What data is indicated in the form?

The application itself has a structure similar to other documents of the same kind. The borrower or co-borrower indicates in it:

- Personal, passport and contact information;

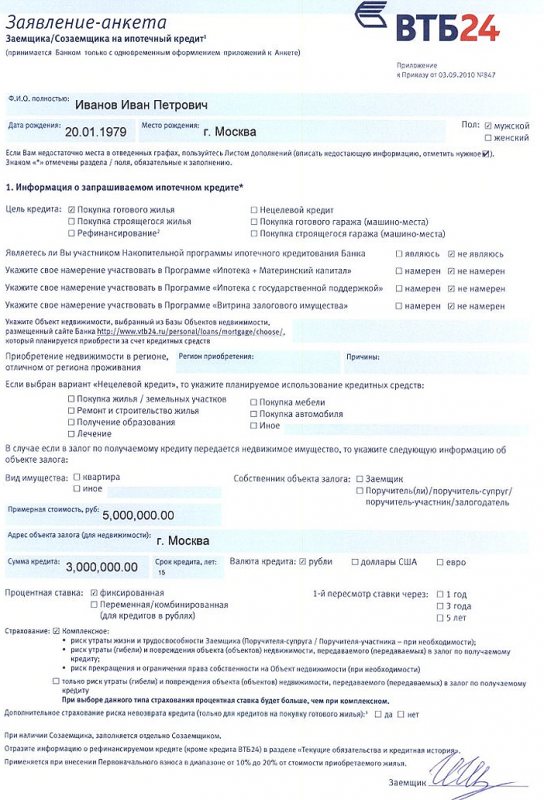

- Information about the mortgage loan being applied for;

- The source from which he received information about mortgage loans at VTB (recommendations from friends, advertising, etc.);

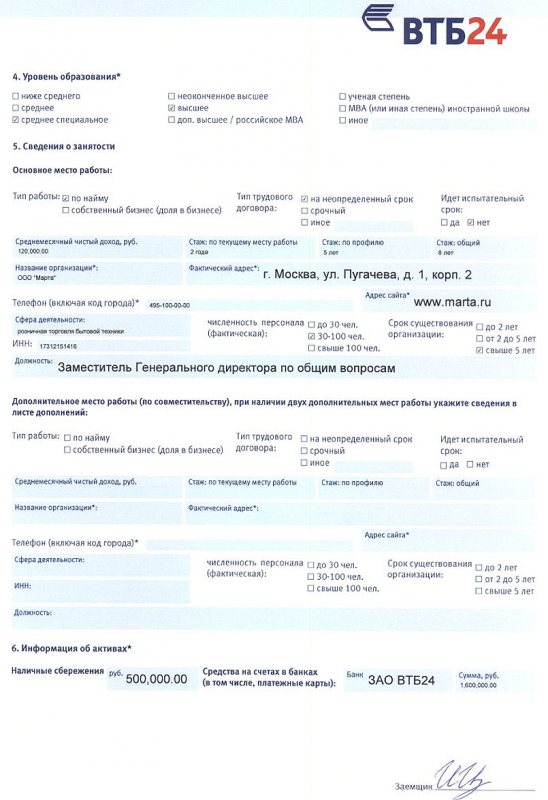

- Information about existing education and employment (indicates the completed educational institution and place of work; if there is several jobs, notes this fact, and writes about this in more detail on the supplement sheet);

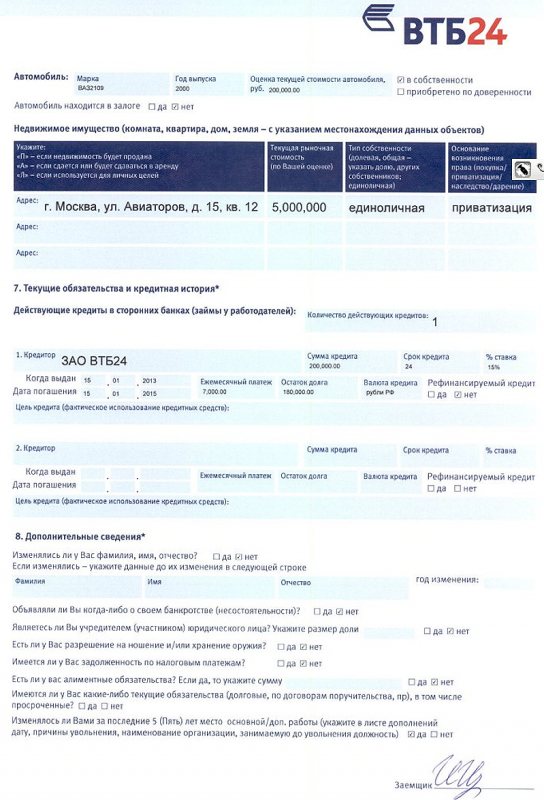

- The assets he has (savings in cash and/or deposits, having a car and/or real estate);

- Information about loans and credit history available at the time of application;

- Additional information (change of surname, availability of a permit to carry weapons, etc.).

Employment information does not need to be completed for military personnel participating in the Military Mortgage Program.

Why does the bank need a borrower's questionnaire?

The specificity of mortgage loans is significant amounts of financing and long debt repayment periods. Accordingly, the bank is interested in obtaining maximum information about the potential borrower.

The questionnaire is a summary of basic information about all parties to the transaction. Filling out the VTB mortgage application form is mandatory not only for the main borrower, but also for guarantors and co-borrowers. On several pages they indicate information about employment, income, place of residence, presence/absence of children, property owned, etc.

It is on the basis of the questionnaire that the initial decision is made. If the credit manager, when checking the data, establishes a discrepancy with the information from the Pension Fund, Federal Tax Service and Rosreestr, the likelihood of refusal increases significantly.

The application form for a mortgage at VTB consists of 3 main sheets, 2 appendices and. You can fill it out either directly at the nearest bank branch or at home.

Applications

Three more sheets are attached to the application.

- Detailed information about the requested loan;

- Consent to the processing of personal data;

- Additions sheet.

The first two applications must be completed: without this, VTB Bank will not consider the application.

In the information about the requested loan, you should indicate its purpose, the desired term and terms of the loan, and also indicate the borrower’s participation in one of the mortgage programs. The “Insurance” column is also filled in.

Look at the same topic: In which banks can you get a mortgage without a down payment on favorable terms?

How can I get a loan from VTB without a 2-NDFL certificate?

In addition to the bank form, the borrower can confirm income using:

- A certificate drawn up in free form, but containing all information about the borrower’s income;

- Certificates from the financial department (for military personnel or law enforcement officials);

- Statements from the salary or debit account into which the salary or additional income is received;

- Extracts from the Pension Fund;

- Documents on additional income.

However, before preparing this or that document, check with the VTB manager whether it is suitable as proof of income.

Where to get the application form

You can take the mortgage application form:

- Directly at any VTB branch;

- On the bank's website.

If the form is taken from a bank, it must be filled out by hand. The data entered into it must be readable, therefore it is recommended to fill out the application form with a bright blue or black pen in block letters.

You can fill out an application for taking out a mortgage directly at a bank branch. This is convenient because if you have any questions you can immediately contact a bank employee.

Certificate on the VTB24 bank form for a mortgage - sample filling

The easiest way to obtain a sample certificate for a mortgage in the form of VTB Bank is on the official website. If you take a closer look at the proposed form, it will become obvious that the form does not contain anything unexpected.

The accountant will have to indicate:

- name of company;

- company tax identification number;

- legal and actual address;

- Contact phone numbers;

- information about the employee, including his position;

- the total amount of wages for the selected period (usually six months);

- monthly income (table).

After that all that remains is to put a stamp and signatures. If the organization does not provide for the position of chief accountant, this fact is indicated in the appropriate note. Additionally, it should be noted that it is not recommended to fill out the form manually; it is better to fill out all the required fields on the computer.

VTB 24 online application: mortgage application form on the bank’s website

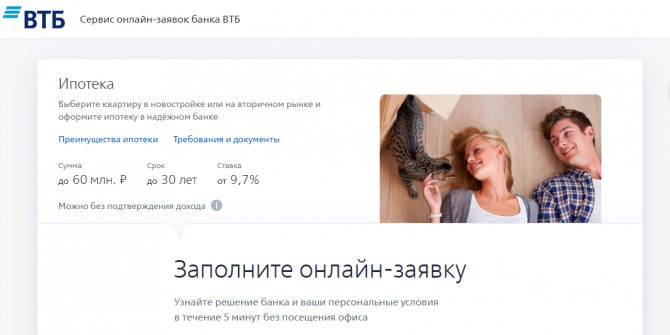

You can apply online on the VTB website. To do this, go to the main page of the site and find the “Mortgage” tab. Then the desired program is selected (for a new building, secondary housing, military mortgage, etc.).

When you open any of these tabs, immediately after listing the main mortgage conditions, there is a “Complete application” button. By clicking on it, you can start filling out the form. Unlike the paper version, electronic filling can only be sequential: you cannot move to the next page of the questionnaire without entering everything into the previous one.

This option is convenient because you can complete the application without haste at home. To clarify questions about filling out, you can call customer support.

VTB Bank website – https://www.vtb.ru. The support phone number is 8 495 777 24 24 for residents of Moscow and for calls from abroad, 8 800 100 24 24 for residents of other regions of Russia.

Preparing to Apply for a Mortgage

In addition to being legible, it is important that the application contains complete and accurate information about the borrower or co-borrower. All fields of the questionnaire (except for the addition sheet) are mandatory. Applications with missing information will not be considered.

For many, a mortgage is the only chance to own a home. Since some applicants understand that they do not qualify as borrowers in all respects, they try to present themselves to the lender in the best light.

However, you cannot provide the bank with knowingly false information about yourself: attributing real estate to yourself, presenting a credit history as positive, overstating or understating your age - all this can be easily verified.

The bank will never issue a loan to an unscrupulous applicant. And the information about the mortgage applicant is checked with special care, because we are talking about providing a long-term loan for a large amount.

The chance of approval of the application will be increased if the applicant provides as much contact information as possible. It would be good if, in addition to his residential address and cell phone number, he also indicated several landline phone numbers (including a work one). This way he will demonstrate the seriousness of his intentions in repaying the loan.

See this same topic: How is a mortgaged apartment divided after a divorce? Judicial practice on the division of an apartment between spouses

Filling out the questionnaire is an additional opportunity for the borrower to weigh all the circumstances and assess how ready he really is to take out a long-term loan for a large amount with collateral in the form of real estate.

Procedure for filling out the form

In the forms and documents section you can apply for a VTB mortgage on the bank's website. The application contains seven mandatory points with sub-points. It is not recommended to skip them. When checking, the manager at the bank will definitely ask why there is no information in the columns.

Status

In the very first paragraph, the person filling out indicates his role in the transaction - borrower or co-borrower/guarantor/mortgagor. In the latter case, the degree of relationship with the main borrower is specified. Next, enter your full name and date of birth.

Source of information about mortgage loans of PJSC VTB

The bank wants to know where the information about mortgage products comes from. This could be an advertisement, a recommendation from a developer/realtor or friends/acquaintances, etc.

Personal data

This item is one of the most voluminous in the borrower’s application form for a VTB mortgage. The applicant is required to provide the following information:

- SNILS and/or INN. An individual taxpayer number is indicated if SNILS is not assigned for various reasons (for example, to military personnel).

- Address of the actual residence. Indicate in full, including postal code, country, region, etc. If the addresses of registration and actual residence coincide, the corresponding checkbox is placed in the application form. Additionally, the relationship to the apartment of residence is noted: commercial or social rental, property (including relatives), etc.

- Contact telephone numbers: cell phone, work, landline at the place of registration and actual residence. The application form for a VTB Bank mortgage also includes an email address. A message with approval/refusal is sent to the specified mobile phone number.

- The next point concerns the marital status of the applicant. Even being in a civil marriage is noted. If, special attention should be paid to the presence/absence of a marriage contract.

- Next, the borrower notes whether he changed his last name. The questionnaire provides space for final corrections. If there were several procedures, information about the rest is indicated in the addition sheet.

- Information about minor children. To fill out an application for a mortgage at VTB, you only need their dates of birth and place of residence (together with the applicant or separately).

Recommended article: How to find out if a mortgage has been approved by Sberbank via the Internet

Education

Copies of diplomas are not required at the stage of filling out the application form for a VTB mortgage. Only the level is indicated (secondary, higher, etc.). Separate columns are dedicated to the presence/absence of an academic degree, MBA, etc.

Employment information

Only Military Mortgage participants can fill out an application for a VTB Bank mortgage without this clause. All others indicate:

- Participation in the salary project directly from VTB PJSC or another bank. A separate line is allocated for the salary card number.

- Main place of employment. A separate link is a fixed-term contract (indicating the dates of admission and dismissal) or an unlimited term. Business owners indicate the size of their share in the authorized capital.

- Job details:

- job title;

- monthly income after tax;

- length of service: general, last place, by profile;

- information about the organization: name, tax identification number, address, telephone numbers and website address;

- field of activity. If none of the options proposed by the bank are suitable, the required industry is indicated in a special column;

- number of personnel, taking into account branches and all divisions;

- how many years the company has been operating (the questionnaire provides several options for time intervals);

- availability of additional income. If the applicant has a part-time job, information about it is filled in in the application.

Assets

Based on this point, the bank assesses the client’s solvency. If the borrower chooses the Victory over formalities program and has a car, residential or commercial real estate, he fills out the Assets section in the addendum sheet. The same should be done (this follows from the example of filling out the VTB mortgage application form) if you own several cars or apartments.

In the main application form, the applicant indicates:

- Availability of funds, including to pay the down payment. If there are several accounts/deposits, the amount for each is indicated.

- Availability of a car. The bank checks the year of purchase, brand and cost at the time of filling out the VTB mortgage application form.

- In relation to real estate, it is necessary to indicate the type (apartment, garage, house, land), the approximate market price (an appraiser's report is not required), the basis for the emergence of the right (purchase, receipt as a gift or inheritance, privatization, other).

Recommended article: How to calculate a mortgage with maternity capital in VTB using an online calculator

additional information

In this paragraph of the completed VTB mortgage application form, the applicant is required to indicate whether he has undergone bankruptcy proceedings and whether he is a payer of alimony. In the latter case, the amount is written down.

This completes filling out the main form of the VTB mortgage application form. Applicant:

- confirms that he is familiar with;

- indicates that he is aware of the costs accompanying the transaction (this applies to state duties, payment for the services of an appraiser and insurer);

- gives .

If the application form with supporting documents is submitted to the bank not by the applicant personally, but by his representative, his full name is indicated in the application form.

You can fill out the VTB mortgage application form on the bank’s official website or one of the many aggregator platforms. Cross-outs and corrections are not allowed.

Sample and example of filling

An example of how to correctly fill out the application form is given below.

Page 1.

Page 2.

Page 3.

Required certificates and documents

In addition to the completed application form, you will also need a primary package of documents for its consideration. It includes:

- Identification documents (passport as a requirement and other additional ones: SNILS, military ID, driver’s license);

- Documents confirming the level of income (certificate of income in form 2-NDFL for employees, tax return and financial statements for individual entrepreneurs).

VTB Bank has the right to request additional documents from the borrower for a more detailed consideration of the issue of granting a mortgage loan.

Questionnaire for guarantor and co-borrower: form

Before moving on to the additional questionnaires required to obtain a mortgage at VTB 24, you should understand what the difference is between these two concepts.

A guarantor can be any person who is not necessarily related to the person in whose name the mortgage is issued. He is responsible under the contract for the fulfillment by the borrower of his obligations. And in case of violations, the obligation to pay the debt will fall on his shoulders. VTB 24 asks for a guarantee in the following cases:

- the borrower lacks a credit history;

- providing a certificate of income in the form of a bank, and not 2NDFL;

- the age of the borrower is on the border of acceptable values.

A co-borrower is a full-fledged participant in the transaction. When considering an application, the bank takes into account its income. There are often cases when the same person becomes a co-borrower and a guarantor.

Attention! Unlike a guarantor, only a close relative can become a co-borrower. This is due to the fact that when buying a home using a mortgage loan, the legally established rule applies: “Whoever is the borrower is the owner.” Thus, it is envisaged for the co-borrower to receive a share in the purchased apartment.

The application form for a co-borrower and guarantor for a mortgage at VTB 24 can be downloaded from the same link on our website. The difference is that you only need to fill out the first 4 pages. Applications are not required for the co-borrower or guarantor.

Document review period

Usually it is 4-5 working days. However, sometimes the candidacy of a borrower, co-borrower or guarantor raises additional questions for VTB Bank, the clarification of which requires additional time.

We should not forget that the bank provides financial services of various kinds to many clients, and each situation again requires time. Therefore, the human factor in solving specific financial problems should not be discounted either.

However, as soon as the applicant’s application is reviewed, a VTB employee will definitely contact him.

The questionnaire is the applicant’s face. Approval or disapproval of a mortgage loan by VTB Bank largely depends on its detailed and accurate completion.

Certificate of income in VTB Bank form 24 for mortgage – 2019

Why do you need a certificate on the VTB Bank form for a mortgage?

The main purpose of the described certificate has already been mentioned above. It contains information about the client's salary and is provided to bank employees as the main confirmation of the borrower's income. Its use is relevant when other documentation does not reflect the real state of affairs and does not leave a potential newcomer a chance to receive the required amount. This document does not perform any other functions, therefore, if the information presented in it completely coincides with what is indicated in 2-NDFL, there is no point in filling it out. Duplicate information provided does not increase the chances of a positive loan decision.