A military mortgage is an excellent opportunity to improve living conditions for all military personnel. But you have to pay for this with even greater attachment to the army, because after connecting to the NIS system, you won’t be able to just leave. So, for example, with less than ten years of experience, almost any dismissal automatically leads to the loss of all savings . There is only one exception - death or missingness. Therefore, before applying for a military mortgage, it makes sense to study in detail the consequences of dismissal and ways to preserve savings. This is why we created this article - it covers the subject of discussion from all sides, with nuances and legal details.

Features of a military mortgage

The government and military departments are actively encouraging healthy young men to enlist. A solution to the housing issue is often cited as one of the arguments: special mortgage programs, preferential interest rates and even a savings system have been developed, where money earned by the military during their service is accumulated and increased. All of the above opportunities are actively used by all contract military personnel.

But these same circumstances prevent many military personnel from resigning at will. Indeed, in this case, it is at least unclear what will happen to the property acquired for the service. What if it will be taken away or the terms of the loan will change dramatically?

First, a short educational program on this topic. A military mortgage refers to a targeted loan in which the debt for purchased real estate is repaid not by the serviceman himself, but by the Ministry of Defense. It happens like this: every year an amount is subsidized into a special account in accordance with the military mortgage program (MMP), which can and should then be spent as initial and subsequent mortgage payments. The amount is sent by a special organization “Rosvoenipoteka”.

The maximum amount is up to 3 million rubles for the entire period of service. In 2020, 280,009.7 rubles are transferred to the savings account per year, and 23,334 rubles are transferred every month.

You can get a military mortgage for almost all categories of housing, including the secondary market and new buildings. It is only prohibited to take dilapidated houses with a wear percentage above 60%, panel-type houses and houses with communal services. Any contract soldier whose age is in the range of 22-45 years can get a military mortgage.

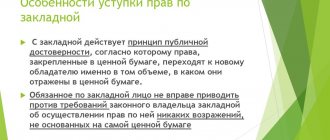

The savings-mortgage system (NIS) has a number of features that a serviceman needs to take into account even before he leaves the Russian military forces. These features, for example, contain the answer to the question of how to withdraw money upon dismissal. The list of these features includes:

- Connection to the NIS program can only be done if the contract with the RF Armed Forces was signed no earlier than 2005;

- At least three years of participation in the program and parallel service must pass before the military can use the money to purchase real estate;

- The amount contributed by military personnel is subject to the right of tax deduction. That is, of all taxes previously paid to the state (13% personal income tax), you can get back 260,000 rubles from the purchase of housing;

- Having a bad credit history is not at all an obstacle to getting a loan. Almost all banks in Russia understand perfectly well that the serviceman himself may not be a completely responsible person, but Rosvoenipoteka, which stands behind him, is a completely different story;

- It should be taken into account that most loan agreements for military mortgages include the right to change the terms of the loan upon dismissal of the borrower . This means that the interest rate may increase, then returning the previous rate will either be impossible or difficult to achieve through legal disputes;

- 10 years of service is a kind of milestone for a military man. If the milestone is passed, even after the death of the borrower as a result of the performance of professional duties, the state will continue to pay the mortgage until the loan is fully repaid. If the required length of service was not obtained, upon the death of a serviceman, the burden of securing the loan falls on the co-borrowers and the family of the deceased.

This is only a small, but the main part of the features of this type of mortgage lending. Now let's look at what happens to the mortgage after certain events - dismissal, for example, or illness.

PROFESSIONALS WILL HELP YOU WEIGH ALL THE PROS AND CONS

The conditions of a military mortgage in the event of resignation do not change; simply, depending on its reasons and length of service, either the former NIS participant himself or the state will pay the money to the bank. The same factors determine whether you will have to return the CZH amount.

This is important to know: Housing subsidies for military personnel in 2020

There are many nuances, if you still have questions, contact our consultants - we will help you sort out possible risks, choose a mortgage with favorable conditions and decide on housing in St. Petersburg and the Leningrad region.

What happens to the mortgage after service ends?

It must be taken into account that preserving all savings is possible only with preferential dismissal. It occurs under the following circumstances:

- 20 or more years of service;

- If the continuous service has reached or exceeded 10 years, preferential dismissal is possible upon reaching the maximum age for the RF Armed Forces, upon dismissal as a result of organizational and staffing measures (OSM), as well as for family reasons;

- For health reasons, but only if the experience is more than 10 years. This refers to illnesses that make service impossible;

- Death of a military man or receiving the status of missing in action.

In some cases, a contract employee receives not only the opportunity to freely dismiss, but also the right to additional employment. military mortgage payments upon dismissal. For example, upon reaching 10 or more years of service, a serviceman receives compensation for all years missing up to 20 years of service - but only if the dismissal occurs for good reasons.

If we talk about the future fate of savings schematically, then we can divide the preservation of funds according to the main criterion - whether the money was spent before dismissal or whether the contract worker had not yet managed to invest it in real estate. It is also very important whether the serviceman retired on preferential terms or not. Let's present this data in the form of a table:

| Length of service | Was the money used? | The right to dispose of property and the future fate of the mortgage |

| Less than 10 years | The contractor managed to invest money in real estate before being fired | All monies already paid by the state for the mortgage will have to be reimbursed within ten years from the date of dismissal. The remaining debt to the bank must be repaid yourself |

| From 10 to 20 years | Everything is preserved - both savings and a preferential interest rate. But the remaining debt to the bank will have to be repaid without government help. The right to additional payments appears to compensate for the missing years of service up to 20 years | |

| 20 years or more | There is no need to return anything. Savings can only be used for the intended purpose, i.e. to pay off debt to the bank. If they are not enough, the balance remains with the borrower. The mortgage ceases to be military, so the interest rate may change. | |

| Less than 10 years | The contract worker did not have time to use up his savings | All savings of the NIS participant are confiscated |

| From 10 to 20 years | All money received under the program can be spent on purchasing housing or for other purposes, but only with preferential dismissal. In this case, he will also have the right to additional payments to compensate for the missing years of service up to 20 years. If the dismissal did not occur on preferential grounds, all savings are burned. | |

| 20 years or more | You can use it as you wish - either for real estate, or simply withdraw it by submitting a report and then spend it on any purpose |

Based on the information received, we can conclude: loyal conditions for a military mortgage remain in case of dismissal for health reasons, but if the dismissal occurred due to a loss of trust or with any violation of contract obligations, without 10 years of service you can not even think about receiving the money from NIS. And 10 years of service only saves you if the contract soldier has managed to invest money in housing.

In what cases will savings not be paid?

As already explained above, in the event of dismissal from the army of a contract soldier with less than 10 years of service (under any heading - “positive” or “negative”, unless he is declared unfit for military service), all of his individual personal information “burns out”. If, during his service, such a contract soldier managed to use these funds to purchase housing, then after the end of his service he needs to fully return them to the state. However, in addition to this category of military personnel, personal income tax is also not paid:

- contract soldiers with 10 to 20 years of service who are dismissed from the ranks of the RF Armed Forces, albeit under a “positive” clause, but not for a preferential reason (for example, on the basis of their own desire to interrupt the current one or unwillingness to sign another contract with the Ministry of Defense);

- military personnel with any length of service who are discharged from the army under a “negative” article (for example, for malicious failure to fulfill the terms of a military contract or for a crime for which the serviceman is convicted in court).

However, some categories of retired military personnel who were at one time dismissed from the ranks of the RF Armed Forces and lost their IPN still have a chance to return this money.

Thus, according to the amendments to Federal Law No. 117 adopted in 2020, mortgage savings are restored in full to those military personnel who were once dismissed from military service under a “positive” article and return to serve in the army with a new contract.

For what reason can savings be withdrawn? Will the mortgaged apartment be taken away?

It is now obvious that a situation is possible when all honestly earned savings are canceled due to one, but serious mistake. This happens when dismissal occurs for the following reasons:

- Repeated non-compliance or outright violation of the terms of the contract. It is also possible to fail to comply only once, but then it must concern an extremely important issue - for example, the preservation of military secrets;

- A military mortgage after voluntary dismissal simply expires if the service is less than 20 years;

- Even if the dismissal occurs on preferential grounds, if the length of service is less than 10, the savings are burned out;

- In the absence of serious (preferential) grounds, an NIS participant loses capital if his experience is less than 20 years.

Thus, without financial losses, you can resign of your own free will only after 20 years of service, if there are no preferential grounds. This is an axiom that every NIS participant needs to learn.

In all four cases, the dismissed person will have to not only repay the remaining mortgage debt along with interest, but also return to Rosvoenipoteka all the money paid towards the apartment. This includes, for example, the down payment, monthly payments and bank fees.

The period during which you need to repay the debt to the state is only 10 years from the date of leaving the RF Armed Forces. In order to mitigate the situation, a flexible payment schedule is being drawn up. If desired, the return period can range from three months to ten years.

What happens if you don’t repay the debt after you quit? Real estate will not be taken away if the debt is repaid on a regular basis. But if you ignore bank requirements, then the bank can always seize the property to pay off the debt, because The apartment is encumbered (pledged) by the bank.

As for ignoring the debt to the state, it is possible to begin enforcement proceedings. A lawsuit will come from Rosvoenipoteka, and the former military man will have to appear. In court, it is almost guaranteed that the debt will be assigned to the violator of contractual obligations. From the moment the writ of execution is opened, the lion's share of income, transfers to cards and accounts of the debtor will be seized, and part of the property may be sold to secure the debt.

Considering all the burden and unpleasant consequences of such an outcome, it is still better to pay off the debt. In addition, often both the bank and Rosvoenipoteka agree to meet halfway - often the debtor is given debt restructuring and even short credit holidays.

Negative option for exiting NIS

All money received by the military from the state budget is returned to the state with interest.

The debt is accrued from the moment the part that went into reserve is removed from the lists. Its size consists of the amount of the targeted housing loan and Rosvoenipoteka contributions.

Here's an example: Alexander bought a studio apartment in St. Petersburg worth 2.8 million rubles. The initial payment in the amount of one million was paid from the CZHZ fund. The rest of the debt was taken out on credit at 12% per annum. For three years, Rosvoenipoteka transferred funds to repay it: 21,678 x 36 = 708,408 rubles.

After voluntary dismissal, the debt due to leaving NIS is 1,708,408 rubles. Alexander now pays the mortgage in the amount of the remaining debt (1.7 million rubles) himself. Of the entire amount allocated as part of state support, pennies were spent on repaying the body of the loan - the lion's share was transferred to pay interest to the bank.

See the same topic: Loan for building a house for young and large families in [y] year

Alexander’s total debt at the time of his retirement was RUB 3,408,408. The debt to the bank is repaid under the terms of the same mortgage agreement: RUB 21,678/month. The debt of Rosvoenipoteka will be signed for 10 years at the Central Bank refinancing rate (9%) - 19,500 rubles per month. Every month, Alexander will have to pay a total of 40 thousand rubles. per month for 10 years. He is thinking about leaving the apartment to the bank.

Military mortgage upon dismissal at the end of the contract

Okay, we have already figured out what happens to savings on a military mortgage when you leave due to illness, at your own request, and in other cases. But is the end of the contract considered sufficient grounds for preferential dismissal?

The conditions in this case are quite strict. If the length of service is less than 20 years, the end of the contract is not considered a valid reason for leaving the Armed Forces. Accordingly, in this case:

- The life insurance certificate is fully returned to the state within 10 years from the date of leaving the army;

- All monthly payments transferred by the state are also returned within 10 years;

- Capital in NIS that is not invested in housing is burned;

- The military is not entitled to additional payments for missing years;

- The encumbrance is removed from the property only after the debt is fully repaid.

If the borrower has not repaid the debts

If a program participant has stopped making payments on a housing loan, Rosvoenipotetka can forcefully sell the collateralized living space through the court.

After the sale of real estate, the money is distributed as follows:

- Repayment of mortgage obligations;

- Payment of expenses for the sale of housing;

- Legal costs;

- Client's personal account (fund balance).

If the money received for the apartment is not enough to cover all the costs, the borrower ends up on the bank’s list of debtors. Repayment of the mortgage also occurs in the manner prescribed by law.

It is not uncommon for military personnel to decide to enter into another contract after dismissal. If there is a state mortgage support program for the military in the region, the applicant can be registered again on the basis of a new contract.

If the dismissal was due to health reasons, general medical conditions or family circumstances, then the restoration of the contribution calculation schedule will occur automatically. During the period that the program participant did not serve in the army, Rosvoenipoteka does not pay the housing loan. The funds that the borrower accumulated before dismissal are used to eliminate mortgage debts. The balance of savings is also taken into account in the updated personal account.

If a serviceman leaves for the reserve at his own request or due to a violation of contractual obligations, the resources accumulated in the NIS are not returned. After the next registration, they go to compensate the debt to the lender (if the mortgage agreement has already been drawn up). Debts of this type are not compensated using budgetary funds.

The procedure for paying off a mortgage after dismissal

- First you need to get a dismissal order;

- After receiving it, the serviceman must submit a report to the military unit. The report must state a request to release the entire or a certain amount from the personal account;

- Next, the report, along with documents from the military unit, is transferred to the Rosvoenipoteka branch;

- A response will be given within one month, after which the contract employee will be able to arrange a transfer from a savings account to a bank account;

- Here, in addition to the accumulated amount, additional/compensation money is also paid, if any is due to the serviceman under the terms of the contract.

That's all. There is money in the account that you can use at your discretion with almost no restrictions.

Savings and mortgage system for military personnel: brief description

Purchasing living space requires investment. Not all individuals who need their own housing have the funds to finance such a purchase.

Applying for a bank mortgage often becomes the most affordable solution to this issue. A military serviceman can take out a targeted housing loan through the savings-mortgage system (NIS) according to Law No. 117-FZ of August 20, 2004.

The NIS program allows a citizen undergoing military service under a contract to purchase housing by taking out a mortgage loan. Categories of military personnel - officers, warrant officers, holders of other ranks - who have the opportunity to use the NIS are stipulated by paragraph 1 of Article 9 of Law No. 117-FZ.

Each serviceman who has expressed a desire to join NIS is given a special account. This account has a specific purpose - certain amounts are regularly credited to it. They are accumulated for the purchase of living space for a military personnel - the holder of a special account.

Participation of a military personnel in the NIS implies the following actions:

- A serviceman joins the NIS by entering the register. He becomes a member of NIS.

- After a minimum of 3 (three) years, a participant in this system can obtain a military mortgage. This right is established by paragraph 1 of Article 14 of Law No. 117-FZ. For this purpose, he applies to a financial institution (bank) authorized to issue such loans.

- The authorized creditor bank opens a personal special account for the applicant, through which target funds are accumulated.

- Repayment of a mortgage loan is carried out by regular transfer by the creditor bank of amounts received into the borrower’s special account within the NIS.

A targeted housing loan provided to a military personnel is paid by an authorized government agency (clause 1 of Article 15 of Law No. 117-FZ). As a rule, a military mortgage will be fully paid off when the citizen-borrower reaches 45 years of age, that is, retires.

Expert opinion

Davydov Dmitry Stanislavovich

Deputy Head of the Military Commissariat

But what about repaying a targeted housing loan if a serviceman is discharged early? Further development of the situation depends on the reason for the borrower leaving the army.

What do they write on the forums?

Forum reviews often help in choosing a bank or program, but they can also cause harm with their negative meaning or confuse them if they are written by an incompetent person.

At any forum you can discuss the legislative framework, changes and functioning of the savings-mortgage system.

Questions are sorted by region and topic.

For example, you can find out about the features of the program in a certain city from different banks or what new buildings are recommended to be considered.

Very often there are questions that can easily be answered on the Internet or in legislation, but I would like to hear the opinions of direct participants.

Military personnel are interested in whether it is possible to purchase an apartment with a mortgage if they already have their own home, and other users answer (in the affirmative), confirming with their own example and stories.

Video on the topic:

Narrower issues include discussions of a program for certain categories of military personnel or the combination of different mortgage programs.

Reviews on the forums are very different, and clients are divided into both satisfied ones who used the program successfully and dissatisfied ones who do not recommend a military mortgage to anyone or consider it a trick of the banks.

Advantages of purchasing housing through this program

This method of acquiring living space is very tempting for many military personnel.

The main advantages of a military mortgage for military personnel:

- The opportunity to purchase housing comes after 3 years of service, regardless of the rank of the serviceman.

- The opportunity to purchase living space not only in a new house under construction, but also in the secondary housing market, as well as in the private sector. But in this case, you need to be extremely careful when registering due to the large share of fraud in the real estate industry.

- Possibility of selling an apartment at any time, subject to certain conditions.

- Possibility of purchasing joint housing if both spouses serve in the ranks of the Russian Armed Forces.

- If a serviceman already owns real estate, this does not in any way affect the possibility of obtaining housing under the mortgage program.

- Housing can be purchased in any region of the Russian Federation, regardless of where the serviceman is serving.

Find out: Which military personnel are entitled to leave for family reasons

Ways to defraud military personnel about mortgages

So, is a military mortgage a scam? Everything is the same as when applying for a standard mortgage loan for civilians.

It is aggravated by the fact that civilians are in no way limited in time when preparing documents - with the exception, of course, of the validity period of certain certificates, but in the end, no one forbids them to go and get a new one - but for the military, literally every minute counts .

If you delay for a day, it may not be enough, and the certificate will expire. So they literally grab the first option they like, hoping for chance. Meanwhile, this is fraught with the following :

- the transaction was executed by an unauthorized person - for example, someone who does not have not only the position of a notary, but even a legal education;

- sale of an apartment using forged documents;

- they demonstrate one area and end up selling another;

- sale on behalf of deceased owners;

- the apartment turns out to be not “clean” - for example, one far from wonderful day the previous tenant returns from a place not so distant.