Life on credit, or American-style mortgage

Americans are a very spoiled nation; they have long been accustomed to living on credit.

A house, a car, furniture, clothes and even groceries - everything can be taken out on credit. Remember any American movie - rarely anyone pays with cash, but absolutely everyone uses credit cards. You can live quite comfortably on debt if the country's economy is stable. The most profitable investment of savings in America is considered to be the purchase of real estate. Since the beginning of the 2000s, there has been a huge demand for housing in the United States, and, consequently, for mortgage loans. But Americans are not so stupid; they plan their spending several years in advance. Often, the home purchased was a kind of breadwinner - real estate prices rise, and mortgage rates fall. You could resell the house, pay off the bank, and pocket the difference. Moreover, the proceeds were quite considerable.

Or you can remortgage your home - sell it to yourself for a lot of money and again get a good income. Banks also made money from this.

Photo: https://pixabay.com/photos/money-finance-mortgage-loan-2696229/

The rise in real estate prices was a kind of impetus for economic growth.

The financial crisis broke out in 2008, but the preconditions for it appeared much earlier. Already in 2006, it was very difficult to sell a house - the real estate market was already at a standstill. Borrowers who previously carefully paid monthly payments found themselves insolvent - losing their business, jobs, and income. It was no longer possible to resell or remortgage the property. And banks demanded repayment of debts.

Two years later, housing prices in Florida fell by thirty percent, and about 60% of houses for sale did not find their buyers. Borrowers were struggling, selling everything they had just to stay afloat and be able to pay the mortgage. Eventually the day would come when they couldn't pay their bills. I had to say goodbye to my positive credit history. Next up is farewell to housing.

Banks sent mass notices to debtors that their homes would be confiscated and put up for auction if they failed to pay. Some desperate borrowers resorted to the short sale procedure, which translated means “short sale.”

Its point is to sell the house at least at some reasonable price, just to pay off the bank, even partially. The banks took this step; they were losing too much money - the number of confiscated houses was huge, but no one was going to buy them. Moreover, it turned out to be very difficult. If there were buyers, they could not even properly inspect the house - angry and embittered former owners very often deliberately caused damage to the property, for example, pouring concrete into the sewer, breaking windows, tearing out electrical wiring.

The most desperate declared themselves bankrupt. And according to the law, until the case is considered in court, the creditor does not have the right to kick the debtor out of the house. The courts were overwhelmed with such cases, so some borrowers managed to live in their former home for six months to a year.

Results

Everything new is well forgotten old.

Much has changed since the financial crisis of 2008. Thus, the Volcker Rule limited the trading operations that banks can conduct, and the third part of the Basel Accord and the Solvency II directive tightened capital requirements for banks, insurance companies and large hedge funds. The Dodd-Frank Act was introduced, aimed at increasing responsibility and transparency in the financial system and regulating bankruptcy procedures. However, much has remained the same since those times. Governments still make important economic decisions using outdated economic models. We place too much faith in quantitative models without understanding the assumptions underlying them. Margin trading links markets that seem to have nothing in common through companies that trade on them. Therefore, risk management is impossible without taking into account the correlation between markets and financial instruments.

I am confident that there will eventually be another financial crisis, although it will look different. I believe that some of the causes of the 2008 crisis that I described will still play a role in the economy. In addition, new operational risks are emerging. These include the rise of similar algorithmic trading systems, loosely coupled electronic exchanges, and poorly designed software. All of this already showed its dark side in 1987, and, more recently, during the flash stock market crash of 2010. In my humble opinion, operational risk will play an increasingly important and dangerous role in the financial systems of the future.

What led to the mortgage crisis

Greed is the main reason why the mortgage bubble burst.

After the horrific terrorist attack on the Twin Towers, the US economy plummeted. The government tried its best to attract foreign investment into the country, and it succeeded - investors were able to revive the economy. Citizens now had free funds in their hands that could be invested in real estate.

Mortgage companies received government support for lending to low-income people. Banks began to offer cheap and affordable mortgage loans that even people with minimal incomes could afford. At the same time, credit history and solvency were often not even checked.

Citizens began to buy housing for themselves en masse (why not take it, since they are offering it on very tempting terms?), hoping that due to rising real estate prices, they would be able to pay off the mortgage for several years, and then resell the house and earn a tidy sum. That is, the population had the opportunity to get easy and quick money.

Now let's go a little deeper into the story. During the financial collapse of the 1930s, the Glass-Steagall Act was passed. He divided banks into commercial and investment. Also, in order to avoid fraud and speculation in the market, trading in shares was prohibited and compulsory insurance of ordinary citizens’ own savings was introduced.

The emergence of free funds in the hands of the population and commercial banks led to the fact that there was too much money. There was a need to “blow off steam,” but trading on the stock exchange was prohibited by the Glass-Steagall Act. Therefore, back in 1982, a law was passed allowing commercial banks to issue loans to any organizations, although previously this was only possible for state banks.

This marked the beginning of great changes in the US banking structure. The market began to float freely, loans began to be issued to everyone and against any collateral, using not a fixed, but a floating rate.

Further, banks began to issue loans to themselves, creating subsidiaries for this purpose.

And, of course, how would we live without subprime lending? For people with low incomes, the terms of a conventional mortgage were unacceptable - the interest rate was too high. And since banks had accumulated a surplus of available funds, it was vitally important to invest this capital somewhere. Mortgage programs with very tempting conditions have appeared.

Photo: https://pixabay.com/photos/house-home-residence-real-estate-961401/

Borrowers were offered:

- use a floating rate. For several years the rate was fixed, and then the bank changed it annually depending on the economic situation in the country. Ninety percent of all borrowers took out a mortgage at a variable rate;

- choose the most optimal payment system. For example, the borrower could choose the amount of monthly payment acceptable to him and the percentage of interest on the mortgage.

The risk was justified - if the borrower did not have enough money to service the loan, the bank confiscated the property, sold it at auction and covered the damage.

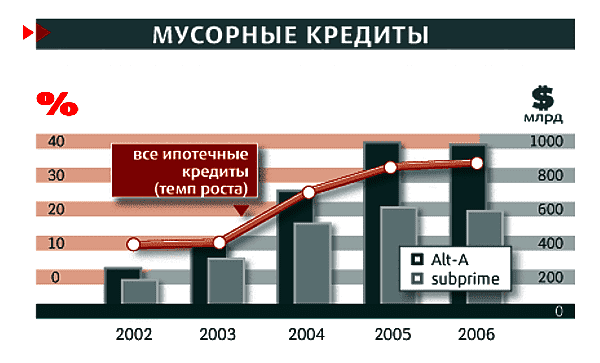

That is, any American could get a loan without a stable income and savings to make a down payment. The banks themselves called such mortgages “junk” because they were high-risk and it was clear to everyone that they were unlikely to make money on them.

For example, New Century Financial had no problem approving a half-million-dollar mortgage for an ordinary McDonalds employee with an annual salary of $35,000. Even a few lives are not enough for him to pay off the bank.

What's the point? Banks sacrificed little to earn huge amounts of money from the sale of mortgage-backed securities.

“Junk” loans were issued to everyone, as long as the borrower had a bank account. Naturally, citizens began en masse to take out mortgages and buy more than one home, in the hope that as prices rise, the costs will be recouped many times over.

The mortgage bubble began to inflate. Loans were handed out left and right. Banks have come up with a new scheme - making money on securities. They began to issue bonds for the amount of the issued mortgage, which were based on a mortgage on real estate. Mortgage loans with similar characteristics were pooled and then sold to investors.

As a result, banks returned the borrowed funds, thereby reducing their risks, and investors resold the bonds, making money on it. The secondary securities market (resale) brought multimillion-dollar profits to banks, investors, brokers, developers and all other participants in the real estate market.

Mortgage securities were issued almost uncontrollably. Most financiers assessed these bonds as something real, secured by collateral real estate and cash. In reality, they turned out to be empty.

Photo: https://pixabay.com/illustrations/invest-money-growing-plan-business-3965215/

In addition, leading American banks agreed with large rating companies to artificially inflate their ratings. There was deception everywhere, cleverly veiled by financial scammers.

Ordinary citizens did not lag behind in fraud and speculation. There was a homeless person or a low-income person for whom several mortgages were issued. For several years, the “good guys” conscientiously paid monthly payments for it, and when housing prices once again rose, the house was sold.

Two years before the crisis, most houses with mortgages were put up for sale. Supply exceeded demand - prices quickly plummeted. It became impossible to sell real estate, and floating interest gradually increased. The subprime mortgage crisis led to a crisis in conventional mortgages. This even affected the middle class, people were no longer able or willing to pay monthly payments.

Banks were unable to collect debts to meet their obligations to investors. They suddenly saw the light and saw that mortgage-backed securities were currently worthless. As a result, the mortgage crisis led to a financial crisis. The bubble has burst...

Based on the above, we can identify the main causes of the mortgage crisis in the United States:

- growth of external investments;

- changes in legislative regulation of the banking system;

- subprime lending to the poor;

- speculation and fraud in the mortgage market.

Subprime lending

For US banking practice, 6-8% of the total mortgage portfolio has traditionally been considered an acceptable level of high-risk loans. But to cover the beginning of the construction boom, such a percentage of unreliable borrowers turned out to be too low and banks began to gradually reduce mandatory requirements. Such loans are called substandard and many modifications have been developed:

- with a floating interest rate (interest-only mortgage) - during a certain initial period of the loan, only interest is paid, and not the principal amount of the debt. By the beginning of the crisis, more than 90% of loans had a floating rate;

- the client’s choice of payment option (“payment option” loan) – you can choose the size of the monthly installment, while the unpaid interest could be added to the principal amount of the loan. Almost every tenth loan in the period 2005-2006 was structured in this way;

- the possibility of repaying most of the debt at the end of the contract (balloon-payment mortgage) and other options.

The apotheosis of the fight for a client at any cost was loans with the presence of assets (funds in a bank account), but without regular income (income, verified assets, NIVA), and loans without any assets or income at all (no income, no assets, NINA).

Implications for the US

Well, the bubble has burst, it’s time to look around and see what the thirst for profit has led to:

- by 2011, more than nine hundred thousand houses were seized from borrowers in favor of banks;

- bankers lost clients, investors lost money, and borrowers lost real estate;

- the stock index is down almost fifty percent since 2006;

- from the summer of 2007 to the fall of 2008, the value of companies involved in production fell by 20%;

- to stay afloat, ML and Bank of America banks merged;

- investment banks Lehman Brothers and Bear Stearns were declared bankrupt;

- the decline occurred in all sectors of the economy;

- a huge number of ordinary people have lost their savings, including pensions.

What did the government do?

The US Government has developed and implemented the following steps.

- An extensive investigation was carried out “at the very top”, where it turned out that the first signs of a bubble appeared back in 2006-2007. Naturally, many market participants guessed this, having managed to hedge their bets and make money from the crisis.

- It was recognized that they were in a hurry with attractive conditions and relaxation of requirements for borrowers.

- At the end of the summer of 2008, the so-called “Paulson Plan” was adopted, designed to save the American economy. At the expense of the budget, the government bought out all the “junk” loans, spending more than seven hundred billion dollars on this.

- An agreement was concluded with the largest creditors on a deferment for ordinary citizens in order to avoid confiscation and sale of collateralized housing.

- Borrowers were partially refunded property taxes to pay off debt obligations.

- Large banks were given preferential loans to help them stay afloat, otherwise their bankruptcy could lead to the collapse of the entire economy.

- Mortgage-backed securities are now permitted to be issued only against actual collateral.

Growing scale

But the crisis did not last long within the borders of this state. Crisis phenomena quickly spread throughout the world. It came as a shock to many that even major players in the banking sector were forced to declare bankruptcy. Some financial institutions were saved from such an end by national governments. Over the next two years, there was a decline in stock market prices. Many companies, when evaluating the placement of their securities, realized that obtaining capital would not always be possible. These processes clearly characterize the global economy in 2008.

The crisis also affected the production sector. In this sector, it manifested itself in a decrease in production volumes and a decrease in demand for goods and raw materials. This, of course, entailed a drop in the need for labor resources. Due to the crisis, many people have lost their jobs due to layoffs.

Consequences for Russia and the global economy

Since the financial market is one of the most advanced and global, almost all countries of the world, including Russia, suffered in one way or another from the US mortgage crisis. And the reason for this is the peg to the American dollar, which is the equivalent of trade.

Photo: https://pixabay.com/illustrations/financial-crisis-stock-exchange-544944/

Chronology of events day by day:

- 2007 - the collapse of the real estate market due to the inability of borrowers to repay debt obligations on high-risk mortgage loans;

- January – July 2008 – shares of the largest mortgage agencies Fannie Mae and Freddie Mac depreciate by 80%;

- September 15, 2008 – Lehman Brothers bank declared bankruptcy (its debt amounted to $613 million);

- September 2008 – indices on world financial exchanges fall;

- July - December 2008 - world oil prices decrease from $133 to $43 per barrel;

- October 2008 – Iceland is on the verge of bankruptcy, asks for an IMF loan;

- October 2008 – Russia cannot obtain refinancing from European banks;

- October 7, 2008 - oil companies Lukoil, Gazprom, Rosneft and others ask the Russian government for loans to pay off debt obligations on external loans;

- October 23, 2008 – Standard & Poor's rating agency changes Russia's sovereign outlook from “stable” to “negative”;

- November 11, 2008 – The Central Bank announces the beginning of the devaluation of the ruble;

- from August 2008 to February 2009, the dollar exchange rate in the Russian Federation increased from 23.41 to 36.17 (almost one and a half times).

Russia's GDP at the end of 2009 decreased by 7.8%. The indicator has not yet returned to pre-crisis growth rates.

Industrial production decreased by 10.8%. According to Forbes, the number of Russian dollar billionaires has decreased by more than a third, and their total capital has decreased by five times.

Domestic borrowers who took out mortgages in foreign currency suffered heavy losses. Due to the sharp rise in the dollar, their debts increased significantly. As a result of this, many Russians lost their property.

Overproduction of the dollar

Some experts single out one main reason for the economic destabilization of 2008. The crisis, in their opinion, resulted from the overproduction of the American dollar. The situation has grown to enormous proportions because the dollar is a world currency. Until the seventy-first year of the twentieth century, the dollar was backed by the gold reserves of the United States. After such a connection between the currency and the precious metal ceased to exist, the dollar was no longer printed in unlimited quantities.

The reason for the massive nature of the crisis is also that the purchasing power of the national American currency is ensured not only by the gross domestic product of the United States itself, but also by a similar indicator of other countries. But even if the financial sector of a country is directly dependent on the dollar, the country has no influence on the volume of currency emission. Even the US government itself has no control over this process. The only structure that has such a right is the US Federal Reserve System. This organization is also called the Central Bank of the United States. It is a collection of twenty private banks. They are united by one area of activity, which is printing dollars. After the connection between currency and gold was broken, there was an increase in the volume of world money. It was many times higher than the volume of actual commodity mass in the world. This situation was a good plus for two subjects - the leaders of the structural elements of the US Federal Reserve System and the states themselves.

A huge amount of finance was spent on issuing loans with reduced requirements for borrowers. Typically, the purpose of such loans was to purchase real estate. Such an offer was very attractive to people, as it provided a lot of opportunities with minimal earnings. The only obligation was to work towards repayment, and the loan term extended over thirty years. Such a program could only be paid for through an unsecured dollar issue. The United States Central Bank assumed in advance that not all funds would be returned. It can be concluded that the government deliberately carried out this process, knowing that at some point the dollar would collapse. That is, the overproduction of the world currency is one of the reasons that the global crisis of 2008 occurred.