VTB loans for individuals

For individuals, the bank offers several types of loans. The client can borrow funds for certain purposes (purchase of a home or car), as well as borrow money without specifying the intended purpose.

You can take out a loan in Russian rubles, US dollars or euros. The money is transferred to the client’s plastic card or bank account.

Crediting to a card is considered more profitable, since there is a grace period during which no interest is charged for using bank funds. In addition, you can receive bonuses in stores by paying cashless.

VTB loans for legal entities

VTB provides credit funds to legal entities (small and medium-sized enterprises), as well as individual entrepreneurs. You can borrow funds for almost any purpose: purchasing new equipment and products, expanding space, purchasing real estate or transport. The main thing is that the company is not bankrupt, generates income, and more than six months have passed since its foundation.

Loans are provided in the same currency as for individuals: American dollars, euros, Russian rubles. The interest rate will be calculated individually for each company. The following can be provided as collateral:

- Transport;

- Plots of land;

- Production equipment;

- Manufactured products;

- Offices, non-residential buildings, apartments and other real estate.

Review of VTB loans

A brief overview of loans will help you get a general idea of banking products. Next, the client himself selects the conditions that suit him, based on his requirements. For example, some types of loans require a photocopy of all entries in the work book.

Large

An individual is provided with a large amount at relatively low interest rates. It can only be received by people who have confirmed their high incomes. For clients who do not receive salaries on a VTB card, the amount will be limited to 3 million rubles , and the interest rate will be increased.

You can calculate the approximate monthly payment and overpayment using the loan calculator located on the official VTB portal under the terms of the “Large” loan.

Calculation of the “Large” loan on the VTB website

Comfortable

Issued to clients who have an average or low income. The bank lends small amounts for a long period of time at favorable interest rates. There is no need to indicate the purpose for receiving funds.

The interest rate is calculated for each person separately, but it will be higher than that of the “Large” loan product. It depends on the period, amount, level of income. The client will learn about a positive decision within 3 days from the moment of contacting: an SMS message will be sent to him.

Mortgage bonus

The mortgage bonus is provided to those VTB clients who have already taken out a mortgage from the bank and are repaying the debt without delay. Issued at a minimum interest rate.

Funds can be used to purchase plumbing equipment, furniture, and household appliances for a new apartment or for renovations.

There are also restrictions for non-salary clients up to 3 million rubles.

Refinancing

This is an interesting offer from VTB that allows you to combine all your debts in one place. If a person has already taken out several loans from different banks, then he can transfer them to VTB and repay them once a month in one amount. In this way, you can combine up to six loans. The main thing is that the client had at least three months left until the end of the term.

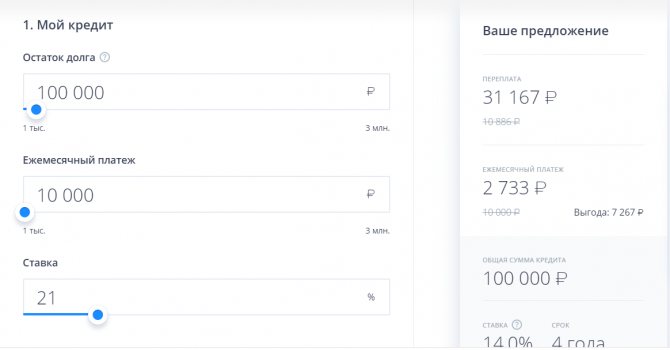

When refinancing, there is a chance to reduce the interest rate. For example, if a person took money at 21% per annum , then VTB will offer to pay only 14% . This is explained by the fact that money for servicing several loans is now taken as if it were one, because they are handled by one institution. You can calculate the benefits using a special calculator.

Online calculation of refinancing using a special calculator

Requirements

VTB, like other banking institutions, puts forward certain requirements for potential borrowers. A more loyal attitude towards salary card holders, since their data has already been confirmed, and bank employees can always access their finances.

The most important conditions are Russian citizenship and registration in the region where the bank branch where the client applied is located.

Requirements for the borrower

The requirements mainly depend on the loan amount. But in any case, the borrower must be an adult (over 21 years old) and officially employed so that he can present a certificate of income from his place of work. He should not have any defaults on loans or problems with repayment in the past.

If the potential borrower is a pensioner, then he needs to consult with VTB employees about the terms of the loan. Persons over 70 years of age will be denied a loan.

Individual entrepreneurs, although they are individuals, are not given consumer loans. Funds loaned to individual entrepreneurs are provided on the terms of legal entities if they can provide 75% of the borrowed amount as collateral.

Bank requirements

Borrowers who meet the following requirements are eligible to receive a mortgage from VTB:

- The age of a potential bank client is from 21 to 60 years (for women) and 65 years (for men). The second age criterion is determined by the number of years at the time of full repayment of the loan. In some cases, the bank may consider age up to 75 years.

- Both citizens of the Russian Federation and foreigners can take out loans from VTB, provided that they work in Russia.

- The total work experience must be at least five years, with at least three months at the last place of work.

- A potential borrower must prove solvency, and the amount of monthly payments should not exceed 40% of total income. A mortgage is provided only if there is a guarantor or co-borrower.

- A positive credit history is welcome.

Required documents

The list of documents for individuals includes:

- Passport confirming Russian citizenship and registration.

- Insurance pension policy (SNILS).

- Certificate from place of employment with salary for the last six months. If the borrower has been working at the enterprise for less than six months, then he must take a certificate for the actual period worked.

- If the client plans to borrow more than 500 thousand rubles, then he brings a photocopy of the work book with the seals of the organization’s HR department or a copy of the employment contract.

- Military personnel must provide a serviceman (officer) identification card and a contract. If he is in the secret service, then you can do without a contract.

People receiving wages on VTB cards will only need a passport and SNILS.

The list for legal entities is more impressive and includes:

- Standard questionnaire;

- Contracts and cooperation agreements with other enterprises;

- Documents confirming the registration of the organization;

- Report for the past period submitted to the tax office;

- Documents for objects that a legal entity provides as collateral;

- Original passports of the owners of the enterprise;

- Documents that reflect the revenue received.

It is possible to provide additional documents; this aspect must be clarified with bank employees. Their list is also on the official VTB portal. If important documents and certificates are missing, lending may be denied.

Don't have time or opportunity to collect documents?

Article on the topic: How to apply for a mortgage using two documents: 5 main steps

VTB offers a “simple mortgage” without proof of income. To receive a loan you will need a passport and SNILS.

However, the tempting conditions hide a number of strict restrictions that discourage many borrowers:

- The client is required to make at least 40% of the loan amount as a down payment;

- The use of maternity capital is not provided;

- The client's age is over 25 years old, under 60 years old. Moreover, by the date of termination of the loan agreement, male borrowers must be no older than 65 years, and female borrowers must be no older than 60 years;

- The mortgage rate will increase by 0.7% - a fee for the speed of registration, the absence of bureaucratic formalities.

( 1 ratings, average: 5.00 out of 5)

Conditions for VTB loans

For the convenience of customers, loan offers have different conditions. To choose the right one, you need to carefully study them and compare them. Let's look at the presented loans in detail.

Rates

| The product's name | Large | Comfortable | Mortgage bonus | Refinancing |

| Interest rate | 15% for salary clients; 15.5% for other categories | From 16% to 22% | 13.5% for everyone | 13.5% - if the amount of debt is more than 600 thousand rubles; 14-17% - if the debt amount is up to 599 thousand rubles. |

As you can see from the table, it is profitable to take a mortgage bonus and refinance large amounts of loans. Salary clients are also given privileges, so if you have the opportunity to transfer your salary to a VTB card, you should take advantage of it.

The “Convenient” loan has the highest interest rates, but almost all people with low income can get it.

Deadlines

| Name | Large | Comfortable | Mortgage bonus | Refinancing |

| Term | From 6 months to 5 years | From 6 months to 5 years | From 6 months to 5 years | Up to 60 months |

You can get a loan for a long period, but it should be noted that the more time given for repayment, the greater the overpayment. Therefore, if your financial situation allows, it is advisable to repay the debt as early as possible. The smallest overpayments will be for repayments within 6 to 12 months.

Available amounts

| Name | Large | Comfortable | Mortgage bonus | Refinancing |

| Amounts | From 400 thousand rubles up to 5 million rub. | From 100 thousand rubles up to 400 thousand rubles | From 400 thousand rubles up to 5 million rub. | From 1 thousand rubles up to 3 million rubles one loan at a time |

The “Large” and “Mortgage Bonus” amounts are the same, but the interest rate of the “Bonus” is lower, so it is more profitable for mortgage loan holders to take it. It should be remembered that only salary card holders receive the maximum amount (5 million) for these offers.

The remaining categories can only be issued 3 million. For “Convenient” and “Refinancing” no restrictions are set.

Other conditions

When refinancing, you can additionally borrow funds from the bank, having previously confirmed your solvency. Only loans in Russian rubles are subject to refinancing. The borrower must not have been in arrears on loans subject to refinancing during the last six months.

For all types of loans, there is the possibility of increasing the amount when extending terms or increasing income. This can be either the borrower’s salary or the total family income.

How to apply for a loan online

- In order to submit an online application, you first need to open the official website of the bank

- Then on the website you need to select the bank loan program that suits you

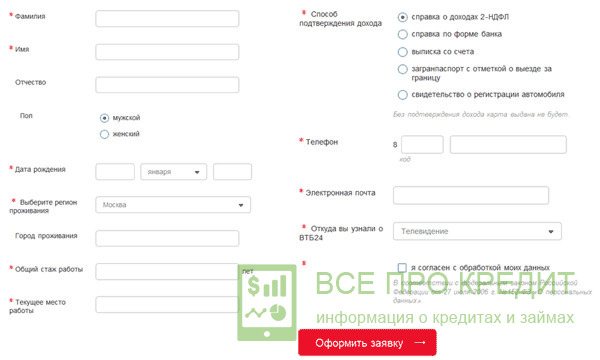

- Then you need to click the “Fill out application” button. In essence, this is a borrower’s application form in electronic form. In electronic forms you must indicate your personal data, income data, information on the loan amount and repayment period. The completed application will then need to be confirmed with an SMS password.

When filling out the application, you must provide all data accurately and reliably, as they are double-checked by the bank. If distortions are identified, the loan will be denied and this will be recorded in your credit history.

That's it, the loan application has been submitted. Now it’s up to the bank - the bank has allocated 1-3 days to review the application. And you need to wait for a call from the manager or an SMS from the bank. This is followed by concluding a lending agreement and receiving a loan at the bank’s cash desk or to a card/account.

Credit insurance

To protect yourself from financial loss, the banking institution offers the client to take out insurance. In case of unforeseen situations, the insurance company will pay the debt.

VTB has two types of insurance programs: Life+ and Profi. Life+ insures the client against disability and death. Pro – from the same cases, but additionally includes insurance against loss of a job and, accordingly, a source of income.

You can refuse insurance, as stated on the bank’s official portal; this does not affect the decision to issue funds to a specific person. But if a person borrows money from VTB for the first time or a large amount, then it is better to agree to insurance, otherwise he may be refused. It is not necessary to use the services of VTB; you can insure yourself with another company, but only with those that are trusted by the banking institution.

When the event specified in the insurance occurs, the insurance company begins making monthly payments. She will do this until the end of the loan term, or until the client becomes able to work or gets a new job.

How to apply for a loan

You can submit an application for a loan to VTB in three ways:

- at the bank office;

- by calling the Bank Information Service Center;

- online.

When submitting an application at a bank office, you must first prepare a basic package of documents, plus additional documents for the selected loan program. Next, in the office you need to contact the manager, he will review your documents and provide you with a loan application to fill out.

When submitting an application by phone, the manager will fill out your application himself, only asking you for your personal information.

When submitting an online application for a loan, you also need to fill out personal information and answer questions about the amount and term of the loan. Next, we will consider step by step the algorithm for submitting an online application.

Overdue loans

If the client does not pay on time or deposits a smaller amount, the bank charges a penalty of 0.1% on the balance of the debt. To avoid unpleasant situations, it is recommended. It allows you to make the first three payments not in full, but only the accrued interest.

Credit holidays will also help you avoid penalties. They allow you to skip a mandatory payment every six months. It is postponed to the next month, and the loan period, accordingly, increases by 30 calendar days.

The service is automatically activated upon conclusion of the contract. At least six months must pass before your first missed payment. You cannot use the service if there are less than three months left until the end of the credit period.

If you intend to skip a payment, you need to call the hotline 8-800-100-24-24 before the deposit date. Activation of credit holidays will cost the client 2 thousand rubles.

Payment methods for loans

You can repay a VTB loan in cash in the following ways:

- directly at the bank's cash desk;

- through online services;

- from a bank card and account;

- via Russian Post.

There are a lot of repayment methods and almost all of them do not require payment of commissions. Each VTB 24 office has a cash desk through which you can make loan payments. Money is deposited into your account the same day, and the payment is not subject to commission.

Paying for a consumer loan through the VTB online client is even more convenient: no visit to the office is required. You just need to log into your online personal account, enter your loan parameters and the payment will be credited to your account the next day.

When paying online, you should be more attentive to the timing of payments, since the money is transferred within 24 hours, which means that payment must be made no later than the day before the payment date. This also applies to a bank card.

Application for a loan at VTB

The application is submitted directly at the bank, online on the official website, through an ATM, mobile application or by landline phone. During a personal visit to the bank, a detailed questionnaire consisting of several sheets is filled out.

It contains 21 points. The questionnaire includes information about the client’s personal data, his passport and additional documents, contact information, amount and name of the loan product, information about family, education and employment.

You will also have to provide information about other loan obligations and property (apartments, cars, land). Filling out the questionnaire will take a lot of time, but after viewing it, the employee will give a preliminary answer about granting or refusing within 5 minutes.

The first page of the application form for receiving credit funds

Over the phone and on the official VTB portal, the client will be provided with a shortened version of the questionnaire containing information about passport data, income, and property. The answer will come within 1-3 days (working days). In some cases, the decision takes up to 7 days. If you haven’t received the SMS message, you can call the hotline and clarify the situation.

Basic set of documents for applying for a loan at VTB

To draw up a loan agreement, an individual must first provide a standard set of documents:

- Russian passport

- If you have one, you need to provide a passport or driver's license

- A copy of the work record book or a fixed-term employment contract, certified by the seal of the organization (for a loan of more than 500 thousand rubles).

- A document confirming the official income of the borrower: form 2-NDFL or a certificate of income indicating the necessary details (for individuals who are employed), and for individuals engaged in individual labor activities - a declaration of income 3-NDFL (usually with a mark from the Federal Tax Service).

- SNILS certificate

- Additional documents depending on the chosen credit program (for a mortgage, for example, documents for an apartment, for a car loan - documents for a car).

For bank clients who receive their income through VTB on plastic salary cards, to apply for a loan you only need to provide a passport and a salary card. In addition, the bank provides special preferential conditions for civil servants, education and healthcare workers, etc.

How to repay the loan?

Repayment is made:

- Through VTB bank terminals;

- In your Personal Account on the banking institution’s website (you can set up automatic payment);

- “Golden Crown” transfers and regular postal transfers;

- Using a mobile application (you can set a reminder);

- At the cash desk of a VTB branch (if the client makes a payment over 30 thousand rubles, then he must show his passport).

In all of the above cases, the commission for depositing funds is not charged, except for transfers. But if you transfer money through the self-service terminal of other banks or Qiwi, you will have to pay a percentage for the service. You must deposit the money before seven o'clock in the evening of the day specified in the contract, otherwise the delay will begin.

It should be noted that the transfer must be sent through the post office in advance (10 days) before the payment date, otherwise they may not arrive on time.

Early repayment of a loan at VTB

If you intend to return the funds or part of them early, the client must write a statement. It indicates passport details, the exact amount of the remaining debt, as well as the option of full or early repayment. The application must be written at least one business day before the monthly payment due date specified in the agreement.

You can deposit funds the very next day after the bank employees accept the application. If the client wrote an application, but was unable to deposit the money, then it is canceled automatically.

How to get a consumer loan from VTB 24?

To submit an online application for a consumer loan at VTB 24, just fill out the appropriate form.

Please provide the following information:

- correct details – full name;

- contact number;

- age and gender;

- amount of credit.

To take out a cash loan from VTB 24, you will need to indicate the amount of your monthly income. The loan amount may change depending on your income.

Important! You should be careful and distinguish between VTB and VTB 24. You can submit an application via the Internet only at VTB 24.

A cash loan from VTB24 can be obtained by contacting the bank or on the website. In the questionnaire you must provide basic information about yourself: age, full name, place of work, contact information, as well as basic loan parameters. The application is approved within a few hours if the amount is small, and up to 24 hours if the amount exceeds 400 thousand rubles. Next, the contract is signed and cash is provided to the client.