One of the largest banks in Russia, VTB (VTB24), is traditionally among the TOP most popular banks trusted by Russians. The bank participates in state support programs, which allows it to quickly respond to citizens’ requests and offer competitive products. Mortgage refinancing at VTB was no exception. For those wishing to apply for it, VTB offers interest rates from 5%.

Mortgage refinancing at VTB in 2020

Borrowers who received a mortgage several years ago at very high rates, on average 14-15% per annum, today have the opportunity to significantly save their family budget. Refinancing a mortgage at VTB will allow you to reduce your monthly payment by reducing the rate or increasing the loan term.

When considering the possibility of refinancing, you need to consider the following points:

- Mortgage refinancing is a new loan for each borrower, so its processing will require expenses comparable to the first loan;

- the type of payment (annuity or differentiated) does not automatically affect the profitability of refinancing - you need to calculate each option separately;

- You can reduce the interest rate by transferring your salary to VTB;

- VTB allows the use of maternity capital;

- the bank will offer special lending conditions if the borrower works in the government service or in a socially important area;

- early repayment at VTB is possible in whole or in part; the bank does not set restrictions or penalties;

- VTB refinances only ruble mortgages.

Attention! The service is available both to borrowers of other banks and to VTB clients at their bank at a lower rate. VTB (VTB 24) does not set any restrictions on this criterion, but the registration procedures will vary.

Loan issuance and rate

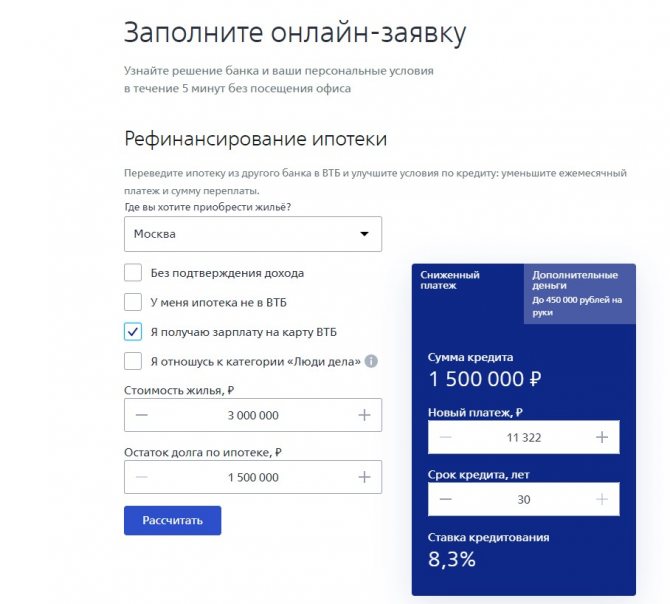

VTB is famous for the fact that it quickly makes decisions on clients, and the interest rate can be calculated from the very beginning. To ensure that the monthly payment amount does not come as a surprise to you, you can use the online calculator located on the bank’s official website even at the application stage.

Enter the basic parameters, and the calculator will calculate the required amount for you. The rate may vary at the discretion of the bank, and if you have benefits, you can 100% count on a reduction in interest. The minimum rate at VTB is 10.01%.

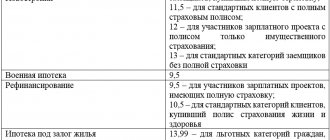

Rates and basic conditions for mortgage refinancing

VTB offers a flexible approach to refinancing - the final interest rate is determined individually for each client. This takes into account not only the loan amount or income, but even the field of activity. We have collected VTB refinancing interest rates and main conditions in the table below.

“People of Action” is a special VTB program for workers in the fields of education and healthcare, law enforcement and tax authorities, customs, federal and municipal authorities. The rate for these categories of citizens is lower.

Interest rates and premiums

| from 5% | Preferential refinancing with state support for families with children, if the property meets the conditions of the state program |

| from 8.3% | The borrower has a VTB salary card and works in one of the areas included in the list of the “People of Business” program. |

| from 8.5% | For everyone else, including those who do not have a VTB salary card, for clients with a mortgage from another bank, for borrowers without proof of income |

The bet allowances are as follows:

- +1% if you refuse comprehensive insurance;

- +2% for the period of re-registration of the pledge.

Although the bank is included in the list of recipients of budget subsidies for issuing preferential mortgages at 6.5%, VTB does not offer refinancing under this program.

Loan term and amount

Other conditions for refinancing at VTB:

- loan term: up to 30 years with income confirmation and up to 20 years without confirmation;

- minimum amount: 1.5 million rubles. for Moscow, except Zelenograd; from 1 million rub. for Zelenograd, St. Petersburg and the Moscow region; 600 thousand rubles – for other regions;

- maximum amount: 30 million rubles;

- you can attract up to 3 guarantors;

- Collateral insurance is mandatory, life insurance is optional.

On-lending at 5% with state support

Refinancing an existing loan under this program is possible for family borrowers who:

- several children, one of whom was born between the beginning of January 2020 and the end of December 2022;

- or one disabled child.

Refinancing is allowed if real estate was purchased from a legal entity under the DDU or DCT. For residents of the Far Eastern region, this condition is softer - you can also buy housing on the secondary market from an individual or even a house in a village.

Attention! The loan amount under this program is limited to 12 million rubles. in Moscow, Moscow Region, St. Petersburg and Leningrad Region, 6 million rubles. – in other regions of the country.

VTB: refinancing a mortgage at your bank

VTB warns its existing borrowers that if they plan to refinance with “their bank” at a lower interest rate (for example, at a 5% mortgage with state support), they have a special service for changing current conditions - “Additional Agreement”.

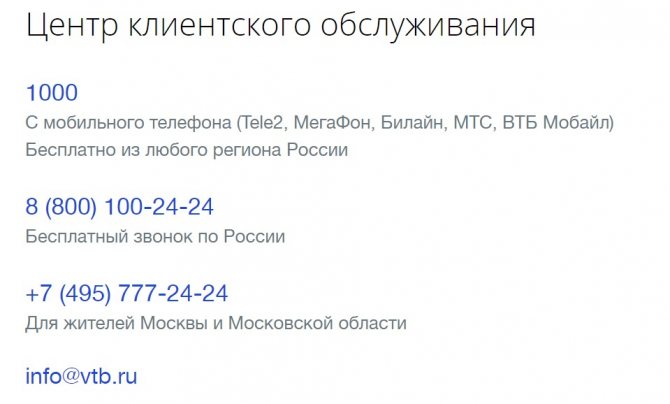

To use the service, you need to call the call center (phone numbers below) or any VTB office.

The essence of the program

How can I refinance a mortgage loan? Is it possible to lower the interest rate? VTB 24 is ready to refinance up to 30 million rubles, but not more than 80% (when considering a loan application based on 2 documents - no more than 50%) of the value of the property.

Refinancing conditions:

- rate from 8.8% per annum (promotional) to 9.3-10% per annum (regular);

- loan term up to 30 years;

- loan amount – from 300 thousand rubles to 30 million rubles (when choosing a lending program based on two documents – up to 20 million rubles);

- no fees for processing a loan;

- early repayment without restrictions or penalties.

It is possible to take into account the borrower’s income, both at the main place of work and part-time. You can choose the “Victory over formalities” program and receive refinancing without an income certificate. The lending limit in this case will be the same - 30 million rubles, but the rate will increase to 10% per annum. The promotional rate of 8.8% per annum is valid only until the end of May 2020, then you can refinance the mortgage only at 9.3-10% per annum.

Requirements for borrowers

VTB is quite loyal to its borrowers, compared to a number of other banks. The requirements for obtaining refinancing are as follows:

- any citizenship - a foreigner can refinance a mortgage at VTB if he works in Russia;

- any registration address;

- permanent place of work in Russia;

- a citizen of the Russian Federation can have a job abroad in a branch of a transnational company;

- no experience requirements;

- no minimum income requirements.

Mortgage guarantors can be spouses (official or not) and close relatives. If the husband and wife do not have a prenuptial agreement, the spouse becomes the obligatory guarantor.

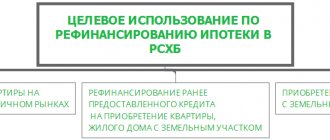

Real estate requirements

VTB considers each apartment individually. Mandatory requirements apply only to refinancing within the framework of a preferential mortgage at 5%:

- housing must be purchased only from a legal entity (registration under DDU or DKP is acceptable);

- For the Far East, it is permissible to purchase real estate on the secondary market or in rural areas.

As a rule, the bank evaluates the location of the property, the condition of the house, the availability of communications and, of course, the estimated value.

Instructions for applying for refinancing online 24

Refinancing at VTB includes several sequential steps:

- Fill out the application online on the website. A preliminary decision will come today – in 15 minutes.

- Collection of necessary documents.

- Signing documents and paying off the first mortgage.

- Re-registration of collateral.

- Registration of insurance.

VTB does not impose additional services or services, for example, electronic registration on its base.

List of documents

To apply for mortgage refinancing, you will need the following documents:

| Borrower's documents | Passport, military ID (for men under 27 years old), SNILS or INN |

| Income proof | Work book, certificate 2-NDFL or according to the bank form. A copy of the 3-NDFL declaration with a tax stamp will do. |

| Information on the refinanced loan | Agreement for the purchase of real estate, a valid loan agreement, certificate of mortgage balance |

Attention! Proof of income is not required if you have a VTB salary card. If you don’t have a card, you can use the “Victory over formalities” option and not confirm income, but the loan rate will be 1% higher - 9.5% instead of 8.5%.

On the Renovar.ru portal you can download for free the VTB Borrower Questionnaire and the Certificate Form based on the bank model (PDF files).

Apply to VTB online

An application for mortgage refinancing can be submitted online on the VTB website.

Filling out will take no more than 5 minutes. You will need to fill in the basic loan parameters, personal data, attach a scanned copy of your passport and select a suitable office. Pre-approval will arrive in 15 minutes.

Attention! VTB approval is valid for 4 months. This time is enough to refinance.

Signing documents and paying off the first mortgage

The loan agreement and the mortgage agreement for real estate with VTB are not signed at the same time. First, a credit agreement is drawn up, under which VTB will repay the debt from the previous bank. The transfer will be non-cash and without the participation of the borrower himself.

Re-registration of collateral

Once the original debt has been repaid, the bank will issue the discharged mortgage. Using it, it will be possible to cancel the mortgage record in order to register a pledge in the name of VTB Bank. The procedure for removing collateral varies from bank to bank. It is in the interests of the borrower to complete the process as quickly as possible, because at the time of re-registration the rate at VTB will be 2% higher than the approved one.

After registering the collateral with VTB, the refinancing procedure is completed.

Insurance

Since refinancing is essentially issuing a new loan, it is necessary to obtain insurance again. To get the best refinancing rate, you need to complete the following package:

- insurance of the structure (apartment as collateral), mandatory by law;

- + life and health insurance of the borrower.

VTB does not require title insurance.

More than 30 insurance companies are accredited by VTB (PDF file), from which you can obtain a suitable policy.

When the first mortgage is paid off, the previous insurer may return part of the insurance amount on the policy that was not fully used. Look at the terms of the insurance contract to check this issue. And from September 1, every borrower will be able to return insurance premiums for early repayment.

Read in detail:

About mortgage insurance

Step-by-step refinancing procedure in 2019

When all doubts are behind you and you have finally decided to refinance your mortgage, then you need to perform the following manipulations.

- You need to go to the bank’s official website and fill out a special application with contact information, after which a company consultant will contact you within a short period of time. Together you will discuss a time convenient for you to apply for a loan.

- Next, you should collect all the necessary documents, and also provide a folder of documents for the first mortgage taken out from a third-party bank.

- After which you need to wait 5 calendar days, during which the bank will make a decision - to approve your application or refuse to refinance the mortgage.

- When the bank gives the go-ahead, you need to go to the nearest VTB branch to sign the agreement.

The algorithm is extremely simple, and the whole process will take you no more than a week.

Is it profitable to refinance a mortgage at VTB?

Calculation of the benefits of refinancing should include a comparison of the full cost of the existing loan and the cost of the future mortgage that will have to be paid to VTB. In this case, you need to take into account:

- if the monthly payment is less, you can still pay the usual amount - this will allow you to pay off your mortgage faster at a comfortable pace;

- refinancing costs include appraisal, insurance, re-registration of collateral, paperwork.

You can make the necessary calculations using our refinancing calculator at the end of the article. If the savings are significant, then refinancing your mortgage with VTB is definitely profitable.

Benefits of loan refinancing

Refinancing a mortgage loan for individuals can significantly ease the fate of the borrower by reducing the inflated interest rate on the mortgage. VTB clients have a unique opportunity to save on loans and not overpay extra money. In addition, it is possible to combine several loans into one, and this allows you to pay all loan amounts in a single payment.

Repaying the loan amount becomes more profitable thanks to refinancing, and you will make your life much easier without additional interest burden.

Expert opinion

Mortgage refinancing at VTB is in great demand. Thus, in May 2020, the bank conducted almost 8 thousand transactions for a total amount of almost 16.4 billion rubles. Compared to 2020, the figures are 8 times higher. VTB conducts a third of all transactions with the population specifically for the refinancing of existing mortgage products, which only confirms the high interest of Russians in the bank’s offers.

Note that the Central Bank still allows for a further reduction in the key rate, which will entail a softening of interest rates on mortgage loans, and therefore on refinancing. In this regard, VTB does not stand aside and is sensitive to the needs of the population.

What loans can be refinanced

If you already have several loans under your belt and a mortgage has been added to them, which “eats up” most of the budget, then sooner or later a situation will arise when you need to reconsider your loans and arrange refinancing.

Often, the main problem that most borrowers face is not the interest rate itself, but the size of the monthly payment. It is this that damages the budget and puts users in a cramped position.

Each client wants to reduce the payment amount and is actively looking for banks with low interest rates. Reducing the rate is not the only way out. You can reconsider the period allotted for paying off the mortgage, and then automatically the monthly payment will correspond to your capabilities.

Of course, the term of the obligation to the banking organization will increase, but this will allow you to loosen the “collar” and have time not only to repay the loan amount, but also to enjoy life.

Mortgage refinancing gives the borrower the following preferences.

- Possibility of reducing the interest rate on the current loan.

- Reduce the amount of your monthly required payment.

- Review the amount of overpayment on the loan.

- Change the term of the mortgage loan.

VTB refinancing of mortgages from other banks provides an excellent opportunity to renegotiate the terms of the mortgage and is a real salvation for many users in Russia. In addition, you can include existing consumer loans in the refinancing process.

Surely most users have experience in obtaining a loan for consumer needs. To prevent it from being an additional burden, VTB can, as they say, “repurchase” the debt, making it part of the mortgage loan. Profitable, reliable and efficient.

Borrower reviews

VTB is actively working with the population, so there are quite a lot of reviews about refinancing online.

In general, clients are satisfied with the conditions of VTB and the work of individual employees. The positive aspects include a real reduction in the rate by several percentage points and significant savings on the monthly payment.