Subsequent collateral is the re-delivery of property (real estate, cars, etc.) to secure funds issued by the lender. Previously, the object was already registered as collateral, and this procedure is used to secure various obligations. In accordance with the law, the requirements of the subsequent mortgagee are satisfied from the value of the property after the previous ones have been satisfied.

What's happened

Federal Law No. 102 “On Mortgages” (Article 43) clearly defines the concept of a subsequent mortgage and the possibility of allowing it. In accordance with this regulatory act, a subsequent mortgage is a re-pledge of property that is collateral for a mortgage loan issued but not paid in full, under a new property encumbrance agreement.

Lenders can be either different institutions/persons or the same mortgagee (bank), only for different loans.

It is important to understand why a subsequent mortgage is needed at all. The most common situation is refinancing an existing loan, that is, refinancing on more favorable terms from another bank. During the re-registration period, which may take some time, a new encumbrance is placed on the property. Then, when the final settlement is made with the first creditor bank, the pledge in its favor will be canceled.

The second situation is when the borrower finds himself in a difficult financial situation and is forced to take out another loan secured in the form of existing real estate. The law does not prohibit encumbering the same object several times.

Important! In simple words, the same property can be pledged under several loans. This is the essence of a subsequent mortgage - the property is encumbered in favor of two mortgagees at once.

Subsequent mortgage

14.04.2009Subsequent mortgage

Federal Law No. 102-FZ of July 16, 1998 “On Mortgage (Pledge of Real Estate) (hereinafter referred to as the Law) establishes a rule that is fundamentally important for economic turnover, according to which property pledged under a mortgage agreement can, under certain conditions, be pledged more than once.

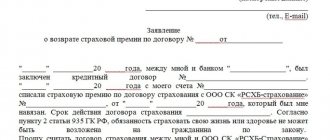

The law does not prohibit the repeated use of property, the pledge of which secures the fulfillment of a certain obligation, to ensure the fulfillment of other obligations. In Art. 43 clause 1 of the Law gives the concept of subsequent mortgage. Property pledged under a mortgage agreement to secure the performance of one obligation (preceding mortgage) may be pledged to secure the performance of another obligation of the same or another debtor to the same or another mortgagee (subsequent mortgage). The primary encumbrance of a mortgage on real estate is defined by the Law as a previous mortgage, and the secondary encumbrance, respectively, as a subsequent mortgage. However, the legislator establishes certain requirements for subsequent mortgages. 1. A subsequent mortgage is allowed if it is not prohibited by previous mortgage agreements on the same property, the validity of which has not terminated by the time the subsequent mortgage agreement is concluded (paragraph 1, paragraph 2, article 43 of the Law). If a previous mortgage agreement provides for the conditions under which a subsequent mortgage agreement can be concluded, the latter must be concluded in compliance with these conditions (paragraph 2, paragraph 2, article 43 of the Law). Despite the fact that provisions prohibiting or limiting subsequent mortgages are included in practice in most contracts, we note the following. First, prior agreements may prohibit or restrict subsequent mortgages only for a certain time - the term of the agreements. Second, the parties to the prior agreement can amend the mortgage agreement and authorize a subsequent mortgage. If a previous agreement prohibited a subsequent mortgage, but a subsequent agreement was nevertheless concluded, such an agreement may be declared invalid by the court upon the claim of the mortgagee under the previous agreement. Thus, the completed transaction is a voidable transaction, and it can be declared invalid regardless of whether the pledgee under the subsequent agreement knew about such a prohibition or did not know. If, by a previous agreement, a subsequent mortgage must be made in compliance with certain conditions, but they are violated when concluding a subsequent agreement, the agreement is not invalidated, however, the claims of the mortgagee under such an agreement are satisfied only to the extent that their satisfaction is possible in accordance with the conditions of the previous one. mortgage agreement. As a rule, mortgage agreements establish the need to obtain consent for a subsequent mortgage from the previous mortgagee. In the event that agreements on previous and subsequent mortgages are concluded between the same persons, then the above rules do not apply. Judicial practice also confirms the right of the parties to enter into one agreement on the pledge of real estate as security for several credit agreements (loan agreements). Such a mortgage agreement does not contradict the law and is subject to state registration. 2. The Law establishes an unambiguous rule that the conclusion of a subsequent mortgage agreement providing for the preparation and issuance of a mortgage is not permitted. A mortgage note can only be issued on the original mortgage. 3. The law establishes the obligation of the mortgagor to inform each subsequent mortgagee, before concluding an agreement on a subsequent mortgage with him, the essential terms of all existing agreements on the mortgage of this property: the subject of the mortgage, its valuation, the essence, size and deadline for fulfilling the obligation secured by the mortgage. The legislator has not established a specific form for reporting prior mortgages. The issue of this is usually resolved in the mortgage agreement itself, where the parties establish the obligation of the mortgagor in writing within a certain period of time to provide information about the encumbrance of the subject of the mortgage. In addition, the mortgagor is obliged to immediately notify each of the mortgagees under previous mortgages about the conclusion of each subsequent mortgage agreement and, upon their request, inform them of the essential terms of such agreement. 4. Rules clause 3 art. 44 of the Law protect the rights of the mortgagee under an agreement on a subsequent mortgage, establishing the impossibility, without his consent, of making changes to the previous agreement, entailing the provision of new claims of the previous mortgagee or an increase in the volume of claims already secured under this agreement. This rule can be changed by introducing the appropriate conditions included by the parties in the previous mortgage agreement. In addition, the last two conditions do not apply if the parties to the previous and subsequent mortgage agreements are the same persons. 5. The subsequent mortgage agreement must contain information about all registration records of previous mortgages of the same property. 6. A subsequent mortgage agreement, like any other mortgage agreement, is subject to state registration, which is carried out in the same manner as the registration of a previous mortgage agreement. Registration entries about the mortgage made earlier are not cancelled, but a new registration entry about the mortgage is entered into the Unified State Register, which makes it possible to determine the priority of the mortgagees' claims. The only difference between the state registration of a subsequent mortgage is that on original copies of a subsequent mortgage agreement, after the state registration of a subsequent mortgage, the registrar makes notes on all registration records on previous mortgages of the same property, for the purpose of which a stamp (stamps) of the registration inscription is affixed to the documents on state registration of the previous mortgage (previous mortgages). The specified stamp must contain the same information that was entered during the state registration of the previous mortgage. In this case, in this stamp(s), after the words “State registration has been carried out,” instead of the word “mortgage,” the words “previous mortgage” are indicated. And in conclusion, I would like to note that there are mortgages of property pledged under an already concluded mortgage agreement, obligations under a new agreement between the same parties are secured, and the parties enter into an additional agreement to the mortgage agreement. From judicial practice we can conclude that a new mortgage agreement must be concluded, which is a subsequent mortgage agreement. L. Volokitina, chief specialist-expert of the department for registration of mortgages and equity participation in construction Return to list

In what cases is it used

The key condition for registering a subsequent mortgage is the absence of prohibiting conditions in the previous mortgage agreement. In practice, there are agreements:

- not allowing re-mortgage of real estate;

- clarifying this possibility (details the conditions for applying a subsequent mortgage);

- not containing any prohibitions on subsequent encumbrance of property.

Many banks refuse to take the risk of agreeing to re-pledge the collateral, so the mortgage agreement includes a clause that makes a subsequent mortgage impossible. There are quite a lot of similar cases in banking practice.

If the transaction was registered despite the presence of a prohibition in the previous document, then it may be declared illegal and invalid through the court (by filing a statement of claim from the first mortgagee).

Important! The borrower has the right to a subsequent mortgage in two cases: when the previous mortgage agreement does not prohibit such collateral or such an opportunity is provided subject to strict compliance with the conditions.

Compliance with the conditions specified in the document is controlled by the credit institution, which is the mortgagee under the first agreement, as well as by the judicial authorities in the event of a case being considered in court.

At the same bank

At the legislative level, it is not prohibited to repeatedly cooperate with the same bank and re-encumber the property that is the object of collateral for a mortgage loan. In a sense, the whole procedure is simplified, since the requirements, set of documents and the sequence of all stages are already familiar and understandable. In certain situations, employees may be ready to make concessions and reduce the time for reviewing the application and completing the transaction itself.

A common situation is that the same client applies to the bank where the loan for the purchase of real estate was issued to obtain a consumer loan. Since the credit burden on the borrower and his family members will increase significantly with the issuance of a new loan, the bank requires the second loan to also be secured with collateral. Re-encumbrance of real estate acquired with borrowed funds is not prohibited by law or bank policy.

Agreement

The subsequent mortgage agreement is drawn up in a standard form and must necessarily contain the following clauses:

- subject of the contract;

- obligations and rights of the mortgagee and pledgor;

- guarantees of the rights of the mortgagee;

- foreclosure on the collateral;

- dispute resolution;

- insurance;

- obligations and claims secured by collateral;

- assessment of collateral;

- state registration of the document;

- addresses and details of the parties.

The fact of re-encumberment of the property must be stated and all details of the previous agreement must be indicated.

Like any other mortgage agreement, it is subject to mandatory state registration with the registration authority (at the Registration Chamber or the MFC).

Agreement on subsequent pledge of real estate (subsequent mortgage)

7.4. In the event of a gross violation by the Mortgagor of the rules for using the subject of mortgage (Part 1 of Article 29 of the Law), the rules for its maintenance or repair (Article 30 of the Law), the obligation to take measures to preserve this property (Article 32 of the Law), if such a violation creates a threat of loss or damage to the subject of the mortgage, as well as in case of violation of insurance obligations (clause 9 of the Agreement) or in the event of an unreasonable refusal to the Mortgagee to inspect the pledged property (clause 7.1.1 of the Agreement), the Mortgagee has the right to demand early fulfillment of the obligation secured by the mortgage within ______ days.