What is the down payment amount?

Until the 2008 crisis, mortgage clients of banks could count on receiving a home loan without a down payment. After economic instability, it turned out that most borrowers who could not meet financial obligations took out a mortgage without a down payment. Based on this fact, many large Russian banks abandoned mortgage loan programs without a down payment.

The amount of the down payment is determined by the cost of the purchased home. The down payment, in essence, is a payment for part of the total price of the purchased property. These funds are deposited into the bank's cash desk during the mortgage process. The remaining amount is issued to the borrower as a loan for the purchase of real estate. The mortgage client of the bank undertakes to repay these funds throughout the life of the loan in accordance with the established payment schedule.

Today, leading banks offer their clients mortgage lending with a down payment of 10-30% of the value of the mortgaged property. Experts believe that the best option for the client and the lender is an amount of 30% of the apartment price. Loans with a down payment below 10% are rarely issued, since in this case the bank does not receive sufficient guarantees for the client’s continued solvency. Interestingly, if the down payment exceeds 50%, credit institutions are also reluctant to cooperate, since interest can only be charged on the remaining loan amount. Accordingly, the bank’s income in this case is significantly reduced in comparison with options when the first mortgage payment on an apartment is 20-30%.

Down payment functions

Non-targeted consumer loans are issued without a down payment. In this regard, many borrowers have questions about why a down payment is needed when applying for a mortgage. There are several answers to this question.

The down payment has the following impact on the loan program:

- Changes the amount of the mortgage loan - the larger the down payment, the lower the loan amount that the client will have to pay over the life of the mortgage. Accordingly, the overpayment decreases proportionally as the down payment increases;

- Affects the interest rate - most credit institutions are ready to reduce the interest rate as the amount of the down payment on the loan increases;

- Reduces insurance costs - due to the fact that when applying for a mortgage, the borrower will have to take out insurance for real estate, and sometimes for life, health and title of the home, the level of insurance costs should be taken into account. The amount of insurance depends on the loan amount. The larger the down payment, the lower the remaining amount of the debt and the lower the insurance payment on it.

- Confirms the client’s reliability – the presence of a certain amount of money in the form of one’s own personal savings acts as confirmation of the client’s solvency for the bank. Accordingly, if the borrower has the opportunity to contribute 30% of the cost of the purchased property, the likelihood of approval of the application for approval of a mortgage loan increases significantly.

- Provides an opportunity to get a loan for clients with a bad credit history - in some cases, if the borrower is willing to pay most of the cost of housing in the form of a down payment, the bank may turn a blind eye to some negative aspects of the credit history. This point is at the discretion of the lender.

In connection with the above, before purchasing a home with a mortgage, experts recommend thinking about accumulating a certain amount of funds.

Construction mortgage

Among other things, the bank makes it possible to obtain a loan for the construction of residential real estate. Is a down payment required for a mortgage from Sberbank to build a house? The contribution is necessary in any case, especially when the collateral property does not yet exist and cannot act as security. In this situation, the loan amount is calculated based on the cost of work and materials agreed with the developer company. Additionally, you must provide a construction plan and construction estimate.

The contribution is 25% of the construction cost. Loan funds are issued in several stages, after a report on the expenditure of the previous batch. The interest rate is also slightly higher than under normal conditions for purchasing housing, and amounts to 12.25% per annum.

Where can I get the down payment?

- Personal savings . Quite often, a person hesitates for a long time to apply for a mortgage, trying to save up for his own home on his own. If this fails over a period of time, a certain amount of cash accumulates, which can be used as a down payment on a mortgage. This option is suitable for those borrowers who have a certain amount of money that is insufficient to pay the full cost of the property. To make it easier for the borrower to accumulate the required amount, some banks offer special mortgage deposits.

- Sale of existing real estate . If a person already has an apartment or house, but wants to improve his living conditions, he can sell his old property and make a down payment on a mortgage for a new home. Such transactions in the Russian credit market are called alternative. This option is also very beneficial for those who have commercial real estate that has no use.

- Applying for a consumer loan . Sometimes, not having his own funds to make a down payment on a loan, the borrower decides to take this money from a bank or microfinance organization. Experts in the field of lending consider this decision to be extremely unfortunate, since in this case the borrower is subject to a double credit burden. Over a certain period of time, a bank client will have to repay two loans at once. At the same time, interest and overpayment on a consumer loan will be significantly higher than on a mortgage loan.

Some categories of borrowers can count on preferential conditions for making a down payment. State mortgage lending programs provide assistance to certain categories of borrowers, including by making a down payment.

- “Maternity capital” is a state assistance program designed for families with two or more minor children. According to current legislation, a citizen who has the right to receive maternity capital can use it, including to improve housing conditions by purchasing real estate with a mortgage. The state program allows for the possibility of using a maternity capital certificate as a down payment on a mortgage. The only condition and limitation is that before this, maternity capital funds should not be used even partially. If the borrower intends to use maternity capital funds to pay the first installment on a mortgage loan, he must understand that the funds will arrive in the bank account only several months after submitting a corresponding request to the pension fund branch.

- “Military Mortgage” - this state support program is aimed at providing housing for military personnel. The program assumes that upon enlistment, an individual savings account is opened for a serviceman. Throughout the entire period of service in the Armed Forces, annual cash receipts are credited to the program participant’s account. Three years after joining the program, the participant can use the savings portion of the military mortgage to pay the down payment on the loan.

Some banks agree to accept additional collateral as part of the down payment.

How to transfer a down payment on a mortgage

During the transaction, the down payment on the mortgage must be transferred to the seller. How to do it right? The process is regulated by the procedure for obtaining a housing loan:

- After approval of the mortgage application and a specific property, you can enter into a transaction.

- Sign the purchase agreement and transfer the money in the agreed amount to the other party.

- The signed agreement and confirmation of payment of the down payment must be submitted to the bank by the day the loan agreement is executed. Together with credit and collateral documentation, they are submitted for registration to Rosreestr. It is better to do this on the same date; it is advisable to transfer the money at the office where you take out the loan.

How is the down payment on a mortgage transferred in cash or non-cash? It all depends on your agreement with the real estate seller. For some it is convenient to receive funds in their hands, for others – in a bank account. In any case, after transferring the first payment, you must have a document that you have already paid the first part of the amount.

When paying in cash, the other party writes on a separate sheet of paper with the obligatory indication of their name, passport details, the essence of the transaction (to pay for the apartment at the address...), and the transferred amount. A short acknowledgment of the transfer of the mortgage down payment to the seller at the end of the purchase agreement is acceptable. In this case, he writes that he received funds for partial payment and signs.

For individuals and legal entities who are paying a down payment on a mortgage, a wire transfer is safer . It is often used by organizations (for example, developers when selling apartments in a new building) and private sellers who are afraid of having a large sum of money on hand. The borrower will need to provide the bank with an executed payment order stamped and signed by the cashier.

If you make a transfer to a bank account at another bank, there may be a fee. It is taken from the sender of the money, that is, from the buyer of the property.

There are other options to transfer money to the seller, but they are used much less frequently:

- Through a safe deposit box, this is one of the safest ways to pay a down payment. The agreement for the use of a bank vault specifies the condition for issuing money to the second party only after successful registration of the transaction in Rosreestr (). Until this moment, he will not be able to collect the first payment. On average, the cost of renting a safe deposit box is 200 rubles per day, so the total will be 1.5-2 thousand rubles.

- Through a letter of credit, or nominal account. The price of this service is quite high, sometimes it reaches even 40 thousand rubles. This is the most secure way to pay a down payment on a mortgage, but due to the high costs, it will only be appropriate for large transactions. A special account is opened in the bank for this transaction (), which contains all the terms of the transfer and the data of the parties. Even if the sale falls through, the buyer will be sure that he will not lose his money.

Recommended article: Allocation of shares in maternity capital without a notary

If Rosreestr returns the documents due to the impossibility of registering the transaction, the initial payment must be returned to the buyer. By agreement with the bank, the borrower is looking for another real estate option. Secure payments using a locker or letter of credit account are much more attractive to him.

When you transfer funds to the other party in cash or send them to a bank account, there is a chance that if the transaction is cancelled, you will not receive them back. Of course this is against the law. However, you should not exclude the risk of running into a dishonest person or a real fraudster. Then all that remains is to go to court to demand the return of the money paid towards the first installment.

What does the law say?

Issues of mortgage lending are regulated at the legislative level through the Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 N 102-FZ. This legislation regulates all the main aspects of mortgage lending, without specifying any restrictions on making a down payment. This means that setting the minimum level of the down payment on the loan is left to the discretion of the credit institution.

Some banks are now ready to provide mortgages without a down payment, but this fact has a significant impact on the interest rate on the loan.

Bank offers

Today there are many mortgage programs with government support on the market. They are also presented on bank websites. But we didn't watch them because they follow certain rules. There are already stated restrictions on the down payment, interest rate, loan amount, etc. Later we will tell you what the down payment will be for a preferential mortgage with state support.

We studied bank mortgage programs aimed at purchasing new housing and not tied to government assistance. It turned out that citizens can take out a mortgage with a down payment of 10%, although often in order to obtain a loan on such conditions it is necessary to meet certain parameters. Or, for example, you will have to pay for a loan at a higher rate. Still, you need to understand that for a bank a low down payment means big risks that must be covered by the interest rate.

At what stage of the mortgage process is the down payment made?

Most banks, even at the stage of collecting documents for approving a mortgage application, require the potential borrower to provide, among other things, documents confirming the availability of funds necessary to make a down payment. The funds themselves must arrive at the account of the lender (bank) immediately before signing the mortgage agreement. If the borrower actually contributes less than the amount stipulated in the terms of the loan agreement, the application may be revised.

When purchasing an apartment with a mortgage with a down payment, the client can deposit funds either by bank transfer or by paying the agreed amount directly to the bank’s cash desk.

Mortgage calculator.

Advice for borrowers when applying for a mortgage

Each potential borrower can:

- increase your chances of having your mortgage application approved by the bank;

- achieve a reduction in the interest rate to a minimum value;

- independently decide on the amount of the down payment, taking into account the minimum established by the bank;

- reduce loan overpayments;

- choose the optimal lending conditions (from the options offered by the bank).

To prevent getting a mortgage from becoming a source of financial problems and disappointments, you need to listen to the advice of professionals - specialists in the field of lending.

Adviсe:

- When choosing the optimal mortgage lending program, you should first use the online calculator, which can be found on the official website of Sberbank. With its help, you can select the most favorable and convenient mortgage terms, as well as calculate the amount of the down payment, the loan term, the amount and cost of the loan, the size and number of regular payments, and take into account individual circumstances (presence/absence of insurance, Sberbank salary card, etc.) .

- Making a down payment is a prerequisite for obtaining a mortgage. Moreover, the larger the amount of the first payment, the higher the chances of receiving a positive response from the bank. Considering that even 15-20% of the cost of housing is a fairly decent amount, which not every family can save, to purchase an apartment on credit it is worth attracting and using all additional and auxiliary sources of financing:

- take part in one of the federal or regional housing programs;

- stand in line to receive a free apartment from the state or a subsidy;

- achieve official recognition of a family with many children, low income or in need of improved living conditions, etc.;

- receive maternity capital if a second or third child is born in the family.

Sberbank actively supports all social government programs and participates in their implementation, therefore, for privileged categories of the population, it offers more favorable lending conditions:

- When applying for a mortgage, you must provide the bank with the most comprehensive and detailed information about all sources of profit, including one-time payments, “gray” income, etc. The higher the average monthly income, the greater the chances of a positive result.

- When applying for a mortgage, you need to take into account not only the availability of the required amount for a down payment, but also your financial capabilities (stability of income, job prospects, availability of additional sources of income, etc.) to properly repay the debt in the future. It is important to take into account the possibility of force majeure circumstances in order to anticipate them and prepare options for solving financial difficulties in advance.

- Do not neglect your right to a tax deduction. This way you can save up to 260 thousand rubles, which is a lot even for citizens with above-average income.

- It is better to give preference to electronic registration, due to which you can not only facilitate and speed up the process, but also reduce the base interest rate by 0.1%.

- In most cases, the purchase of residential real estate is carried out through agencies, so it is better to do this through those that are official partners of the bank. It's reliable, simple and profitable. When the selected housing is approved on the DomClick partner website, the base rate is reduced by 0.3%.

- Insurance of collateral real estate is a mandatory condition of all mortgage lending programs at Sberbank, but insurance of the life and health of the borrower is voluntary. But the bank offers to reduce the rate by one point if the client agrees to take out such insurance. Here you need to take into account the difference between the cost of insurance and the overpayment of interest in case of refusal. In most cases, taking into account the price of the insurance policy, the client wins by 0.5%, plus he also receives certain benefits from the insurance itself, because in the event of his death or disability, the insurance company will pay the remainder of the debt for him.

Credit offers from leading Russian banks

Depending on how much the potential borrower has to make a down payment, banks are ready to change the terms of the loan, in particular the mortgage interest rate. Let's consider the conditions of the largest Russian banks regarding the down payment.

| Bank | Minimum down payment | Features of making a down payment on a mortgage |

| Sberbank | 20% | The vast majority of Sberbank's mortgage programs set the minimum down payment at 20%. This means that if the estimated value of the property is 4 million rubles, you will have to make at least 800 thousand rubles as a down payment. Only participants in the federal program “Young Family” can count on reducing this figure to 15%. The interest rate depends on the amount of the down payment. If the down payment on the loan is between 20% and 30%, the interest rate will be 13%. If from 30% to 50%, the rate is reduced to 12.75%. If the borrower is ready to pay more than half the cost of the property when drawing up a mortgage agreement, the interest rate can be reduced to 12.5%. The example is given taking into account the same loan term of 10 years. If a mortgage is taken out to build a house, the minimum contribution will be 30% of the construction estimate. |

| VTB 24 | 15% | You can get a mortgage from VTB24 Bank with a minimum down payment of 15%. This feature is not available in all regions. For residents of the Vladimir, Chelyabinsk, Kemerovo and Ivanovo regions, the minimum down payment is 20%. Mortgages at VTB24 are issued for a period of up to 30 years. If the borrower chooses the “Mortgage on two documents” loan offer, the minimum down payment amount will be 50% of the appraised value of the home. The amount of the down payment on a mortgage for a secondary home does not differ from the conditions when purchasing an apartment in a new building. |

| Deltabank | 15% | DeltaCredit Bank is ready to provide borrowers with a mortgage if the client has at least 15% of the cost of the purchased property. The interest rate in this credit institution is also very attractive for clients and is 12% per annum. Moreover, if a potential borrower is ready to pay more than half of the cost of housing in the form of a down payment, the interest rate on the loan can be reduced to 11.5%. |

| AHML | 20% | The Agency for Housing Mortgage Lending (AHML) offers borrowers to take out a mortgage for an apartment in a new building or on the secondary real estate market at 12% per annum. The minimum down payment amount is always 20% of the appraised value of the selected home. |

| Rosselkhoz Bank | 15% | The minimum down payment on mortgage loans at Rosselkhozbank is 15%. If real estate is purchased on the primary market (in a new building), this amount should be more than 20% of the price of the apartment. If a bank client takes out a mortgage to purchase luxury apartments or a large private house, the bank will require a down payment of at least 30% of the cost of the expensive property. The maximum life of the mortgage will be 30 years. |

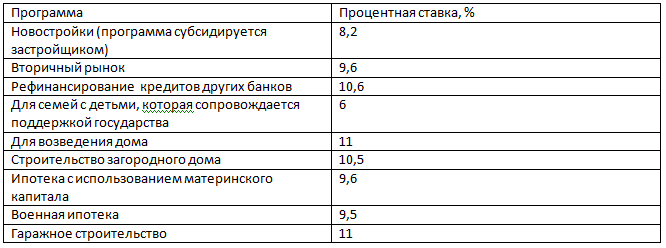

Mortgage interest rate in Sberbank

The interest rate on mortgage lending at Sberbank depends on the type of program chosen.

Each program covers a different type of property. For example, a bank will issue a loan for the construction of a house only if the construction takes place on land that is intended for development. On the secondary market, it is possible to purchase not only apartments, but also private houses or land plots.

Mortgage application review period

The duration of consideration of a mortgage application depends on the method in which it was submitted.

If you submit an online application, a preliminary response can be given by bank employees within 1-2 days.

If a citizen submitted an application directly at a bank branch, it may be under consideration from 3 to 5 days. If the applicant is a Sberbank salary card holder, he receives privileges in terms of consideration of loan applications - bank employees make a decision within a few hours or within two working days.

The time frame for making a decision is influenced by factors such as the category of the client, the type of property being purchased, and his address.

Procedure for granting a loan

In the standard case, applying for a mortgage at Sberbank includes the following steps:

- collecting papers, submitting an application;

- searching for housing to buy;

- coordination of the selected property with bank representatives;

- signing a contract;

- transaction registration;

- payment to the seller of the cost of housing.

Each stage is accompanied by its own characteristics. The application can be submitted in two ways: online or directly at a bank branch. After preliminary approval, the bank gives the borrower 90 days to find suitable housing. There is no need to rush in this matter - it is better to carefully check the cleanliness of the documents and the reliability of the transaction.

If the selected premises are a new building, and the developer is on the list of accredited companies, then nothing needs to be agreed upon - the client receives permission automatically. Approval will be required if the borrower has chosen housing (on the secondary or primary market) that is not accredited by Sberbank.