by the bank. “But if I were the client, I would ask the question: why didn’t any of the banks accredit it? Is it worth taking such an object? — Vadim Pakhalenko from TKB noted.

Alternative options

You can also get a loan to purchase housing that is not the most liquid for banks within the framework of the so-called alternative programs.

For example, the same mortgage programs, which are so-called targeted (or non-targeted) loans secured by existing real estate, says Irina Vekshina from INCOM-Real Estate. “If a person wants to buy a suburban property, for example, but the bank does not lend it, then the bank can be provided with other real estate as collateral,” explains the expert.

According to her, such programs have their advantages: for example, no loan fees, early repayment of the loan without restrictions, etc. However, the requirements there are quite strict - both to the property itself (it should not be in disrepair, registered for major repairs, have less than three floors, etc.), and to the borrower (for example, according to the conditions of a number of banks, his age should not exceed 55-60 years).

“Absolut Bank” offers to consider the “Perspective” program with a rate of 14.95% per annum as an alternative to a mortgage. In essence, this is the same cash loan secured by real estate. “The main advantage of such a lending program is the opportunity to receive a large amount for a long period at a low interest rate for any purpose. Whether it’s buying a plot of land, a cottage, a townhouse or a dacha in the village,” says bank representative Ivan Lyubimenko.

Uralsib Bank is ready to consider real estate of third parties as collateral. Another alternative option is a consumer unsecured loan, “but it will be smaller, and the rates are higher,” the bank warns.

“In general, if the bank has not approved the mortgage, then a consumer unsecured loan for a large amount will most likely not be approved either. A mortgage is a less risky product for a bank due to the presence of collateral,” admits Dina Orlova from Banki.ru.

There is another option - to “borrow” the missing amount to purchase the treasured real estate from microfinance companies, suggests Anna Borisova from KASKAD Family.

“If a mortgage is not possible, you can use collateral loans issued by microfinance companies at an average annual rate of 13.5-14.5% per annum with a loan/collateral ratio of 30/70, of which 70 are borrowed funds. The downside to this program is obvious - it is a high annual rate. Plus, approval happens quickly, just with a very flexible system for reviewing the borrower, which banks cannot afford,” says the expert.

In the new buildings market, an alternative to a mortgage can be an installment plan from the developer. “Many development companies have installment programs, in addition, there are leasing programs, but they usually apply to expensive business-class housing,” says Andrey Osipov from VTB24.

Thus, it is possible to get a mortgage even for objects that are illiquid for banks. Banks have few special mortgage lending programs for such properties, but there are alternative options for obtaining a loan, from which you can always choose the most profitable one. But in general, buyers of bank “illiquid assets” should be prepared for higher rates and for the bank to scrutinize the object of purchase or construction.

Mortgage promotions and special offers

TableMap

| Project | Special offer |

| May resort town | Mortgage from 4.5% |

| Nagatino i-Land | Mortgage from 1.2%! |

| Wings | Mortgage from 1.2%! |

| Rays | A year without payments |

| Rumyantsevo-Park | Mortgage from 0.1%! |

| Summer garden | Mortgage from 1.2%! |

| Residential area D1 | Mortgage 0.5% for 12 months |

| Fresh | Mortgage from 0.1%! |

| Sky | Mortgage from 3.2%! |

| iLove | Mortgage 5.85% |

| Heart of the capital | Mortgage from 0.1%! |

| Silver fountain | Mortgage for apartments from 5.85%! |

| SYMBOL | Mortgage from 0.1%! |

Data source: Real estate database IRN.RU

show all