Until how many years can you take out a mortgage?

As soon as a person receives pensioner status, the opportunity to earn a lot becomes inaccessible to most people. It is possible that there are additional sources of income (business, renting out apartments), but they must be officially confirmed in order to influence a positive outcome.

The closer a person is to retirement age, the more severe the conditions offered by banking organizations. First of all, this concerns the period for which the loan is provided. If young families can extend the loan even for 25 years, then for older people this period is limited to 7-15 years.

Example: You are 50 years old. You contact the bank, where the conditions require a maximum loan term of 25 years. But, since there are only 10 years left until retirement, this means that this will be your limit. As a result, the monthly payment will increase several times. To repay the debt, you will have to prove your solvency (only official sources of income are taken into account). Alas, not everyone is able to take out such a loan.

But not everything is so sad. After all, banks understand the situation and are often ready to soften the conditions: they recommend attracting guarantors, asking for valuable collateral. This will allow you to increase the loan period to 5-7 years, which is already good.

For those over 40

But not all citizens of the Russian Federation are destined to fall under the “distribution of freebies.” It is advisable to meet the following criteria to increase the likelihood of receiving a loan:

- After the borrower becomes a pensioner, he must have other permanent sources of income. And only official, documented ones. This increases authority in the eyes of bank employees;

- Ideally, the client should not have minor children or other persons supported by the borrower. Family status (having a working husband or wife) is also welcome, which increases total income and has a positive effect on the bank’s decision;

- There is highly liquid movable or immovable property that can be used as collateral;

- Attracting solvent co-borrowers (from 2 to 4) will significantly increase the likelihood of a positive response. It is best when children or other persons with family ties act as guarantors. In the event of a serious illness or death of the main borrower, all loan obligations are transferred to the guarantors;

- Don’t forget about your credit history, which should be good enough for the bank to trust you;

- It is necessary to undergo a full medical examination and take out insurance in case of death and disability. These are additional costs, but you can’t do without them.

Up to what age can pensioners get a home mortgage?

We discussed this topic in detail in this article. We recommend following the link for a detailed consideration of all the features of the relationship between banks and people of retirement age.

Let's consider several cases that are typical for most Russian credit institutions:

- “Bank of Moscow” is ready to provide loans to women up to 55 years old, and to men up to 60 years old;

- SKB and Uralsib offer an even more loyal approach with a limit of 65 years;

- The most optimal programs are offered by Sberbank and VTB24 - 75/70, respectively.

This is important to know: How to return an apartment purchased with a mortgage to the bank

You can check out other great deals on this page.

You decide for yourself which financial institution to contact. But it is better to apply to several organizations at once. This way you will significantly increase your chances. Try to give as many arguments as possible in your favor: attract co-borrowers, provide certificates of employment, provide guarantees by pledging your own real estate or vehicles.

Up to what age can you take out a mortgage from Sberbank?

In the previous section, the limit was indicated - 75. But it is not always possible to “get the go-ahead” in such conditions. The most reputable Russian bank constantly updates the list of profitable programs. Here are the most popular schemes:

- For men (60) and women (55) – lending with state support;

- The program for employees in the ranks of the Armed Forces (military) provides for a maximum age of 45;

- If you want to purchase a country house (or intend to get money for its construction), then you can count on a mortgage loan of up to 75.

General reasons have been listed that may not work in certain situations. First of all, Sberbank estimates the amount of permanent monthly income that can cover debt obligations. An important point is continuous work experience; also, you must be registered at your last place of work for at least one year.

Plus, the annual rate is only 12.5%, but you can get a 0.5% discount if you make a larger down payment.

In this publication, we discussed the topic: “Until what age can you take out a mortgage for an apartment?” If you are interested in the minimum lending age, we recommend reading the material at the link.

Reasons for age restrictions on mortgages

The limitation of young borrowers to 18 years of age was based on legal rules; according to the legislation of the Russian Federation, financial and material responsibility arises after 18 years of age . Therefore, the question “at what age can you take out a mortgage” has a clear answer - from 18 years of age. But in each specific bank the conditions may be stricter. At the same time, banks carefully consider the personality of the borrower at this age, study the likelihood of a young man being drafted into the ranks of the Russian Armed Forces, or a change in the marital status of young people, and the main factor is the presence of a stable income.

These factors are considered by banks as additional risks for the repayment of mortgage loans. As for the maximum permissible age of a borrower for older people, until recently the age of the borrower was determined by the date of his retirement . According to this rule, the issuance of a mortgage was supposed, other things being equal, at the age when the repayment of the last installment would fall on the date of the borrower's retirement. Banks believe that when the borrower reaches retirement age, his solvency will deteriorate sharply, and he will not be able to repay the mortgage loan. The conditions are, frankly speaking, discriminatory. Western banks do not have very liberal views on the age of the borrower; in Northern Europe there are no such restrictions at all.

These restrictions do not correspond to normal logic. After all, the housing received with a mortgage is pledged to the bank. Elderly people very often purchase housing for their children and grandchildren, which means that in the event of the death of an elderly borrower, children will remain the payment of contributions. They probably won’t want to leave their unpaid housing to the bank. And, in the event of the borrower’s death, the bank can sell the collateral and pay off the debt.

It’s just that the majority of Russian banks are not socially oriented; their main focus is making a profit. In general, the Russian banking system is less professional than the European and American ones and does not have the skills and tools to work on mortgage lending to the population.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

To fill these gaps, the government created the Agency for Housing Mortgage Lending (AHML) in 1997, which was supposed to harmonize the problems of banks and mortgage borrowers and expand the categories of mortgage borrowers among the Russian population. It was in 1997 that the Agency recorded age restrictions; it officially determined the age limits of potential mortgage borrowers. “The loan is provided to capable citizens of the Russian Federation aged 18 to 65 years (subject to the availability of a signed insurance agreement for the borrower for the entire loan period).”

How important is the age criterion?

Or the bank offers elderly borrowers to include younger family members in the mortgage agreement in the form of co-borrowers, who will subsequently be responsible for repaying payments to the bank until the mortgage agreement is terminated. Under such conditions, a number of banks agree to issue a mortgage even for a 75-year-old borrower with a mortgage term of 10 years. But most banks play it safe, and when asked “until how many years can you take out a mortgage?” they formulate their position: “The age for obtaining a mortgage should not exceed 55/60 years on the date of expiration of the loan . In these banks, a male borrower no older than 45 years old can get a mortgage loan for a period of no more than 15 years, and a female borrower at the same age can get a mortgage for a 10-year period. In these banks, the argument for refusing mortgages to older people is the risk of non-repayment of the loan, which, according to bank representatives, arises for the borrower at work, where upon reaching retirement age he may be asked to give up his job to younger workers.

Who can take out a loan?

Banks put forward the following requirements for those who can take out a mortgage for an apartment:

- Having Russian citizenship. Some banks also provide the opportunity to obtain a loan for foreign citizens who are in the Russian Federation legally. This means that he must have registration at the place of stay or permanent registration at the place of residence. In addition, he must have permission to work in the Russian Federation.

- Permanent registration at the bank's location is required . Not all credit institutions make such a requirement, but some of them have it.

- Those who can get a loan must have worked for at least six months at their last place of work Attention is also paid to how long the borrower worked in previous places and how often he changes jobs. If the period of employment at previous places of work is short and the client often moves to a new employer, his candidacy may not be approved by the bank. The only exception is a change of job through transfer.

- Income level. When calculating solvency, all documented income is taken into account. The standard confirmation form is 2-NDFL certificate. The monthly payment should not exceed half of the total family income. Payments on existing debts are deducted from income.

- The client should not have problems with credit history. Bad credit history also includes fines and claims on the bailiffs’ website. If a potential borrower has many existing loans and credit cards, this may also be grounds for refusing to issue a loan. Even if the client does not use cards, the fact of their availability will affect the calculation of his solvency. Therefore, it makes more sense to take your credit cards to the bank and close the account.

Factors that are determined by the category of the borrower:

- Age. Young people are given mortgages for a longer period.

- Income level.

- Family status. People who are married will be given a loan more readily.

- Availability of co-borrowers or other housing that can be used as collateral.

From what age and until what age is a loan given?

Mortgage loans can be obtained by persons from 21 years of age, in some banks from 23 years of age. Before this age, a person does not yet have his own finances and does not stand firmly on his feet.

The maximum age for obtaining a mortgage loan is 55 years. Moreover, banks also set the maximum age that a citizen can reach to repay a mortgage. Basically it's 75 years old. Those. If a person takes out a mortgage at age 55, he cannot take it out for more than 20 years.

This is important to know: Is it possible to register people in a mortgaged apartment?

Maximum age for obtaining a mortgage loan

If no special category applies to your situation, and you decide to take out a mortgage loan on standard terms, then your age limit will be retirement age. Moreover, reaching retirement age becomes the maximum limit for loan repayment. So, for women, 55 years is the maximum age for repayment of a mortgage loan, and for men, this limit is 60 years. This means that the financial institution is not interested in the question at what age you will take out a loan, but when receiving a loan, you must choose the most favorable moment, not forgetting about the convenient repayment period.

Let's look at a specific example: if you are a man and have decided to take out a mortgage for a period of 10 years, then keep in mind that this idea can be implemented until the time you reach 50 years old. Otherwise, the bank will be forced to shorten your loan repayment period.

A natural question arises: why did financial institutions set such strict age restrictions? The reason, first of all, is the instability of the financial situation of Russian pensioners. The realities of modern life indicate that after a citizen reaches retirement age, his risk of losing his job increases due to the hiring of a younger specialist for his position. Finding a new job for a pensioner is not so easy! When banks assess possible risks, they do not ignore the fact that a pensioner’s health may deteriorate.

It should be emphasized that if, in spite of everything, you decide to use a mortgage and agree to a shorter term than planned due to your age, then you should not immediately give up and get upset. The time period on the mortgage that you are missing can be covered at any time with a consumer loan. Moreover, financial institutions provide this type of loan much more willingly.

A number of banks have developed preferential loan programs for those pensioners who receive their pensions into an account opened with a given financial institution. The loan repayment period can be up to five years. If the pensioner continues to work at her official place of work, she should not have any problems at all with obtaining a mortgage loan. Of course, income must be officially confirmed.

Conditions for taking out a loan

Maturity

Mortgage loans are divided into 3 categories:

- Short-term: up to 10 years.

Maximum and minimum amounts

Minimum amounts are set depending on the bank's policy. Often this is 30% of the cost of housing. It is more profitable for the bank to offer larger amounts in order to make a larger profit. The maximum amount is 70-80% of the market value of housing. Some banks give 100%, but the interest rate in this case will be higher.

To calculate specific amounts, you can use the calculator on the bank’s website. The necessary data is entered into the cells: property value, interest rate, loan term, etc. Next, the system will calculate the amount of the monthly payment and the total amount of payments. There are calculators that allow you to calculate how much of a mortgage loan will be approved by the bank depending on the client’s income.

Types of housing

The bank must be sure that if the borrower fails to fulfill its obligations, it will be able to sell the housing and return its funds. To buy a home, it must meet the following conditions:

- The housing is not municipally owned.

- Purchasing an apartment does not violate the rights of third parties (for example, the seller’s spouse or his children).

- The house in which the housing is purchased is not in disrepair or barracks type.

- If the purchase is in a new building, the house must be completed, or the reliability of the developer must be confirmed.

- The apartment must have all amenities: gas, water, electricity.

You will find more information about the requirements for an apartment with a mortgage here.

An initial fee

The minimum down payment is 10% of the cost of housing, the average figure is 20%. The interest rate will depend on the amount of funds deposited: the higher the percentage of the down payment, the lower it is. Maternity capital can be used as a down payment.

Interest rates

The total amount of expenses depends on the interest rate. The minimum interest rates of banks range from 6% to 12%.

What determines the term of a mortgage loan?

• Type of housing; • Type of mortgage; • Age of the borrower.

Housing type

For how many years are they given a mortgage for an apartment and to whom?

It all depends on the availability of a down payment and meeting the bank’s requirements. If you have made a down payment and meet all the criteria, you will be issued a loan for 10-25 years. Also, the exact period will depend on the cost of the apartment.

It is important to know!

According to experts, the ideal period for paying off a mortgage is 10-15 years.

The longer the period, the higher the amount of overpayment. 80 percent of Russian banks provide for early loan repayment.

Therefore, even if you take out a mortgage for 20 years, you will be able to pay it off 5-7 years earlier. A loan to purchase a house is issued for a period of 30-50 years. Banks consider all applications individually. Therefore, there is no definite answer for how many years you will receive a loan to buy a house or build it, no.

Types of mortgage

The term of the mortgage loan also depends on the program.

Namely: • Military; • For a young family; • No down payment.

The parameters of loans (term, amount, rate) for the purchase of housing under the military program are regulated by Federal Law-117. The essence of the program is that during the period of service, funds from the military fund are transferred to the military’s personal account, which can be used to apply for a loan.

Remember!

The term of the military mortgage loan is affected by the amount of accumulated funds.

However, all cases are individual. Loans for the purchase of housing are given to young families for different periods.

Maximum - 30 years. Spouses whose age does not exceed 35 years can receive a loan. Several banks issue mortgages without a down payment. According to the terms, it is issued for a period of no more than 5 years. This way the bank compensates for the risks associated with non-repayment of funds.

Borrower's age

When asking how many years a mortgage is for, you need to take age into account.

Hope, if you belong to the category of able-bodied citizens aged 25 to 45 years, you will be given a loan for 1-30 years. Exceptions apply to borrowers represented by pensioners and young people (18-25 years old).

They belong to the risk category of citizens with unstable income. Therefore, banks that issue housing loans to such borrowers limit the terms to 5-10 years.

What nuances should be taken into account in the registration conditions?

- If the development company is accredited by the bank, then the mortgage interest rate may be lower by an average of 1%.

- You can also reduce the interest rate if you take out a mortgage from the bank where the salary card was issued.

- Under an assignment agreement, the interest rate will be higher.

- By finding funds for a larger down payment, you can reduce the interest rate, and therefore the overpayment.

- If you use the services of appraisers verified by the bank when assessing the value of your home, the loan application procedure will go faster.

- Before receiving a loan, you will have to evaluate the home, insure it, and pay commissions. This also needs to be taken into account.

Mortgage lending conditions in 2020

Having found out how many years you can get a mortgage from Sberbank, you should start collecting documents. By and large, you only need to collect certificates and statements confirming all the above conditions of the bank.

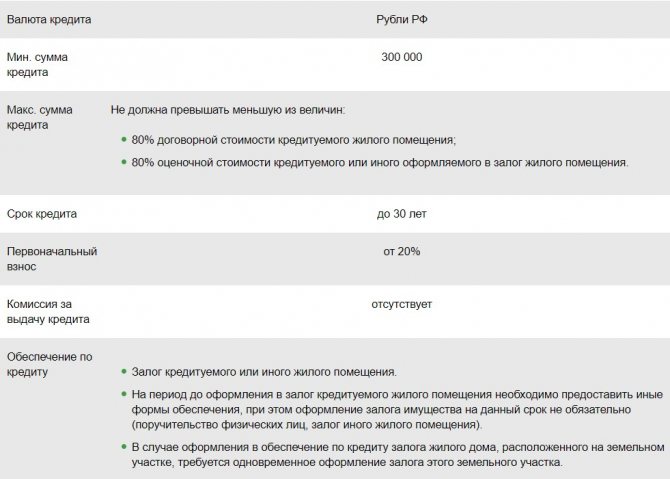

At the same time as preparing the documents, you need to select a suitable mortgage program. Each of them has its own interest rate, as well as repayment terms. In addition, there are targeted mortgage programs that are created for the purchase of various types of housing: in the primary or secondary markets, in a multi-storey building under construction or for the construction of a private house. Typically, interest rates range from 7.4–12%. Other parameters are almost the same in each program:

- minimum loan amount – from 300 thousand rubles;

- The maximum loan amount is up to 1.5-3 million rubles. In some cases, the loan size can vary up to 10 million rubles;

- terms (except for mortgages for military personnel);

- the amount of the first payment is from 15%.

Depending on the size of the down payment, the bank may provide different mortgage repayment terms. If most of the amount is paid, you can get a mortgage on the most favorable terms.

This article tells you how many years a bank can approve a mortgage and other details of applying for a mortgage loan.

Risks

In a new building

When purchasing an apartment in a building under construction, money is paid upon concluding a contract, but you can use the housing only when the house is put into operation. Then it will be possible to register ownership of the apartment. This also determines the risks:

- During the construction of a house, the cost of housing may increase.

- The house may not be completed at all, and the company will go bankrupt.

- The disputed status of the land on which housing is built may subsequently prevent you from taking ownership.

- Risk of double sale (one living space is sold to several persons).

- Purchasing an apartment with a defect.

You can read more about mortgages for a new building here.

On the secondary market

“Secondary” means a property with registered property rights. The danger of losing your own and borrowed money arises under circumstances sufficient to challenge the transaction. For example:

- The ownership was registered illegally.

- There may be third parties claiming the property (heirs, spouses).

- The person signing the document during the sale did not have the authority to do so (the person was declared incompetent, etc.).

- Selling an apartment violates the rights of minors.

Even if there are no problems with the legality of the transaction, there may be problems with the apartment itself:

- A person in prison may be registered in the apartment. When he returns, he will claim his rights to live in it.

- If the housing is no longer new, there may be problems with wiring, pipes, etc.

You can read more about mortgages for secondary apartments here.

Many citizens want to buy their own housing, but incomes in the Russian Federation do not allow them to do this right away. Mortgage lending, which is offered by many banks, comes to the rescue. Before choosing a specific bank, you need to study different offers to choose the best option. To get results, you can submit documents to several banks at once.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Up to what age do banks provide a mortgage for housing?

Mortgage lending appeared on the domestic banking services market relatively recently, but has already become popular among the population. This is no coincidence, because attracting bank borrowing resources is the only way for many families to purchase residential real estate. Such a loan differs not only in the large amount, but also in the duration of repayment. Up to what age do banks give mortgages for housing is a pressing issue, since credit institutions set additional requirements for their potential clients.

This is important to know: Can a mortgaged apartment be taken away for debts?

The influence of age on the issuance of a mortgage

Since mortgage repayment terms can vary from several years to several decades, the bank strives in every possible way to avoid the risks associated with non-payment of debt obligations. For almost all banks, the age restrictions are the same.

At what age are mortgages issued?

One of the main requirements that the bank puts forward to its clients is the age limit. At Sberbank you can get a mortgage loan from the age of 21. However, there are differences in restrictions regarding the cutoff figure.

Up to what age can you get a mortgage?

The age of the borrower at the time of closing the mortgage matters, subject to scheduled payments.

Mortgage programs have different age limits.

Restrictions for women

- a loan secured by state support - up to 55 years, that is, within the retirement age;

- mortgage for the purchase of a private house or apartment (secondary or primary market) – up to 75 years;

- loan for the construction of a country house - up to 75 years.

Restrictions for men

- loan with state support - up to 60 years;

- mortgage for the purchase of a house or apartment (secondary or primary market) – up to 75 years;

- loan for building a house – up to 75 years;

- mortgage for military personnel - up to 45 years.

Age restrictions for military personnel

Mortgages for military personnel are issued until the borrower reaches the age of 45 years.

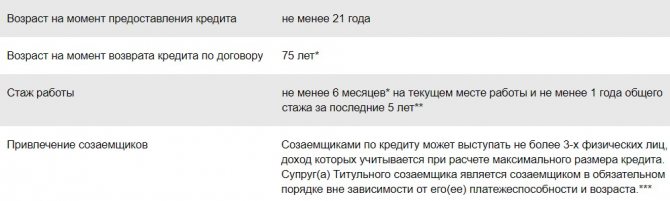

Essential conditions for obtaining a mortgage are length of service, as well as salary level. This largely determines the size of the mortgage loan.

Experience is confirmed in two directions:

- stability (you must work at your last job for at least 6 months);

- reliability (over the last 5 years you must have worked for a total of more than 12 months in any organization).

Up to what age do banks give a mortgage for housing and other age restrictions?

When deciding whether to issue a mortgage loan, the bank pays attention to the following characteristics of the applicant:

- income level;

- credit history;

- age.

Depending on these indicators, the terms of the loan also depend, which include such as the interest rate, the amount of allocated funds and the repayment period. This is due to the fact that all of the specified parameters of the borrower create his solvency. The bank's ideal client is a citizen who applies between the ages of thirty and forty years. In this case, he will have time to pay off the loan before retirement.

If we separately consider such a criterion as age, it becomes clear what risks the bank seeks to avoid. Young age can cause problems with employment, since with a lack of experience it is quite difficult to find a job. On the contrary, cooperation with elderly people can be complicated due to the client's inability to work due to illness or death.

Thus, age for a mortgage plays an important role. As a rule, banks set a minimum and maximum age threshold for borrowers. However, increased competition due to the growing number of banking organizations has led to a relaxation of the requirements. To expand their client base, banks are ready to lend even to people of retirement age. However, it is worth considering that this does not reduce the risks. Therefore, additional conditions must be taken into account.

Most often, the answer to the question up to what age a housing loan is given is the following: up to 65 years. It turns out that most banks are ready to add literally a few years to the retirement age. A certain number of banks provide loans to citizens under 70 years of age. The upper age limit rarely reaches 75 years. Fluctuation in a smaller direction is also possible: there are credit organizations for which it is mandatory that the full repayment of the loan occurs before the person retires.

Please note that there is an employment requirement: some banks will only accept applications from retirees who are still working.

A military mortgage has its own specifics: in this case, the maximum age is 45 years.

Young people need to know that for a loan such as a mortgage, the borrower must be at least 18 years old. However, such proposals are practically never found. As a rule, they agree to work with clients who have just reached the age of majority only if they have guarantors and collateral. Most banks in their requirements indicate the age from 21 years, some increase it to 23 years. If you have already crossed this threshold, the level of solvency comes to the fore, which is assessed based on your level of income. It is also important to meet the work experience requirement. The bank assigns the status of a young family if the spouses are not yet 35 years old. Separate programs are offered for them on preferential lending terms. In particular, it is possible to receive a government subsidy.

It is worth noting that if spouses apply for a mortgage, then the chances of approval are higher. For the bank, couples have an advantage over single borrowers, since they are jointly and severally liable. Even if one of the spouses loses his solvency, the obligations under the loan will be fulfilled by the second. Age requirements may also be relaxed, especially if there is a significant age difference.

Benefits when obtaining a mortgage

The state has developed the “Affordable Housing for Young Families” program, under which borrowers under 35 years of age can receive subsidies to pay their mortgage. The subsidy amount can be up to 35% of the cost of the purchased property.

Some banks also provide preferential conditions for young people. Special programs allow you to reduce the interest on the loan, increase the number of co-borrowers, extend the loan repayment period, and obtain more favorable insurance conditions. Thus, the “Young Family” program at Sberbank offers mortgage benefits provided that at least one of the spouses is under 35 years old.

You can get a discount on a mortgage if you have minor children; belonging to certain professions also provides certain advantages. For example, a military mortgage has age restrictions, but the conditions are more favorable. In this case, payments for the purchase of real estate can be made into a special savings system. The maximum age for repaying a military mortgage is 45 years. Preferential conditions are also available to medical workers when applying for a mortgage before the age of 40.