Gazprombank's reduction in mortgage rates allows existing borrowers to improve lending conditions and reduce the amount of the final overpayment for the use of borrowed funds. The procedure has certain features that it is recommended to learn about before contacting the bank.

What is the reason for the rate reduction?

For many Russian citizens, a mortgage has become the only financial instrument with which they can purchase their own home. The banking services market today offers a large number of offers, including for primary and secondary housing sectors.

The disadvantages of credit products are considered to be:

- High level of overpayment for the use of borrowed funds;

- Duration of the contractual relationship;

- Inability to accurately plan for a long period of time;

- Instability of the economic situation and unpredictability of inflation processes;

- High degree of influence of political factors on the financial services market.

Over the past few years, the lending market has seen a downward trend in interest rates, which was largely due to persistently low inflation and stable economic development. This situation allowed the Central Bank to decide on the possibility of reducing the key rate.

Based on its value, Russian banks determine the level of interest on the mortgage products they offer. The decision of the Central Bank caused a response from the largest players in the financial market, so within a short time there were statements about easing the conditions of lending programs.

Over the past year, the country's largest banks have decided to reduce mortgage rates. This trend has affected almost all financial products, allowing clients to count on re-issuing loans on new terms and reducing the amount of the final overpayment. Even reducing the rate by a fraction of a percent, taking into account large volumes of mortgage loans, ultimately leads to significant savings in the family budget.

Main reasons for refusal

The decision of a financial institution to issue housing on credit will be negative if the client has the following:

- bad credit history;

- current loan debt;

- low level of earnings or high payment burden;

- providing false information or forged documents;

- non-compliance with the creditor's requirements;

- problems with the collateral object.

Additionally, loan approval cannot be expected if the borrower has experienced personal bankruptcy in the last 5 years.

Important! All indicators of the borrower form his single credit rating, which the lender takes into account when considering the application. In case of non-compliance with the established parameters, refusal occurs immediately.

Bad credit history

The most common reason for a bank’s negative decision is a damaged CI:

- untimely closed loans;

- complete absence of loans for life;

- the presence of unclosed overdue loan programs;

- long period of missed payments.

All these points are reflected in the credit history bureau, to which any lender conducting its financial activities on the territory of the Russian Federation has access.

Debt

The reason for rejecting the application may be any debt that the citizen who applied for the loan has:

- on current loans;

- before the bailiff service;

- property tax debts;

- debts on administrative fines.

With the exception of the first point, the remaining data does not affect the lending history, however, the bank’s security service also checks them when applying for a large loan.

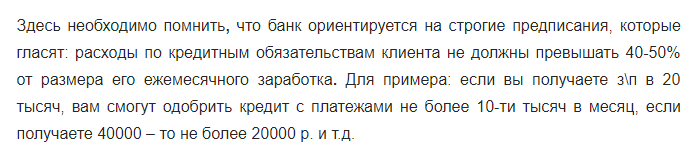

Low official income

Another reason for refusal of a mortgage is an unstable or low level of official earnings, or its absence. When checking, the lender calculates the borrower's income as follows:

- part of utility costs;

- certain transportation costs;

- food costs;

- other expenses of the borrower.

As a result, the loan payment should account for no more than 20-30% of monthly earnings, otherwise the loan will be refused.

Forgery of documents

The security service of a financial institution is staffed with specialists. Often, many of them have previously served in law enforcement agencies and other government agencies, which is why they have access to a full check of the borrower. If the attached documentation is not listed in the departmental database, the loan will be denied. Additionally, the client risks facing criminal liability for producing false documents.

Important!

Some dishonest mortgage brokers periodically provide false income confirmation certificates, which promises serious consequences for the borrower.

Non-compliance with bank requirements

Each financial institution puts forward a number of requirements to its clients, which corresponds to minimizing the risk of loss of funds. These parameters are designed so that the lender bears minimal risks or completely eliminates all possible losses.

Problems with the collateral

A lender may not approve a large loan request if the following difficulties exist:

- property has been seized;

- there is a ban on registration actions;

- the property is encumbered;

- a minor is registered in the property;

- there is no approval from another share owner.

Additionally, the loan will be refused if there is no insurance and documents for the real estate property.

Other reasons

There are also other reasons why a bank has the right to refuse a mortgage to a potential borrower:

- the citizen has been declared bankrupt over the past 5 years;

- there is an outstanding criminal record;

- there is no registration on the territory of the Russian Federation;

- a specific document has not been provided;

- False information provided.

There may be a lot of reasons for refusal, but lenders often do not voice why they do not approve the application.

Important! When applying for a mortgage, borrowers should take certain steps in advance to significantly increase their chances of getting a loan.

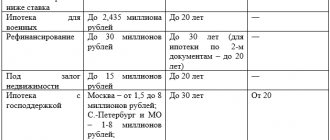

Offers from Gazprombank.

Today, Gazprombank's line of mortgage offers includes several products. Clients are given the opportunity to obtain borrowed funds to purchase real estate in the primary and secondary markets. If you wish, you can become the owner of a standard-layout apartment or townhouse.

The level of the interest rate depends on several factors, and the final value is calculated taking into account the use of an individual approach to the client.

The following points are decisive:

- the volume of the loan issued;

- the amount of the advance payment;

- region where housing is located;

- quality of lending history;

- the client has a special status.

The procedure for obtaining a mortgage loan is standard for all programs. The list of documents depends on its focus, attraction of subsidies from the state and the specific circumstances of the transaction.

It might be interesting!

Mortgage with down payment from Gazprombank.

Documents for deferred payment

Consideration of the issue of mortgage restructuring at Gazprombank occurs after the complete submission. You need to study the list of papers on the bank’s website and only then go to its office. What is required from co-borrowers:

- ;

- copies of passports of all participants in the transaction (borrower, co-borrowers, guarantors, mortgagors);

- confirmation of the deterioration of the financial situation (extract from the salary account, work book with a record of dismissal, additional agreement to the employment contract on changing the salary, certificate of registration with the Employment Center, etc.);

- documents indicating that income will soon decrease (notification of staff reduction);

- evidence of increased expenses (death certificates of family members, disability status, court decision on alimony);

- document on loss of ability to work (sick leave, certificates of chronic disease or disability, death certificate of the borrower or co-borrower);

- child's birth certificate, maternity leave order;

- certificate of conscription into the army;

- documentary evidence of significant loss of property.

Recommended article: At what age can you take out a mortgage?

A package of documents for restructuring a mortgage at Gazprombank is collected depending on the current situation. You should refer to the list above. However, the bank has the right to request other documents if necessary.

Important to know: What to do if you don’t have money to pay your mortgage

Bankruptcy and mortgage: how to save an apartment?

Conditions of the current mortgage.

Svetlana

Real estate expert

Ask a Question

A popular and popular mortgage program from Gazprombank is the “New Residents” product. The reduction in the interest rate with the latest changes in conditions amounted to 0.2 percentage points, and the base rate today is 7.5%.

Borrowed funds are provided on the following terms:

- loan term – up to 30 years;

- cash limit – 60 million rubles;

- minimum amount – 100,000 rubles;

- down payment – from 10%.

A reduction in the interest rate to the base level is possible if a residential property is purchased from a bank partner, the client has the status of a participant in the Gazprombank salary project and agrees to conclude an additional insurance agreement.

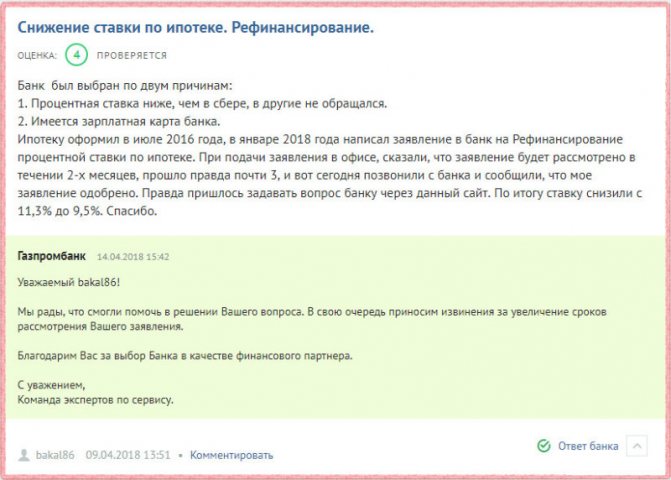

If the client wishes to take advantage of the refinancing program, it is possible to conclude an agreement at a rate of 8.9%. To use this opportunity, the term of the current loan must be at least 12 months. Two delays are allowed, but the duration of each should not exceed 29 days.

Features of refinancing

Having received a refusal to reduce interest on an existing housing loan, you can submit an application to refinance a mortgage from another bank to Gazprombank.

In this case, the bank reduces the interest rate, reduces the current monthly payment, and also allows you to get an additional loan.

The latter can be used for personal purposes or to repay a consumer loan from another institution. There must be more than 3 years until the end of the current loan.

Refinancing at Gazprombank is in demand among people who have mortgages in other banks (according to information from the Banki.ru portal)

Refinancing conditions in 2020 at Gazprombank look like this:

- Amount: from 0.5 million rubles or from 15% of the housing price;

- Limit: 45 million or 85% if the property was purchased from the owner, 80% in a new building;

- Duration: 3.5 – 30 years;

- Insurance: real estate is mandatory, title - upon separate request, personal - voluntary;

- Interest rate: from 9.2%.

For the period before registration of the pledge, the following rate increases are provided:

- +1%, when drawing up a power of attorney for an authorized employee of Gazprombank to register a mortgage;

- +2%, in the absence of a power of attorney.

Application to reduce interest rates on Gazprombank mortgages 2020.

All procedures for building relationships with the bank are clearly regulated, so there are usually no difficulties in filling out an application. When registering, you will need to indicate the date and number of the loan agreement, carefully double-checking the details. When visiting a bank branch, it is recommended to have the original agreement on paper with you. It is also necessary to correctly indicate contact information for feedback.

The period for consideration of applications usually does not exceed 30 days, and the client is informed about the decision made via SMS or other type of message. It can contain both a positive and negative answer, since the bank has the right to accept any verdict. The bank has the right to make a decision based on its criteria and not explain the reasons for issuing a decision that is unsatisfactory for the current borrower.

It might be interesting!

Mortgage for a house with a plot of land in Gazprombank in 2020.

Mortgage restructuring conditions

If you understand that it has become difficult to repay a Gazprombank housing loan, there is no need to bring the situation to the point of judicial collection or transfer of debt to collectors. You can solve financial problems at the very beginning, when there is no overdue payment yet. Mortgage restructuring at Gazprombank will help, but this procedure is carried out under special conditions.

There are two ways to make loan repayment easier:

- full deferment of repayment for a certain time;

- reduction of the monthly payment during the grace period.

The first thing you need to do is confirm your difficult financial situation, which does not allow you to pay the loan as before. Documents will be accepted by the bank for consideration if the borrower or co-borrower has the following circumstances:

- they lost their jobs and registered as unemployed;

- disability group 1 or 2 has been established, which does not allow full work;

- disability for more than 2 months;

- income decreased by more than 30%;

- a child was born;

- a disabled person was taken into care.

At Gazprombank, mortgage restructuring is available if the requirements for the loan itself are met. Its amount cannot exceed 15 million rubles. The housing that is the subject of the mortgage must be the only one suitable for the borrower or co-borrower to live in.

Mortgage restructuring at Gazprombank

is carried out only once.

Reviews.

In open sources there are many negative reviews from existing clients of various banks who are indignant at the unlawful actions of credit institutions. This reaction is often caused by a refusal to request a reduction in the mortgage interest rate. Many people consider it wrong that the terms of the program have changed, and the bank refuses similar actions for existing loans.

Svetlana

Real estate expert

Reducing the interest rate is unprofitable for banks, since the level of profit received largely depends on its value. The downward trend is largely due to high competition in the financial services market and the struggle to expand the client base. The bank has the right not to comment on the reasons for the refusal, but under certain conditions the chance of receiving a negative decision is quite high.

The following circumstances aggravate the situation:

- Bad credit history;

- Refusal to conclude an insurance contract;

- Short term of the contract;

- A small number of payments made;

- Previous use of the restructuring mechanism, credit holidays and other tools to improve lending conditions;

- Admission of delays and financial irregularities.

Today, banks are ready to cooperate with clients and apply an individual approach to their activities. Credit institutions strive to retain existing borrowers, since it is extremely undesirable for them to leave for competitors.

Sometimes the applicant may be given conditions under which a request for a reduction and preferential conditions can be granted. In a significant proportion of cases, such situations are associated with a proposal to conclude voluntary insurance in relation to the life and health of the main borrower.

When issuing a positive decision, it is necessary to take into account that the new rules will only apply to outstanding loan debt. There is no compensation for the paid part of the loan and the current balance will be repaid only through new payments.

Registration procedure

Mortgage restructuring at Gazprombank will take some time. The lender needs to assess the client's financial situation and calculate new repayment terms. If an incomplete list of documents is presented, they may refuse. But more often than not, the credit institution will accommodate you halfway, because it is also interested in further repayment of the loan.

The procedure for restructuring a mortgage at Gazprombank occurs in the following order:

- the client collects a package of papers and submits them to the bank for review;

- documents are checked, and if necessary, clarifying information is requested;

- the lender makes a decision and communicates it to the borrower;

- An additional agreement to the loan agreement is signed and a new payment schedule is issued.

How to get a mortgage at Gazprombank

The procedure for applying for a loan is quite simple.

- The first step is to submit an application.

To do this, it is first advisable to get advice from a Gazprombank employee. This can be done by phone or at the nearest branch. Then you need to collect the documents necessary to assess your financial condition. After which you can apply for a mortgage at the nearest office or on the Gazprombank website.

- Get a solution.

After you have submitted your application, you need to wait for an SMS with the bank’s decision. If the application is approved, you can begin searching for housing to purchase. Three months are given for this. The bank's decision on your application is valid for 90 calendar days.

- Choose an apartment.

Choose an apartment on the secondary market or in a new building.

If you are purchasing an apartment in a building under construction, check whether the property is accredited by the State Budgetary Inspectorate. If the house under construction is not accredited, you must provide an extended package of documents (the list can be checked at the bank branch).

Once you have your eye on a suitable apartment, obtain the necessary documents from the owner or developer and send them to the bank. The State Property Committee must approve the apartment that you are providing as collateral.

If the bank agrees with your choice, then all that remains is to complete the transaction.

- Get a loan.

To sign a mortgage agreement, you need to go to a bank branch. After this, all that remains is to draw up an agreement with the real estate seller.

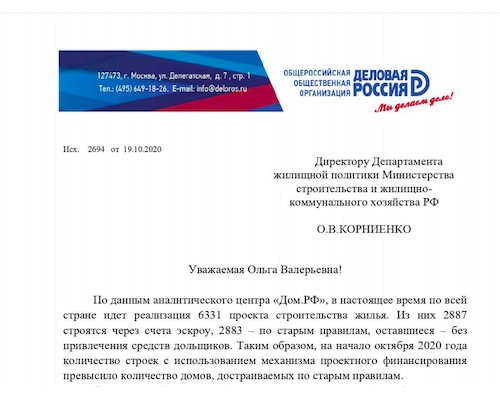

The all-Russian public organization “Business Russia” sent a proposal to the Ministry of Construction to introduce appropriate changes to 214-FZ . This document is available on the ERZ.RF portal.

Photo: www.pbs.twimg.com

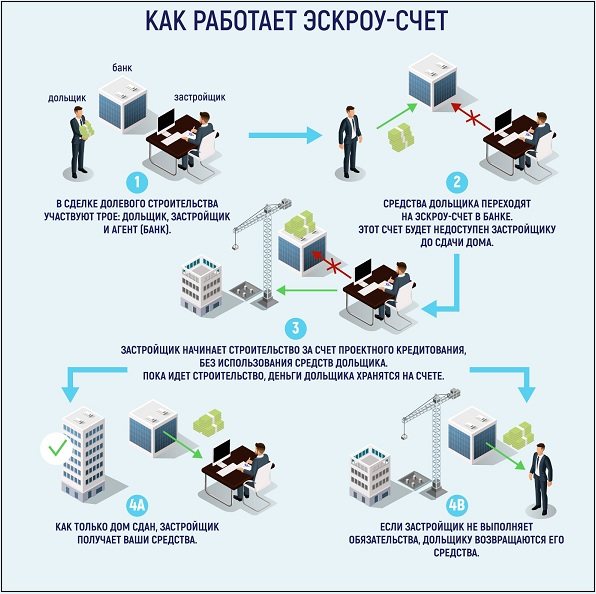

According to the initiative of Business Russia, it is proposed to reduce the current period for opening escrow accounts established by 214-FZ from 10 to 3 working days.

The authors of the appeal note that, despite the positive perception of the new work mechanisms, developers remain hostage to the imperfection of the banking system and overly strict rules for the use of project financing.

In practice, banks are not always in a hurry to open escrow accounts promptly, and the period for opening accounts, taking into account weekends, can be up to 14 calendar days. At the same time, the developer continues to pay interest to the bank for using the loan funds.

All this negatively affects medium and small developers, reducing the already low profitability of projects.

Photo: www.infokanal55.ru

Let us remind you that in accordance with Federal Law 202-FZ, which came into force in July 2020, funds from construction participants are transferred to the developer immediately after receiving permission to put into operation. Previously, it was required to provide information about the registration of ownership in relation to one shared construction project.

As of September 1, 2020, banks have already opened 15,817 escrow accounts totaling RUB 36.2 billion.

The ERZ.RF portal previously reported that, based on the results of 8 months of this year, the volume of housing construction in Russia using escrow accounts reached 38.5 million square meters. m.

| Photo: www.alatvesti.ru | Photo: www.omskrielt.com |

Other publications on the topic:

Bank DOM.RF disclosed accounts for the developer of the Four Seasons residential complex in Voronezh

Central Bank: the volume of funds in escrow accounts exceeded 600 billion rubles

Russia's leading developer opened the first escrow accounts as part of project financing from VTB Bank

Bank DOM.RF opened escrow accounts for a large Perm developer constructing a residential complex in the regional center

"Business Russia" records a steady trend of declining demand for housing in new buildings

“Business Russia”: the cost of loans for developers is 12-18% per annum

The Chamber of Commerce and Industry proposes to introduce phased disclosure of escrow accounts for developers

Bank DOM.RF opened escrow accounts for the developer of a Nizhny Novgorod residential complex

Expert: in a crisis, developers should be allowed to gradually open escrow accounts

The amount of funds transferred from disclosed escrow accounts reached 7 billion rubles (graphs)

In more than a quarter of the constituent entities of the Russian Federation, escrow accounts were opened

Bank DOM.RF disclosed escrow accounts to Voronezh DSK

Bank of Russia: gradual opening of escrow accounts is a return to the past, fraught with the emergence of new pyramids

The State Duma did not support the Social Revolutionaries' bill on the gradual disclosure of escrow accounts

Vladimir Yakushev: The issue of gradual disclosure of escrow accounts has been postponed for at least a year

Why can they refuse?

When considering a potential client’s application, credit institutions evaluate quite a lot of indicators both regarding the client himself and co-borrowers (if any). Also, a lot of attention is paid to the property for the purchase of which a loan obligation is issued. Sometimes situations arise when, it would seem, in full compliance with all factors that matter to the bank, the applicant is refused to provide funds. Moreover, the banking organization and its employees are not required to explain the reason for the refusal. In this regard, obtaining information about the reasons for which the bank may refuse will significantly save time and help to foresee the weaknesses of one of the factors in advance and strengthen others. Among the main reasons for refusal of mortgage lending are bad credit history, low liquidity of real estate, insolvency of the borrower, provision of false information, etc. Let's look at each of the reasons in more detail.

Bad credit history

One of the reasons for refusal to provide a mortgage loan is a bad credit history, which is paid attention to by almost all large banking organizations that have been operating for several years - Sberbank, VTB, Raiffeisenbank and others. This history is formed on the basis of the relationship between the bank client and financial institutions in the process of obtaining loans and repaying them. Moreover, the relationship with the bank to which the mortgage application is submitted is not necessarily taken into account. The Central Bureau of Credit Histories contains information on lending to the borrower in all banking organizations of the Russian Federation.

If, when applying for previous loans, current payments were overdue or, even worse, obligations remained outstanding, the terms of which had already expired, you should not count on a positive decision from the bank. Sometimes situations may arise in which, in fact, the borrower himself is not to blame for a bad credit history - this happens if there was some glitch in the program and the payment information was not received on time, while the transfer itself was completed on time or a loan was issued to the applicant when producing a fake or stolen document. Every citizen of the Russian Federation has the right to check his credit history and if such situations arise, he should immediately contact the bank that submitted such information to correct the situation.

Low liquidity of mortgage real estate

Low liquidity of an apartment is an equally common reason for refusal to provide a loan. Almost all banks pay special attention to the characteristics of real estate that will be purchased through a mortgage and will act as collateral. As an example, we can cite Gazprombank, Rosselkhozbank, which will not make a positive decision if the apartment or house does not meet certain requirements. This fact is due to the fact that, provided that the borrower is unable to repay the loan, the housing will be sold and from the proceeds the bank will receive the amount of money due to it, and it is unlikely that it will be possible to sell an illiquid apartment at a profit.

Low income of the borrower

The next reason for refusal may be the lack of a sufficient level of income. When deciding on the possibility of providing a large amount of debt, the bank must be sure that the client will be able to repay the loan on time. An income certificate, which contains information about official earnings, serves as a confirming factor of the borrower’s solvency. If, on the basis of the loan provided, the borrower is unable to repay the obligation using no more than 35-50% of the income (depending on the conditions of the banking organization), then the mortgage will be denied.

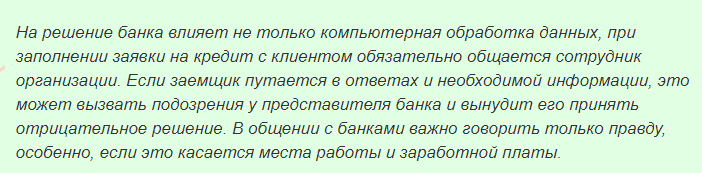

Providing false information

An attempt to provide false data or forged documents also becomes a factor that increases the possibility of refusal. Situations often arise when, in order to obtain a mortgage loan, potential borrowers provide documents that are not valid. Despite the fact that it is quite simple to draw up a document in which the data does not correspond to reality, security officers can find out how true the data is and the financial institution will not only refuse to provide funds, but may also blacklist the applicant. Lack of funds for a down payment also leads to refusal of a mortgage. Despite the fact that lending institutions can provide money without a down payment, the lack of funds to pay part of the cost of housing significantly reduces the chances of receiving approval.

Other reasons

Gazprombank and Absolut Bank, for example, may refuse a loan if the borrower has unpaid fines in the traffic police or debts to the tax inspectorate, in particular, resulting from non-payment of due amounts of contributions by a person who is an individual entrepreneur. The presence of a criminal record has a similar negative impact - banks make concessions only if such a criminal record was given conditionally and is not associated with the commission of serious offenses or economic crimes.

Labor instability is an equally rare reason for refusal. Despite the fact that the client provides a certificate of income from his current place of work, banking organizations can check the history of his employment relations. A refusal can be obtained if the applicant has changed many jobs and there is a significant gap between official employment, since such a factor indicates his financial unreliability. Also, refusals often occur simply due to the client’s uncertainty - if, when communicating with a bank specialist, the mortgage applicant is confused in the answers, behaves insecurely, and makes many calls to provide certain data. Employees of a financial organization may regard such behavior as an attempt to provide false data and will definitely include this in the appropriate form.

Who can get a mortgage from Gazprombank

The bank imposes the following requirements on the borrower:

- Citizenship of the Russian Federation;

- registration or permanent residence in the Russian Federation;

- no negative credit history;

- age not less than 20 and not more than 70 years (as of the date of full repayment of the loan);

- continuous work experience at the last place of work of at least 3 months and total work experience of at least 1 year.

Gazprombank also clarifies that in order to obtain a mortgage, the borrower’s income must allow him to receive and service the requested loan amount.