Features of mortgages in Kazakhstan

Resident card

Mortgage lending in Kazakhstan allows you to purchase a decent property located in this Republic. Today, this is available not only to citizens of this country, but also to foreigners.

In particular, for people who are registered in Russia for citizens of the Republic of Belarus and other countries. You just need to confirm that you permanently reside in the Republic of Kazakhstan.

However, this is only available if the person has a residence permit in Kazakhstan.

In this case, a person who wants to apply for a mortgage in one of the Kazakh banks can gain access to the purchase of any real estate, on the terms of the chosen lender. However, first, you need to understand whether you meet all the requirements, whether the terms of mortgage lending are favorable for you and whether you like the options for affordable mortgage real estate.

It will be useful to view:

Possible problems and design nuances

The largest banks in the country offer mortgages on rather difficult conditions. How to get money without a down payment? In Kazakhstan, potential borrowers can count on affordable mortgage loans from several banks. Let's look at the best deals. It should be taken into account that in order to approve the transaction, additional collateral in the form of valuable property will be required.

KZI Bank provided mortgages for up to five years at ten percent in 2020. The bank's official website contains information about the temporary cessation of lending to individuals.

At Eurasian Bank, clients can take advantage of several programs. The terms of the “Simply Mortgage” product include:

- The loan term is up to 240 months.

- The loan is issued in the national currency - tenge.

- The remuneration rate is set at thirteen percent.

- Potential borrowers can choose several ways to obtain a mortgage.

- The standard down payment amount is set at thirty percent per annum. If the client does not have enough cash savings, he can pledge additional property as a guarantee.

To confirm ownership and value of real estate, additional documents must be provided to the bank.

Other offers also apply:

- The client can choose housing in a complex under construction.

- The Shar Kurylys project has a low interest rate - only 12.5% per annum. In this case, the size of the down payment depends on the official amount of income. If the client can confirm solvency, the amount of the first payment is set at fifteen percent. If the bank takes into account indirect income, the client should contribute at the initial stage from thirty percent of the cost of housing.

- Participants in the Romulus project can receive a loan in national currency. The remuneration rate with official confirmation of income is nine percent. The down payment, subject to proven solvency, is set at five percent.

Requirements of banks for borrowers

First of all, you should pay attention to the requirements that the bank puts forward for its borrowers. Of course, each lender can set its own parameters, but initially it is necessary to focus on the basic ones, which are used in most banks of the Republic of Kazakhstan.

Namely:

- The borrower must be a citizen of Kazakhstan;

- If the client is a citizen of another country, then he must confirm the fact of permanent residence in the Republic of Kazakhstan and obtain a residence permit ;

- The ideal borrower must be at least 21 years old , but at the same time no older than 48. In certain cases, the client may be older, but a prerequisite is to make the final mortgage payment before retirement age. If the borrower is under 21 years of age, then his parents are involved in the mortgage as guarantors or co-borrowers;

- At least 6 months of work at your last place of employment;

- The client must have sufficient income. The salary of an ideal borrower should be at least 100,000-150,000 tenge per month ;

- Positive credit history.

Note! Different banks may set different age thresholds. In addition, the client’s earnings may be less, depending on the loan term and loan amount. The main thing is that you can make monthly payments without significant damage to your budget.

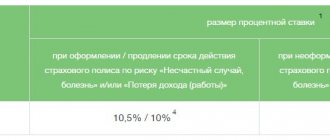

Interest rate

The information presented above allows us to draw a conclusion about the possible difference in interest rates depending on the source of financing of the loan being issued. The logic is simple: if the rate is subsidized by a non-bank source, then it will be minimal for the borrower.

For example, under the regional development program the following mortgage interest rates apply:

- 7.5% per annum – if funding is provided from the budget;

- 9.5 – 10% per annum – when financed by the bank.

It is important to understand that only a borrower in dire need of housing who has documentary evidence of being placed on the waiting list can receive the minimum rate.

Under the Astana Zhastary program, a fixed rate of 5% per annum will be established for the entire loan term. And for mortgages for the military, the rate will be announced at the stage of approval of the application, since the issue of financing state support may take some time.

Conditions for obtaining a mortgage

Credit institutions set their own conditions for participating in mortgage lending.

However, a potential borrower must immediately pay attention to the following points:

- Currency in which you can take out a loan;

- Cost and existing types of commission;

- Repayment method;

- Options for purchased real estate;

- Interest rate.

Currency

In 2020, credit institutions in Kazakhstan are not very willing to issue mortgages and large loans in tenge. However, despite this, some banks still support the national currency, although the terms of such lending will not be very favorable for the borrower.

Basically, you can take out a mortgage in the following currencies:

- Tenge;

- Euro;

- Dollars.

Recommended viewing:

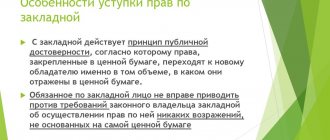

Commission

Different lenders may support different types of fees. At the same time, their cost will be different, depending on the type and the lender.

There can be three of them in total:

- For acceptance and consideration of the application;

- For obtaining a mortgage;

- For issuing a mortgage.

Note! More often than not, lenders support two of the three types of fees listed above.

Overpayment and early repayment

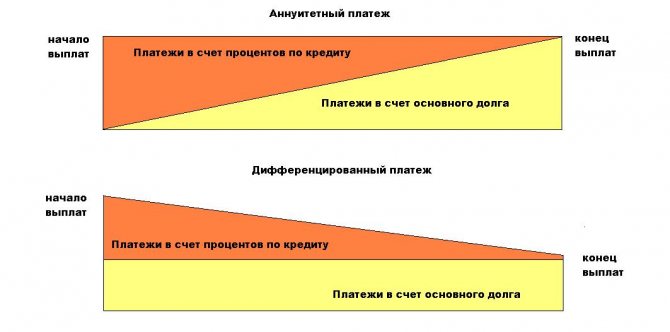

In a Kazakh bank, you can choose either an annuity or a differentiated payment method.

The first option provides that the borrower makes monthly payments, the amount of which does not change throughout the entire loan term. Differentiated payment provides for payment of the mortgage in equal shares.

How to get a mortgage for your primary home

If we take the results of 8 months of the current year, the leader in issuing mortgages, Zhilstroysberbank, then the share of primary lending is significant - 38% of loans were issued for the purchase of housing on the primary market and 58% for the purchase of real estate on the secondary market. This share was largely ensured by the bank’s implementation of government programs.

You can take out a mortgage for housing under construction

A bank loan for the purchase of an apartment can be obtained at the construction stage, but this is only if the construction company has a guarantee from the Housing Guarantee Fund (HGF), which is a subsidiary of the Baiterek holding.

The scheme is as follows: the developer receives guarantees from the Housing Property Fund and enters into an agreement with Housing Construction Savings Bank, which will allow its investors to buy cheaper apartments during the construction phase without any additional collateral. It is enough to have a down payment of 30% of the cost of housing.

The important thing is that there are no restrictions for citizens to purchase an apartment within the project. Unlike state programs, there are no conditions regarding the lack of housing and permanent registration.

However, there are still few facilities that have received a guarantee from the Fund and they are concentrated only in a few cities, such as Nur-Sultan, Almaty, Shymkent. This is due to the fact that obtaining a guarantee from the Guarantee Fund implies great requirements for developers, namely: work experience must be at least 3 years, results of completed housing space, break-even activity for the last two financial years. Therefore, shareholders who will buy apartments from developers who have received a guarantee from the Housing Property Fund will be protected from non-completion of construction.

Documents for a mortgage for primary housing

If a developer cooperates with a bank, then, as a rule, the mortgage managers who will handle the transaction have already provided the bank with a package of documents. Among them, the most often required:

— all title documents (commissioning certificate and others);

— LLP decision to sell the apartment;

— a letter from the developer about the readiness to sell the property;

— details for transfer;

— director’s identity card;

- cadastral certificate for an apartment or house.

The buyer also provides:

— originals and copies of identity cards of the borrower (co-borrower, guarantor) and spouses;

— address certificates of the borrower/co-borrower(s)/guarantor and spouses;

— original and copy of the marriage certificate of the borrower (co-borrower, guarantor);

— a certificate of salary of the borrower (co-borrower, guarantor) indicating all deductions provided for by the legislation of the Republic of Kazakhstan;

— If the client is an individual entrepreneur, then he must provide a certificate of state registration or a corresponding notification from the tax authority, a patent/tax report for the last 12 months, a declaration (form 910, 911, 200, 220, 240), and a certificate of absence of debt.

The most profitable mortgage programs for “primary”

Housing Construction Savings Bank programs

Today, mortgages from Housing Construction Savings Bank remain the most profitable and in demand. Over 50% of loans issued to Kazakhstanis for the purchase of housing are provided by HCSBK through the housing construction savings system. The share of loans from this bank from the country’s mortgage portfolio at the end of 2020 was already 51.4%, compared to 42.4% a year earlier.

Within the framework of “Nurly Zher”, loans at a rate of 5% per annum can be obtained if there is 20% of the cost of housing in the HCSBK account. These are preferential conditions for participants in state programs.

To purchase housing outside of state programs and the bank’s own program “Your Home,” the investor must accumulate 50% of the cost of housing for at least 3 years in order to receive a loan at a rate of 5%.

Calculation of the cost of purchasing an apartment using a housing loan

| Apartment cost | 10 000 000 |

| Monthly contribution during the accumulation period | 150 000 |

| Savings for 3 years, taking into account the state bonus and bank remuneration | 5 858 384 |

| Monthly payment for the next 6 years at 5% per annum | 66 700 |

| Overpayment | 660 784 |

"7-20-25." The terms of participation

The object of lending is primary housing.

The interest rate is 7%.

Down payment - from 20%.

The loan repayment period has been increased to 25 years.

There are no commissions.

Housing should not cost more than 25 million tenge for the cities of Astana, Almaty, Aktau, Atyrau, 15 million tenge for other regions.

The participant must not own housing, with the exception of rooms in dormitories with a usable area of less than 15 square meters for each family member; residential buildings are in disrepair.

Calculation of housing costs using the “7-20-25” program

| Apartments in the city Astana, Almaty, Aktau and Atyrau | Monthly fee, in tenge (with a loan term of 25 years) |

| 1-room (from 37 sq.m.) | 37 317 |

| 2-room (from 50 sq.m) | 50 888 |

| 3-room (from 65 sq.m) | 66 154 |

| Apartments in other regions | Monthly fee, in tenge (with a loan term of 25 years) |

| 1-room (from 37 sq.m.) | 29 400 |

| 2-room (from 50 sq.m) | 39 579 |

| 3-room (from 65 sq.m) | 51 453 |

According to the press service of the IO “Baspana”, as of the beginning of September, 10,306 loan applications were approved under the “7-20-25” program.

To date, loans under this program are issued by 8 banks: Bank CenterCredit, Sberbank, Halyk Bank, ATFBank, Jýsan bank, Bank RBK, Eurasian Bank and ForteBank.

The terms of participation

Potential program participants often have difficulties with official confirmation of income. The minimum income must cover the monthly loan payment, expenses for dependents, essential goods, utilities, transport, communications and other obligatory payments available to the borrower. When buying an apartment for 10 million, it is enough to officially confirm a monthly income of 120 thousand tenge. You can attract a co-borrower.

A “Prequalification” project was launched for potential program participants. The service allows any Kazakhstani to assess online their ability to obtain a loan under the “7-20-25” program and significantly reduce the time it takes to obtain a loan from a bank.

"Baspana Hit"

This is a market-based residential mortgage lending program. Citizens who have housing can participate in it. You can purchase both primary and secondary housing. Since the purchased housing is accepted as collateral, it must meet the requirements for collateral established by the internal documents of the participating bank. That is, the bank independently determines the requirements for collateral based on the principle of its liquidity.

A limit on the cost of housing has been determined: for Astana, Almaty, Aktau and Atyrau - 25 million tenge, for the regions - 15 million tenge.

According to the monitoring of the kn.kz portal, the call centers of 6 banks respond to their readiness to lend under the Baspana Hit program: Bank RBK, Bank CenterCredit, Sberbank, ATFBank, Halyk Bank, Tsesnabank.

The terms of participation

The object of lending is primary and secondary housing.

Down payment - from 20% of the cost of housing.

Annual rate - base rate of the National Bank + 1.75%. Considering that it is now 9.25%, the rate on the Baspana product is 11%.

The loan term is up to 15 years.

Calculation of the monthly payment under the “Baspana Hit” program when making a down payment of 20% for 15 years

| With an object price of 10 million | With an object price of 15 million | With an object price of 20 million | With an object price of 25 million |

| 90 900 | 136 400 | 181 900 | 227 300 |

| Overpayment | Overpayment | Overpayment | Overpayment |

| 8 366 700 | 12 551 000 | 16 734 000 | 20 916 000 |

Managers emphasize that the borrower’s income must be at least 60,000 tenge. But its exact size depends on the cost of housing. For example, when purchasing an apartment worth 10 million tenge, the official income of the borrower must be at least 180,000 tenge. You can attract a co-borrower.

Banks in this program have the right to charge commissions approved by the National Bank.

"Horde"

Mortgage "Horde" has also recently appeared on the mortgage market. The program is designed for the purchase of housing in the expensive segment - up to 65 million tenge.

This product is a loan from the Kazakhstan Mortgage Company to individuals for the purchase of apartments through partner banks. According to the press service of the KMC, currently the following financial institutions are the partners of IO Kazakhstan Mortgage JSC: Bank JSC, First Heartland Jýsan Bank JSC, Eurasian Bank JSC, BI Finance Mortgage Center.

The terms of participation

The object of lending is real estate on the primary and secondary housing market for all Kazakhstanis, regardless of whether they own housing.

The mortgage loan rate is 12% per annum with full confirmation of solvency, and 14% per annum with partial confirmation.

Down payment - from 30% of the cost of housing with full confirmation of income and from 50% with partial confirmation. The contribution can be replaced by collateral in the form of real estate.

Loan amount - 1 to 40 million tenge, for loans in the cities of Nur-Sultan and Almaty - up to 65,000,000 tenge.

The loan term is up to 20 years.

Any citizen of Kazakhstan over the age of 21 can become a borrower. At the time of loan repayment, the age of the borrower or co-borrower must not exceed retirement age.

Calculation of the monthly payment under the “Horda” program when making a down payment of 30% for 20 years

| With an object price of 10 million | With an object price of 15 million | With an object price of 20 million | With an object price of 25 million |

| 77 100 | 115 600 | 154 200 | 192 700 |

| Overpayment | Overpayment | Overpayment | Overpayment |

| 11 498 000 | 17 247 000 | 22 996 000 | 28 746 000 |

Mortgage without state participation

To complete the picture, it is worth noting that with the development of state mortgage lending programs, standard mortgage programs from banks become irrelevant for citizens. High interest rates, increased borrower income requirements and large fees make commercial mortgages uncompetitive. One way or another, mortgage programs with state participation satisfy the needs of all categories of potential borrowers, regardless of the availability of housing, the choice of primary or secondary markets. All that remains is to choose a program that suits the borrower’s needs.

The only advantage of banks’ own programs is the cost of housing, which can be high and limited only by the borrower’s income.

Options for purchased real estate

In Kazakhstan, a borrower can take out a mortgage either for housing or for land. Along with this, a foreigner permanently residing in the Republic has rights to the same types of real estate as a citizen.

However, if you want to purchase a plot of land, then there will be more difficulties.

For foreigners, stateless people or non-state legal entities, you can take out a mortgage on a land plot only for the following purposes:

- To develop a site with industrial or non-industrial (residential, including) buildings;

- To maintain structures in accordance with their purpose.

This is indicated in Article 23 of the Land Code of the Republic of Kazakhstan. Also, it states that foreigners, stateless people and non-state legal entities do not have the right to purchase land for agricultural and forestry activities. Such plots can only be obtained on lease, and even then only for 10 years. The latter is stipulated in Article 10 of the Land Code of the Republic of Kazakhstan.

Note! Based on the above, it is assumed that a foreigner can purchase an apartment, a house and a plot of land to build a house on a mortgage. But for citizens of the Republic of Kazakhstan there are no such restrictions.

At the same time, some banks require that the borrower buy real estate in the region where they are located. That is, if the lender is located in Petropavlovsk, then you will no longer be able to move to Almaty.

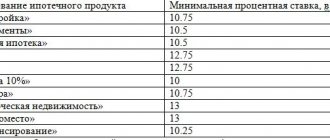

Banks and mortgage interest rates

To better understand how profitable a mortgage in Kazakhstan is, you need to familiarize yourself with the offers of the most popular credit institutions in the Republic of Kazakhstan. Also, it is worth finding out which banks set acceptable interest rates, what additional conditions they impose and how they differ from other lenders.

| Bank | Loan terms | Interest rate (% per annum) | Down payment (% of the loan amount) | Peculiarities |

| Sberbank | 10 years | From 14.6% | 30% | Sberbank mortgage offers low interest rates and government programs for beneficiaries. The Young Family program is supported. |

| Altyn Bank | 10 years | 18% | 40% | Low commission cost. For participants in the salary project, the rate is reduced by 1%. |

| CenterCredit | 10 years | From 16.5% | 30% | You can take out a mortgage without proof of income. |

| People's Bank of Kazakhstan | 30 years | From 17.5% | 20% | The longest loan term and low down payment cost. |

| RBK | 10 years | From 19% | From 30% | Opportunity to take out a loan for a very large amount. |

| Qazaq | 15 years | From 19% | From 20% | A loan for a small amount is possible. |

| ForteBank | 10-15 years | From 21.49% | From 15% | Low down payment cost. |

| Tsesnabank | 10 years | From 20.5% | From 40% | Possibility of lending without a down payment. |

| Eurasian Bank | Up to 20 years | From 12.5% | From 30% | Possibility of lending without a down payment. |

| Alfa Bank | 10 years | 23% | From 30% | Possibility of lending without a down payment. |

Note! However, the most profitable mortgage is the offer from Housing Construction Savings Bank. Housing Construction Savings Bank of Kazakhstan allows you to take out a mortgage without a down payment. This is the best option if you already have 50% of the cost of the selected property. You will have to pay 150,000 tenge monthly if the property costs 12 million. Along with this, the loan term will be short - you will be able to pay off the mortgage in just 3 years.

Is it possible to get a mortgage without a down payment to HCSB?

Housing Construction Savings Bank of Kazakhstan is the only bank in the country engaged in the implementation of a system of housing construction savings. The essence of such a system is to attract funds from the population into housing construction deposits and issue preferential mortgage loans with a zero down payment.

That is, the client opens a special deposit in the bank intended for the purchase of housing in the future. By concluding an agreement on housing construction savings (HCS), the investor undertakes to make monthly contributions to his account. The minimum amount accumulated on the deposit will be used to pay part of the cost of the purchased property, and the remaining part will be issued to the borrower in the form of a mortgage loan on preferential terms.

The benefit here is obvious: the client receives not only the interest accrued on the accumulated funds, but also an automatic guarantee of the issuance of a mortgage in the near future. The minimum accumulation period is 3 years. To apply for a mortgage, you must accumulate at least 30% of the property price in your account.

Each client is assigned certain evaluation points, depending on the amount of accumulated funds, his financial reputation and other indicators. The final parameters of the mortgage (interest rate, amount and term) will depend on the score received. The higher this score, the more profitable it will be to get a loan to purchase a home.

Obtaining a housing loan today is only possible using the housing insurance system. In other cases, you will need to contribute at least 30-50% of the cost of housing from your own savings.

Procedure for obtaining a mortgage

When applying for a mortgage loan, you will need to take the following steps:

- Apply;

- Attach to it your passport, a certificate of your place of residence, salary and a certificate from the Pension Fund;

- Wait until the application is reviewed and your documents are checked;

- Next, the cost of payments is calculated;

- Take certified copies of documents for the apartment from the seller and provide them to the bank;

- After verification, give the seller a letter from the lender;

- Conclusion of purchase and sale agreements and mortgages;

- Making a down payment;

- Receiving a loan and transferring money to the seller.

Mortgages in Kazakhstan are not too different from those in Russia. You can become a borrower even without being a citizen of the Republic of Kazakhstan, the only main thing is that you permanently reside in this country. Any payment method and type of mortgage are available to you. Regarding contributions, to calculate their cost you can use the calculator located directly on the bank’s website.

Maximum amount and what income is needed

For a mortgage without a down payment, the maximum value of loan funds issued by the bank cannot exceed 45 million tenge. This figure is not a final value, since it can be increased by attracting a co-borrower/co-borrowers.

Important! Co-borrowers are subject to exactly the same requirements as the borrower in terms of solvency, employment and other parameters. The co-borrower bears joint liability together with the borrower for the proper fulfillment of loan obligations.

As for the required income, you can determine its minimum during a consultation with a bank employee or by using a mortgage calculator on the bank’s website, when the system determines the approximate monthly payment.