One of the subscribers reported that he was faced with a problem with obtaining a preferential mortgage at 6% for families with two or more children, one of whom was born after January 1, 2020. On our Youtube channel I have already posted a video where I call the bank and ask about the availability of this type of mortgage lending, here I will also post a complete list of banks that provide mortgages at 6%.

Mortgage subsidies in 2020: what you need to know

The proposal for state assistance is relevant for representatives of many segments of the Russian population . It contributes to a clear improvement in the living conditions of these citizens. In this case, we are talking about concessions that are expressed in subsidies.

Subsidies and benefits are two concepts that have fundamental differences between themselves

Please note: There can often be confusion between the following two concepts:

- subsidies;

- privileges.

We are talking specifically about subsidies. Their difference lies in the expression in the form of a sum of money provided to a person on certain conditions in order to achieve a specific goal. In this case, the goal is to directly provide people with the opportunity to take out a mortgage and adequately pay for it within the established time frame .

In order to take part in this program, it is mandatory to collect a certain package of official documents. Their entire list is designated as necessary for participation in the federal subsidy program “Housing”, which has several directions.

Thus, young families just starting their journey are offered to take advantage of a subsidy for the purchase of housing, the amount of which will be equal to 35% of the cost of the real estate . However, the price reduction will be carried out according to the conditions determined in the territory of each constituent entity of the Russian Federation.

As for credit institutions, they, in turn, can also offer additional ways to lower the rate, however, only on the condition that you decide to purchase future housing from specific construction companies.

You can only get housing from a new building under this program; resale housing is not included in the consideration

State subsidies help not only young families cope with the issue of securing permanent housing, but also directly developers, who would have difficulty surviving the crisis if not for the systematic flow of funds from participants in the housing program.

List of TOP banks with mortgages at 6 percent in 2019

It is up to the borrower to decide which bank to apply for a mortgage. The main thing is that the choice should fall on an organization included in the official list. It is impossible to provide it in full for a number of reasons. You can get acquainted with them in Order of the Ministry of Finance No. 88 dated February 19, 2018.

Banks that issue mortgages at 6 percent per annum vary in terms of their provision and requirements for a potential client. Let's take a closer look at the benefits of cooperation with the most popular organizations.

TKB - mortgage loan at 6 percent with an online solution

Low-interest mortgages for large families (from 5.5% per annum) from Transcapitalbank are provided on the following conditions:

- The minimum amount is 300 thousand rubles.

- The loan period is from 3 to 25 years.

- Down payment – from 20%.

- The borrower's age is from 21 to 75 years.

- Minimum work experience – 12 years.

- Work experience at the last place of work is at least 3 months.

- The term of doing business for an individual entrepreneur is at least 1 year.

You can take out a mortgage for an apartment, townhouse or country house. The bank focuses on purchasing housing in shared ownership. A preferential mortgage in combination with maternity capital will require the allocation of shares for all family members in any case. A mortgage is issued upon presentation of a certificate of income from the place of work of both parents (co-borrowers).

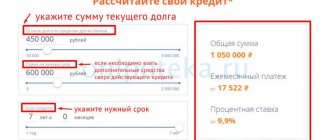

A convenient online calculator is presented on the official website of Transcapitalbank. The potential borrower only needs to fill out the necessary data in the empty form and find out the preliminary amount of the monthly payment. The service allows you to submit an application for a mortgage online. It makes getting approval much easier.

The bank states that if you have a bad credit history or you (or your spouse) are an individual entrepreneur, you can also leave an online application and receive a decision without visiting the bank. A high approval rate confirms that almost everyone can get a mortgage without refusal.

Online application to TKB

Sberbank - six percent mortgage with state support for families with children

Mortgages with state support from Sberbank are provided for a period of up to 30 years. The program conditions are standard. The following requirements are imposed on the client:

- Age from 21 to 75 years.

- Total experience of at least 1 year.

- Work at the current place for at least 6 months.

- The spouse acts as a co-borrower (this is also true for an unregistered marriage).

The potential borrower will need to fill out an application form. You can also apply for it online through the official website; here you can also calculate the amount of contributions using an online calculator. It is necessary to provide a civil passport and income certificate. We wrote more about Sberbank’s mortgage program in a separate article.

Gazprombank - mortgage for families with 2 or more children

Gazprombank launched the Family Mortgage program. The subsidized interest rate is set for the entire loan term and is fixed in the contract. The loan is provided for a period of no more than 30 years, subject to payment of 20% of the down payment.

Mortgages for families with children are issued after an analysis of the parents’ solvency. One of them will act as a borrower, the second – a co-borrower. Like other banks, Gazprombank adheres to the standard conditions for obtaining a subsidy:

- Down payment – minimum 20%.

- The minimum amount is from 100 thousand rubles.

- The maximum amount for residents of Moscow, Moscow Region, St. Petersburg, Leningrad region is 8 million rubles, other regions - 3 million rubles.

- The minimum loan term is 12 months.

A convenient online calculator is presented on the official website of Gazprombank. You can submit an application online by filling out an empty form on the website, or by visiting the bank in person. The maximum period for consideration of an application at a bank branch is 10 days. When filling out the online form – 1 day.

Preferential family mortgage program from VTB

Unlike other banks, VTB, in addition to the subsidy, the state also provides its own 1% discount for families with children. Residents of the Russian Federation aged 21 to 65 will be able to get a preferential mortgage from VTB. The bank allowed not only spouses, but also their parents to act as co-borrowers. There are no strict requirements for experience. The main thing is to provide certificates of income for the last 6 months.

An application for 5 percent on a mortgage can be submitted on the bank’s official website. If approved, a manager will contact the future borrower. He will answer all your questions and make a preliminary calculation of monthly payments.

Application approval is valid for 4 months. You can choose an apartment in any new building. At the same time, VTB provides a list of verified developers. The bank does not exclude the possibility of refinancing a previously opened loan, provided that the family fully complies with the standard conditions. We have already told readers about the current mortgage offers of VTB Bank. Be sure to read..

Mortgage at 6% in PSB for Sberbank salary earners

Promsvyazbank offers young people over 21 years of age a preferential mortgage with government subsidies. The main feature of the PSB offer is a simplified application for Sberbank payroll clients. Those who receive their salary on a Sberbank card can apply for a mortgage at 6% by presenting only a passport and a certified statement from their salary account.

Other features of Promsvyazbank’s housing program

- Interest rate is 6% per annum for the subsidy period.

- You can only get a preferential rate for apartments in new buildings .

- The mortgage term can be chosen as short as 3 years or as long as 25 years. The main thing is that your income allows you to choose a minimum period.

- The maximum amount is 3 million rubles.

- A small contribution of 100 thousand rubles. If you do not have the 10-20 percent down payment that other banks require, then the PSB offer is your choice!

For non-salary clients of PSB and Sberbank, in order to approve the application, you will need to provide:

- Passport.

- Certificate of income 2-NDFL or other document confirming income.

- Birth certificates of children.

- Certificate of marital status.

- SNILS and military serviceman, if the man is under 27 years old.

Uralsib - 6 percent for all participants in the housing cooperative program in the Republic of Belarus

You don’t have 2 children and don’t have a down payment on an apartment? Uralsib offers an unusual solution for obtaining a mortgage. Since many families cannot afford to pay a down payment, the Housing Construction Savings (HCS) program was developed especially for them. For more than 5 years it has been successfully operating in the Republic of Bashkorstan.

The essence of the program is as follows

- An account is opened to accumulate a down payment for a period of up to 6 years.

- The account holder makes a monthly deposit of a certain amount.

- After the end of the accumulation period, a mortgage is issued.

- The accumulated funds are used to pay the down payment.

Only residents of the Republic of Bashkorstan, aged 18 to 70 years, can participate in the program. You can apply for participation by visiting any bank branch.

The bank takes into account the standard requirements for mortgage subsidies. The loan is issued according to general rules, including a detailed check of solvency.

What programs are in effect this year and under what conditions are they provided?

We already mentioned a little higher that the subsidy program does not exist in a single version. On the contrary, there are several such programs, and each of them is subject to the fulfillment of various conditions, as well as the schemes under which you will receive a subsidy. The participants in the program are, respectively, you yourself, the organization that erected the building within which you are going to purchase real estate, and the bank that will provide you with a mortgage. Next in the table, let's look at which programs you can choose from today.

Today there are many subsidy programs from which those in need can choose

Table 1. Main housing subsidy programs operating in Russia today.

| Program | Description |

| Housing 2011-2020 | The main goal of this program is to provide the needy segments of the population with quality housing, which will be sold to them at a price that can be described as affordable. The program is being implemented throughout the state as part of the construction of complex residential real estate at the economy class level. Providing such housing to citizens is possible only with the help of: ·subsidies; certificates. At the same time, the construction of houses is low-rise, which greatly increases such indicators of buildings as: ·ecological cleanliness; ·energy efficiency. |

| Young family | Perhaps this program is the most famous of the many similar government projects. Those taking part can receive a refund of up to 40% of the cost of the home they purchased. They pay the remaining amount from: ·maternity capital funds received for the birth of a second child; money borrowed from a credit institution. In this case, it is necessary to make so-called initial payments, the amount of which will be 10% of the total cost of the property. In total, a family can receive up to a million Russian rubles. |

| Subsidies for employees of public sector sectors and government agencies | Citizens included in the categories indicated in the left column can take advantage of a specially developed subsidy program for the purchase of residential real estate. It should be noted that the money is paid to you only one time. In order for the funds to be paid to you, you must fill out an application for receipt of funds, as well as the corresponding package of documents. It is necessary to indicate that all previous places of work of this citizen should not have provided this procedure, otherwise, at the new place you will also be denied it. |

Providing subsidies is possible only on the condition that you comply with the requirements set by the state and other parties to the program

The conditions for granting subsidies will generally be the same in each case, namely:

- The work experience for persons who are civil servants, as well as for representatives of budgetary organizations, must be at least 3-5 years;

- citizens applying for a subsidy should not own housing, or have the official right to live in living space belonging to relatives (except for cases where you own a room or other premises whose area is less than 15 square meters);

- officials with the status of parents of many children, or high-ranking executives, may be assigned additional facilitating conditions or privileges;

- compensation given to citizens by the state can subsequently be used only in accordance with the letter of the law;

- the transaction between the person who received the subsidy and the seller of the real estate must subsequently be documented;

- provided that the money received by transferring the payment is not fully used, the remaining funds must be returned back to the state.

In addition to the main and most popular subsidies, there are other, little-known ones that can help you find housing just as well

There is also a list of additional subsidies, the value of which is not as significant as those we listed above, however, they must be taken into account by those who still want to take advantage of government assistance .

Table 2. What other subsidies can be used to purchase additional housing.

| Subsidy | Description |

| Subsidies for the birth of a child | This relief from the state is aimed at supporting families that cannot create the necessary conditions for their already born or only planned offspring. At the state level, a decision was made not only to extend the previously described programs, but also to introduce a new type of benefits. To receive this subsidy, young parents (or future parents) must collect a package of documents appropriate to the situation and submit it to the bank. Subject to certain conditions, people approved to participate in the program will be able to: · receive reimbursement of part of the funds spent for a period of up to five years; · provided that their family has at least two children, the loan rate for them will be only 6%. |

| Military subsidies | Separate housing subsidies are also organized for military personnel who have not yet purchased residential property. In particular, this form of support from the state also applies to citizens who have retired according to their length of service. Money is provided to military personnel only in the form of a special certificate, which cannot be cashed out for purposes other than its intended purpose. Providing preferential mortgages to the military is possible only in those conditions when the serviceman has a service period of at least three years. As for the interest rate, in this situation it will be 9.9% per year. |

Tax deduction for mortgage interest

A tax deduction is a part of income on which the state allows you not to pay personal income tax. One of its most common types is property. When buying a home - on credit or without it - you can get back up to 260 thousand in taxes paid, the exact amount will depend on the price of the apartment.

But that is not all. When purchasing a home with a mortgage, you can take advantage of a tax deduction on interest. If the apartment was purchased before 2014, then you can return 13% of the total overpayment amount. For real estate purchased later, there is a limit: you can get 13% of 3 million rubles, that is, up to 390 thousand. If the overpayment is less, then the tax deduction will be less.

Let's say you bought an apartment with a mortgage and are going to pay the loan according to schedule. The total overpayment for it will be 1.2 million. This means you can qualify for a refund of 156 thousand.

Please note that you can use the interest deduction only once in your life and for one object.

Since we are talking about exemption from personal income tax, the amount of payments will depend on your official income. If you receive 300 thousand per year, then the maximum refund amount for 12 months is 39 thousand, if 1 million - 130 thousand. But you can request a deduction for several years in a row until you return the entire amount due to you.

You can receive a deduction:

- through an employer - they will simply stop paying you personal income tax until you reach the limit;

- through the tax office - you will be refunded the amount of tax paid for the previous year.

Requirements for mortgage subsidy programs in 2020

Study the programs in more detail to understand which one is best for you

In order for you to take advantage of the government subsidy program for the purchase of a home, you must demonstrate compliance with the official requirements relevant to applicants. Most often, these requirements fall into the standard category, but in some exceptional cases non-standard conditions may be added to them. It all depends on what category of citizens you belong to and what program you decide to use.

Requirements for borrowers

Requirements for the Housing program

Using the Housing program, you can receive support from the state only if the following mandatory conditions are met:

- you have citizenship of the Russian Federation;

- age is no more than 35 years;

- you do not own residential real estate, or you do, but for some reason it is not actually suitable for living in it.

When we talk about the phenomenon “not suitable for habitation,” we mean that the housing does not meet the established standards for area per person.

The categories of citizens listed below can count on individual subsidy conditions

There are certain categories of citizens who are provided with individual subsidy programs. This is about:

- security forces and military;

- persons who were forced to leave their previous place of residence;

- employees of government agencies, prosecutors and investigative departments;

- workers in Baikonur;

- citizens affected by man-made radiation disasters;

- scientists;

- persons moving from the far north.

Requirements for applicants to participate in the “Young Family” program

To take part in the Young Family program, citizens must:

- the full membership of the social unit they have formed will live in a house, apartment or other type of housing, the area of which will be 42 square meters (or less than 18 square meters);

- have Russian citizenship;

- be under 35 years of age and older than 18 years of age;

- have a minor child;

- have a certain level of income that allows you to pay off your mortgage.

Interesting information

What do you need to participate in the Housing for Russian Family program?

According to the desired program, subsidies are issued to persons whose age ranges from 25 to 40 years , who need their living conditions to improve.

Persons participating in this program can successfully add their own savings or maternity capital funds to their existing funds and government assistance

They can pay for the purchase of an apartment using:

- a loan taken from a credit institution;

- maternal capital;

- other means.

At the same time, the person making the loan must have a permanent place of employment. In some regions of our country there are additional requirements on this issue, which will also be taken into account after you receive an application for participation in the program.

Mortgage for a young family, you can find out about it in a special article.

Requirements for real estate

Real estate received under any subsidy program must also meet the requirements for it. Thus, funding from the state comes for housing that has already been purchased, or plans are just underway it .

At the same time, only new buildings can be borrowed with the help of subsidies. Apartments belonging to the old stock category cannot be purchased under any of the housing programs.

The size of the total housing area in a new building must be consistent with the standards for each member of one family. Banks can also place claims on real estate. Therefore, in order to obtain more accurate and detailed information regarding this issue, it would be best to contact the credit institution directly.

State program "Young Family"

Photo: Takmeomeo/pixabay.com

The point is simple: the authorities are ready to support young families and pay part of the mortgage loan for them. For married couples without children, such support will be 30%, and for families with at least one child - 35%.

To receive such a bonus, you must meet a number of criteria:

- — Only citizens under 35 years of age (married couple or single parent with children) can participate in the program.

- — You must be on the list of families in need of improved housing conditions (regional authorities are responsible for this, so the procedure for registration should be clarified with local departments).

- — You must have the funds to pay the balance of your mortgage.

However, even if you meet all the criteria, this does not guarantee that you will receive such a subsidy. The fact is that the queues for it are long, and people can wait for years. But you try anyway.

How can I get a subsidy from the state?

Back in 2020, the subsidy program for fixed-term mortgages came into force

Starting from January 1 last year, a new mortgage subsidy program has been implemented. All categories of citizens that we previously identified in this article can become its participants. In this case, the interest rate on the loan will be preferential and will be 6% for the buyer, while the rest of the payment segment will be provided only from the state.

However, you need to understand that this program is urgent, that is, the duration of its implementation is limited to a short time period, therefore, if you belong to the category of citizens in need of housing, we advise you to hurry up.

Preferential mortgage for families with two children

If a second child is born in your family (starting from 2020), you have the right to reduce the mortgage rate to 6% per annum. Moreover, this applies to the entire subsequent term of the loan. True, only if the housing was purchased on the primary market (purchase at the “pit” stage also counts).

It is also important that such benefits are issued only for real estate worth less than 6 million rubles (in the capital the limit is higher - 12 million).

Usually banks are willing to agree to such conditions because they have nothing to lose. What you don't pay them extra will be compensated by the state.

Where to apply for a subsidy

Depending on which program you are eligible to participate in, you will need to contact the following authorities:

- local administration;

- housing committee;

- municipality;

- agency for residential mortgage lending.

In addition, in order to clarify the information you are interested in regarding the terms of the loan, you need to come to the bank and clarify on what conditions it will be able to conclude an agreement with you for the provision of a mortgage.

To become the owner of an apartment in a new building, contact the administration or other body regulating this issue

What kind of real estate can you buy?

An apartment in a building under construction under an equity participation agreement, a finished apartment or a house with a plot, if the seller is a legal entity. The seller of real estate cannot be investment funds, their management companies or individuals.

Read on topic: 15 questions about escrow accounts

To obtain a loan, you need to save at least 20% of the cost of your home. Maternity capital can be used as a down payment. The maximum loan amount in Moscow, the Moscow region, St. Petersburg and the Leningrad region is limited to 12 million rubles, in all other regions - 6 million rubles.

Procedure for receiving government subsidies

What do you need to take part in the Housing program?

To participate in the program indicated by the title, you need to collect a valid package of papers, and then contact the local administration . On the spot, you will need to provide the collected documents as confirmation that you need new housing. Provided everything is in order, you will be registered.

Once it is your turn, you will receive a certificate to provide the funds you requested. Afterwards, an agreement will be signed with the credit institution, and then with the selected bank to open an account. And after all these steps, you will become a proud home owner, and will be able to use government funds as promised.

Participation in the “Young Family” program

Those individuals who want to participate in the “My Family” program also collect a package of documents that are needed in order to open a bank account and enter into a mortgage agreement with it. True, in this case, in order to receive state assistance, you will no longer need to apply to the city administration, but directly to the Housing Committee.

In each case, the application will be considered within a certain period established by law

Consideration of the application can take up to 2 months. Provided that the final answer is in your favor, a queue will be assigned. As soon as yours comes up, you can already apply for a loan and pay off your remaining debt. Housing is purchased using funds provided by the state.

Program "Housing for Russian families"

To participate in the desired program, you must select a specific construction project that interests you. Afterwards, the documents are collected and submitted for consideration to the municipality, where they will approve or disapprove your inclusion in the program.

After receiving a positive response, housing with a suitable area will be selected. It is advisable to first clarify the question of the availability of such housing with the developer, and at the same time find out what features this housing has. Only after this will it be possible to purchase a home.

For what period is it better to take it?

The process of determining the most economically advantageous terms for obtaining a mortgage is individual for the borrower.

The mortgage calculator , where the monthly payment to the bank can help him with this .

This amount, multiplied by the term specified in the mortgage loan agreement, will form the final cost of the purchased housing.

The potential borrower should compare the result obtained with current market prices for housing with similar characteristics.

Based on the current situation in the real estate market, the difference in prices between housing purchased with your own funds and through a mortgage scheme can be 2-3 times .

The overwhelming majority of mortgage loans issued by the population should be classified as mortgage lending programs Their market share is approximately 55-60% of the total amount of loans issued.

Such statistics speak in favor of the fact that Russian borrowers consider the terms of repayment of mortgage debt of 10-20 years to be the most optimal , despite the increase in the cost of housing by more than 2 times relative to current market prices.

The maximum price delta of 2.5-3.5 times occurs with long-term mortgage lending programs with repayment periods for loans taken within 20-30 years .

Therefore, whenever possible, the borrower should choose a mortgage with the shortest possible repayment period for the loan amount.

According to the statistics available from banks, no more than 10-15% of potential mortgage borrowers are now able to short-term mortgages for a period of one to 10 years .

Moreover, the amount they overpay for housing will on average be 90-100% of the current cost of an apartment on the primary residential real estate market.

This is the most cost-effective way to purchase a home using a mortgage scheme, since this amount will be the minimum amount.

To find out how long it is better to take out a mortgage, watch the video:

What documents need to be collected

To take part in these programs, will need collect a specific package of papers. So, it should be noted that in general the list of documents will be similar for each case, however, you will still need to study it first so as not to get into trouble and not lose a lot of time on paperwork.

Thus, in one hundred percent of cases, the borrower must submit an application for government financing, indicate who the members of his family are by providing copies of passports and birth certificates, as well as a marriage certificate.

What documents you will need to collect will depend on which program you have decided to participate in

Provided that you will need to prove that you own certain funds, you will need to bring an account statement that will prove that you will be able to pay the down payment.

Other offices will require a more extensive list of documents from you, namely, certificates:

- about your financial situation;

- proving that you receive wages every month;

- about the income of other family members;

- from the house register;

- being proof of official employment, etc.

As you can see, it is better to clarify the list of necessary papers in advance before starting business with departments, so as not to delay receiving an apartment through your own fault.

Let's sum it up

If you need an apartment, don't miss the chance and take advantage of a mortgage!

Mortgage subsidies are for some of our citizens a real chance for a different, better and more enjoyable life. If you are included in the category of those in need, take advantage of your right to a different life and receive them, not forgetting to collect all the necessary documents according to the rules and within the established time frame.